Australia Food Service Pasta Market Size, Share, Trends and Forecast by Product Type, Foodservice Channel, and Region, 2025-2033

Australia Food Service Pasta Market Overview:

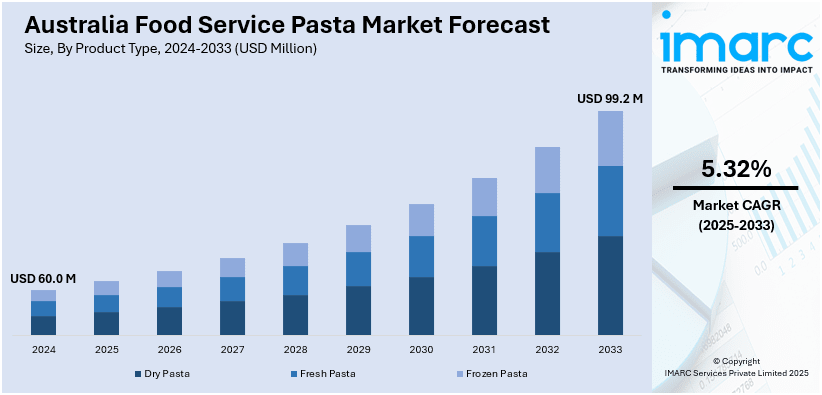

The Australia food service pasta market size reached USD 60.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 99.2 Million by 2033, exhibiting a growth rate (CAGR) of 5.32% during 2025-2033. The rising demand for plant-based and health-conscious pasta options, fueled by dietary trends, such as veganism and gluten-free diets is augmenting the Australia food service pasta market share. Premium and artisanal pasta growth is driven by consumer preference for high-quality, authentic dining experiences. Additionally, sustainability, ethical sourcing, and social media influence are shaping menu innovation and customer choices.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 60.0 Million |

| Market Forecast in 2033 | USD 99.2 Million |

| Market Growth Rate 2025-2033 | 5.32% |

Australia Food Service Pasta Market Trends:

Rising Demand for Plant-Based and Health-Conscious Pasta Options

The shift toward plant-based and health-conscious offerings is significantly supporting the Australia food service pasta market growth. With increasing consumer awareness of dietary preferences such as veganism, gluten-free, and low-carb diets, restaurants, and food service providers are expanding their pasta menus to include alternative ingredients. Australia's plant-based meat sector has grown, with sales rising 47% between 2020 and 2023 and per-capita consumption increasing by 28%. The growth can be seen to be driven by the rise in popularity of veganism and increased demand in the food service industry. Beyond substituting in customers' minds for classic products such as burgers, the wholesale market has grown 59% in the past year. With increasing price equivalence (local products are currently $3.72 per kilogram cheaper than imports), the sector is well-positioned for wider integration into Australian food service menus. Chickpea, lentil, and zucchini-based pastas are also gaining popularity as nutritious, high-protein substitutes for traditional wheat pasta. Additionally, the demand for organic and whole-grain pasta is rising as health-conscious consumers prioritize clean-label and minimally processed foods. Foodservice operators are responding by partnering with local suppliers to source sustainable ingredients, aligning with Australia’s growing focus on ethical and environmentally friendly dining. This trend is further driven by younger demographics, particularly millennials and Gen Z, who are more likely to seek out innovative, health-focused pasta dishes in cafes and fast-casual dining settings.

To get more information on this market, Request Sample

Growth of Premium and Artisanal Pasta in Food Service

The increasing demand for premium and artisanal pasta varieties is creating a positive Australia food service pasta market outlook. New research reveals that Australia's food service sector has seen a 26% year-on-year spike in restaurant reservations, driven by Gen Z and Millennials who prefer immersive dining and themed attractions. Additionally, 85% of Australian restaurants are utilizing artificial intelligence, and targeted email marketing has generated over AUD 5 Million (approximately USD 3.05 Million), indicating that digital innovation is driving ongoing growth. Consumers are willing to pay more for high-quality, handcrafted pasta made with specialty ingredients such as durum wheat, truffle-infused oils, and imported Italian cheeses. Upscale restaurants and gourmet food service providers are capitalizing on this trend by offering house-made pasta dishes with unique flavors, such as squid ink linguine or saffron-infused pappardelle. Additionally, the rise of experiential dining has led to a rise in pasta bars and interactive cooking stations where chefs prepare fresh pasta on-site. This trend reflects a broader shift toward authenticity and craftsmanship in food service, as consumers seek memorable dining experiences. Social media influence also plays a role, with visually appealing pasta dishes driving customer interest and demand for premium offerings in both casual and fine-dining establishments.

Australia Food Service Pasta Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type and foodservice channel.

Product Type Insights:

- Dry Pasta

- Fresh Pasta

- Frozen Pasta

- Filled Pasta

- Simple Pasta

- Ready Meal Pasta

The report has provided a detailed breakup and analysis of the market based on the product type. This includes dry pasta, fresh pasta, and frozen pasta (filled pasta, simple pasta, and ready meal pasta).

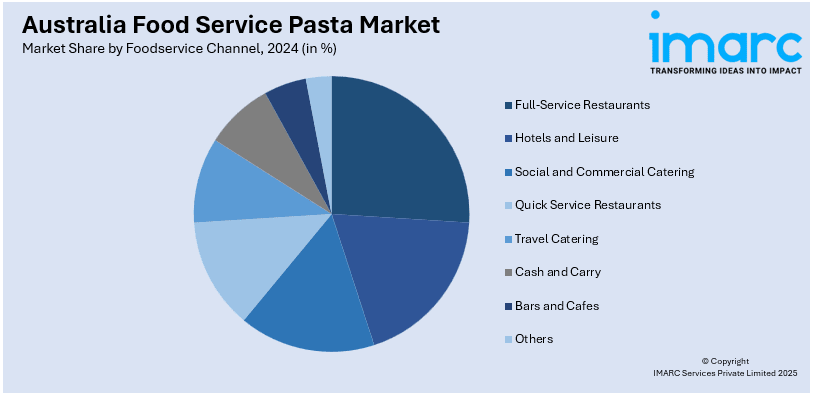

Foodservice Channel Insights:

- Full-Service Restaurants

- Hotels and Leisure

- Social and Commercial Catering

- Quick Service Restaurants

- Travel Catering

- Cash and Carry

- Bars and Cafes

- Others

A detailed breakup and analysis of the market based on the foodservice channel have also been provided in the report. This includes full-service restaurants, hotels and leisure, social and commercial catering, quick service restaurants, travel catering, cash and carry, bars and cafes, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Food Service Pasta Market News:

- Barilla launched its limited-edition heart-shaped pasta at Coles in Australia and New Zealand at $ 4.90 in February 2025. The launch was in response to the growing demand for premium, freshly made pasta in the food service industry. Coinciding with Valentine’s Day, the product capitalizes on the Australian preference for Italian cuisine, with 36% of the population favoring it. This move also reinforces Barilla’s commitment to sustainability, which began with Barilla’s transition to paper-based packaging. This unique shape enhances the potential for romantic and themed dining experiences, creating new opportunities for innovative pasta menus in the food service industry.

- Australian brand PhycoHealth launched a range of its seaweed-based food and pasta line in 51 Holland and Barrett stores across the UK in 2024. With its nutrient-dense and sustainable seaweed pasta in line with the global trend toward sustainable food service solutions, the brand won the IFE Manufacturing Award for Innovative Protein Source. With the removal of tariffs under the Australia–UK Free Trade Agreement, PhycoHealth is well-positioned to enhance its influence in both the Australian and global pasta markets.

Australia Food Service Pasta Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Foodservice Channels Covered | Full-Service Restaurants, Hotels and Leisure, Social and Commercial Catering, Quick Service Restaurants, Travel Catering, Cash and Carry, Bars and Cafes, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia food service pasta market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia food service pasta market on the basis of product type?

- What is the breakup of the Australia food service pasta market on the basis of foodservice channel?

- What is the breakup of the Australia food service pasta market on the basis of region?

- What are the various stages in the value chain of the Australia food service pasta market?

- What are the key driving factors and challenges in the Australia food service pasta?

- What is the structure of the Australia food service pasta market and who are the key players?

- What is the degree of competition in the Australia food service pasta market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia food service pasta market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia food service pasta market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia food service pasta industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)