Australia Flat Glass Market Size, Share, Trends and Forecast by Technology, Product Type, Raw Material, Application, Type, End Use Industry, and Region, 2025-2033

Australia Flat Glass Market Overview:

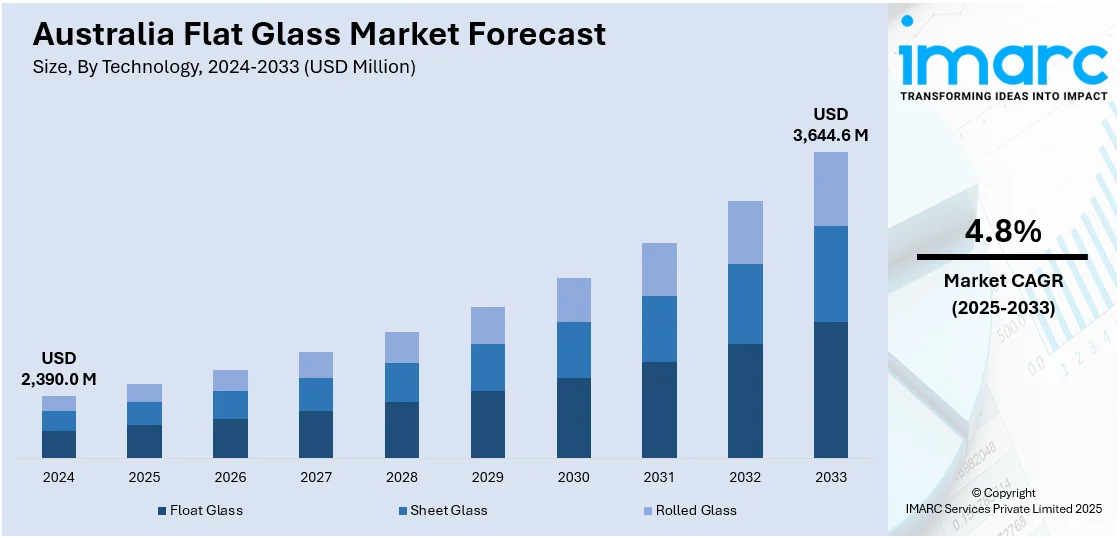

The Australia flat glass market size reached USD 2,390.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 3,644.6 Million by 2033, exhibiting a growth rate (CAGR) of 4.8% during 2025-2033. The market is driven by the government's continued investment in infrastructure like transportation terminals, public buildings, and smart cities, rising concern for energy efficiency and environmental laws, and developments in tempering and lamination technology and fabrication.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2,390.0 Million |

| Market Forecast in 2033 | USD 3,644.6 Million |

| Market Growth Rate 2025-2033 | 4.8% |

Australia Flat Glass Market Trends:

Growth in Residential and Commercial Construction Activity

Australia's robust construction industry, especially in major cities is driving the need for flat glass products. The flat glass market has an inherent association with the property and infrastructure segments, as glass is an intrinsic element in contemporary building design. Improvements in urban development driven by increasing populations, immigration, and advancements in residential apartments, high-rises, and business complexes are positively influencing the market. The government's continued investment in infrastructure like transportation terminals, public buildings, and smart cities also require large amounts of float and processed glass. Design shifts toward large glass facades, expansive floor plans, and increased daylighting are also facilitating the use of flat glass in new construction and retrofits. The IMARC Group predicts that the Australia construction market size is expected to reach USD 588 Billion by 2033.

To get more information on this market, Request Sample

Rising Need for Energy-Efficient and Sustainable Building Components

Growing concern for energy efficiency and environmental laws are bolstering the market growth in Australia. Glass technologies that enhance thermal insulation, like double-glazed and low-emissivity (low-E) glass, are becoming mandatory in residential and commercial buildings. These items help save on heating and cooling expenses, and they comply with Australia's National Construction Code (NCC) and the energy efficiency requirements it enforces. Green building ratings systems also promote developers and architects to specify energy-efficient glass solutions to improve building performance ratings. Moreover, changing tastes are also encouraging people to turn toward environment friendly living, which further catalyzes the demand for sustainable building materials. As net-zero and carbon-neutral projects become more popular nationwide, flat glass that provides passive solar design support and reduces environmental footprint is playing a more vital role in the built environment. Apart from this, the heightened focus on glass recycling to reduce carbon footprint is facilitating the production of flat glass from scraps. In 2024, REDWAVE opened the largest glass recycling facility in Australia with the capacity to process 200,000 tons of recycled glass per year.

Technological Advancements in Glass Processing and Fabrication

Advancements in glass production and processing are improving the potential and usage of flat glass in Australia. Improved high-performance glass products with increased strength, safety, and functionality are created as a result of new technologies. For example, developments in tempering and lamination technology enable the manufacture of flat glass that is more resistant to breakage and external impact, thus satisfying the high safety standards demanded in architectural and automotive applications. Smart glass technologies like electrochromic and photochromic glass are also becoming popular, enabling users to precisely control transparency and solar gain. In addition, automated glazing, coating, and cutting systems are enhancing production efficiency and customization, allowing glass manufacturers to quickly fulfill varied design specifications. These technologies are not only expanding the use of flat glass but also increasing its aesthetic and structural value in contemporary construction and interior design.

Australia Flat Glass Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on technology, product type, raw material, application, type, and end use industry.

Technology Insights:

- Float Glass

- Sheet Glass

- Rolled Glass

The report has provided a detailed breakup and analysis of the market based on the technology. This includes float glass, sheet glass, and rolled glass.

Product Type Insights:

- Basic Float Glass

- Toughened Glass

- Coated Glass

- Laminated Glass

- Insulated

- Extra Clear Glass

- Others

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes basic float glass, toughened glass, coated glass, laminated glass, insulated, extra clear glass, and others.

Raw Material Insights:

- Sand

- Soda Ash

- Recycled Glass

- Dolomite

- Limestone

- Others

The report has provided a detailed breakup and analysis of the market based on the raw material. This includes sand, soda ash, recycled glass, dolomite, limestone, and others.

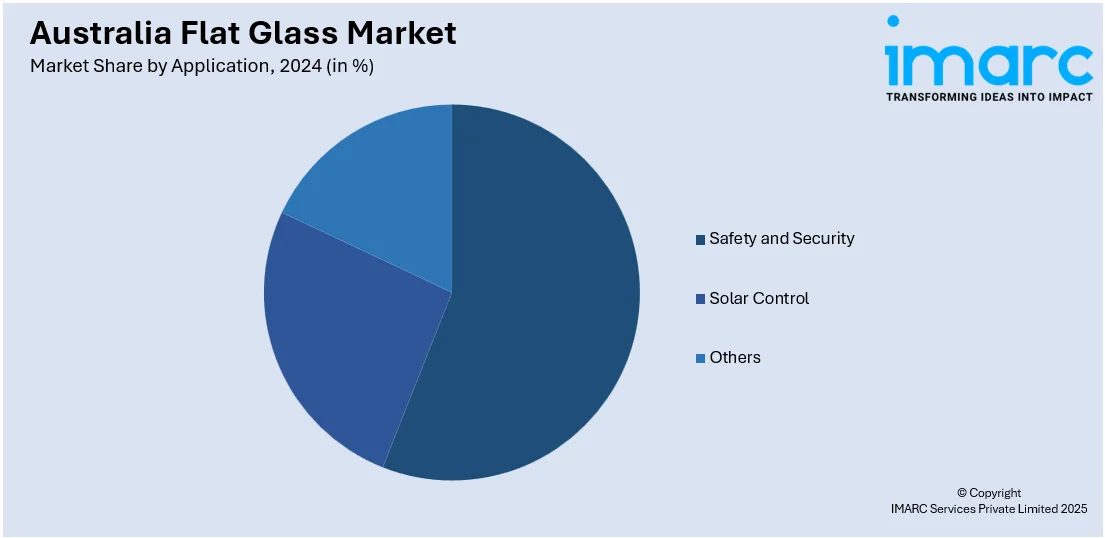

Application Insights:

- Safety and Security

- Solar Control

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes safety and security, solar control, and others.

Type Insights:

- Fabricated

- Non-Fabricated

The report has provided a detailed breakup and analysis of the market based on the type. This includes fabricated and non-fabricated.

End Use Industry Insights:

- Construction

- Automotive

- Solar Energy

- Electronics

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes construction, automotive, solar energy, electronics, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Flat Glass Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Float Glass, Sheet Glass, Rolled Glass |

| Product Types Covered | Basic Float Glass, Toughened Glass, Coated Glass, Laminated Glass, Insulated, Extra Clear Glass, Others |

| Raw Materials Covered | Sand, Soda Ash, Recycled Glass, Dolomite, Limestone, Others |

| Applications Covered | Safety and Security, Solar Control, Others |

| Types Covered | Fabricated, Non-Fabricated |

| End Use Industries Covered | Construction, Automotive, Solar Energy, Electronics, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia flat glass market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia flat glass market on the basis of technology?

- What is the breakup of the Australia flat glass market on the basis of product type?

- What is the breakup of the Australia flat glass market on the basis of raw material?

- What is the breakup of the Australia flat glass market on the basis of application?

- What is the breakup of the Australia flat glass market on the basis of type?

- What is the breakup of the Australia flat glass market on the basis of end use industry?

- What is the breakup of the Australia flat glass market on the basis of region?

- What are the various stages in the value chain of the Australia flat glass market?

- What are the key driving factors and challenges in the Australia flat glass market?

- What is the structure of the Australia flat glass market and who are the key players?

- What is the degree of competition in the Australia flat glass market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia flat glass market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia flat glass market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia flat glass industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)