Australia Food Logistics Market Size, Share, Trends and Forecast by Transportation Mode, Product Type, Service Type, Segment, and Region, 2025-2033

Australia Food Logistics Market Overview:

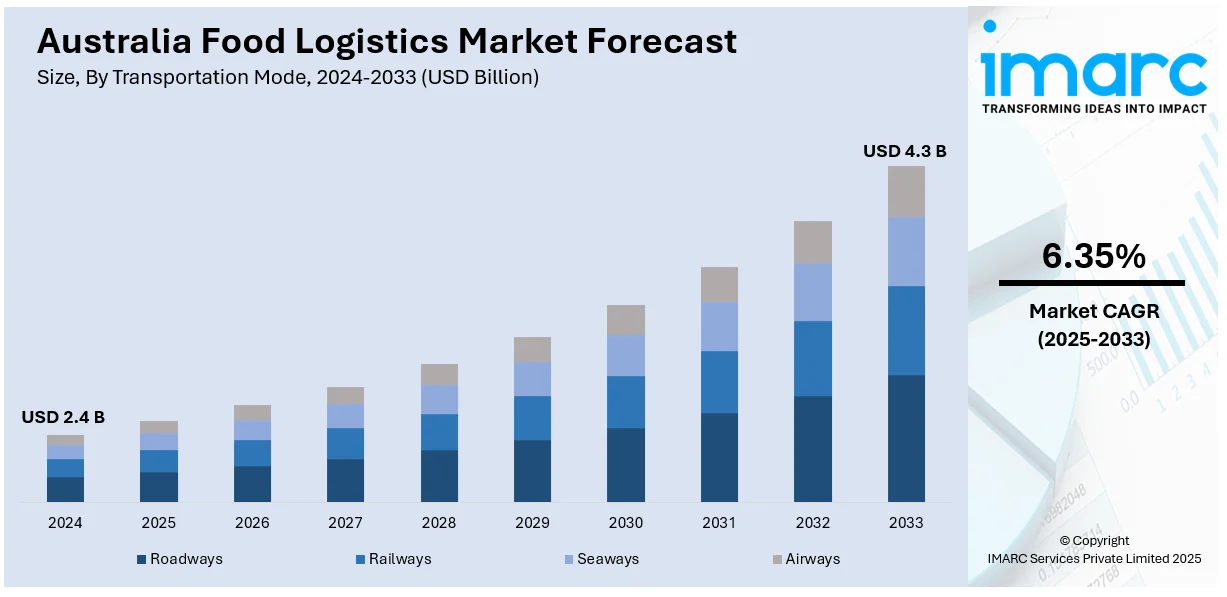

The Australia food logistics market size reached USD 2.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.3 Billion by 2033, exhibiting a growth rate (CAGR) of 6.35% during 2025-2033. The market is transforming with a high emphasis on sustainability, spurred by electric vehicle uptake and government policies. Similarly, initiatives to minimize carbon emissions, improve supply chain resilience, and promote local agriculture guarantee long-term stability and efficiency in food distribution, contributing further to market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.4 Billion |

| Market Forecast in 2033 | USD 4.3 Billion |

| Market Growth Rate 2025-2033 | 6.35% |

Australia Food Logistics Market Trends:

Shift Toward Green and Efficient Transport

Australia's food logistics market is experiencing a steady move toward sustainable and low-emission transport systems. Environmental regulations and national decarbonization goals are prompting supply chain operators to re-evaluate traditional delivery models. Companies are being pushed to incorporate electric and hybrid vehicles, improve fuel efficiency, and optimize delivery routes. These developments are not only aimed at lowering emissions but also at reducing operational costs over time. Businesses in the food sector are responding to growing pressure to make their operations more environmentally responsible, especially in urban areas where pollution control is a major concern. In June 2024, McDonald's Australia, in partnership with Martin Brower, launched its first electric delivery truck to carry food products across Sydney. The vehicle operates with zero tailpipe emissions, signaling a key milestone in food distribution logistics. This step is expected to influence other major retailers and food service providers to adopt similar models, setting a new standard in the logistics value chain. As demand for clean transport grows, fleet modernization and electrification are becoming critical investment areas. The trend also aligns with global ESG targets, reinforcing Australia's shift to a more sustainable food delivery network that reduces environmental impact while supporting efficiency in last-mile delivery operations.

To get more information on this market, Request Sample

Focus on Supply Chain Resilience and Food Access

In recent years, Australia has faced several challenges that have put its food supply chains under strain ranging from global trade disruptions and climate events to rising input costs and workforce shortages. These challenges have made it clear that the food logistics sector must become more resilient and adaptable. Strengthening domestic food systems, increasing regional storage and processing capacity, and securing efficient distribution channels are now central goals. Improving food access in both urban and rural communities depends heavily on a reliable and robust logistics framework. In March 2025, the Australian Government introduced the "Feeding Australia" initiative, supported by AUD 3.5 Million in funding. This strategy aims to improve food security by building stronger, more localized supply chains, reducing dependency on vulnerable global routes, and supporting sustainable agricultural practices. By focusing on resilience, the initiative supports long-term stability in food logistics, ensuring consistent availability of key commodities during both regular and crisis periods. This approach is expected to drive private-sector collaboration, increase public investment in logistics infrastructure, and promote regional innovation in storage, transportation, and cold chain systems. The outcome is a logistics ecosystem that can better withstand shocks and maintain food access across all regions of the country.

Australia Food Logistics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on transportation mode, product type, service type and segment.

Transportation Mode Insights:

- Roadways

- Railways

- Seaways

- Airways

The report has provided a detailed breakup and analysis of the market based on the transportation mode. This includes roadways, railways, seaways, and airways.

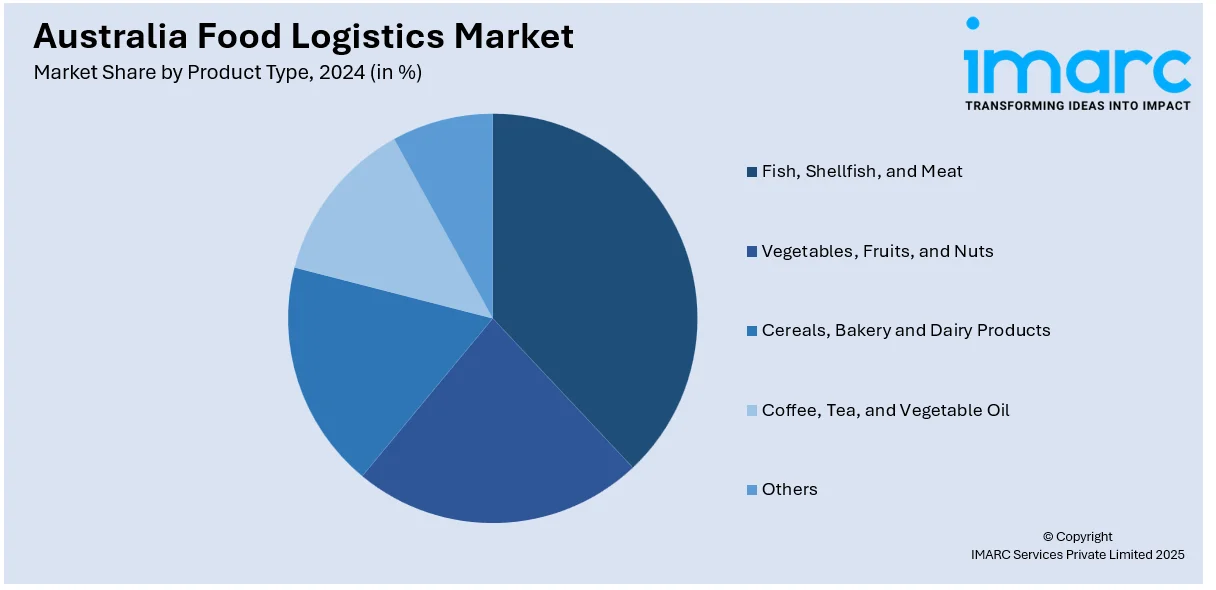

Product Type Insights:

- Fish, Shellfish, and Meat

- Vegetables, Fruits, and Nuts

- Cereals, Bakery and Dairy Products

- Coffee, Tea, and Vegetable Oil

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes fish, shellfish, and meat, vegetables, fruits, and nuts, cereals, bakery and dairy products, coffee, tea, and vegetable oil, and others.

Service Type Insights:

- Cold Chain

- Non-Cold Chain

The report has provided a detailed breakup and analysis of the market based on the service type. This includes cold chain and non-cold chain.

Segment Insights:

- Transportation

- Packaging

- Instrumentation

The report has provided a detailed breakup and analysis of the market based on the segment. This includes transportation, packaging, and instrumentation.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Food Logistics Market News:

- February 2025: Mindsprint expanded its global footprint by opening an office in Sydney, Australia, focusing on cutting-edge IT solutions. This expansion aimed to enhance food logistics by providing advanced Data Analytics, AI, and Supply Chain Optimization, contributing to industry growth and operational efficiency.

- August 2024: DecisionNext partnered with Kilcoy Global Foods, an Australian leader in premium beef and protein products. The collaboration utilized AI-driven insights to optimize commodity pricing and logistics, enhancing efficiency and market responsiveness. This strategic move supported Kilcoy’s global expansion and improved supply chain decisions.

Australia Food Logistics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Transportation Modes Covered | Roadways, Railways, Seaways, Airways |

| Product Types Covered | Fish, Shellfish, and Meat, Vegetables, Fruits, and Nuts, Cereals, Bakery and Dairy Products, Coffee, Tea, and Vegetable Oil, Others |

| Service Types Covered | Cold Chain, Non-Cold Chain |

| Segments Covered | Transportation, Packaging, Instrumentation |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia food logistics market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia food logistics market on the basis of transportation mode?

- What is the breakup of the Australia food logistics market on the basis of product type?

- What is the breakup of the Australia food logistics market on the basis of service type?

- What is the breakup of the Australia food logistics market on the basis of segment?

- What are the various stages in the value chain of the Australia food logistics market?

- What are the key driving factors and challenges in the Australia food logistics market?

- What is the structure of the Australia food logistics market and who are the key players?

- What is the degree of competition in the Australia food logistics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia food logistics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia food logistics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia conveyor belt industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)