Australia Food Enzymes Market Size, Share, Trends and Forecast by Type, Source, Formulation, Application, and Region, 2026-2034

Australia Food Enzymes Market Summary:

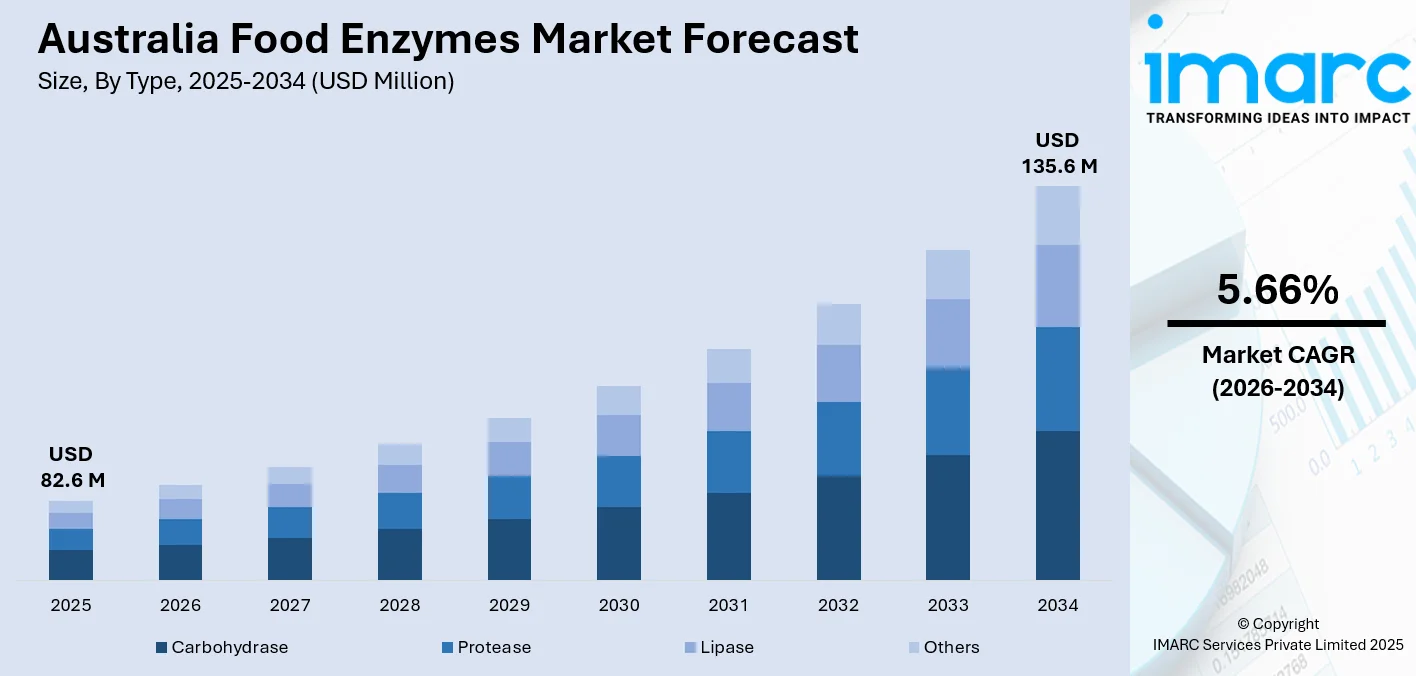

The Australia food enzymes market size was valued at USD 82.6 Million in 2025 and is projected to reach USD 135.6 Million by 2034, growing at a compound annual growth rate of 5.66% from 2026-2034.

The Australia food enzymes market is experiencing robust growth, driven by rising demand for clean-label and minimally processed food products. Enzymes play a vital role in enhancing food quality, improving processing efficiency, and extending shelf life across applications, including dairy, bakery, and beverages. The increasing consumer preference for healthier food options and functional ingredients continues to fuel the market expansion.

Key Takeaways and Insights:

- By Type: Carbohydrase dominates the market with a share of 59% in 2025, owing to its essential role in starch conversion, sugar formation, and texture modification across bakery, brewing, and processed food applications. Growing demand for healthier foods with improved digestibility is driving adoption.

- By Source: Microorganisms lead the market with a share of 64% in 2025. This dominance is driven by cost-effective production capabilities, superior scalability, and consistent enzyme quality through advanced fermentation technologies and precision biotechnology methods.

- By Formulation: Powder exhibits a clear dominance in the market with 61% share in 2025, reflecting strong manufacturer preference for extended shelf stability, ease of storage, precise dosing capabilities, and cost-effective transportation across food processing facilities.

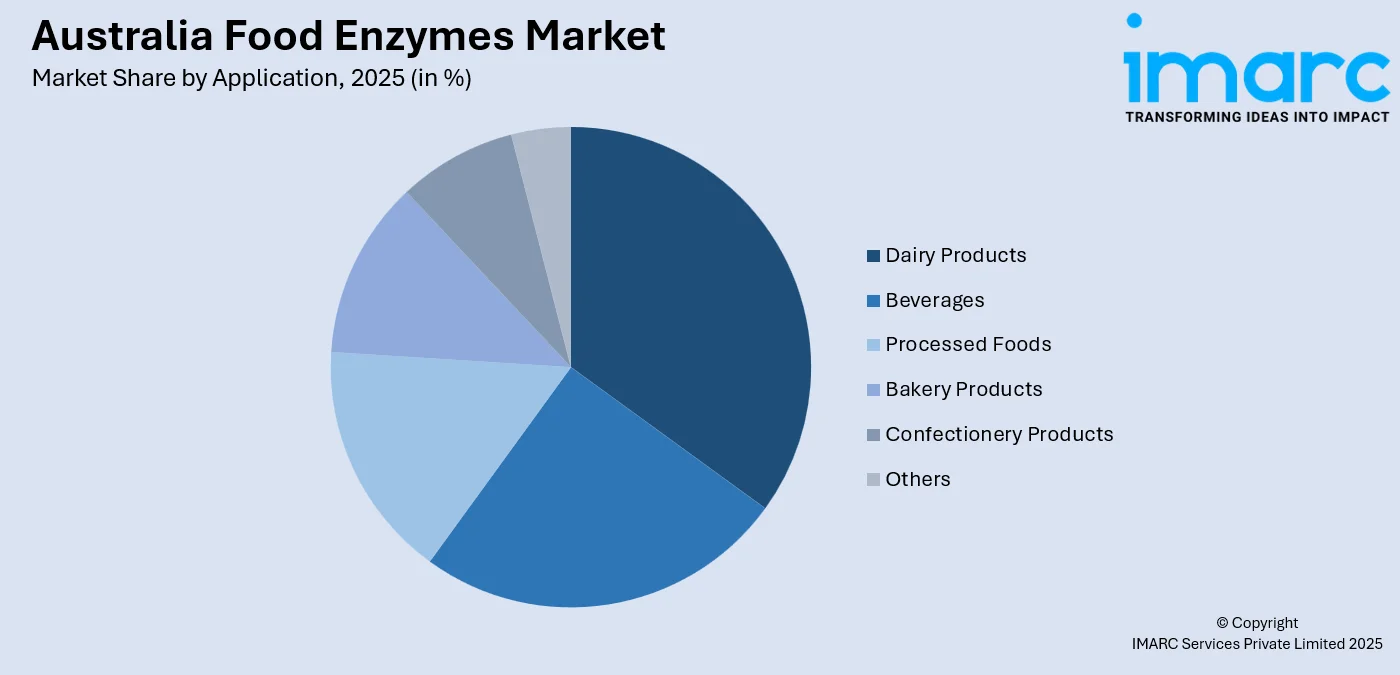

- By Application: Dairy products comprise the largest segment with a market share of 35% in 2025, propelled by the growing demand for lactose-free items, functional dairy formulations, and enzyme-oriented improvements in cheese texture, yogurt consistency, and milk processing efficiency.

- By Region: Australia Capital Territory & New South Wales represents the largest region with 30% share in 2025, fueled by the presence of major food processing facilities, established dairy and bakery manufacturing infrastructure, and strong consumer markets in Sydney metropolitan areas.

- Key Players: Key players drive the Australia food enzymes market by investing in research and development (R&D) activities, expanding enzyme product portfolios, and strengthening distribution networks. Their focus on clean-label solutions, biotechnology innovations, and strategic partnerships with food manufacturers accelerates enzyme adoption across diverse processing applications nationwide.

To get more information on this market Request Sample

The Australia food enzymes market is propelled by multiple growth factors converging to transform food manufacturing practices nationwide. The rising demand for convenience and processed foods among Australian consumers is a primary growth catalyst, as busy lifestyles and dual-income households increasingly rely on pre-packaged meals requiring enzyme-enhanced preservation and flavor consistency. Advancements in biotechnology and genetic engineering are enabling manufacturers to develop specialized enzyme formulations with enhanced stability and functionality. The expanding functional food sector continues to appreciate enzymes for their contribution to improved nutritional value, enhanced digestibility, and reduced sugar and fat content in food products. As per IMARC Group, the Australia functional food market size reached USD 6.6 Billion in 2024. Additionally, Australia's robust food safety regulatory framework administered by Food Standards Australia New Zealand supports enzyme innovation while maintaining stringent quality standards that reinforce consumer confidence.

Australia Food Enzymes Market Trends:

Growing Preferences for Clean-Label and Natural Processing Solutions

Australian consumers are becoming more focused on ingredient labels, preferring items with fewer synthetic additives and more natural processing agents. This shift towards transparency is reshaping food manufacturing priorities, as producers seek enzyme-based alternatives to synthetic chemicals. Food enzymes derived from microbial, plant, and animal sources offer a natural way to enhance processing without chemical interventions. The clean-label movement is particularly influential in the bakery and dairy sectors where enzymes replace traditional chemical improvers and emulsifiers while maintaining product quality and consistency.

Rising Adoption of Enzyme Technology in Lactose-Free Product Development

The growing awareness about lactose intolerance among Australian consumers is driving significant adoption of lactase enzymes in dairy product manufacturing. As per World Population Review, the lactose intolerance rate in Australia was 0.51% in 2025. Food producers are increasingly leveraging enzyme technology to create lactose-free milk, yogurt, and cheese variants that maintain authentic taste profiles and nutritional value. This trend aligns with broader health consciousness where consumers seek digestive-friendly alternatives without compromising on dairy consumption habits. Enzyme-enabled lactose-free products are expanding beyond specialty channels into mainstream retail distribution.

Advancements in Multi-Enzyme Cocktail Formulations for Enhanced Functionality

Manufacturers are increasingly developing sophisticated carbohydrase enzyme cocktails, combining amylase, cellulase, xylanase, and pectinase, to produce healthier foods and enhance food processing byproduct value. These multi-enzyme systems enable comprehensive substrate breakdown for improved nutrient availability and processing efficiency. The shift towards tailored enzyme blends addresses specific application requirements in brewing, baking, and fruit juice production. This innovation supports sustainable manufacturing by maximizing raw material utilisation and reducing processing waste across food production facilities.

Market Outlook 2026-2034:

The Australia food enzymes market outlook remains positive, as food manufacturers increasingly adopt enzyme technologies to enhance processing efficiency, improve product quality, and respond to evolving consumer preferences for healthier, clean-label food items. The market generated a revenue of USD 82.6 Million in 2025 and is projected to reach a revenue of USD 135.6 Million by 2034, growing at a compound annual growth rate of 5.66% from 2026-2034. The ongoing investments in biotechnology R&D are enabling manufacturers to create advanced enzyme solutions with improved thermal stability, pH tolerance, and application-specific performance characteristics. The expanding functional food sector and growing demand for digestive health products continue to support enzyme adoption across dairy, bakery, and beverage applications.

Australia Food Enzymes Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Carbohydrase | 59% |

| Source | Microorganisms | 64% |

| Formulation | Powder | 61% |

| Application | Dairy Products | 35% |

| Region | Australia Capital Territory & New South Wales | 30% |

Type Insights:

- Carbohydrase

- Amylase

- Cellulase

- Lactase

- Pectinase

- Others

- Protease

- Lipase

- Others

Carbohydrase dominates with a market share of 59% of the total Australia food enzymes market in 2025.

Carbohydrase has become indispensable in the Australia food enzymes market, due to its versatile applications in starch conversion, sugar formation, and texture modification processes. Carbohydrase enzymes encompass amylase, cellulase, lactase, pectinase, and xylanase variants that collectively address diverse processing requirements across the bakery, brewing, and juice production sectors. The growing demand for healthier foods with improved digestibility and reduced sugar content continues to drive carbohydrase utilisation in Australia.

The bakery industry demonstrates particularly strong carbohydrase adoption where amylase enzymes improve dough handling properties, enhance bread volume, and extend product freshness without chemical additives. Maltogenic amylase specifically extends softness retention in packaged bread for up to seven days under ambient conditions, addressing consumer preferences for longer-lasting bakery products. Australian food manufacturers increasingly deploy enzyme cocktails, combining multiple carbohydrase types, to achieve comprehensive substrate breakdown, maximize nutrient release, and improve processing efficiency while supporting clean-label product positioning across mainstream retail channels.

Source Insights:

- Microorganisms

- Plants

- Animals

Microorganisms lead with a share of 64% of the total Australia food enzymes market in 2025.

Microorganisms dominate the market in Australia, due to their cost-effective production capabilities, superior scalability through fermentation processes, and consistent quality characteristics. Bacteria and fungi represent the primary microbial sources, with genetically optimized strains enabling high-yield enzyme production under controlled manufacturing conditions. Advanced bioprocessing methods and precision fermentation technologies continue to enhance enzyme specificity and stability, enabling manufacturers to develop tailored solutions addressing specific food processing requirements across diverse application segments.

Australia has updated the regulations concerning the use of food processing additives. The revised rules, released on the Australian Gazette website on April 17, 2024, specifically emphasize the incorporation of genetically modified cellulase enzymes sourced from Aspergillus niger as processing aids, improving production efficiency and quality in brewing applications. This regulatory advancement demonstrates Australia's supportive environment for microbial enzyme innovation while maintaining stringent safety oversight. Microbial sources offer advantages, including year-round production independence from agricultural cycles, reduced environmental footprint compared to animal-derived alternatives, and compatibility with vegetarian and vegan product formulations increasingly demanded by Australian consumers.

Formulation Insights:

- Powder

- Liquid

- Others

Powder exhibits a clear dominance with a 61% share of the total Australia food enzymes market in 2025.

Powder commands market leadership, owing to its extended shelf stability, ease of storage, precise dosing capabilities, and cost-effective transportation characteristics. Powdered enzymes exhibit lower moisture sensitivity, reducing the risk of microbial growth and activity degradation during transportation and warehousing. These characteristics make them particularly suitable for Australia’s geographically dispersed food manufacturing facilities, where extended storage and long-distance distribution are common. Manufacturers also prefer powders for their compatibility with automated dosing systems used in large-scale food processing operations.

Additionally, powdered enzymes offer formulation flexibility across diverse food applications, including baking, dairy processing, brewing, and starch modification. They can be easily blended with dry ingredients, ensuring uniform dispersion and consistent performance during processing. Powder formats also provide cost efficiencies by minimizing cold-chain requirements and reducing packaging complexity. This economic advantage, combined with reliable performance and handling convenience, reinforces the dominance of powder in the Australia food enzyme market.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Beverages

- Processed Foods

- Dairy Products

- Bakery Products

- Confectionery Products

- Others

Dairy products comprise the leading segment with a 35% share of the total Australia food enzymes market in 2025.

Dairy products lead food enzyme application demand, driven by rising lactose-free product consumption, cheese manufacturing optimization, and yogurt texture improvement requirements. Lactase enzymes enable production of digestible dairy products for lactose-intolerant consumers, while proteases and lipases enhance cheese flavor development and texture characteristics. The lactose-free dairy industry in Australia is thriving, demonstrating substantial consumer demand for enzyme-enabled dairy alternatives. This growth reflects increasing health consciousness among Australian consumers seeking dairy products that accommodate digestive sensitivities without compromising nutritional value.

Dairy processors increasingly rely on enzymes to improve production efficiency, consistency, and yield across milk, cheese, and fermented dairy categories. Enzymes support faster processing cycles, better whey utilization, and reduced raw material wastage, contributing to cost optimization for manufacturers. In yogurt and cultured products, enzymes help achieve smoother textures, enhanced mouthfeel, and improved stability during shelf life. Growing innovations in premium and functional dairy offerings, including high-protein and probiotic products, further accelerate enzyme adoption, as producers focus on quality differentiation and value-added formulations tailored to evolving consumer preferences.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & South Australia

- Western Australia

Australia Capital Territory & New South Wales represents the largest region with a market share of 30% of the total Australia food enzymes market in 2025.

Australia Capital Territory & New South Wales commands the largest regional market share, driven by concentration of major food processing facilities, established dairy and bakery manufacturing infrastructure, and substantial consumer markets centered in Sydney metropolitan areas. Strong demand from packaged foods, beverages, and convenience food segments supports steady enzyme consumption. High urban population density ensures large-scale, stable demand for enzyme-enabled food products. Continuous expansion of modern food processing plants further strengthens regional market leadership.

The region benefits from proximity to major ports facilitating ingredient imports, developed transport infrastructure enabling efficient distribution networks, and presence of leading food technology companies establishing technical support services for enzyme optimization. Research institutions and industry laboratories collaborate closely with manufacturers to advance enzyme applications and formulation efficiency. Availability of skilled food technologists supports adoption of advanced food enzyme solutions. Regulatory familiarity and streamlined compliance processes also improve speed-to-market for enzyme-based innovations.

Market Dynamics:

Growth Drivers:

Why is the Australia Food Enzymes Market Growing?

Rising Demand for Convenience and Processed Food Products

The escalating demand for convenience and processed food products among Australian consumers represents a primary growth catalyst for the food enzymes market. Modern lifestyles, characterized by busy schedules, dual-income households, and urbanization, have fundamentally shifted food consumption patterns toward ready-to-eat (RTE) meals and pre-packaged food items. As per the Australian Bureau of Statistics, over a third of women (36%) and 30% of men frequently felt hurried or short on time. Food enzymes enable manufacturers to produce large volumes efficiently while maintaining consistent quality across extended distribution timeframes. In bakery products, enzymes improve dough handling, volume, and softness characteristics essential for commercial bread production. Dairy product manufacturers leverage enzymes to enhance fermentation processes, develop flavor profiles, and extend shelf life without excessive preservative use. The convenience food trend extends across demographic segments as consumers increasingly prioritize time savings without compromising food quality expectations. This behavioral shift creates sustained demand for enzyme solutions enabling product preservation, texture maintenance, and sensory attribute enhancement throughout supply chain distribution.

Growing Consumer Preference for Clean-Label and Natural Ingredients

Australian consumers are increasingly health-conscious and scrutinize product ingredient labels, favoring items with recognizable, natural components over synthetic additives and chemical processing aids. This clean-label movement is fundamentally reshaping food manufacturing priorities, as producers seek enzyme-based alternatives that satisfy consumer transparency expectations while maintaining product quality standards. Enzymes derived from microbial, plant, and animal sources offer natural processing solutions that enhance food attributes without introducing artificial ingredients to product formulations. The trend aligns with broader wellness consciousness where consumers associate natural ingredients with healthier lifestyle choices. Food manufacturers recognize that clean-label positioning provides competitive differentiation in increasingly crowded retail environments. Enzyme adoption enables formulation simplification by replacing multiple synthetic additives with single enzyme solutions delivering equivalent functionality. The generational shift towards ingredient awareness particularly influences purchasing decisions among millennial and younger consumers who prioritize authenticity and ingredient transparency in their food selections.

Advancements in Biotechnology and Enzyme Engineering

Technological advancements in biotechnology and enzyme engineering are significantly enhancing production capabilities and expanding application possibilities for food enzymes in Australia. Modern bioprocessing methods, including advanced fermentation technology, precision protein engineering, and optimized strain development, are improving enzyme efficiency, specificity, and stability characteristics. These innovations enable manufacturers to create enzymes with tailored performance attributes addressing specific processing requirements across diverse food categories. Enzyme engineering allows development of variants with enhanced thermal stability, broader pH tolerance ranges, and improved activity under challenging manufacturing conditions. The biotechnology progress reduces production costs while simultaneously improving enzyme quality and consistency. Collaborations between biotechnology firms, research institutes, and food manufacturers are accelerating commercialization of next-generation food enzyme solutions. These technological advancements support cleaner processing, reduced chemical usage, and improved sustainability across Australia’s food manufacturing sector.

Market Restraints:

What Challenges the Australia Food Enzymes Market is Facing?

Limited Temperature and pH Operational Ranges

Food enzymes demonstrate sensitivity to temperature and pH conditions that can significantly constrain their effectiveness in certain manufacturing environments. Extremely high or low pH values may result in complete loss of enzyme activity, while temperature fluctuations beyond optimal ranges compromise catalytic performance. The narrow operational windows require precise process control and monitoring systems, increasing manufacturing complexity and equipment investment requirements. Different enzyme types exhibit varying optimal conditions depending on their source and intended application, necessitating careful formulation matching to specific processing requirements and limiting versatility in multi-product manufacturing facilities.

Consumer Perception Concerns Regarding Genetically Modified Enzymes

Genetically modified enzymes face consumer perception challenges as some Australian consumers associate these products with potential long-term health concerns despite scientific evidence supporting their safety. This perception creates market adoption barriers particularly among health-conscious consumers who prioritize natural and non-modified ingredients. Food manufacturers must navigate these consumer sensitivities when formulating products, potentially limiting enzyme selection options and increasing development complexity. The regulatory approval processes for genetically modified enzymes require extensive safety documentation and testing, adding time and cost to market entry for innovative enzyme products targeting Australian food manufacturers.

Regulatory Approval Complexity and Compliance Requirements

Obtaining regulatory approvals for enzyme use in food products through Food Standards Australia New Zealand presents significant compliance challenges for manufacturers and suppliers. The approval process requires extensive safety data, efficacy documentation, and manufacturing quality assurance evidence before enzymes can be marketed for food processing applications. This regulatory framework, while ensuring consumer safety, creates entry barriers for smaller enzyme suppliers and delays commercialization timelines for innovative enzyme products. Additionally, ongoing compliance monitoring and documentation requirements increase operational costs for food manufacturers integrating enzyme technologies into their production processes.

Competitive Landscape:

The Australia food enzymes market demonstrates a concentrated competitive structure, dominated by major international biotechnology corporations with established global distribution networks and extensive research capabilities. These market leaders leverage their scale advantages to offer comprehensive enzyme portfolios, spanning carbohydrase, protease, and lipase categories, across multiple food applications. Competition centers on product performance differentiation, technical support services, and application-specific solution development tailored to Australian food manufacturing requirements. The competitive environment drives continuous innovations in enzyme formulation, stability enhancement, and clean-label compatibility. Market participants invest substantially in R&D to expand product portfolios with innovative enzymes designed for emerging applications, including plant-based foods and functional ingredients.

Recent Developments:

- In September 2025, Food Standards Australia New Zealand (FSANZ) evaluated a request from IFF Australia Pty Ltd to revise the Australia New Zealand Food Standards Code to allow the use of the enzyme thermolysin, derived from a Rokko strain of Anoxybacillus caldiproteolyticus as a processing aid. The enzyme is applicable for protein breakdown in the production and/or processing of dairy products, eggs, meat and fish, protein concentrates and isolates, yeast, and in brewing beer.

Australia Food Enzymes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Sources Covered | Microorganisms, Plants, Animals |

| Formulations Covered | Powder, Liquid, Others |

| Applications Covered | Beverages, Processed Foods, Dairy Products, Bakery Products, Confectionery Products, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia food enzymes market size was valued at USD 82.6 Million in 2025.

The Australia food enzymes market is expected to grow at a compound annual growth rate of 5.66% from 2026-2034 to reach USD 135.6 Million by 2034.

Carbohydrase dominated the market with a share of 59%, driven by its essential role in starch conversion, sugar formation, and texture modification across bakery, brewing, and processed food applications.

Key factors driving the Australia food enzymes market include rising demand for convenience foods, growing consumer preferences for clean-label ingredients, advancements in biotechnology and enzyme engineering, and expanding functional food sector.

Major challenges include limited temperature and pH operational ranges affecting enzyme effectiveness, consumer perception concerns regarding genetically modified enzymes, regulatory approval complexity, and competition from established international players limiting domestic market entry opportunities.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)