Australia Flower Market Size, Share, Trends and Forecast by Product Type, Application, Distribution Channel, and Region, 2026-2034

Australia Flower Market Overview:

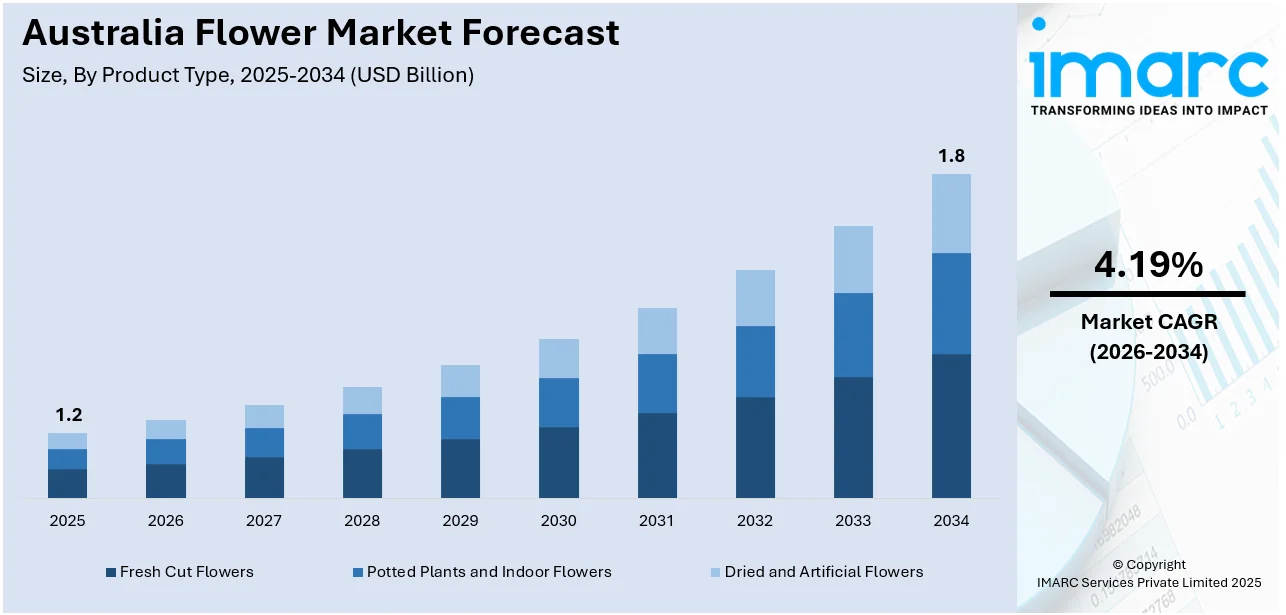

The Australia flower market size reached USD 1.2 Billion in 2025. Looking forward, the market is expected to reach USD 1.8 Billion by 2034, exhibiting a growth rate (CAGR) of 4.19% during 2026-2034. The rising consumer demand for premium and sustainable floral products, increasing exports of native and exotic flowers, expanding online retail channels, and government initiatives supporting eco-friendly practices and local cultivation are some of the key factors driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1.2 Billion |

| Market Forecast in 2034 | USD 1.8 Billion |

| Market Growth Rate 2026-2034 | 4.19% |

Key Trends of Australia Flower Market:

Rise of Sustainable and Eco-Friendly Floriculture

A significant trend shaping the Australian flower market is the growing emphasis on sustainability, driven by increasing environmental awareness among consumers. According to a 2023 survey, 89% of Australians consider adopting a sustainable lifestyle important, with 14% rating it as extremely important. This shift in consumer values is reflected in the rising demand for locally grown, pesticide-free, and organically farmed flowers. In response, Australian floriculturists are embracing eco-friendly farming practices, including drip irrigation, biodegradable packaging, and natural pest control methods. Additionally, native flower species such as kangaroo paw, waratah, and waxflower, which require less water and fewer resources, are gaining popularity due to their reduced environmental impact. Government incentives supporting biodiversity and sustainable agriculture, along with growing consumer awareness campaigns, are further driving this trend, ensuring that sustainability remains at the forefront of the floral industry in Australia.

To get more information on this market Request Sample

Expansion of Online Flower Delivery and E-Commerce

The digital transformation of the retail sector is having a profound impact on the Australian flower industry, with e-commerce becoming a major sales channel for florists. As of 2024, approximately 63.94% of Australia's population, which is around 17.08 million people, are active online shoppers, marking a 45% increase from 2020. This shift is particularly noticeable in the flower sector, where online flower delivery services like Interflora, EasyFlowers, and Bloomex have seen robust growth in order volumes. The convenience of online shopping, along with features such as same-day delivery and bouquet customization, is appealing to consumers, especially Millennials and Gen Z. Furthermore, the integration of artificial intelligence (AI) and machine learning (ML) is also transforming the customer experience. Personalized bouquet tools and automated delivery updates enhance satisfaction and help retain customers. As more consumers continue to prefer shopping online, florists and growers who invest in strong digital platforms and effective marketing strategies are well-positioned to thrive in this increasingly competitive landscape.

Growth Drivers of Australia Flower Market:

Cultural and Festive Demand for Flowers

The strong cultural association between flowers and special occasions continues to be a major driver of demand in the Australian flower market. Celebratory events such as Valentine’s Day, Mother’s Day, weddings, anniversaries, and graduations generate consistent sales peaks throughout the year. Additionally, corporate events, ceremonies, and hospitality venues frequently use fresh floral arrangements to enhance branding and ambiance. Floral gifting has become a widely accepted tradition across all demographics, helping to sustain steady year-round consumption. As more people view flowers as essential expressions of emotion and celebration, demand remains resilient even during economic fluctuations. This cultural embedding of flowers into everyday life and milestone events ensures a dependable customer base for florists, wholesalers, and growers, reinforcing floriculture as a stable and dynamic sector.

Increasing Popularity of Home Aesthetics and Indoor Decor

With a rising interest in interior design and wellness, Australian consumers are incorporating flowers and floral arrangements into their homes as part of daily décor, which is a major factor driving the Australia flower market growth. Fresh flowers are valued not only for their beauty but also for the sense of calm, vibrancy, and connection to nature they bring into living spaces. Social media trends and home styling content on platforms like Instagram and Pinterest further inspire consumers to use flowers creatively in kitchens, living rooms, and workspaces. During the pandemic, this trend accelerated as people sought comfort and aesthetic improvement while spending more time indoors. The use of flowers as lifestyle accessories has transformed floristry from occasional to habitual consumption. This shift opens ongoing revenue streams for retailers offering subscription models, DIY floral kits, and interior-focused floral services.

Growing Demand for Native and Exotic Varieties

There is increasing appreciation for native Australian flowers such as kangaroo paw, banksia, protea, and waratah, driven by their distinct appearance, long vase life, and adaptability to Australian climates. These flowers have gained popularity both domestically and in export markets across Asia, Europe, and North America. Consumers are drawn to their uniqueness and rustic charm, which complement modern interior design and event themes. Moreover, exotic and hybrid varieties grown locally are also gaining traction as consumers look for visually striking and unusual floral arrangements. The growing interest in native biodiversity has inspired florists and landscape designers to highlight indigenous species in their offerings. This trend supports both conservation awareness and the commercial value of Australian flora, strengthening the market’s export potential and domestic differentiation.

Opportunities of Australia Flower Market:

Expansion of Floriculture Tourism and Flower Festivals

Australia’s growing floriculture tourism sector presents a valuable opportunity for flower producers and related businesses. Iconic events such as the Toowoomba Carnival of Flowers and Floriade in Canberra draw thousands of visitors annually, promoting regional tourism while spotlighting the floral industry. These festivals not only increase public appreciation for flowers but also offer local growers direct access to consumers through pop-up markets, workshops, and exhibitions. They create a vibrant platform for businesses to showcase new varieties, sustainable practices, and floral design innovations. The experiential nature of these events drives seasonal flower demand and helps foster long-term consumer engagement, which is fueling the Australia flower market share. As interest in flower-based experiences and agri-tourism continues to grow, festivals and floral tourism are becoming strategic tools for market expansion and brand building.

Technological Advancements in Post-Harvest Management

Advancements in post-harvest management technologies are unlocking new potential within Australia’s flower market. Improved cold chain logistics, vacuum cooling, and modified atmosphere packaging are helping to extend the shelf life and freshness of cut flowers, which is crucial for both domestic distribution and export. These innovations reduce spoilage, ensure product quality during long transit times, and enhance customer satisfaction. Additionally, better storage and handling systems enable growers to meet fluctuating demand more effectively and minimize losses during peak seasons. As these technologies become more accessible and cost-efficient, they also open doors for smaller growers to enter broader markets with confidence. The ability to maintain consistent quality from farm to vase enhances competitiveness and supports expansion into high-value retail, event, and export channels, further boosting the Australia flower market demand.

Demand from Premium and Niche Segments

There is growing demand in Australia for premium and niche floral offerings that emphasize exclusivity, personalization, and artistic design. High-end consumers, particularly in metropolitan areas, are seeking custom floral arrangements for weddings, luxury events, and corporate branding. This demand is fueling growth in specialty florists who provide bespoke services, rare flower varieties, and personalized design concepts. Corporate clients are also increasingly incorporating floral styling into offices, showrooms, and promotional campaigns to enhance brand image and ambiance. These high-margin segments allow florists to differentiate themselves from mass-market retailers by focusing on creativity, craftsmanship, and storytelling. As consumers continue to seek unique, experience-driven floral products, businesses that cater to the premium niche can command higher prices and build strong brand loyalty within a discerning client base.

Challenges of Australia Flower Market:

Supply Chain and Distribution Inefficiencies

Australia’s vast landmass and dispersed population create significant logistical challenges for the domestic flower industry. Transporting fresh-cut flowers from rural production zones to urban retail centers must be done swiftly to preserve freshness and quality, but the required cold chain infrastructure is often lacking or inconsistent. Remote growers face higher freight costs, delays, and a lack of direct access to metropolitan markets, limiting their competitiveness. Seasonal demand spikes further strain existing logistics networks, making timely delivery more difficult. Additionally, rising fuel prices and labor shortages in the transport sector exacerbate the issue. These inefficiencies increase the final retail price or lead to product losses, impacting profitability. Improving supply chain coordination and regional infrastructure is essential for the sustainable growth of Australia’s floral sector.

Impact of Climate Change and Extreme Weather

Australia's flower industry is increasingly vulnerable to the effects of climate change, including heatwaves, droughts, bushfires, and erratic rainfall patterns. According to the Australia flower market analysis, these extreme weather conditions disrupt planting and harvesting schedules, reduce crop yields, and affect flower quality and shelf life. Prolonged dry spells raise irrigation costs, while sudden storms and flooding can damage entire crops. Such unpredictability forces growers to invest in protective infrastructure like greenhouses or shade nets, increasing operational costs. Furthermore, shifts in seasonal flowering periods complicate supply planning and market timing. Smaller farms, in particular, may lack the resources to adapt effectively, making them more susceptible to economic loss. Climate variability not only threatens consistent supply but also raises sustainability concerns across the value chain, requiring long-term adaptation strategies and climate-resilient cultivation methods.

Competition from Imported Flowers

Australia’s flower market faces growing competition from imported varieties, particularly from low-cost producing countries such as Kenya, Colombia, and the Netherlands. These countries benefit from economies of scale, favorable climates, and established global supply chains, allowing them to offer flowers at significantly lower prices. Imported blooms often dominate supermarket chains and large-scale retailers, limiting visibility and sales opportunities for local producers. This price pressure forces Australian growers to either lower margins or shift to niche or premium segments, which not all can afford. Additionally, fluctuations in international shipping conditions and biosecurity regulations can further complicate the domestic market. While imports help meet seasonal shortages and offer variety, they also threaten the sustainability of small- and medium-scale flower farms across Australia by undercutting local pricing.

Australia Flower Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on product type, application, and distribution channel.

Product Type Insights:

- Fresh Cut Flowers

- Potted Plants and Indoor Flowers

- Dried and Artificial Flowers

The report has provided a detailed breakup and analysis of the market based on the product type. This includes fresh cut flowers, potted plants and indoor flowers, and dried and artificial flowers.

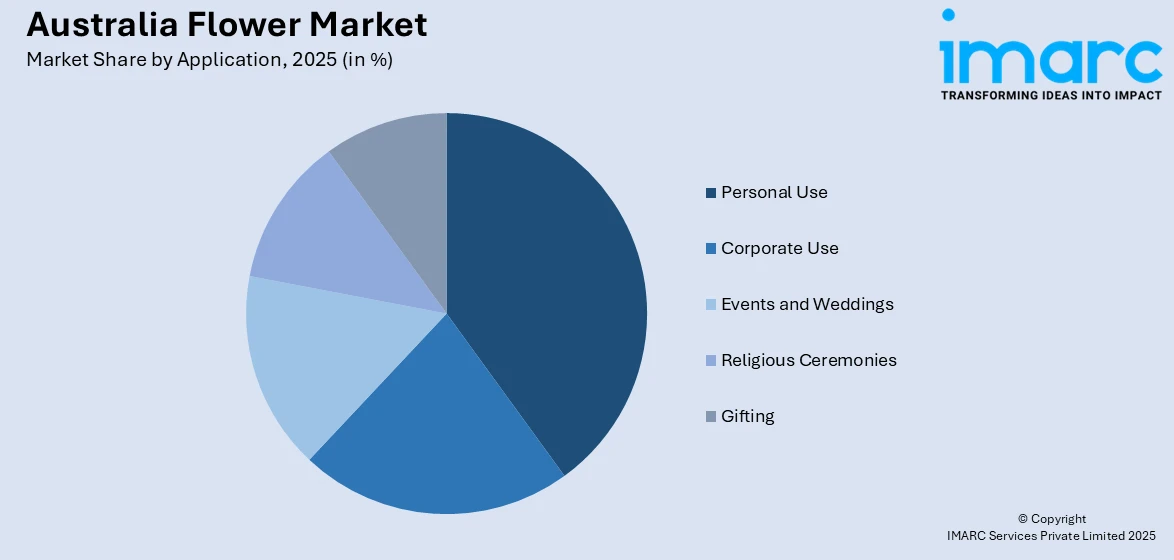

Application Insights:

Access the comprehensive market breakdown Request Sample

- Personal Use

- Corporate Use

- Events and Weddings

- Religious Ceremonies

- Gifting

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes personal use, corporate use, events and weddings, religious ceremonies, and gifting.

Distribution Channel Insights:

- Online Retail

- Offline Retail

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes online retail and offline retail.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Flower Market News:

- April 2025: Lynch Group, an Australian flower wholesaler, streamlined operations by exiting two potted plant farms, including a Queensland orchid site. The company projects 6% revenue growth this year as it focuses more on delivering flowers and enhancing overall profitability.

- February 2024: Danziger's 2024–2025 Cut Flowers Catalog introduced over 100 new varieties, emphasizing innovation and high-quality blooms. Highlights include ENCHANTÉ, a vivid deep blue flower with a domed shape and long vase life; UNICORN, known for its dynamic blooms and design versatility; and SAFORA CLASSIC BLUE, featuring delicate pastel hues and high yield.

Australia Flower Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Fresh Cut Flowers, Potted Plants and Indoor Flowers, Dried and Artifical Flowers |

| Applications Covered | Personal Use, Corporate Use, Events and Weddings, Religious Ceremonies, Gifting |

| Distribution Channels Covered | Online Retail, Offline Retail |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia flower market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia flower market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia flower industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The flower market in Australia was valued at USD 1.2 Billion in 2025.

The Australia flower market is projected to exhibit a CAGR of 4.19% during 2026-2034.

The Australia flower market is projected to reach a value of USD 1.8 Billion by 2034.

The Australia flower market is witnessing rising demand for native and seasonal blooms, driven by consumer preference for locally sourced, sustainable options. Online flower delivery, event-based customization, and eco-friendly packaging are gaining momentum. Additionally, export opportunities for premium native varieties are expanding across international markets, enhancing industry growth.

Key growth drivers of the Australian flower market include increasing demand for flowers in home décor, gifting, and celebrations; rising popularity of native and exotic blooms in export markets; and rapid expansion of online flower delivery platforms offering convenience, customization, and same-day service across urban and regional areas.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)