Australia Firearms Market Size, Share, Trends and Forecast by Type, Technology, Operation, End Use, and Region, 2025-2033

Australia Firearms Market Overview:

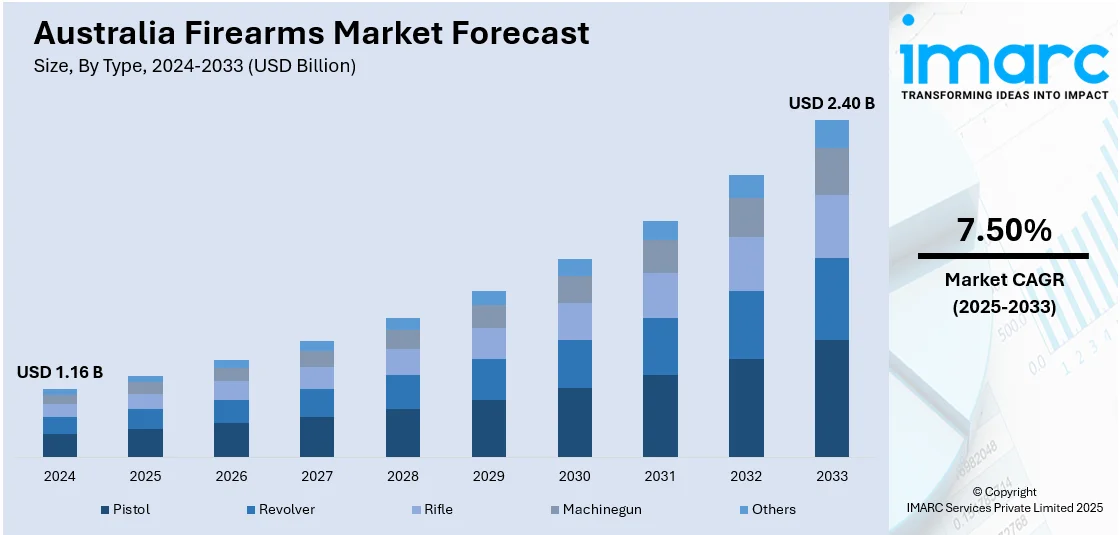

The Australia firearms market size reached USD 1.16 Billion in 2024. Looking forward, the market is expected to reach USD 2.40 Billion by 2033, exhibiting a growth rate (CAGR) of 7.50% during 2025-2033. The market is driven by a combination of cultural appreciation for outdoor activities like hunting and sport shooting, strict regulatory frameworks ensuring responsible ownership, and growing interest in collectible and historical firearms. Additionally, rising participation in shooting clubs and competitions promotes Australia firearms market share, while manufacturers focus on quality and specialized products. Public safety concerns and compliance requirements also shape consumer behavior, encouraging education and secure practices, making the market both niche and highly regulated.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.16 Billion |

| Market Forecast in 2033 | USD 2.40 Billion |

| Market Growth Rate 2025-2033 | 7.50% |

Key Trends of Australia Firearms Market:

Technological Advancements and Innovation in Firearms Design

A key driver in Australia’s firearms market is the ongoing advancement in firearms technology and innovation. While regulatory constraints limit certain firearm types, manufacturers are investing in improved design, materials, and precision engineering to cater to legal demand. Innovations such as lighter composite stocks, improved optics, ergonomic designs, and enhanced recoil systems are attracting enthusiasts seeking better performance and user comfort. These advancements are particularly relevant to sporting and hunting firearms, where accuracy and reliability are paramount. Additionally, smart safety features and modular designs that allow customization within legal limits appeal to both new and experienced users. This focus on innovation helps sustain market interest despite legal constraints, offering consumers value through performance and adaptability. It also encourages a competitive local manufacturing sector, contributing to product diversity and ongoing engagement within the licensed firearms community across Australia.

To get more information on this market, Request Sample

Increased Demand for Sporting and Hunting Firearms

In Australia, around 642,000 people participate in recreational hunting and shooting, contributing over $2.4 billion annually to the economy and supporting nearly 20,000 full-time jobs. This growing interest reflects a cultural connection to outdoor pursuits like hunting and clay target shooting, particularly in rural and regional communities. Enthusiasts increasingly seek precision rifles and shotguns suited for various game and shooting sports. The rise in recreational shooting clubs and competitions fosters responsible firearm use and safety education. Manufacturers and retailers are responding to this demand with a broader selection of specialized firearms, focusing on quality, customization, and reliability. Despite Australia’s strict gun laws, the sporting and hunting sector remains a strong, legally compliant niche where firearms are regarded as tools for sport rather than self-defense. This trend highlights the role of firearms in supporting regional economies, community engagement, and outdoor heritage in a tightly regulated environment further impelling the Australia firearms market growth.

Rise in Interest for Collectors and Historical Firearms

A notable trend in the Australia firearms market is the increasing interest in collectible and historical firearms. Enthusiasts are drawn to vintage models, military surplus weapons, and firearms with significant historical value. This trend is driven by appreciation for craftsmanship, heritage, and the unique stories behind each firearm. Collectors often seek rare or limited-edition pieces, carefully maintaining and showcasing them as part of personal or museum collections. This niche segment focuses less on practical use and more on preservation, history, and investment potential. Dealers specializing in collectible firearms have adapted by offering authentication services and ensuring compliance with legal requirements for ownership and display. The collector market fosters a culture of respect for the historical and technical evolution of firearms within Australia’s legal boundaries.

Growth Drivers of Australia Firearms Market:

Regulatory Framework and Licensing

Australia's development of its firearms market is closely linked with its strict regulatory framework, which is based on major changes made following the 1996 National Firearms Agreement. In contrast to most other areas, Australia's method is based on a tiered system of licensing linked to genuine need, featuring recreational shooting, professional, and pest control categories. This establishes an organized situation in which firearm ownership is tightly regulated yet remains vibrant. Significantly, surging sport shooting and hunting participation, particularly rural and regional community involvement, has driven a consistent demand for licenses, accessories, and gun safety training services. Indigenous communities and landowners in communities such as the Northern Territory and Western Queensland also frequently need firearms for cultural and land management purposes, which dictates regional licensing levels. The continued government support for firearm safety training courses and computerized tracking systems also enables orderly expansion, increasing the openness of the industry while helping with the Australia firearms market demand as well.

Pest Control Demands and Agricultural Demand

The Australian firearms industry is also driven by its expansive agricultural industry, where firearms play a utilitarian purpose beyond sport or recreation. Farmers, station owners, and rural landholders tend to depend on weapons to control pests to keep invasive species such as feral pigs, wild dogs, and foxes at bay, which undermine livestock and agriculture. This demand is especially heightened in Queensland and New South Wales, whose expansive farming operations are prevalent. The distinctive geography and low population density of Australia's outback render traditional pest control techniques unfruitful, making firearms increasingly practical aids. In addition, seasonal fluctuations of wildlife populations, caused by climatic conditions such as floods or bushfires, also stimulate demand on a particular basis. The congruence of firearm availability and environmental management supplies an aura of legitimacy and usefulness to the market. Firearms applied in this environment are typically specialized and promote innovation in design and production by local suppliers that serve agricultural needs.

Leisure Culture and Competitive Target Shooting

According to the Australia firearms market analysis, the region’s changing recreational environment plays a major role in the development of the market, especially through the increasing popularity of target sports. Clubs for activities like target shooting, clay pigeon shooting, and long-range precision shooting are increasing in number and are attracting participants from both urban and rural environments. This has led to a market of consumers who are interested in high-performance equipment, specialized gear, and firearms designed for sport. This subculture's support infrastructure—everything from clean shooting ranges to training academies—has thrived in states such as Victoria and South Australia. Moreover, Australia's participation in international shooting events has provided excitement for young enthusiasts and put advanced firearms technology in the spotlight. Recreational commerce also enjoys the full-service commerce generated by organized events and local competitions, which promote community involvement and stimulate sales of weapons and accessories such as ammunition, clothing, and maintenance kits. This cultural acceptance of responsible sporting use continues to drive attitudes and support industry growth in a traditionally conservative region with respect to weapon ownership.

Opportunities of Australia Firearms Market:

Local Manufacturing and Innovation Expansion

The local firearms industry in Australia is an area with significant potential for expansion through domestic manufacturing and technical innovation. The country's somewhat insular geography and high import restrictions mean that favorable conditions exist for local manufacturers to flourish by supplying customized firearms to satisfy particular Australian demands. Companies can capitalize on this by creating models that are suited to extreme climatic conditions, e.g., dust-proofed designs for dry environments such as the Pilbara or corrosion-proofed parts for coastal regions. More opportunities exist in creating firearms aligned with Australia's tightly regulated legal landscape, which has established consumer confidence in locally made, compliant products. Regional producers also gain from intimate engagement with sports clubs, farming communities, and police institutions to customize products and improve performance based on user feedback. With growing interest in precision shooting and country pest management, opportunities for developing manufacturing capacities and improving product design are ever more promising, yielding potential for export to the international market as well.

Expansion in Training Services and Safety Education

Australia's systematic framework of firearm ownership provides fertile soil for the development of training services and safety education programs. With access to firearms tied to compulsory courses and certificates, providers can leverage increased demand for thorough, high-quality training. The country's focus on responsible ownership, especially in culturally sensitive areas like Indigenous country or preserved nature corridors, emphasizes the importance of localized training modules based on indigenous knowledge. Numerous areas, such as Tasmania and Northern Territory, provide specialized terrain and wildlife issues, necessitating sophisticated and context-dependent application of firearms, presenting opportunities for training companies to specialize. Public sector collaboration can also propel educational programs throughout schools, rural towns, and hunting clubs, instilling safe handling skills and environmental stewardship. Such initiatives not only meet regulatory requirements but also ensure an educated user base and favorable public perception for the industry. As gun ownership continues to overlap with recreation, agriculture, and conservation, education continues to be a key to sustainable development.

Diversification through Recreational and Tourism Segments

Australia's tourism and recreation industries are untapped resources in terms of diversifying the firearms industry. While niche adventure tourism is expanding, especially in rural provinces such as South Australia and Western Australia, shooting sports have started to attract domestic and foreign tourists. Firearms experiences like clay shooting packages, guided pest control safaris, or precision marksmanship events, provides new revenue streams while stimulating local economies. These activities tend to be associated with licensed operators who facilitate compliance with laws while delivering culturally enriched and ecologically sensitive experiences. Further, the country's strong traditions of bushcraft and outback travel enable rich immersion experiences that couple firearm use with more comprehensive survival and land management training. Experiential tourism operators can gain by adding firearm-related services into their packages, particularly when touting safe and skill-based activities. By targeting tourists who crave authentic, hands-on experiences, operators can frame Australia's firearms market not only as a tool-based industry but as part of a bigger cultural and lifestyle narrative.

Challenges of Australia Firearms Market:

Severe Legislative Obstacles and Compliance Expenses

One of the challenges to the Australian firearms market is to overcome the nation's extremely stringent legal landscape. Australia has one of the most far-reaching firearms regulatory schemes in the world, where each state has its own series of variations in licensing, ownership restrictions, and transport regulations. These convoluted laws tend to create considerable administrative weight for dealers, producers, and personal owners. Firearm sellers must spend considerable amounts on compliance initiatives, such as safe storage systems, strict record-keeping, and regular audits, all of which drive up operating expenses. Novel firearm technologies or designs that are introduced into the market also undergo longer periods of legal classification and approval, which can hamper innovation and slow product release. In states such as New South Wales and Victoria, urban policy changes and attitudes within local councils’ further impact availability, sometimes generating imbalances in access to the market within the country. This patchwork of regulation generates uncertain barriers for companies attempting to scale up nationally.

Public Sentiment and Media Scrutiny

Australia's firearm sector exists in a sociopolitical context of heightened public opinion against the proliferation of guns. The memory of the Port Arthur massacre continues to influence public opinion, with sporadic demands for more stringent laws despite genuine market segments expanding. Mainstream media reports tend to focus on illegal firearm events or report on black-market transactions, creating suspicion around legal firearm ownership. This tends to negatively impact the public image of the industry, notably in city centers where recreational and agricultural firearm use is less conspicuous. Shops and shooting clubs are often subjected to local resistance when setting up new premises or holding shooting competitions. Furthermore, any high-profile shooting incident can trigger public outcry, causing demand to fluctuate temporarily and policy to be reviewed. Consequently, the companies in the industry need to make a concerted effort at public education and outreach to dispel myths and encourage proper use, and this serves another level of challenge on expansion.

Supply Chain Constraints and Geographic Challenges

The country's distinctive geography and proportionally small internal production base create supply chain challenges for the firearms industry. Much of the firearms and accessories are imported, and hence the companies must contend with a labyrinthine set of international trade rules and disruptions in the supply chain. Such reliance makes the industry vulnerable to delays arising from geopolitical tensions, global shipping fluctuations, and adherence to changing import/export policies. In addition, transporting guns and associated products throughout Australia's vast territory is expensive, especially for accessing distant or rural areas where demand is constant, but infrastructure is poor. Dealers in outback regions such as Western Queensland or the Kimberley region tend to have long delivery lead times and reduced availability of advanced equipment. These territorial challenges make markets less efficient and impede responsiveness to consumers. The fact that there are no centralized distribution centers specifically designed for the gun industry exacerbates these challenges, which in turn makes scalability a daunting prospect for small to medium-sized businesses attempting to expand their national presence.

Australia Firearms Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, technology, operation, and end use.

Type Insights:

- Pistol

- Revolver

- Rifle

- Machinegun

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes pistol, revolver, rifle, machinegun, and others.

Technology Insights:

- Guided

- Unguided

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes guided and unguided.

Operation Insights:

- Automatic

- Semi-Automatic

- Manual

The report has provided a detailed breakup and analysis of the market based on the operation. This includes automatic, semi-automatic, and manual.

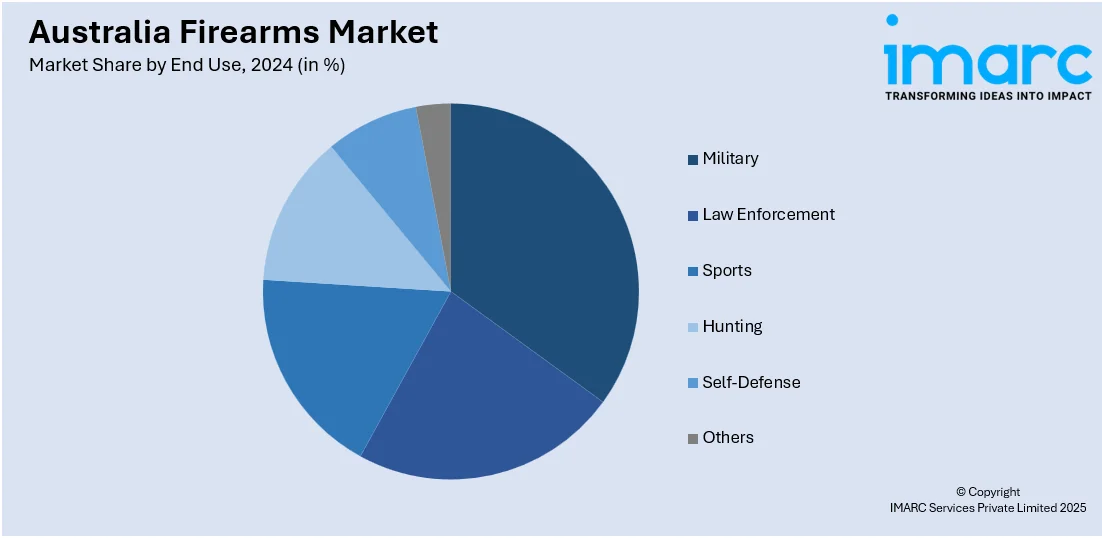

End Use Insights:

- Military

- Law Enforcement

- Sports

- Hunting

- Self-Defense

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes military, law enforcement, sports, hunting, self-defense, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Firearms Market News:

- In April 2025, The UK and Australia are partnering to develop modular "plug-and-launch" weapons systems, combining the UK’s Modular Weapons Testbed with Australia’s Sharktooth program. This initiative focuses on low-cost, adaptable technologies like 3D-printed engines, modular warheads, and advanced guidance. Aimed at boosting interoperability and reducing costs, the collaboration enhances both nations’ defense capabilities while supporting innovation across their defense industries, including small businesses and academia. Concept demonstrators will validate technology before military integration.

Australia Firearms Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Pistol, Revolver, Rifle, Machinegun, Others |

| Technologies Covered | Guided, Unguided |

| Operations Covered | Automatic, Semi-Automatic, Manual |

| End Uses Covered | Military, Law Enforcement, Sports, Hunting, Self-Defense, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia firearms market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia firearms market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia firearms industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia firearms market was valued at USD 1.16 Billion in 2024.

The Australia firearms market is projected to exhibit a CAGR of 7.50% during 2025-2033.

The Australia firearms market is expected to reach a value of USD 2.40 Billion by 2033.

The Australia firearms market is evolving through rising recreational shooting interest, regional demand for pest control tools, and diversification of safety training programs. Local manufacturers exploring niche segments like precision sport and agricultural use, along with digital licensing systems and public education efforts are further reflecting a shift toward responsible, regulated firearm growth.

The Australia firearms market is driven by regulated sporting culture, rural pest control needs, and growing demand for licensed recreational use. Agricultural regions rely on firearms for wildlife management, while competitive shooting gains popularity nationwide. Government investment in safety training and licensing also encourages structured growth within strict regulatory boundaries.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)