Australia Food Service Market Size, Share, Trends and Forecast by Sector, System, Type of Restaurant, and Region, 2025-2033

Australia Food Service Market Size and Share:

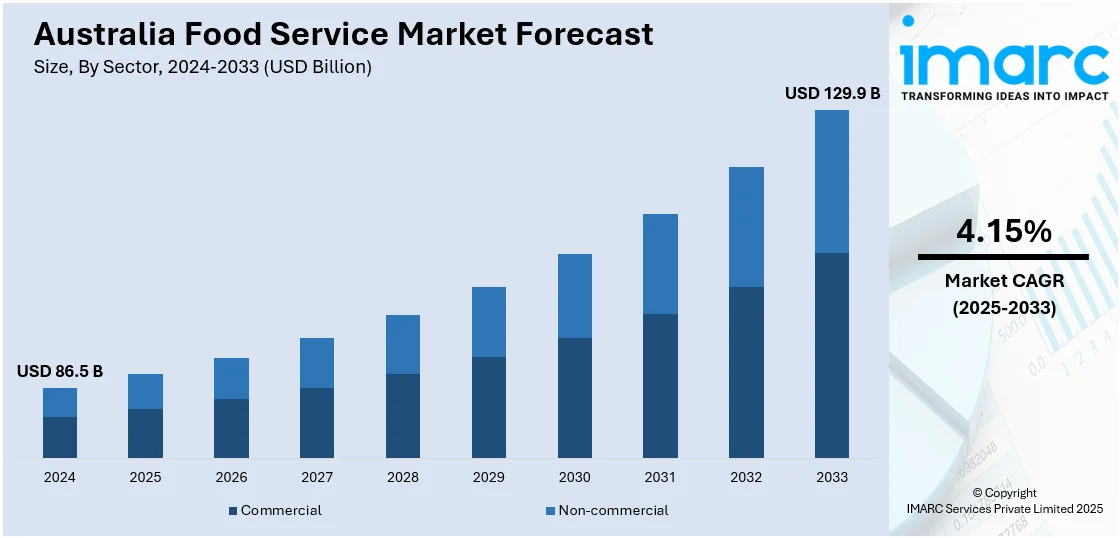

The Australia food service market size reached USD 86.5 Billion in 2024. Looking forward, the market is expected to reach USD 129.9 Billion by 2033, exhibiting a growth rate (CAGR) of 4.15% during 2025-2033. The market share is expanding, driven by the growing volume of visitors, which is encouraging hospitality businesses to improve menu offerings and provide better customer service. This, along with rising focus on healthy and organic food options, is stimulating the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 86.5 Billion |

| Market Forecast in 2033 | USD 129.9 Billion |

| Market Growth Rate 2025-2033 | 4.15% |

Key Trends of Australia Food Service Market:

Growing focus on healthy and organic food options

Rising focus on healthy and organic food options is offering a favorable Australia food service market outlook. More people are prioritizing nutrition, clean ingredients, and mindful eating in their daily choices. With inflating disposable incomes, people are becoming more willing to spend on premium meals that align with their health goals. According to the CEIC, in Australia, gross disposable income reached a record peak of 435,293.000 AUD Million in September 2024. The ongoing shift towards wellness-oriented eating habits is driving the demand for organic items, plant-based dishes, gluten-free meals, and low-sugar or additive-free alternatives. Restaurants, cafes, and food delivery services are responding by updating menus, sourcing from organic farms, and introducing new wellness-focused products. Food chains are also emphasizing calorie counts, ingredient transparency, and ethical sourcing to attract health-conscious customers. The popularity of veganism, flexitarian diets, and sustainable eating is further strengthening this trend. Beverage selections are also evolving, with fresh juices, kombucha, and herbal teas gaining traction.

To get more information on this market, Request Sample

Increasing tourism activities

Rising tourism activities are impelling the Australia food service market growth. According to the information provided by the World Travel & Tourism Council’s (WTTC) 2024 Economic Impact Research (EIR), Australia’s tourism sector was expected to contribute USD 265.5 Billion to the national economy in 2024. Tourists, both domestic and international, are frequently seeking out local and international cuisines during their travel, increasing footfall in restaurants, cafes, street food stalls, and quick-service outlets. With Australia being a popular destination known for its natural beauty, cultural diversity, and urban attractions; the food service sector is experiencing steady growth in tourist hotspots. High volumes of visitors are encouraging hospitality businesses to expand operations, improve menu offerings, and provide better customer service by catering to different tastes and preferences. This surge in demand is also leading to innovations in food presentation, healthier meal options, and the integration of technology for ordering and payment convenience. Seasonal events, festivals, and coastal tourism are further boosting food service utilization, especially in scenic and recreational areas. As travel experiences are becoming more food-oriented, businesses are aligning with the tourism industry to offer packages that combine dining with sightseeing. Airports, hotels, and travel hubs are also upgrading their food services to meet traveler expectations. Government efforts to promote Australia’s culinary culture through tourism campaigns are supporting this expansion.

Growth Drivers of Australia Food Service Market:

Shifting Consumer Lifestyle & Urban Culture

One key growth driver in Australia's food service market is the changing lifestyle of urban consumers. Dual-income working households, professionals, and younger generations are increasingly focusing on convenience and flexibility of dining occasions. This pattern is identified in strong demand for quick-service formats, breakfasts in cafés, brunch, and grab-and-go meals, especially in capital cities such as Sydney, Melbourne, and Adelaide. Australians persist in eating out regularly even under economic constraints because many are willing to pay for premium, where quality, convenience, and atmosphere combine. The growth of non-traditional work patterns like remote, hybrid, and gig-economy, also fuels demand for office catering, home delivery of food, and pop-up or mobile restaurants. Food festivals, culinary events, and street food markets also reinforce this cultural trend by providing new experiences appealing to residents and tourists alike. Combined with the region’s iconic café and brunch culture, these changes in lifestyle are making both independent restaurants and larger chains develop new menus, service models, and digital services to match the Australia food service market demand.

Digital Transformation & Online Food Delivery Growth

Technology and digital innovation are powerful drivers for growth for the food service sector in Australia. The broad availability of smartphones and internet-based services has driven accelerated adoption of app ordering, contactless payment, loyalty programs, and AI-driven personalization. Delivery platforms like third-party aggregators and branded apps, are increasingly becoming part of quick-service and full-service restaurant operations, taking orders beyond the four walls year-round and fueling order volume growth. Cloud kitchen and ghost kitchen models have become more popular with less capital needed and focus on delivery-only operations. Such formats enable operators to host several cuisines in a single outlet, using digital technology for back-end integration and front-end interfaces. From AI-driven ordering systems in fast food chains to digital menu boards and QR code restaurants, companies across Australia are incorporating technology into operations on a deep level to deliver efficiency and customer interaction. This digitalisation fuels growth by enhancing convenience, minimizing friction points in the customer experience, and facilitating analytics-based decision-making in a vast range of food service enterprises.

Multicultural Cuisine and Global Palate Preferences

According to the Australia food service market analysis, one of the robust growth drivers in the industry is the growing demand for multicultural cuisine and varied dining options. Being one of the most multicultural nations on the planet, Australia's food culture is dominated by Asian, Middle Eastern, Mediterranean, and South American tastes. This diversity can be most clearly seen in cities such as Melbourne and Sydney, where precincts are famous for international cuisine specialties. Customers have also become increasingly adventurous with their eating habits, regularly opting for authentic, fusion, or local options that mirror global culinary styles. Consequently, cafes and restaurants are diversifying their menus, importing specialty items, and recruiting internationally experienced chefs to deliver expectations. This increase in global palate demand also benefits food trucks, pop-up restaurants, and themed dining events, all of which feed into an eclectic food culture. The increased multicultural population, combined with a large rate of international tourism and exposure, guarantees that Australia's food service market remains progressive in its outlook.

Australia Food Service Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on sector, system, and type of restaurant.

Sector Insights:

- Commercial

- Non-commercial

The report has provided a detailed breakup and analysis of the market based on the sector. This includes commercial and non-commercial.

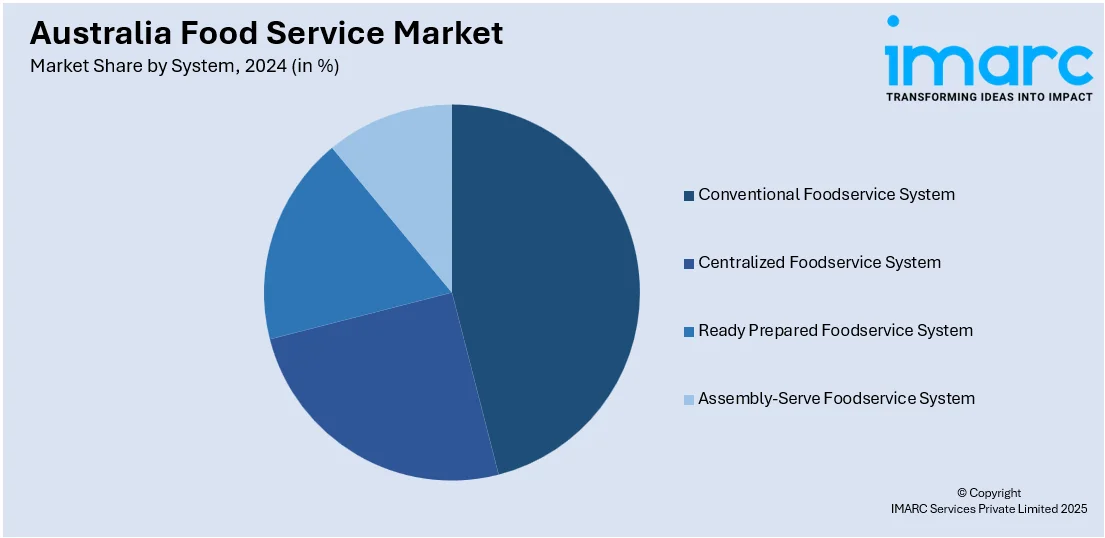

System Insights:

- Conventional Foodservice System

- Centralized Foodservice System

- Ready Prepared Foodservice System

- Assembly-Serve Foodservice System

A detailed breakup and analysis of the market based on the system have also been provided in the report. This includes conventional foodservice system, centralized foodservice system, ready prepared foodservice system, and assembly-serve foodservice system.

Type of Restaurant Insights:

- Fast Food Restaurants

- Full-Service Restaurants

- Limited Service Restaurants

- Special Food Services Restaurants

The report has provided a detailed breakup and analysis of the market based on the type of restaurant. This includes fast food restaurants, full-service restaurants, limited service restaurants, and special food services restaurants.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided, including:

- Cravable Brands

- Domino's Australia

- Guzman y Gomez Limited

- McDonald's Australia

- Nando's

- Retail Food Group Limited

- Ribs & Burgers

- Starbucks Coffee Australia

- Zambrero

Australia Food Service Market News:

- In December 2024, Food & Hospitality Week, a brand-new hospitality mega event, was set to debut at the MCEC, Australia, from 18-20 May 2025. The unique event aimed to bring together four significant exhibitions in a single location: Foodservice Australia, Pizza Pasta & Italian Food Show, the Restaurant Technology Show, and the Commercial Kitchen Show.

- In August 2024, Proud to be a Chef, supported by Fonterra and Anchor Food Professionals, marked its 25th anniversary by introducing the esteemed Australian Chef George Calombaris, the program’s inaugural winner, as its mentor and ambassador. Annually, Proud to be a Chef, a leading foodservice mentorship initiative, granted 32 apprentice chefs a unique culinary experience. Participants gained access to mentorship, masterclasses, networking chances, and the opportunity to win a USD 7,500 culinary scholarship designed to fit their specific professional goals.

Australia Food Service Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sectors Covered | Commercial, Non-commercial |

| Systems Covered | Conventional Foodservice System, Centralized Foodservice System, Ready Prepared Foodservice System, Assembly-Serve Foodservice System |

| Types of Restaurants Covered | Fast Food Restaurants, Full-Service Restaurants, Limited Service Restaurants, Special Food Services Restaurants |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Companies Covered | Cravable Brands, Domino's Australia, Guzman y Gomez Limited, McDonald's Australia, Nando's, Retail Food Group Limited, Ribs & Burgers, Starbucks Coffee Australia, Zambrero, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia food service market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia food service market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia food service industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia food service market was valued at USD 86.5 Billion in 2024.

The Australia food service market is projected to exhibit a CAGR of 4.15% during 2025-2033.

The Australia food service market is expected to reach a value of USD 129.9 Billion by 2033.

The Australia food service market is evolving with rising demand for convenient dining, digital ordering, and diverse global cuisines. Urban lifestyles, tech integration, and multicultural influences are reshaping menus and service models. Sustainability, health-conscious options, and delivery-focused formats also continue to fuel innovation across restaurants, cafes, and takeaway establishments.

The Australia food service market is driven by urban lifestyle shifts, growing demand for convenience, and widespread digital adoption. Multicultural demographics fuel diverse culinary preferences, while technology enhances ordering and delivery efficiency. Health trends and experiential dining further contribute to the sector’s expansion across cities, regional hubs, and tourism-driven areas.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)