Australia Food Sweetener Market Size, Share, Trends and Forecast by Product Type, Application, Distribution Channel, and Region, 2025-2033

Australia Food Sweetener Market Size and Trends:

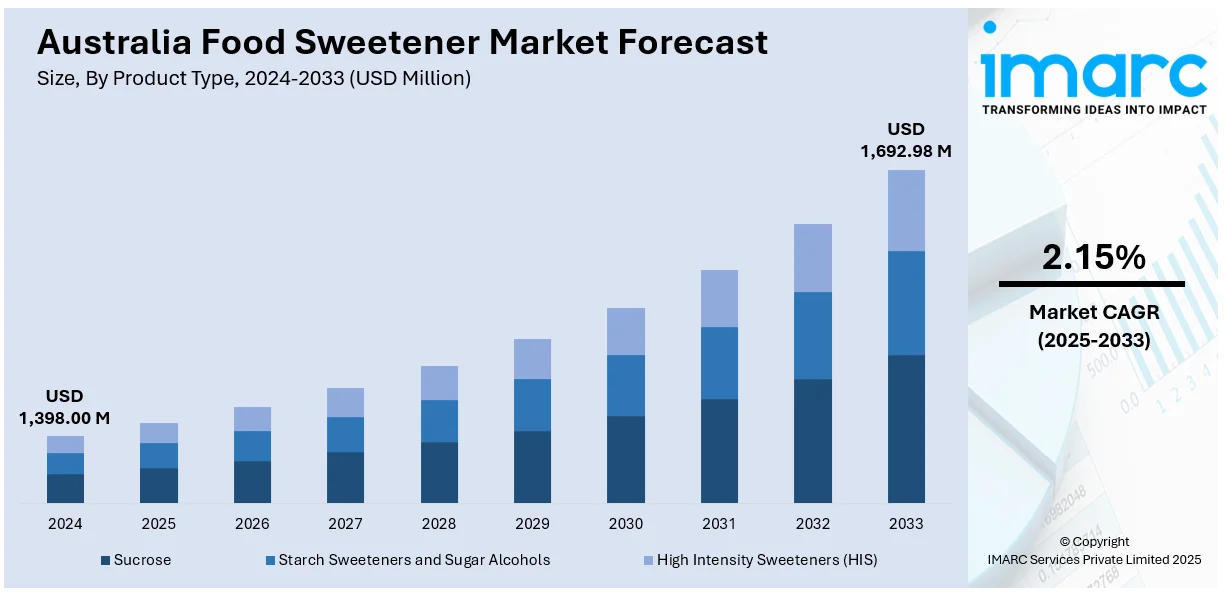

The Australia food sweetener market size reached USD 1,398.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,692.98 Million by 2033, exhibiting a growth rate (CAGR) of 2.15% during 2025-2033. The market is fueled by heightening health awareness, need for natural and low-calorie solutions, and growing uses in functional foods and beverages. Consumers are increasingly looking for sugar substitutes that fit wellness trends and dietary requirements. Formulation and customization innovations are also influencing product offerings. As these trends become stronger, Australia food sweetener market share will continue to grow steadily across various product segments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,398.00 Million |

| Market Forecast in 2033 | USD 1,692.98 Million |

| Market Growth Rate 2025-2033 | 2.15% |

Australia Food Sweetener Market Trends:

Growing Popularity of Natural and Plant-Based Sweeteners

The Australia market has seen considerable movement towards plant and natural sweeteners, driven by increasing demand from consumers for healthier and sustainable food options. Consumers are more aware of what goes into their food and are turning towards clean-label products that have fewer artificial additives. This has driven the uptake of sweeteners like stevia, monk fruit, coconut sugar, and agave nectar, which are seen as healthier alternatives to traditional refined sugars. For instance, in 2024, Lakanto Australia extended its product line by introducing Brown Lakanto, a natural 1:1 brown sugar alternative with zero carbs and 93% fewer calories, now found at major retailers across the country. Moreover, with changing dietary trends towards organic and less-processed foods, companies are reformulating products to include these natural sweeteners in different segments such as beverages, bakery, and dairy alternatives. This consumer-led shift toward plant-based alternatives demonstrates focus on nutritional content, reduced glycemic load, and sustainability. Australia food sweetener industry outlook reports that future trends will sustain this movement, with natural sweeteners dominating upcoming innovation, as they are set to meet changing consumer demands and drive long-term market growth.

To get more information on this market, Request Sample

Increasing Incorporation of Low-Calorie Sweeteners in Functional Foods

The growing emphasis on health and well-being in Australia has driven low-calorie sweetener uptake in functional foods. Consumers are highly conscious of calorie consumption, sugar cutbacks, and metabolic well-being, so demand for foods that provide nutritional value without sacrificing flavor is being driven. Furthermore, this change has come especially in areas like fortified beverages, protein bars, and food supplements, wherein low-calorie sweeteners erythritol, stevia, and allulose are being utilized for both flavor as well as nutrition goals. Gaining popularity as low-sugar and weight-management diets have spurred manufacturers to employ these sweeteners to attract fitness-oriented consumers to enjoy balanced treats. Sweetener technology advancements have also facilitated better taste profiles, bringing low-calorie versions closer to becoming a standard choice. For example, in April 2023, Sweegen introduced Sweetensify Flavors, with brazzein and thaumatin II sweet proteins. This innovation allows for greater sugar reduction and healthier formulations for food and beverage companies worldwide. Consequently, Australian food sweetener share in functional foods is forecast to grow steadily, propelled by consumer desire for food items that support wellness aspirations without compromising on favorable taste experiences.

Shifting Towards Personalized Sweetening Solutions Across Various Applications

Customization is a dominant trend that is impacting the application of sweeteners within the Australia food and beverage market, with manufacturers increasingly demanding solutions that are specific to particular product requirements. The trend is being fueled by the necessity to fine-tune sweetness levels, ensure the right texture, and have compatibility with functional ingredients while also responding to consumers' needs for healthier options. Tailored sweetening systems are being embraced in a range of applications, such as beverages, bakery, dairy, and sauces, to allow manufacturers to optimize taste with nutritional needs like lower sugar levels and cleaner labels. Ingredient technology advances are making it possible to create proprietary sweetener blends that improve product performance while providing a rewarding sensory experience. As food preferences remain dynamic, manufacturers are tapping these tailored formulations as a way of differentiating products and responding to consumer demands for personalized nutrition. Australia food sweetener market growth is likely to be highly driven by this trend towards continued market expansion.

Australia Food Sweetener Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, application, and distribution channel.

Product Type Insights:

- Sucrose

- Starch Sweeteners and Sugar Alcohols

- Dextrose

- High Fructose Corn Syrup (HFCS)

- Maltodextrin

- Sorbitol

- Xylitol

- Others

- High Intensity Sweeteners (HIS)

- Sucralose

- Stevia

- Aspartame

- Saccharin

- Neotame

- Acesulfame Potassium (Ace-K)

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes sucrose, starch sweeteners and sugar alcohols (dextrose, high fructose corn syrup (HFCS), maltodextrin, sorbitol, xylitol, and others), and high intensity sweeteners (HIS) (sucralose, stevia, aspartame, saccharin, neotame, acesulfame potassium (Ace-K), and others).

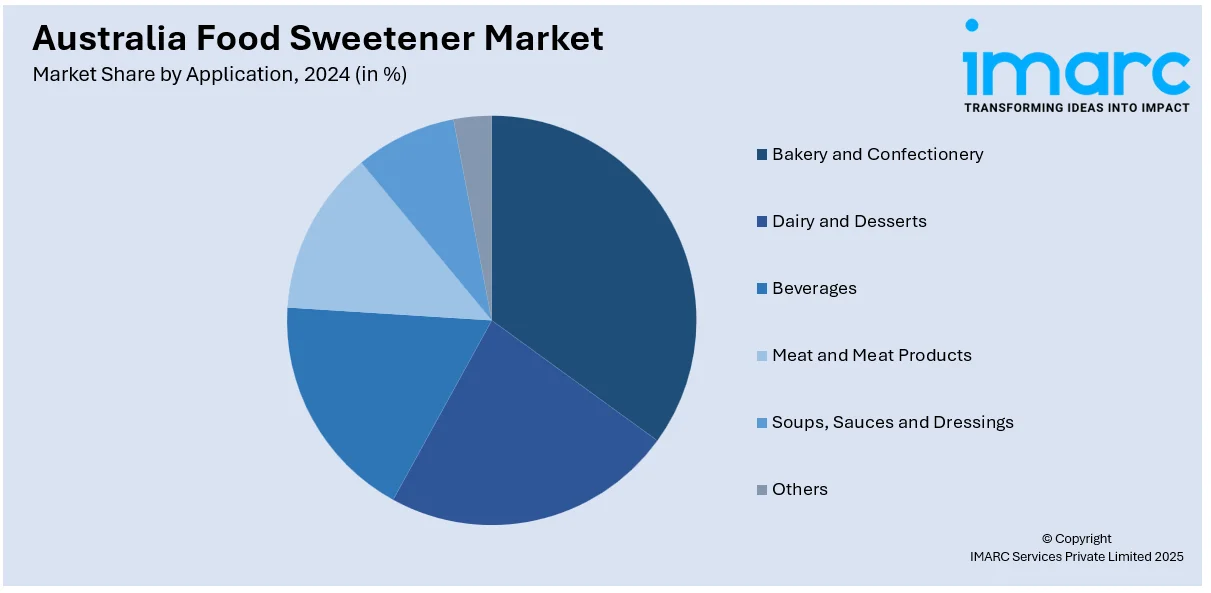

Application Insights:

- Bakery and Confectionery

- Dairy and Desserts

- Beverages

- Meat and Meat Products

- Soups, Sauces and Dressings

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes bakery and confectionery, dairy and desserts, beverages, meat and meat products, soups, sauces and dressings, and others.

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Departmental Stores

- Convenience Stores

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, departmental stores, convenience stores, online stores, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Food Sweetener Market News:

- In November 2024, Samyang Corporation gained Novel Food approval for allulose from Food Standards Australia New Zealand (FSANZ). This is the first-ever approval of allulose in the region, which will allow its application in sugar-reduced and sugar-free food products, positioning Samyang to gain market share in Australia and New Zealand.

Australia Food Sweetener Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Applications Covered | Bakery and Confectionery, Dairy and Desserts, Beverages, Meat and Meat Products, Soups, Sauces and Dressings, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Departmental Stores, Convenience Stores, Online Stores, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia food sweetener market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia food sweetener market on the basis of product type?

-

What is the breakup of the Australia food sweetener market on the basis of application?

- What is the breakup of the Australia food sweetener market on the basis of distribution channel?

- What is the breakup of the Australia food sweetener market on the basis of region?

- What are the various stages in the value chain of the Australia food sweetener market?

- What are the key driving factors and challenges in the Australia food sweetener?

- What is the structure of the Australia food sweetener market and who are the key players?

- What is the degree of competition in the Australia food sweetener market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia food sweetener market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia food sweetener market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia food sweetener industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)