Australia Fleet Leasing Market Size, Share, Trends and Forecast by Lease Type, Vehicle Type, Lease Duration, End Use Industry, and Region, 2025-2033

Australia Fleet Leasing Market Overview:

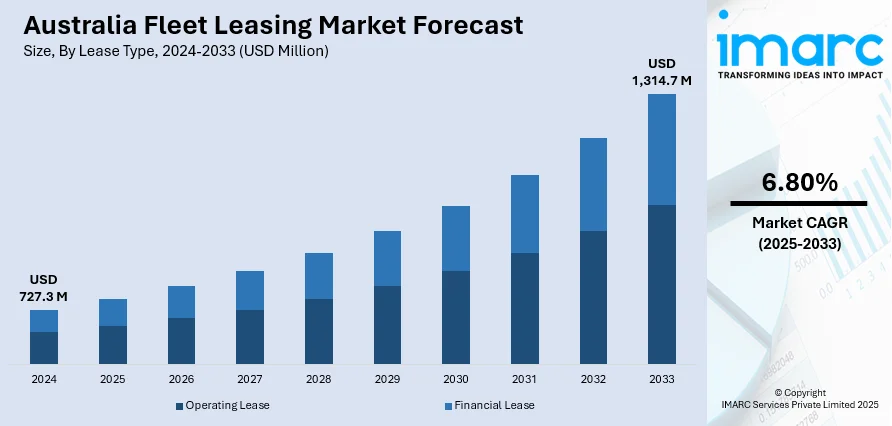

The Australia fleet leasing market size reached USD 727.3 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,314.7 Million by 2033, exhibiting a growth rate (CAGR) of 6.80% during 2025-2033. Rising demand for cost-efficient vehicle management, tax benefits, increasing adoption of electric vehicles, and a shift toward operational leasing are some of the factors contributing to Australia fleet leasing market share. Corporate sustainability goals and technological advancements in fleet management solutions also support market growth and efficiency.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 727.3 Million |

|

Market Forecast in 2033

|

USD 1,314.7 Million |

| Market Growth Rate 2025-2033 | 6.80% |

Australia Fleet Leasing Market Trends:

Rising Adoption of Electric Vehicles in Corporate Fleets

Australia fleet leasing market is undergoing a significant transformation as more organizations embrace electric vehicles (EVs) to meet sustainability and operational goals. Driven by growing environmental awareness and supported by government initiatives such as EV fleet incentives in New South Wales, companies are shifting toward cost-effective and flexible leasing models that integrate EVs into business operations. These programs encourage the adoption of lower-emission vehicles while offering financial and logistical benefits, including reduced fuel costs, lower maintenance, and streamlined leasing options. This shift not only helps businesses align with carbon neutrality targets but also modernizes their vehicle management strategies. The increasing focus on operational efficiency, sustainability, and financial prudence is shaping the future of Australia’s commercial vehicle leasing ecosystem. These factors are intensifying the Australia fleet leasing market growth. For example, in January 2024, Fujitsu partnered with Origin to lease five electric vehicles across Victoria, New South Wales, and Queensland under the 360 EV Flex Plan, supporting its carbon neutrality goal by 2030. This EV trial boosts Australia’s fleet leasing market, aligning with NSW’s EV Fleet Incentive program to reduce emissions and promote cost-effective, flexible vehicle solutions for corporate fleets transitioning to electric mobility.

To get more information of this market, Request Sample

Growth of Shared Mobility and Flexible Leasing Models

The fleet leasing sector in Australia is expanding beyond traditional models, with increasing focus on peer-to-peer car-sharing platforms and flexible leasing arrangements. These new models enable scalable, on-demand access to vehicles, making them attractive for both urban users and businesses. The integration of connected car technology supports real-time tracking, efficient vehicle utilization, and seamless digital booking experiences. As more vehicles become available through shared fleets in major cities like Sydney and Melbourne, the market is adapting to meet consumer demand for short-term, affordable, and flexible mobility solutions. This evolution enhances operational efficiency, reduces ownership burdens, and supports sustainability efforts, offering a versatile alternative to conventional fleet leasing. The shift reflects a broader move toward innovation and user-centric services in vehicle leasing. For instance, in November 2024, ComfortDelGro (CDG) invested USD 2 Million in Drive lah to support its expansion in Australia, where the platform operates as Drive mate. With 500 vehicles and 5,000 users, the peer-to-peer car-sharing platform would receive up to 3,000 CDG-owned vehicles in Sydney and Melbourne. This move strengthens Australia’s fleet leasing and shared mobility market, leveraging connected car technology and flexible vehicle rental models.

Australia Fleet Leasing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on lease type, vehicle type, lease duration, and end use industry.

Lease Type Insights:

- Operating Lease

- Financial Lease

The report has provided a detailed breakup and analysis of the market based on the lease type. This includes operating lease and financial lease.

Vehicle Type Insights:

- Passenger Vehicles

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes passenger vehicles, light commercial vehicles (LCVS), and heavy commercial vehicles (HCVS).

Lease Duration Insights:

- Short-Term Leasing (Less than 12 months)

- Medium-Term Leasing (1-3 years)

- Long-Term Leasing (More than 3 years)

The report has provided a detailed breakup and analysis of the market based on the lease duration. This includes short-term leasing (less than 12 months), medium-term leasing (1-3 years), and long-term leasing (more than 3 years).

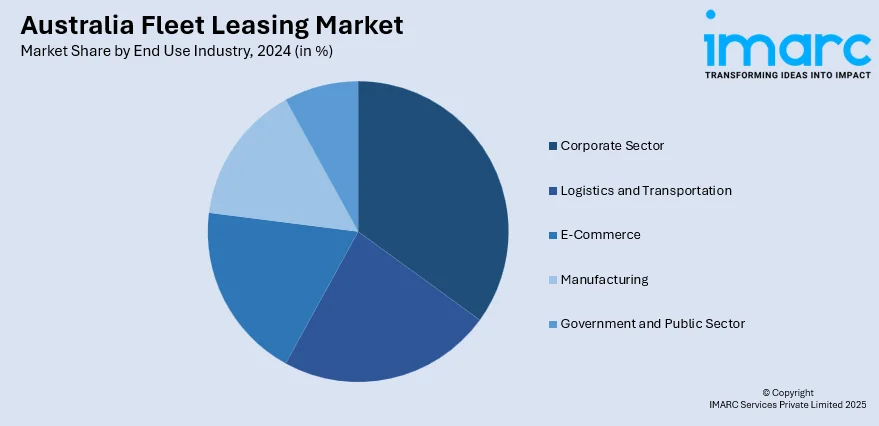

End Use Industry Insights:

- Corporate Sector

- Logistics and Transportation

- E-Commerce

- Manufacturing

- Government and Public Sector

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes corporate sector, logistics and transportation, e-commerce, manufacturing, and government and public sector.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Fleet Leasing Market News:

- In March 2025, FleetPartners launched an advanced online lease calculator and car chooser, allowing Australian businesses to compare leasing costs across 1,600+ vehicle models. The platform offers bundled lease pricing, factoring in running costs like servicing and registration. With digital credit approvals up to USD 150,000 and lease terms up to 60 months, FleetPartners aims to streamline vehicle leasing for small businesses and ABN holders, enhancing efficiency in the fleet leasing market.

Australia Fleet Leasing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Lease Types Covered | Operating Lease, Financial Lease |

| Vehicle Types Covered | Passenger Vehicles, Light Commercial Vehicles (LCVs), Heavy Commercial Vehicles (HCVs) |

| Lease Durations Covered | Short-Term Leasing (Less than 12 months), Medium-Term Leasing (1-3 years), Long-Term Leasing (More than 3 years) |

| End Use Industries Covered | Corporate Sector, Logistics and Transportation, E-Commerce, Manufacturing, Government and Public Sector |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia fleet leasing market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia fleet leasing market on the basis of lease type?

- What is the breakup of the Australia fleet leasing market on the basis of vehicle type?

- What is the breakup of the Australia fleet leasing market on the basis of lease duration?

- What is the breakup of the Australia fleet leasing market on the basis of end use industry?

- What is the breakup of the Australia fleet leasing market on the basis of region?

- What are the various stages in the value chain of the Australia fleet leasing market?

- What are the key driving factors and challenges in the Australia fleet leasing market?

- What is the structure of the Australia fleet leasing market and who are the key players?

- What is the degree of competition in the Australia fleet leasing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia fleet leasing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia fleet leasing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia fleet leasing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)