Australia Food and Grocery Retail Market Size, Share, Trends and Forecast by Product, Distribution Channel, and Region, 2025-2033

Australia Food and Grocery Retail Market Overview:

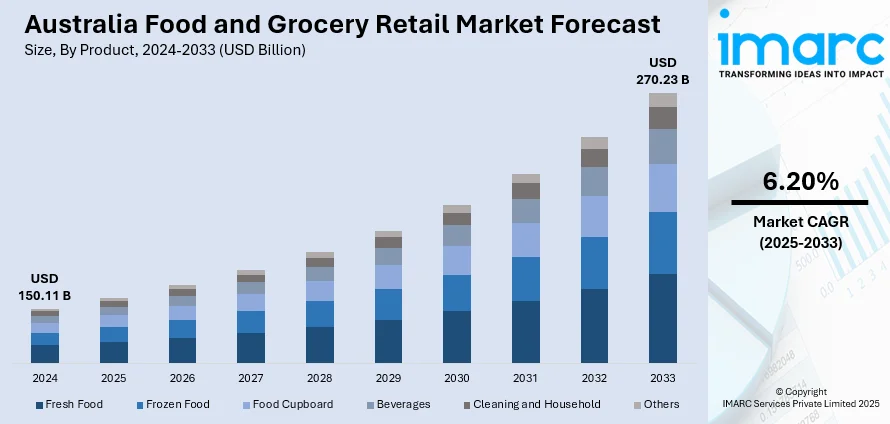

The Australia food and grocery retail market size reached USD 150.11 Billion in 2024. Looking forward, the market is projected to reach USD 270.23 Billion by 2033, exhibiting a growth rate (CAGR) of 6.20% during 2025-2033 The market is driven by factors such as changing consumer preferences towards health and wellness, increased focus on sustainability, technological advancements in e-commerce and delivery, demographic shifts with an aging population, and economic conditions impacting disposable incomes and spending patterns.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 150.11 Billion |

| Market Forecast in 2033 | USD 270.23 Billion |

| Market Growth Rate (2025-2033) | 6.20% |

Key Trends of Australia Food and Grocery Retail Market:

Rising Demand for Organic and Health-Conscious Products

One notable trend in the Australian food and grocery retail market is the rising demand for organic and health-conscious products. As consumers become increasingly aware about health benefits associated with organic foods, retailers are expanding their offerings to include a broader range of organic items across various categories. This shift is also influenced by the growing trend of sustainable and responsible food sourcing practices, with consumers opting for products that promote health and support environmental well-being. Consequently, Australian retailers are enhancing their marketing strategies to highlight organic certifications and the provenance of their offerings, catering to the ever-evolving preferences of health-oriented shoppers. For instance, as per recent industry statistics, the Australian organic market in 2023 reached a value of USD 3.1 Billion, growing 5.4% year-over-year. It directly contributes USD 851 Million to the economy and supports over 12,000 jobs. Key trends include 65% consumer adoption, with top products being fruit, vegetables, dairy, and meat. Certified organic land spans 35.7 Million hectares, and organic exports total USD 750 Million, with the USA, China, and Singapore as primary markets. The sector also has a 30% reduced carbon footprint, and organic viticulture production increased by 4.8%, reaching 18,500 tonnes.

To get more information of this market, Request Sample

Expansion of Online Grocery Shopping

Another significant trend is the accelerated growth of online grocery shopping and contactless payment solutions. For instance, as per the data by Australian Bureau of Statistics, online retail sales totaled AUD 4.41 Billion (USD 2.82 Billion) in December 2024, up by 4.2% month-on-month, and 12.7% year-on-year. This shift in consumer behavior has driven a rapid adoption of e-commerce platforms for grocery purchases. Retailers are investing heavily in technology to enhance their online shopping interfaces and streamline supply chain logistics, thereby improving customer experience and fulfillment efficiency. Additionally, contactless payment methods have gained prominence, providing consumers with convenience and security during transactions. As a result, traditional brick-and-mortar retailers are developing click-and-collect services and home delivery options, creating a hybrid shopping experience that aligns with the convenience-driven lifestyle of modern consumers while meeting their needs for efficient and reliable purchasing solutions.

Expansion of Private Label Brands

Private label brands are becoming an emerging strategic priority for Australian food and grocery retailers. Retailers are expanding their own-brand ranges to provide affordable substitutes for national brands, meeting price-conscious consumers' needs without compromising on quality. The products usually include packaged food, beverages, dairy products, and household products, allowing retailers to differentiate themselves in a competitive market. The growth of private labels is also driven by changing tastes among consumers, as customers search for value without compromising quality. Retailers leverage these brands to enhance customer loyalty, increase profit margins, and increase supply chain efficiency. As the penetration of private labels grows across supermarkets, hypermarkets, and online platforms, it plays a vital role in shaping overall competitiveness and directly impacts Australia food and grocery retail market share throughout the sector.

Growth Factors of Australia Food and Grocery Retail Market:

Rising Urbanization and Changing Lifestyles

The rapid expansion of urban settlements in Australia is reshaping consumer habits, underscoring the importance of convenience and time-saving options in food and grocery shopping. Urban households and busy professionals are increasingly opting for ready-to-eat meals, pre-packaged goods, and efficiency-oriented shopping provided through supermarkets, hypermarkets, and online shopping. This change in consumers' purchasing behavior has led the retailers to expand their product offerings and innovate services like home delivery and click-and-collect. Apart from that, using smaller store formats in the urban area and longer opening hours is becoming prevalent to suit the fast urban lifestyle. As consumers continue to seek accessibility, variety, and convenience, retail strategies are evolving to satisfy these demands, leading to a rise in Australia food and grocery retail market demand across both physical and digital platforms.

Technological Integration

Technology is significantly altering the landscape of the Australian food and grocery retail market. Retailers are increasingly implementing digital payment solutions, mobile applications, self-checkout kiosks, and AI-based inventory management systems to enhance operations and improve the customer experience. Advanced analytics enable retailers to fine-tune stock levels, forecast consumer preferences, and provide tailored promotions, which enhance efficiency and profitability. Automation in warehousing and logistics also speeds up order fulfillment, especially in online grocery sectors. These technological advancements lower operational costs and boost consumer convenience and satisfaction. By capitalizing on technology, retailers can maintain competitiveness in a fast-changing environment, fostering operational excellence and broadening their reach. This adoption of technology is a vital element in sustaining Australia food and grocery retail market growth.

Increasing Disposable Income

The rise in disposable income in Australia is leading consumers to allocate more funds toward premium and high-quality food products. Shoppers are increasingly drawn to organic, natural, and functional foods, as well as gourmet offerings and imported brands, reflecting a shift toward health-consciousness and lifestyle choices. Greater financial capacity also facilitates the purchase of convenience foods, ready-to-eat meals, and specialized dietary products. In response, retailers are diversifying their product ranges and introducing premium options to meet this changing demand. As consumer spending power increases, both physical stores and online platforms are witnessing higher sales and the adoption of higher-margin products. According to Australia food and grocery retail market analysis, this evolution in consumption patterns, driven by increasing incomes, is a crucial factor influencing product offerings and market growth.

Australia Food and Grocery Retail Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product and distribution channel.

Product Insights:

- Fresh Food

- Frozen Food

- Food Cupboard

- Beverages

- Cleaning and Household

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes fresh food, frozen food, food cupboard, beverages, cleaning and household, and others.

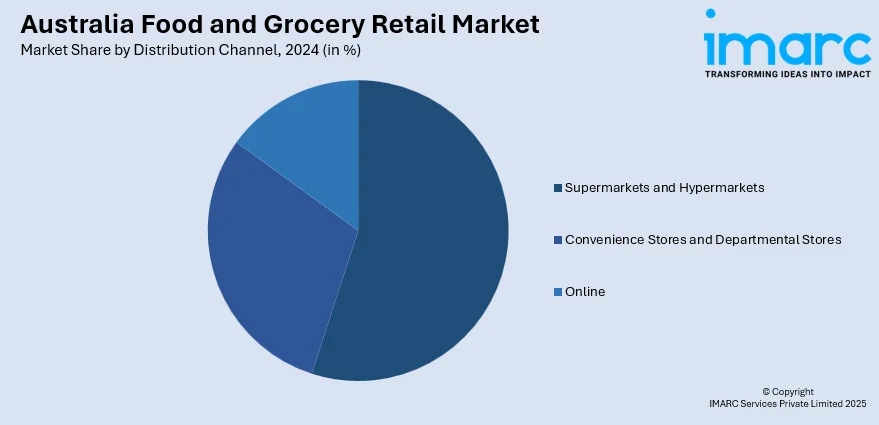

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores and Departmental Stores

- Online

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, convenience stores and departmental stores, and online.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Food and Grocery Retail Market News:

- In February 2025, Instacart and Coles Supermarkets introduced Caper Carts, AI-powered smart trolleys, at Coles’ Richmond Traders location in Melbourne, Australia. These trolleys allow customers to shop, bag, and pay seamlessly. The Caper Carts use AI, cameras, and a built-in scale to track purchases and sync with Coles' Flybuys rewards program. Customers can also access personalized offers, earn points, and view in-store specials. Coles is the first retailer in the APAC region to implement this technology, enhancing the omnichannel shopping experience.

- In July 2024, ALDI Australia launched its "ALDIcore" campaign in partnership with BMF and Ogilvy PR, inviting dedicated shoppers to share their unique experiences for a chance to win three years of free groceries. The campaign celebrates the diversity of ALDI shoppers and their loyalty. Participants can enter by sharing stories on social media using the hashtag #ALDIcore. The initiative highlights the community's passion for ALDI products and shopping methods, making it the supermarket's largest competition yet.

- In August 2024, Woolworths introduced Australia's first digital supermarket trolley, the Scan&Go Trolley, available for trial at its Windsor store. The device allows customers to scan and bag items while tracking their spending in real-time. This innovation enhances convenience, time-saving, and budget control. Scan&Go Trolley complements existing shopping methods, including self-checkout and online services.

Australia Food and Grocery Retail Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Fresh Food, Frozen Food, Food Cupboard, Beverages, Cleaning and Household, Others |

| Distribution Channels Covered |

Supermarkets and Hypermarkets, Convenience Stores and Departmental Stores, Online |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia food and grocery retail market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia food and grocery retail market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia food and grocery retail industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The food and grocery retail market in Australia was valued at USD 150.11 Billion in 2024.

The Australia food and grocery retail market is projected to exhibit a compound annual growth rate (CAGR) of 6.20% during 2025-2033.

The Australia food and grocery retail market is expected to reach a value of USD 270.23 Billion by 2033.

The Australia food and grocery retail market is experiencing trends such as rising demand for online and contactless shopping, increased focus on health and organic products, and expansion of private label offerings. Retailers are also integrating smart technology, sustainability practices, and smaller convenience store formats.

The market is driven by rising urbanization, changing consumer lifestyles, and increasing disposable income. Growth is further supported by technological integration, expansion of retail chains, growing online grocery adoption, and rising demand for premium, organic, and convenient food products, which together enhance accessibility, choice, and customer satisfaction across the sector.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)