Australia Fisheries and Aquaculture Market Report by Segment (Fishes, Crustaceans, Molluscs, and Others), and Region 2026-2034

Australia Fisheries and Aquaculture Market Overview:

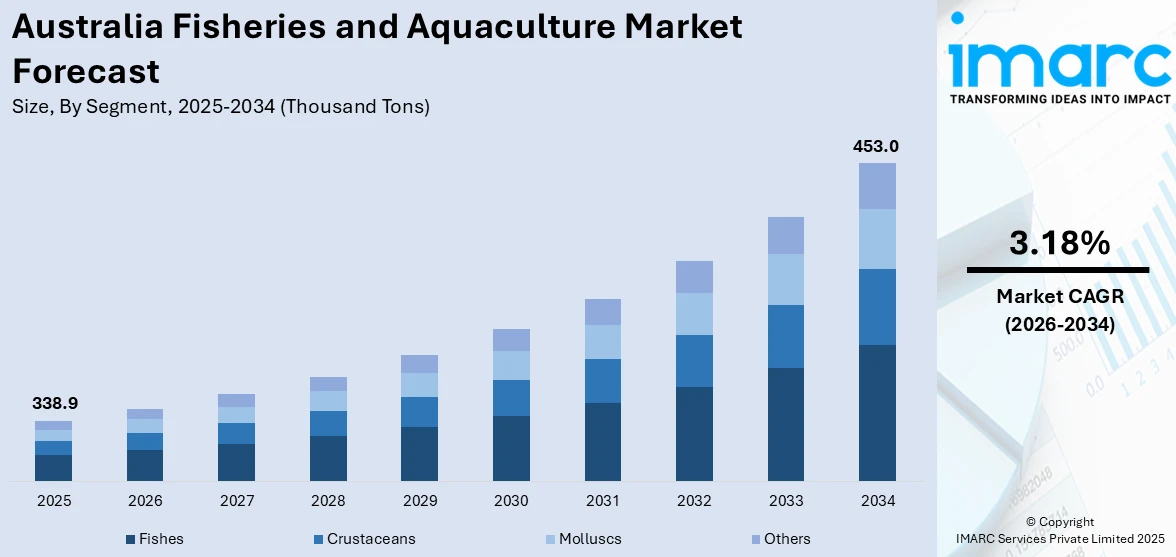

The Australia fisheries and aquaculture market size reached 338.9 Thousand Tons in 2025. Looking forward, the market is projected to reach 453.0 Thousand Tons by 2034, exhibiting a growth rate (CAGR) of 3.18% during 2026-2034. The market is significantly growing due to rising need for sustainable seafood, ample export opportunities, and advancements in aquaculture technology. Moreover, the market profits from beneficial government schemes encouraging sustainable practices, further fueling market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | 338.9 Thousand Tons |

| Market Forecast in 2034 | 453.0 Thousand Tons |

| Market Growth Rate 2026-2034 | 3.18% |

Key Trends of Australia Fisheries and Aquaculture Market:

Rising Trend of Sustainability in Aquaculture

Australia fisheries and aquaculture market is witnessing a substantial inclination toward sustainability. With government policies endorsing responsible and eco-friendly fishing, aquaculture activities are actively emphasizing on lowering environmental impact. Moreover, cutting-edge technologies, such as recirculating aquaculture systems (RAS) and integrated multi-trophic aquaculture (IMTA), are increasingly gaining momentum, bolstering production capacities while reducing ecological disruption. For instance, in July 2024, Huon Aquaculture, a leading food processing and aquaculture company in Australia, announced the development of a RAS facility in Tasmania, with an investment of USD 73 million. The construction is anticipated to initiate in Q1 2025. In addition, this trend caters to the heightening global customer demand for ethically sourced seafood, offering a competitive edge for Australian producers in global market dynamics. Furthermore, by heavily investing in sustainable techniques, the sector is poised to address both export and local demands, establishing itself as one of the major markets in sustainable seafood production.

To get more information on this market, Request Sample

Rapid Growth of Export Market

The fisheries and aquaculture market in Australia is witnessing robust growth in seafood exports, primarily driven by propelling international demand for sustainable as well as high-quality seafood products. According to the Department of Agriculture, Fisheries and Forestry, Australia produces around 300,000 tons of seafood annually. Key exports market in certain continents have substantially contributed to this trend, as costumers in these regions are rapidly preferring premium Australian seafood. Moreover, the country’s stringent certifications and regulation policies regarding fishing practice improve its appeal in global market, where food traceability as well as safety are prime objectives. Additionally, export versatility beyond conventional markets is also being pursued, with significant opportunities ascending in certain international regions, further boosting Australia’s position as one of the major seafood exporters.

Increasing Technological Innovations in Aquaculture

Technological innovations are revolutionizing fisheries and aquaculture market in Australia, notably driving both sustainability and efficiency. Some of the advancements that are rapidly being deployed include artificial intelligence (AI) for fish health tracking, automated systems for fish feeding, and real-time monitoring systems for water quality assessment. For instance, in July 2023, researchers at James Cook University developed Australia’s first prototype tool called Mobile Fish Landmark Detection Network that leverages AI algorithm, industrial camera, and a conveyer belt to detect and monitor healthiest fish for selective breeding practices. Moreover, such upgraded technologies facilitate aquaculture operators to minimize cost, maintain required standards of product quality, and streamline production. In addition, biotechnological advancements in disease prevention and breeding are supporting the adaptability as well as higher yield in aquaculture species. Furthermore, the incorporation of such innovations establishes Australia as a pioneer in tech-driven, modern aquaculture sector, fueling both export and domestic market profitability.

Growth Drivers of Australia Fisheries and Aquaculture Market:

Rising Seafood Consumption

The increasing need for seafood in Australia impacts the fisheries and aquaculture sector to a large extent. Owing to greater numbers of consumers focusing on health, seafood is increasingly being seen as a nutrient-rich protein, full of omega-3 fatty acids and beneficial vitamins. Processed and fresh seafood both are seeing greater interest due to hectic lifestyles, which are compelling the population to look for convenient yet healthy food alternatives. The urban trends and growing disposable incomes also add to this change, causing seafood to be incorporated into a number of culinary traditions. This growth in consumption is driving consistent market expansion and attracting additional investment into aquaculture to meet demand. The high-quality image of Australia for seafood also adds to the strength for export opportunities, contributing to the momentum. These elements significantly bolster Australia fisheries and aquaculture market share by fulfilling local needs while boosting export potential.

Expansion of Value-Added Products

Value-added seafood products are emerging as a promising growth avenue in Australia’s fisheries and aquaculture industry. Ready-to-cook, marinated, frozen, and packaged seafood items are becoming increasingly popular among consumers who seek convenient options without sacrificing quality. This trend is strongly influenced by hectic lifestyles, urban dining preferences, and the appeal of global cuisines. Retailers and food service providers are also adopting value-added seafood to align with shifting consumer preferences and minimize waste. For exporters, processed and packaged seafood meets international standards and offers longer shelf life, enhancing competitiveness in global markets. Consequently, the increase in product diversification and innovation continues to boost Australia fisheries and aquaculture market demand and creates new revenue opportunities for industry stakeholders.

Government Support and Regulations

Government initiatives play a significant role in advancing the fisheries and aquaculture sector in Australia. Policies that promote sustainable fishing practices, rigorous monitoring of stock levels, and funding for aquaculture research help ensure the industry's long-term viability. Supportive regulations highlight quality control and sustainability, making Australian seafood a strong contender in global markets. Investment in infrastructure, such as hatcheries, monitoring systems, and export facilities, further enhances the sector’s capabilities. Moreover, collaboration between government, industry, and research organizations fosters innovation in aquaculture practices. Such initiatives safeguard marine ecosystems while improving productivity and global outreach. These regulatory frameworks and support measures are essential in fueling Australia fisheries and aquaculture market growth while balancing economic and environmental responsibilities.

Opportunities of Australia Fisheries and Aquaculture Market:

Eco-Certification and Branding

Growing consumer awareness regarding sustainability and ethical sourcing is transforming the seafood industry. Consumers are showing a preference for products that are eco-friendly, responsibly harvested, and traceable from source to table. This shift creates opportunities for seafood companies to adopt eco-certifications and labels, which ensure adherence to global environmental standards while enhancing brand positioning. Companies can utilize these certifications to penetrate premium retail and export markets, achieve higher price points, and cultivate customer loyalty. Furthermore, eco-certification fosters transparency and trust, which are essential for nurturing enduring relationships with consumers, distributors, and regulatory bodies. Consequently, seafood producers that commit to sustainable practices can stand out in a competitive landscape while aiding environmental conservation.

Tourism and Aquaculture Synergies

Integrating tourism with aquaculture operations offers an innovative path for business expansion. Farms can provide guided tours, interactive educational activities, culinary events, and hands-on seafood preparation workshops. These initiatives draw domestic and international visitors and promote awareness about sustainable seafood practices. According to Australia fisheries and aquaculture market analysis, the combination of tourism and aquaculture can generate additional revenue streams, boost brand visibility, and enhance customer engagement. This approach allows for the display of innovative farming techniques and locally sourced seafood products, creating a distinctive experience that strengthens customer loyalty. For rural and coastal communities, this strategy aids regional economic growth and fosters investment in infrastructure, which results in more resilient and profitable aquaculture operations in the long run.

Diversification of Species

Broadening aquaculture to include species beyond traditional choices like salmon and tuna represents a significant opportunity to meet the rising consumer demand. Growing a broader range of species such as shellfish, prawns, and niche or exotic varieties enables producers to cater to changing tastes and dietary needs. Diversification helps reduce reliance on a single product, lessening risks associated with price fluctuations, disease outbreaks, or regulatory shifts. It also opens up new domestic and international markets, particularly for premium or specialty seafood items. Additionally, introducing a variety of species encourages product innovation, paving the way for value-added offerings such as ready-to-cook seafood kits or gourmet selections. For producers, strategic diversification boosts competitiveness, increases revenue potential, and promotes sustainability by balancing ecological effects across various species and production methods.

Australia Fisheries and Aquaculture Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on segment.

Segment Insights:

- Fishes

- Crustaceans

- Molluscs

- Others

The report has provided a detailed breakup and analysis of the market based on the segment. This includes fishes, crustaceans, molluscs, and others.

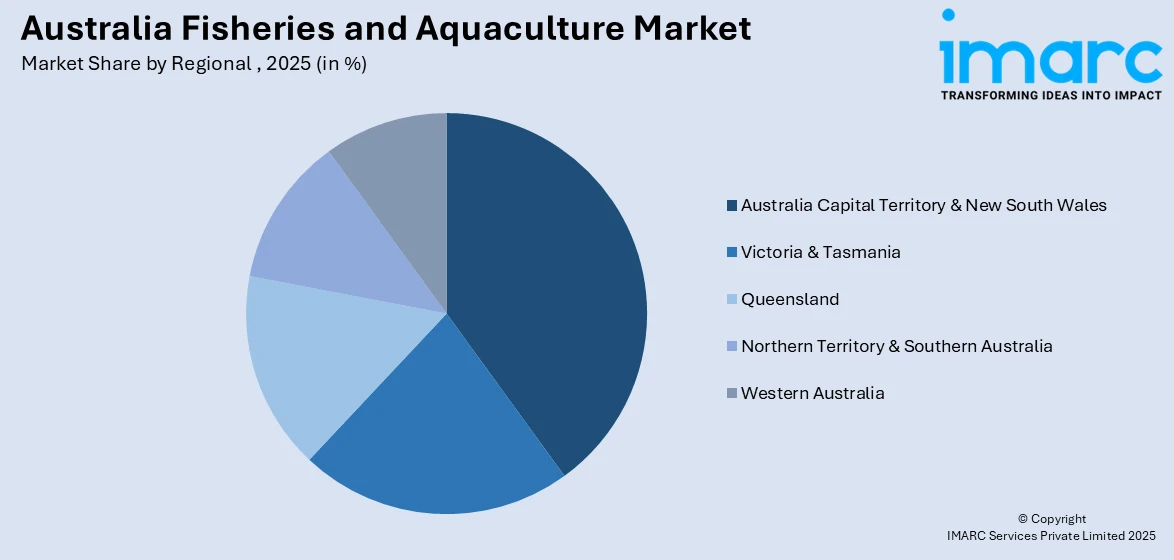

Regional Insights:

Access the comprehensive market breakdown Request Sample

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Fisheries and Aquaculture Market News:

- In July 2025, Australia Bay Seafoods launched its new fishing trawler, the FV Australia Bay, built in Vietnam and now docked in Darwin. The vessel is set to operate in the NT's Demersal Fishery, marking a significant addition to the company's operations, as highlighted during the launch event by key officials.

- In February 2025, Australian scientists announced that they are researching a new sustainable aquaculture species, the native pompano fish, to reduce 62% of seafood imports. The CSIRO has conducted successful breeding trials, aiming to enhance local seafood production. Early market tests show promise, focusing on taste, growth rates, and fish behavior in farming conditions.

- In November 2024, CSIRO introduced pompano, a fast-growing white-flesh fish, to Australian aquaculture, potentially boosting the economy by over USD 1 Billion. Ideal for northern Australia’s tropical climate, this initiative aims to reduce reliance on imported seafood and create a sustainable fish industry, while offering new culinary options and export opportunities.

- In August 2024, Tidal, a leading AI and underwater robotics company, announced new investments to expand its foothold in Australia aquaculture market. Tidal will provide aquaculture farmers with AI-integrated camera system and software to track and monitor fisheries growth in real-time.

- In February 2023, NaturalShrimp Inc., a well-known aquaculture company, announced a strategic collaboration with the Australian Prawn Farmers Association and the Fisheries Research and Development Corporation (FRDC) to evaluate company’s patented technology of electrocoagulation for prawn wastewater treatment, The company aims to aid aquaculture farmers in removing pollutants like nitrites and ammonia from water, which is a major challenge for prawn market in Australia, and boost prawn yield.

Australia Fisheries and Aquaculture Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Thousand Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Segments Covered | Fishes, Crustaceans, Molluscs, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia fisheries and aquaculture market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia fisheries and aquaculture market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia fisheries and aquaculture industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The fisheries and aquaculture market in Australia reached 338.9 Thousand Tons in 2025.

The Australia fisheries and aquaculture market is projected to exhibit a compound annual growth rate (CAGR) of 3.18% during 2026-2034.

The Australia fisheries and aquaculture market is expected to reach 453.0 Thousand Tons by 2034.

Rising adoption of sustainable and eco-friendly fishing practices, increased focus on high-value species, integration of advanced aquaculture technologies, and expansion of processed and ready-to-cook seafood products are shaping the market. Export-oriented strategies and digital monitoring of farms are also gaining traction.

Increasing domestic and international demand for seafood, supportive government policies and funding, technological advancements in aquaculture farming, and rising consumer preference for protein-rich and ready-to-eat seafood products are driving market expansion. Additionally, investments in cold-chain logistics and quality certification standards are enhancing product accessibility and market competitiveness.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)