Australia Foodservice Packaging Market Size, Share, Trends and Forecast by Material, Packaging Type, Application, and Region, 2026-2034

Australia Foodservice Packaging Market Summary:

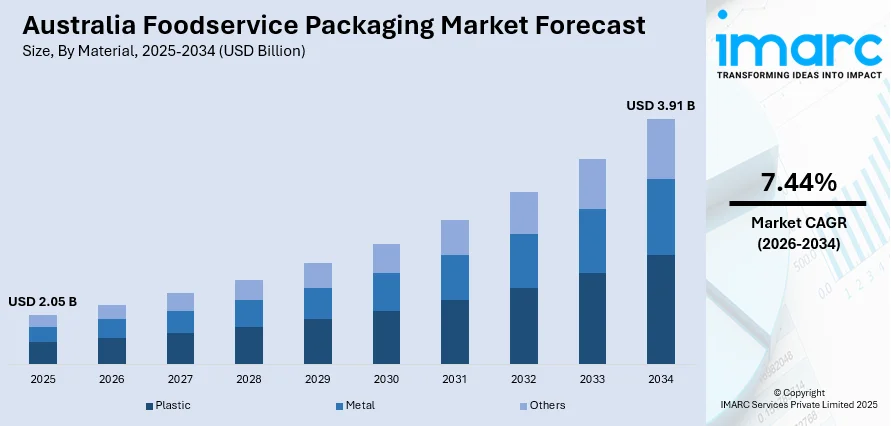

The Australia foodservice packaging market size was valued at USD 2.05 Billion in 2025 and is projected to reach USD 3.91 Billion by 2034, growing at a compound annual growth rate of 7.44% from 2026-2034.

The market is experiencing transformative growth driven by Australia's expanding quick-service restaurant sector, rising demand for convenient takeaway solutions, and increasingly stringent environmental regulations targeting single-use plastics. The convergence of sustainability mandates, evolving consumer preferences for eco-friendly packaging, and rapid digital commerce expansion is fundamentally reshaping competitive dynamics and creating substantial opportunities for market participants across the value chain in the Australia foodservice packaging market share.

Key Takeaways and Insights:

- By Material: Plastic dominates the market with a share of 50% in 2025, driven by its versatility, cost-effectiveness, and widespread adoption across quick-service restaurants and food delivery applications requiring durable, lightweight packaging solutions.

- By Packaging Type: Paper and paperboard leads the market with a share of 36% in 2025, owing to regulatory support for sustainable alternatives, consumer preference for recyclable materials, and brand commitments to reducing plastic packaging footprints.

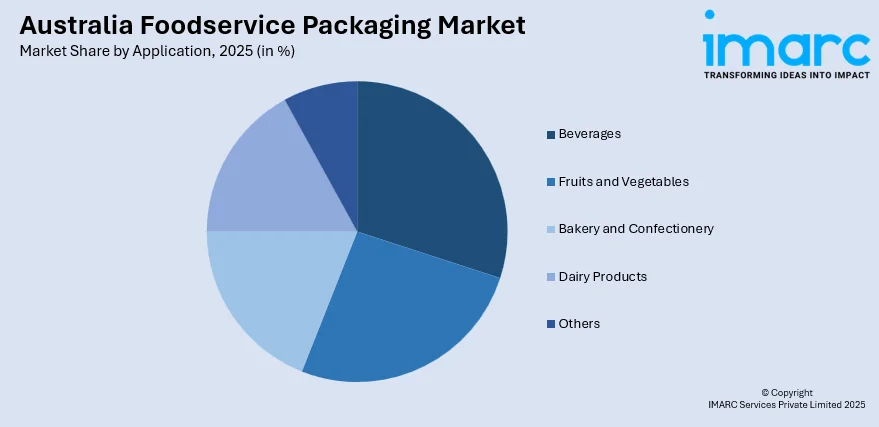

- By Application: Beverages represent the largest segment with a market share of 25% in 2025, supported by Australia's strong coffee culture, expanding ready-to-drink beverage consumption, and increasing demand for on-the-go drink packaging solutions.

- Key Players: The Australia foodservice packaging market exhibits moderate competitive intensity, with established domestic manufacturers competing alongside international sustainable packaging specialists across material segments, driven by innovation in compostable solutions and regulatory compliance capabilities.

To get more information on this market, Request Sample

The Australian foodservice packaging landscape is undergoing significant transformation as sustainability imperatives reshape material selection and product development priorities. The quick-service restaurant sector, commanding approximately 39% of the foodservice market share, serves as a primary demand driver for packaging solutions that balance operational efficiency with environmental responsibility. Collins Foods, Australia's largest KFC franchisee, reported a 6.6% increase in annual revenue in 2024 from its expanding network, exemplifying the robust foodservice expansion fueling packaging requirements. State-level single-use plastic bans have accelerated adoption of paper-based and compostable alternatives, with South Australia, Western Australia, and Victoria implementing progressive restrictions that mandate industry-wide material transitions. The convergence of regulatory pressure, consumer sustainability awareness, and foodservice sector growth positions the market for sustained expansion throughout the forecast period.

Australia Foodservice Packaging Market Trends:

Accelerating Transition to Compostable and Biodegradable Materials

Australia's foodservice packaging sector is increasingly adopting sustainable and compostable materials against the backdrop of environmental concerns and changing consumer expectations. Companies are shifting from traditional plastic-based alternatives to biodegradable solutions developed from sugarcane, cornstarch, and bamboo fiber. In September 2024, Detpak unveiled Australia's largest range of compostable PBS packaging with over twenty recyclable cartons, trays, and lunchboxes in support of new South Australian and Western Australian legislation reducing single-use plastics.

Minimalist and Functional Design Innovation

Minimalist and functional design has become a flagship trend in Australia's foodservice packaging, with emphasis on usefulness, simplicity, and visual appeal. The movement embraces clean aesthetics, subdued colors, and straightforward structural formats that improve product readability and handling for both consumers and workers. Beyond aesthetics, functional innovations including spill-proof lids, microwave-safe packaging, and stackable designs are gaining popularity to support fast-paced foodservice operations. In May 2025, Foopak exhibited its innovative sustainable paperboard solutions, including Foopak Bio Natura certified compostable and recyclable at Foodservice Australia, meeting increasing demand for environmentally friendly food packaging.

Smart Labeling and Digital Integration

Technological advancements are enabling intelligent packaging solutions that enhance food safety and supply chain transparency across Australia's foodservice industry. Time-temperature indicators, QR codes, and freshness sensors incorporated into smart labels provide real-time product quality and shelf- life information for perishable items. These technologies are particularly beneficial in supporting hygiene regimes, reducing food waste, and furthering overall quality control processes. As consumer digital literacy increases, demand for interactive packages continues to rise, making intelligent packaging both a valuable operational tool and competitive advantage aligned with broader digital transformation efforts in the foodservice sector.

Market Outlook 2026-2034:

The Australia foodservice packaging market demonstrates robust growth potential throughout the forecast period, underpinned by structural demand drivers including expanding delivery and takeaway foodservice models, regulatory mandates favoring sustainable packaging, and continued quick-service restaurant network expansion. The Australian Government's 2025 National Packaging Targets, mandating 100% of packaging to be reusable, recyclable, or compostable and 50% average recycled content included in packaging, continues to drive material innovation and market restructuring toward fiber-based and biodegradable solutions. The market generated a revenue of USD 2.05 Billion in 2025 and is projected to reach a revenue of USD 3.91 Billion by 2034, growing at a compound annual growth rate of 7.44% from 2026-2034.

Australia Foodservice Packaging Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Material | Plastic | 50% |

| Packaging Type | Paper and Paperboard | 36% |

| Application | Beverages | 25% |

Material Insights:

- Plastic

- Polyethylene

- Polyamide

- Ethylene Vinyl Alcohol

- Metal

- Others

The plastic segment dominates with a market share of 50% of the total Australia foodservice packaging market in 2025.

Plastic materials continue to lead Australia's foodservice packaging market due to their exceptional versatility, lightweight properties, and cost-effectiveness that enable widespread adoption across quick-service restaurants, cafes, and food delivery operations. Polyethylene, polyamide, and ethylene vinyl alcohol variants offer distinct functional advantages including moisture barriers, heat resistance, and structural integrity that maintain food quality during transport and storage. In April 2024, Amcor Group introduced a one-liter polyethylene terephthalate bottle crafted from 100% post-consumer recycled materials, specifically designed for carbonated soft drinks, demonstrating the industry's innovation trajectory toward sustainable plastic solutions.

Despite environmental pressures driving plastic reduction initiatives, the material maintains market dominance through ongoing innovation in recyclable and recycled-content formulations that address regulatory requirements while preserving functional performance. Major players including Pact Group Holdings, Amcor, and Orora continue investing in advanced plastic packaging technologies that balance sustainability mandates with foodservice operational requirements. The sector's adaptation includes development of lighter-weight packaging that reduces material consumption while maintaining protective properties, alongside increased incorporation of post-consumer recycled content that supports circular economy objectives outlined in Australia's 2025 National Packaging Targets.

Packaging Type Insights:

- Paper and Paperboard

- Flexible

- Rigid

- Others

The paper and paperboard segment leads with a share of 36% of the total Australia foodservice packaging market in 2025.

Paper and paperboard packaging has emerged as the fastest-growing segment within Australia's foodservice packaging landscape, driven by regulatory pressure eliminating single-use plastics and consumer preference for recyclable, biodegradable alternatives. Foldable cartons, grease-resistant wraps, and fiber-based containers are progressively displacing polystyrene clamshells and plastic packaging across quick-service restaurants, cafes, and food delivery operations. The In November 2024, Mars MasterFoods launched Australia's first paper-recyclable squeeze-on tomato sauce packaging, decreasing plastic content by 58% and targeting removal of 190 metric tons of plastic by 2025.

State-level single-use plastic bans have accelerated paper and paperboard adoption, with South Australia, Western Australia, Victoria, and New South Wales implementing progressive restrictions that mandate fiber-based alternatives for food containers, cups, and takeaway packaging. Leading manufacturers including Detpak, BioPak, and Visy have responded with expanded product portfolios featuring commercially compostable and kerbside recyclable solutions. The regulatory certainty provided by Australia's 2025 National Packaging Targets, requiring 100% of packaging to be reusable, recyclable, or compostable, has catalyzed capital investment in barrier-coating technologies and fiber-processing capabilities that support continued segment expansion.

Application Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Beverages

- Fruits and Vegetables

- Bakery and Confectionery

- Dairy Products

- Others

The beverages segment holds the largest share with 25% of the total Australia foodservice packaging market in 2025.

The beverages application segment leads Australia's foodservice packaging market, driven by the nation's sophisticated coffee culture and expanding ready-to-drink beverage consumption patterns. Australians consume high amount of coffee due to which the substantial consumption volume generates significant demand for takeaway cups, lids, and beverage carriers that meet both functional requirements and sustainability expectations. In March 2025, Visy released a beverage can containing 83% recycled content, manufactured at its Yatala, Queensland facility, representing a significant advancement in sustainable beverage packaging through industry collaboration.

The segment benefits from regulatory attention focused on beverage container sustainability, with state-level bans targeting plastic cups, lids, and straws accelerating adoption of paper-based and compostable alternatives. BioPak's introduction of PHA-lined cups, claimed as Australia's first home compostable coffee cup, exemplifies innovation responding to both regulatory mandates and consumer preferences. The Australia beverage packaging market reached USD 3,506 million in 2024 and is projected to grow at a compound annual growth rate of 5.00% through 2033, with foodservice channels representing a primary demand driver as coffee chains, quick-service restaurants, and cafes continue expanding their beverage offerings.

Regional Insights:

- Australian Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Australian Capital Territory & New South Wales market is driven by Sydney's position as Australia's largest metropolitan foodservice hub, extensive quick-service restaurant networks, progressive single-use plastic regulations, and advanced food delivery infrastructure.

Victoria & Tasmania represents a significant market share supported by Melbourne's thriving café culture, strong sustainability-focused consumer base, and February 2023 single-use plastic bans accelerating adoption of paper-based and compostable packaging alternatives.

Queensland exhibits the fastest regional growth trajectory, benefiting from the September 2025 Queensland Government manufacturing strategy allocating grants to support advanced packaging technology adoption and production expansion.

Northern Territory & Southern Australia demonstrates steady growth driven by South Australia's leadership in single-use plastic legislation, with September 2024 bans on plastic barrier bags and beverage containers accelerating sustainable packaging transitions across foodservice operations.

Western Australia shows robust expansion supported by the WA Plan for Plastics implementing progressive bans through 2025, with September 2024 restrictions on plastic produce bags and foodware lids driving demand for compliant compostable alternatives.

Market Dynamics:

Growth Drivers:

Why is the Australia Foodservice Packaging Market Growing?

Expanding Quick-Service Restaurant and Food Delivery Sector

Australia's quick-service restaurant sector serves as a primary demand driver for foodservice packaging, commanding a substantial share of the foodservice market share with consumers spending rapidly per week on fast food. The sector's expansion directly correlates with increased packaging requirements for takeaway containers, beverage cups, and delivery packaging solutions. Delivery and takeaway models dominate Australia's QSR landscape, with restaurants optimizing menus for delivery, investing in efficient packaging, and expanding partnerships with platforms like Uber Eats and DoorDash. This robust sector expansion ensures sustained demand growth for foodservice packaging solutions throughout the forecast period.

Stringent Single-Use Plastic Regulations Driving Material Innovation

Australia's comprehensive regulatory framework targeting single-use plastics is fundamentally reshaping the foodservice packaging landscape and driving innovation in sustainable alternatives. State governments have implemented progressive bans covering plastic bags, cups, lids, cutlery, and expanded polystyrene containers, with South Australia, Western Australia, Victoria, and New South Wales leading regulatory action. The Australian Government's October 2024 packaging regulation reform introduced national standards, chemical bans, and extended producer responsibility requirements to enhance recyclability across all packaging categories. In order to reduce waste, boost recycling rates, and promote a circular economy for packaging, the Australian government began a consultation process on September 28, 2024.From September 2024, Western Australia banned disposable plastic produce bags and lids for foodware containers, while South Australia extended restrictions to plastic barrier bags and single-use beverage containers including coffee cups. These regulatory mandates create assured demand for compliant paper-based, compostable, and recyclable packaging alternatives, supporting market growth while accelerating industry transition toward circular economy principles.

Rising Consumer Sustainability Awareness and Brand Accountability

Heightened environmental consciousness among Australian consumers is driving demand for sustainable foodservice packaging solutions and compelling brand owners to prioritize eco-friendly packaging strategies. According to PwC's 2024 Voice of the Consumer Survey, consumers are willing to spend an average of 9.7% more on sustainably produced or sourced goods, even amid cost-of-living pressures. Australia's 2025 National Packaging Targets mandate 100% of packaging to be reusable, recyclable, or compostable, while requiring 70% of plastic packaging to be recycled or composted. Almost one in five Australian restaurants introduced more eco-friendly and sustainable options to their dining experience in 2024, while nearly a third of restaurant business owners indicated intentions to switch to more sustainable packaging. This convergence of consumer preference, regulatory mandate, and brand accountability creates favorable conditions for sustainable packaging market expansion.

Market Restraints:

What Challenges is the Australia Foodservice Packaging Market Facing?

Higher Costs of Sustainable Packaging Alternatives

The transition from conventional plastic packaging to sustainable alternatives presents significant cost challenges for foodservice operators, particularly smaller independent establishments operating on thin margins. Compostable and biodegradable packaging materials typically command premium pricing compared to traditional plastic options, creating financial barriers to adoption that may slow market transition despite regulatory mandates and consumer preferences.

Supply Chain Volatility and Raw Material Price Fluctuations

Foodservice packaging manufacturers face ongoing challenges from volatile pulp prices, fragmented recycling infrastructure, and rising energy costs that impact production economics and pricing stability. Old corrugated cardboard and kraft pulp trade in US dollars, exposing Australian converters to currency and freight shocks that affect gross margins, while domestic recovered fiber availability fluctuates with collection rates and export policy changes.

Infrastructure Gaps in Composting and Recycling Systems

Despite growing adoption of compostable foodservice packaging, Australia's composting infrastructure remains underdeveloped relative to market requirements, limiting the environmental benefits of biodegradable packaging solutions. Collection and processing capacity constraints, inconsistent access to industrial composting facilities across regions, and consumer confusion regarding proper disposal methods reduce the effectiveness of compostable packaging initiatives and challenge market development.

Competitive Landscape:

The Australia foodservice packaging market exhibits moderate competitive intensity characterized by the presence of established domestic manufacturers alongside international sustainable packaging specialists competing across material segments and application categories. Market dynamics reflect strategic positioning ranging from premium, innovation-driven compostable offerings to value-oriented recyclable solutions targeting cost-conscious foodservice operators. Key domestic players positions through vertically integrated operations, extensive distribution networks, and ongoing investment in sustainable product development. The competitive landscape is increasingly shaped by sustainability certifications, regulatory compliance capabilities, and innovation in barrier technologies that enable paper-based packaging to match plastic functionality.

Recent Developments:

- In September 2024, Detpak launched Australia's largest range of more than 20 commercially compostable and recyclable PBS-lined commercially compostable and recyclable PBS-lined cartons, trays, and lunchboxes, comprising over 20 product variants in support of new South Australian and Western Australian legislation reducing single-use plastics. The PFAS-free packaging range is certified to Australian and European composting standards, offering eco-friendly solutions for the takeaway food sector.

- In February 2024, Copar launched its groundbreaking PFAS-free wheat straw packaging at APPEX 2024 in Melbourne, providing recyclable and compostable substitutes for plastic packaging suitable for fresh produce and meat while maintaining MAP compliance and facilitating sustainability transitions for foodservice businesses.

Australia Foodservice Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered |

|

| Packaging Types Covered | Paper and Paperboard, Flexible, Rigid, Others |

| Applications Covered | Beverages, Fruits and Vegetables, Bakery and Confectionery, Dairy Products, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia Foodservice Packaging market size was valued at USD 2.05 Billion in 2025.

The Australia Foodservice Packaging market is expected to grow at a compound annual growth rate of 7.44% from 2026-2034 to reach USD 3.91 Billion by 2034.

Paper and paperboard leads the market with a share of 36% in 2024, driven by regulatory mandates phasing out single-use plastics and growing consumer preference for recyclable, eco-friendly packaging alternatives.

Key factors driving the Australia foodservice packaging market include expanding quick-service restaurant and food delivery sector growth, stringent single-use plastic regulations driving material innovation, and rising consumer sustainability awareness compelling brand owners to prioritize eco-friendly packaging strategies

Major challenges include higher costs of sustainable packaging alternatives creating financial barriers for smaller foodservice operators, supply chain volatility and raw material price fluctuations affecting production economics, and infrastructure gaps in composting and recycling systems limiting the effectiveness of biodegradable packaging initiatives.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)