Australia Flooring Market Size, Share, Trends and Forecast by Type, End User, and Region, 2025-2033

Australia Flooring Market Overview:

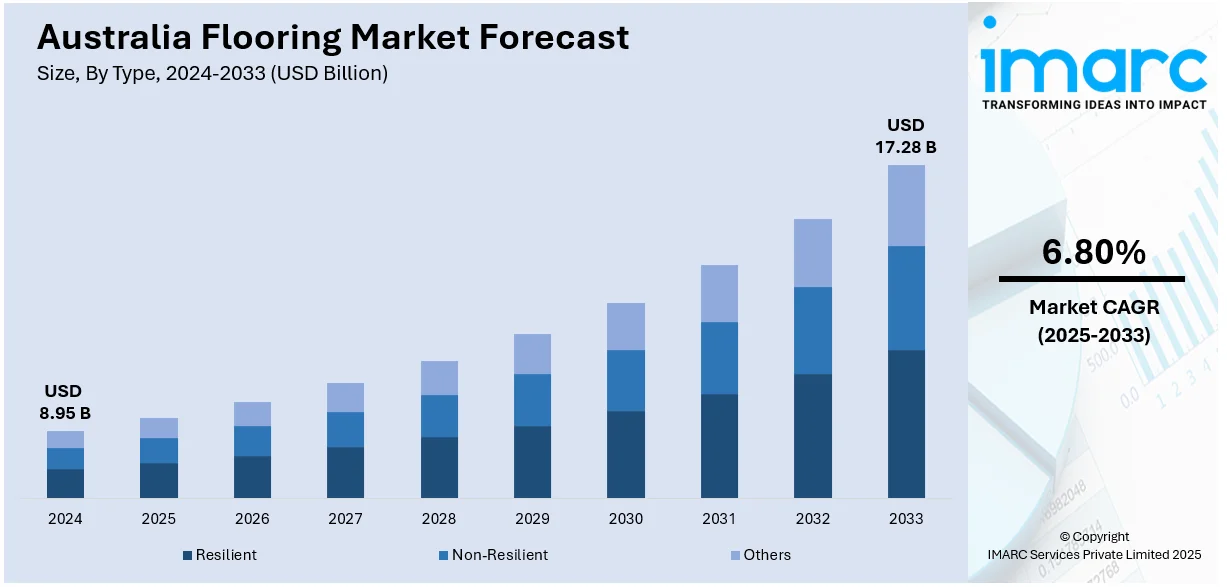

The Australia flooring market size reached USD 8.95 Billion in 2024. Looking forward, the market is expected to reach USD 17.28 Billion by 2033, exhibiting a growth rate (CAGR) of 6.80% during 2025-2033. The market is driven by increased demand for sustainable and eco-friendly materials, rising construction and renovation activities, advancements in flooring technologies, growing consumer preference for aesthetic and durable flooring options, and government initiatives promoting green building practices, alongside innovations in product design and performance.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 8.95 Billion |

| Market Forecast in 2033 | USD 17.28 Billion |

| Market Growth Rate 2025-2033 | 6.80% |

Key Trends of Australia Flooring Market:

Growth in Infrastructure and Real Estate Development

A significant factor contributing to the growth of the Australian flooring market is the country's sustained development in infrastructure and real estate. Australia has witnessed a steady rise in both residential and commercial construction, driven by urban population growth and substantial public investment in infrastructure projects. Developments, including high-rise residential buildings, commercial office spaces, educational institutions, healthcare facilities, and transportation hubs, have collectively generated a strong demand for a diverse range of flooring materials, ranging from hardwood and vinyl to carpet tiles and laminates. Government programs, such as those led by the National Housing Finance and Investment Corporation (NHFIC), and incentives for first-time homebuyers have supported a marked increase in housing construction, particularly in major urban centers like Sydney, Melbourne, and Brisbane. As construction volumes continue to rise, flooring remains a critical component, both in terms of function and design. Commercial development in sectors, such as hospitality and retail, also plays a significant role in increasing the demand for durable, low-maintenance flooring products. Additionally, Australia’s stringent building codes and environmental policies are promoting the use of high-quality, long-lasting, and sustainable flooring solutions.

To get more information on this market, Request Sample

Rising Consumer Preference for Sustainable and Eco-Friendly Flooring

Another important trend shaping the Australian flooring industry is the growing consumer preference for environmentally sustainable products. Environmental awareness among Australian consumers has led to heightened interest in flooring materials that are renewable, recyclable, ethically sourced, and emit low levels of volatile organic compounds (VOCs). As a result, materials such as bamboo, cork, reclaimed timber, and linoleum have gained popularity due to their ecological benefits. In response to these preferences, flooring manufacturers are increasingly introducing products made from recycled content, using non-toxic adhesives and low-emission finishes. Companies prioritizing sustainable practices not only meet regulatory requirements but also enhance their competitiveness in a market that places a premium on environmental responsibility. Regulatory measures such as the Building Sustainability Index (BASIX) and national net zero targets are influencing decision-making among both homeowners and developers. Flooring products are now evaluated based on factors such as thermal efficiency, carbon footprint, and lifecycle performance. This shift is further supported by public education campaigns and third-party certifications (e.g., FSC and GECA), which help validate environmental claims and build consumer trust in sustainable flooring options.

Growth Drivers of Australia Flooring Market:

Rise in Home Renovation and DIY Culture

The surge in home renovation and do-it-yourself (DIY) culture across Australia is driving significant growth in the flooring market. Homeowners are increasingly taking on improvement projects to modernize interiors, enhance property value, or adapt spaces for hybrid work and living. This trend has boosted demand for easy-to-install flooring options such as laminate, click-lock vinyl, and peel-and-stick tiles, which require minimal tools and expertise. Influenced by online tutorials and social media design trends, consumers are more confident in handling installation tasks themselves. Additionally, DIY-friendly flooring products are often more cost-effective, making them attractive to budget-conscious households. Retailers are capitalizing on this trend by offering bundled kits, online guides, and personalized recommendations, further supporting Australia flooring market growth across the residential flooring segment.

Demand for Aesthetic and Custom Flooring

There is a growing preference among Australian consumers for flooring that reflects personal style, elevates interior aesthetics, and aligns with contemporary design trends. Homeowners and interior designers are gravitating toward customizable flooring options that offer unique textures, colors, patterns, and finishes. High-end materials like engineered timber, patterned tiles, and designer vinyls are increasingly chosen for their ability to complement modern and minimalist spaces. Demand is especially strong in urban and affluent households where aesthetics significantly influence purchase decisions. The desire for visual distinction has prompted manufacturers to expand product portfolios with bespoke collections, digital printing, and mixed-material formats, which is fueling the Australia flooring market share. This focus on aesthetic value and personalization is reshaping the market from a utility-driven space into one centered on design expression and lifestyle enhancement.

Government Support for Energy-Efficient Interiors

Australia’s regulatory push toward sustainable and energy-efficient buildings is contributing to increased demand for flooring solutions that enhance indoor insulation and thermal performance. Policies promoting energy ratings in residential and commercial properties indirectly encourage the use of flooring materials that contribute to reduced energy consumption. Products like carpet tiles, cork flooring, and multi-layer engineered wood offer both functional insulation and comfort, supporting these efficiency goals. Additionally, green building certifications and rebate programs motivate developers and homeowners to select flooring with environmental benefits. Flooring companies are responding with low-VOC, thermally efficient, and eco-labeled options to align with these standards. As sustainable construction becomes a national priority, flooring that supports better indoor climate control will continue to gain market traction in both public and private development projects.

Opportunities of Australia Flooring Market:

Expansion in Commercial and Hospitality Sectors

The commercial and hospitality sectors in Australia are undergoing rapid modernization, with an increasing emphasis on creating appealing, durable, and functional interiors. Hotels, co-working spaces, cafes, and retail outlets are investing in contemporary flooring solutions to improve aesthetics, comfort, and customer experience. High footfall areas require resilient materials like hybrid flooring, vinyl tiles, and ceramic options that combine style with long-term durability. Additionally, businesses are opting for low-maintenance and easy-to-clean surfaces to reduce upkeep costs. This trend has opened up lucrative opportunities for flooring manufacturers to develop sector-specific products that meet both design and performance criteria. As interior environments become a key differentiator in attracting customers and tenants, demand from the commercial and hospitality sectors is expected to grow steadily across Australia in the coming years.

Innovation in Smart and Multi-Functional Flooring

The integration of technology into flooring materials is creating new opportunities in Australia’s premium flooring segment, which is further driving the Australia flooring market demand. Innovations such as smart flooring embedded with sensors can track foot traffic, detect motion, and monitor environmental conditions, making them ideal for commercial, healthcare, and luxury residential spaces. Other advancements include noise-reduction technology, anti-microbial coatings, and surfaces that adapt to temperature changes for enhanced comfort. These multi-functional features appeal to consumers seeking both functionality and sophistication in their flooring choices. Additionally, such innovations support energy efficiency and safety, aligning with the growing interest in smart homes and commercial automation. As technological awareness and demand for high-performance flooring rise, manufacturers focusing on research and development (R&D) and tech-enabled offerings are well-positioned to capture a high-value market niche in Australia.

Regional and Remote Area Penetration

With metro flooring markets nearing saturation, manufacturers are identifying strong growth potential in Australia’s regional and remote areas. These areas are experiencing gradual infrastructure development, improved road connectivity, and housing expansion, all of which drive the need for modern flooring solutions. Consumers in smaller towns are increasingly exposed to urban design trends via digital platforms, fueling demand for aesthetically appealing and durable flooring materials. Additionally, government investments in regional development and housing projects are generating fresh opportunities for suppliers and installers. Logistics challenges are being addressed through local distribution networks and partnerships with regional retailers. As awareness and affordability improve, regional and rural markets are set to emerge as important contributors to Australia’s flooring industry, offering long-term expansion beyond saturated urban centers.

Challenges of Australia Flooring Market:

Volatility in Raw Material Prices

The Australian flooring market faces ongoing challenges due to fluctuations in the prices of key raw materials such as wood, PVC, adhesives, and synthetic resins. These price shifts are influenced by global supply chain disruptions, changing import/export policies, and commodity market instability. For manufacturers and suppliers, this unpredictability strains profit margins and makes cost forecasting difficult. As a result, companies often struggle to maintain stable pricing for consumers while staying competitive. Price volatility also limits smaller businesses' ability to stock diverse flooring options or invest in innovation. End-users, especially in the construction and renovation segments, face higher material costs, which can delay or scale down projects. Overall, raw material instability remains a critical barrier to consistent growth and affordability in the sector.

Labor Shortages and Installation Expertise

A significant challenge in the Australian flooring industry is the shortage of skilled labor, particularly certified installers and flooring technicians. According to the Australia flooring market analysis, this issue is more pronounced in remote and regional areas, where access to trained professionals is limited. The lack of installation expertise often results in project delays, substandard outcomes, and increased overall costs for both residential and commercial clients. Furthermore, as advanced flooring materials like hybrid tiles, engineered wood, and luxury vinyl require precise handling, the skills gap hampers quality execution. Training programs and workforce development have not kept pace with the growing market demand. Labor shortages also discourage builders from adopting newer, more complex flooring solutions, slowing innovation uptake. Addressing this talent gap is essential for market sustainability and service quality improvement.

Environmental Compliance and Recycling Barriers

Environmental regulations in Australia have become increasingly stringent, requiring flooring manufacturers and importers to meet high standards for emissions, material safety, and recyclability. While this shift aligns with global sustainability goals, it poses challenges for businesses, especially small and mid-sized firms, due to the high cost of compliance. Flooring products must adhere to certifications for VOC emissions, responsible sourcing, and end-of-life recyclability. However, Australia's recycling infrastructure for complex materials, like multi-layer vinyl, laminates, and composite boards, remains underdeveloped. This limits the industry's ability to implement circular economy practices. Moreover, disposing of or recycling old flooring materials can be both logistically and financially burdensome. Navigating this regulatory landscape requires strategic investment and innovation, which may slow market growth and product diversification in the short term.

Australia Flooring Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type and end user.

Type Insights:

- Resilient

- Non-Resilient

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes resilient, non-resilient, and others.

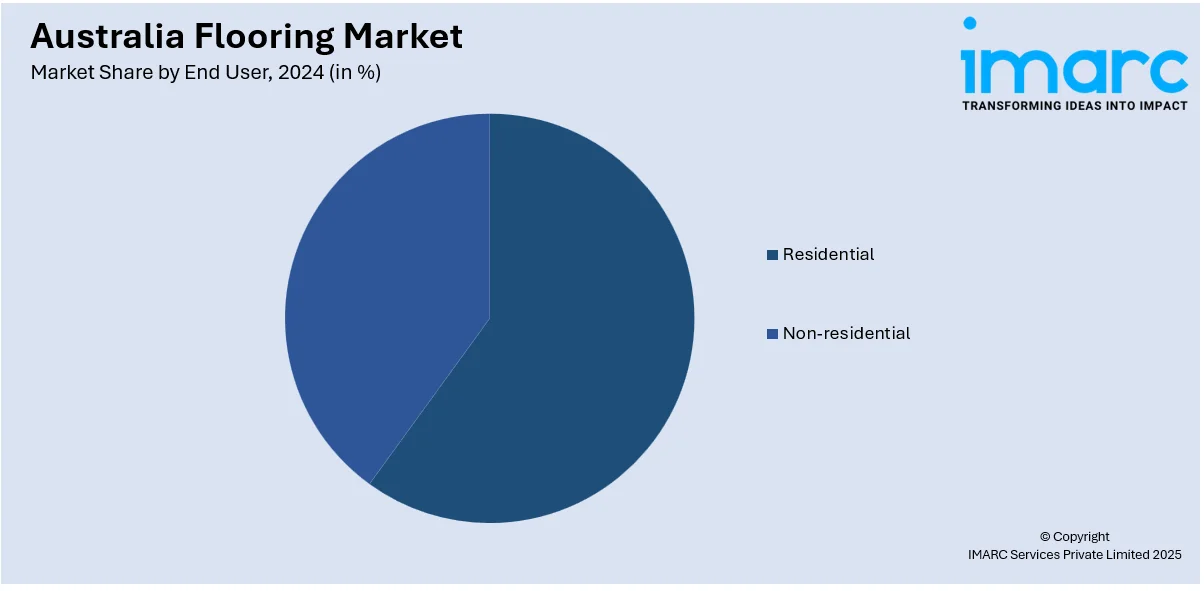

End User Insights:

- Residential

- Non-residential

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes residential and non-residential.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Flooring Market News:

- November 2024: The NSW Government established a new Housing Delivery Authority (HDA) to expedite approvals for major residential projects, aiming to reduce approval times and accelerate housing supply. This initiative is expected to increase demand for flooring solutions, as the rapid development of new homes will require a substantial supply of flooring materials to meet construction timelines.

- July 2024: Artedomus launched four exclusive Decoratori Bassanesi tile collections in Australia, featuring handcrafted designs by renowned artists. This introduction boosts demand for premium, artisanal flooring solutions, offering unique and textured options for designers and homeowners seeking distinctive floor aesthetics.

- February 2024: Bona acquired Australian distributor Ezi Floor Products, expanding its presence in the Asia-Pacific market. This move enhances access to Bona’s high-quality flooring products and services across Australia, boosting demand and strengthening Bona’s position in the competitive flooring industry.

Australia Flooring Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Resilient, Non-Resilient, Others |

| End Users Covered | Residential, Non-residential |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia flooring market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia flooring market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia flooring industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The flooring market in Australia was valued at USD 8.95 Billion in 2024.

The Australia flooring market is projected to exhibit a CAGR of 6.80% during 2025-2033.

The Australia flooring market is projected to reach a value of USD 17.28 Billion by 2033.

The Australia flooring market is witnessing strong demand for sustainable and eco-friendly materials, such as bamboo and cork. Hybrid, SPC, and luxury vinyl tiles are gaining popularity due to durability and water resistance. Growing renovation activities, smart flooring technologies, and acoustic performance enhancements are further shaping consumer preferences across residential and commercial segments.

Key growth drivers of the Australian flooring market include rising construction and renovation activities, growing preference for sustainable and low-maintenance materials, advancements in flooring technologies, and increasing demand for hybrid and waterproof solutions in both residential and commercial applications. Urbanization and lifestyle upgrade further fuel market expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)