Australia Forage Market Size, Share, Trends and Forecast by Crop Type, Product Type, Animal Type, and Region, 2025-2033

Australia Forage Market Overview:

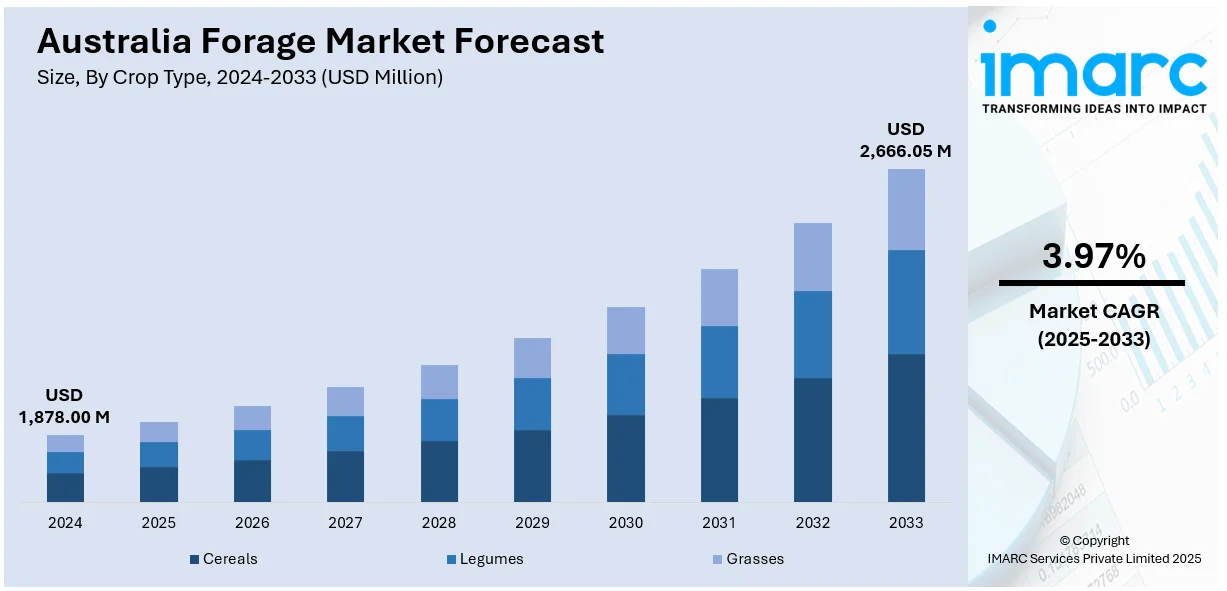

The Australia forage market size reached USD 1,878.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,666.05 Million by 2033, exhibiting a growth rate (CAGR) of 3.97% during 2025-2033. The market is being driven by the elevating demand for high-quality livestock feed to support meat and dairy exports, alongside increasing adoption of drought-resilient forage crops in response to climate change, encouraging sustainable agriculture practices and boosting productivity amid shifting environmental and economic conditions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,878.00 Million |

| Market Forecast in 2033 | USD 2,666.05 Million |

| Market Growth Rate 2025-2033 | 3.97% |

Australia Forage Market Trends:

Rising Demand for High-Quality Animal Feed

A key market driver is the escalating demand for superior-quality animal feed to sustain the country's livestock industry. Australia is one of the largest exporters of lamb, beef, and dairy globally, and this creates a need for a regular supply of nutrient-laden forage like alfalfa, clover, and a range of grasses. Forage is crucial in promoting animal well-being, raising milk production, and facilitating quality meat, which are essential for sustaining the competitiveness of Australian livestock in international trade. The climatic conditions in Australia, especially in areas like Victoria, New South Wales, and Western Australia, are suitable for growing forage crops. In addition, with rising pressures on sustainable livestock production, adoption of forage-based feeding systems that minimize dependency on grain diets and support improved animal nutrition continues to grow. Livestock producers are also investing in advanced forage storage methods like silage and haylage to enable year-round production. The incorporation of scientific innovation in forage genetics, irrigation techniques, and harvesting technology has further enhanced production efficiency, responding to the changing needs of the domestic and export-oriented livestock sector.

To get more information on this market, Request Sample

Increasing Shift Toward Drought-Resilient Forage Crops

Another key driver is the growing influence of climate change, especially in the form of recurrent droughts, unpredictable rainfall, and increasing temperatures. These climatic stresses have led both government agencies and agricultural players to focus on the development and use of drought-tolerant forage crops that can perform well under water-limited conditions. Conventional forage crops are being substituted or supplemented with harder crops like lucerne (alfalfa), sorghum, and native grasses that use less water and provide more accommodation to stressful environmental conditions. To meet these challenges, Australian private seed industry companies and agricultural research institutes are investing heavily in the genetic improvement of forage crops in order to enhance their resistance to heat and drought. Increased adoption of conservation methods such as rotational grazing and conservation agriculture also suits the aim of sustaining forage productivity under climatic variability. In addition, policymakers are promoting the use of drought-resistant forage through financial support, training, and land management programs, which has expanded awareness and implementation among farmers.

Australia Forage Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on crop type, product type, and animal type.

Crop Type Insights:

- Cereals

- Legumes

- Grasses

The report has provided a detailed breakup and analysis of the market based on the crop type. This includes cereals, legumes, and grasses.

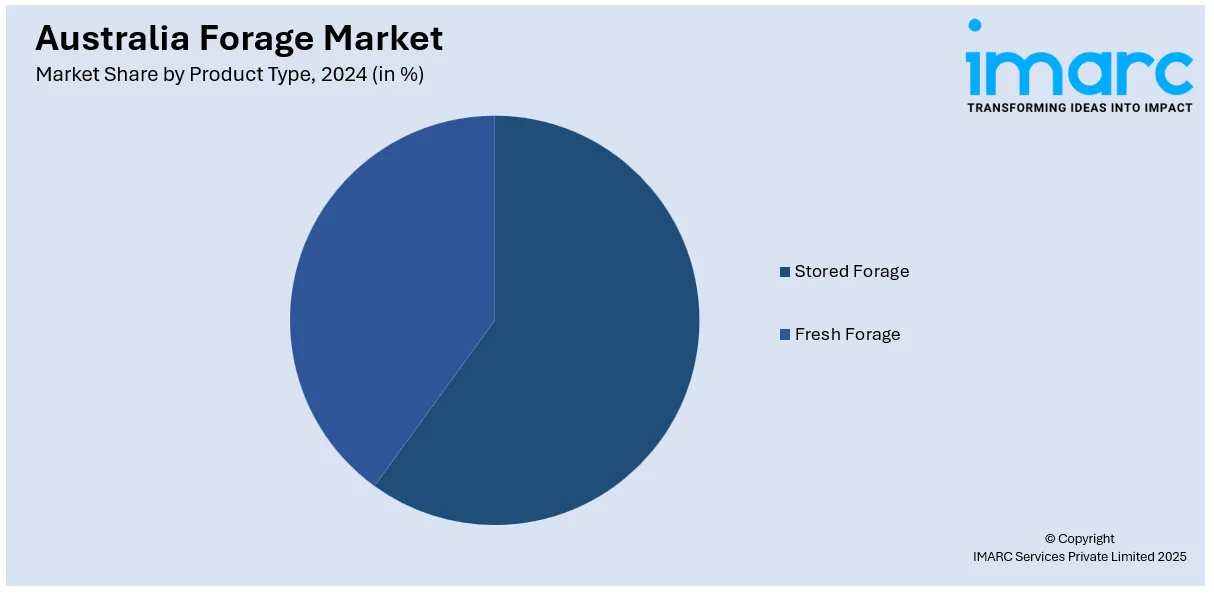

Product Type Insights:

- Stored Forage

- Silage

- Hay

- Fresh Forage

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes stored forage (silage and hay) and fresh forage.

Animal Type Insights:

- Ruminants

- Swine

- Poultry

- Others

The report has provided a detailed breakup and analysis of the market based on the animal type. This includes ruminants, swine, poultry, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Forage Market News:

- July 2024: A new AUD 100 million feed mill officially opened in Kwinana, Western Australia to enhance the region's capacity for producing high-quality animal feed. By bolstering the supply of nutritionally optimized feed, the mill supported improved forage efficiency and livestock productivity.

- February 2024: Dairy Australia released the 2024 Forage Value Index (FVI), a pivotal tool aiding dairy farmers in selecting optimal ryegrass cultivars for forage production. This edition introduced the Forage Quality Rating, assessing metabolizable energy (ME) concentrations across seasons, crucial for enhancing milk yield and protein utilization. The FVI also now encompassed data from Western Australia, expanding its regional applicability.

- November 2023: RAGT Australia acquired BASF’s open-pollinated wheat seed assets, enhancing its portfolio of fodder and dual-purpose crops. This acquisition introduced diverse wheat germplasm, including varieties suited for forage production, aligning with RAGT's multi-species strategy.

Australia Forage Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Crop Types Covered | Cereals, Legumes, Grasses |

| Product Types Covered |

|

| Animal Types Covered | Ruminants, Swine, Poultry, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia forage market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia forage market on the basis of crop type?

- What is the breakup of the Australia forage market on the basis of product type?

- What is the breakup of the Australia forage market on the basis of animal type?

- What are the various stages in the value chain of the Australia forage market?

- What are the key driving factors and challenges in the Australia forage market?

- What is the structure of the Australia forage market and who are the key players?

- What is the degree of competition in the Australia forage market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia forage market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia forage market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia forage industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)