Australia Forging Market Size, Share, Trends and Forecast by Technique, Material, Industry, and Region, 2025-2033

Australia Forging Market Overview:

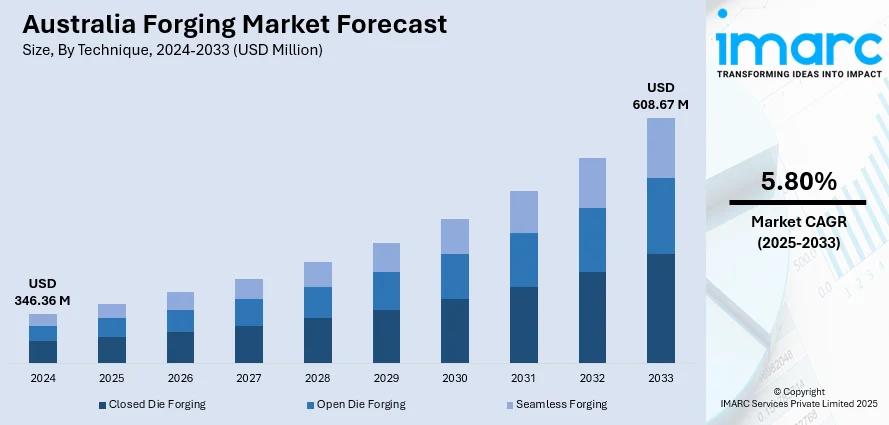

The Australia forging market size reached USD 346.36 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 608.67 Million by 2033, exhibiting a growth rate (CAGR) of 5.80% during 2025-2033. The market is fueled by growing demand from major industries like automotive, defense, mining, and infrastructure. Advances in forging processes, expanding automotive manufacturing, and investments by the government in infrastructure activities are driving the growth in the market. The increase in demand for high-quality forged parts is also helping to drive the Australia forging market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 346.36 Million |

| Market Forecast in 2033 | USD 608.67 Million |

| Market Growth Rate 2025-2033 | 5.80% |

Australia Forging Market Trends:

Technological Advancements in Forging Processes

Technological developments in forging technology are transforming the Australian forging industry. New technologies such as precision forging, isothermal forging, and closed-die forging are enhancing the quality, efficiency, and level of customization of the forgings. The technologies enable strong and lightweight parts to be manufactured with less wastage of material, enhancing the efficiency of operations and reducing cost. In addition, automation and robotics are increasingly contributing to increasing the consistency and accuracy of forged materials. For example, in April 2025, the ARM Institute launched a new Project Call that focuses on robotic inspection for casting and forging. The project seeks solutions for automated, scalable dimensional and thermal inspection of high-mix, low-volume parts at hot and ambient temperatures. It also aims to shift from manual to autonomous mobile inspection platforms. The initiative addresses challenges against legacy component manufacturing, labor shortages, and increasing demands for sophisticated, real-time quality control in the casting and forging industries. With these advanced forging technologies being embraced by manufacturers, the market will experience increased product quality and capacity for production, propelling the growth of the Australia forging market and making it even more competitive in the world market.

To get more information on this market, Request Sample

Expanding Demand from Mining and Defense Sectors

The mining and defense industries are significant contributors to the Australia forging market growth. Australia's expansive mining industry demands tough, high-performance forged parts for equipment and machinery, particularly in drilling and extraction. The defense industry's demand for precision-forged components for armaments, vehicles, and aerospace systems is also driving demand for high-quality forgings. As more investments are being made in defense and mining infrastructure, demand for forged components keeps growing. As these sectors grow, the Australian forgings market will see enduring demand, driving its growth and enabling it to remain competitive in world markets. For instance, in March 2025, Airbus and Australian start-up Drone Forge entered into a Letter of Intent to deploy the Flexrotor uncrewed aerial system (UAS) in the Asia-Pacific region. The Flexrotor, a VTOL UAV designed for defense, surveillance, and challenging environments, will be supported by a new service center in Perth. This partnership aims to commercialize advanced UAV technologies across commercial, government, and defense sectors. With its proven performance and versatile payload capabilities, the Flexrotor is set to become a crucial asset in the development of uncrewed aviation operations.

Australia Forging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional levels for 2025-2033. Our report has categorized the market based on technique, material, and industry.

Technique Insights:

- Closed Die Forging

- Open Die Forging

- Seamless Forging

The report has provided a detailed breakup and analysis of the market based on the technique. This includes closed die forging, open die forging, and seamless forging.

Material Insights:

- Nickel-based Alloys

- Titanium Alloys

- Aluminum Alloys

- Steel Alloys

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes nickel-based alloys, titanium alloys, aluminum alloys, and steel alloys.

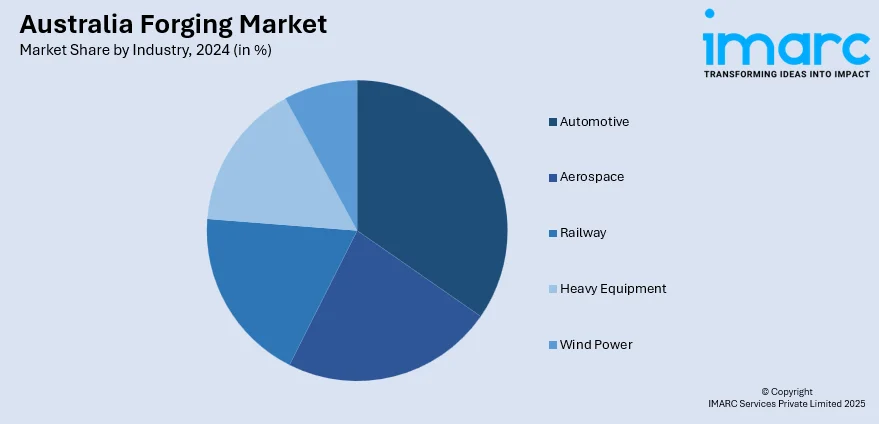

Industry Insights:

- Automotive

- Aerospace

- Railway

- Heavy Equipment

- Wind Power

The report has provided a detailed breakup and analysis of the market based on the industry. This includes automotive, aerospace, railway, heavy equipment, and wind power.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Forging Market News:

- In May 2025, UNSW Sydney signed a Memorandum of Understanding (MoU) with India’s Steel Research & Technology Mission (SRTMI) to drive innovation and sustainability in the steel sector. The two-year collaboration focuses on decarbonisation, circular economy, and digital technologies to improve steel production efficiency. The partnership aims to develop advanced materials and digital solutions, aligning with India and Australia’s shared commitment to global sustainability goals.

- In February 2025, Future Forgeworks awarded SMS group a contract to supply Australia's first sustainable CMT mill for rebar steel production. Located in Queensland, the new mill will utilize low-emission CMT® technology, reducing carbon emissions by 90%. Set for completion by 2027, the project will support decarbonization efforts and meet the rising demand for sustainable construction materials.

- In January 2024, Bradken, an Australian company and subsidiary of Hitachi Construction Machinery, acquired a foundry in Chilca, Peru, from Funtec to locally manufacture mill liners for the South American mining market. This acquisition strengthens Bradken's global expansion, allowing for quicker product delivery and less dependence on imports from India and Canada. Powered by hydroelectric energy, the facility will reduce CO₂ emissions by 95%. Production is expected to start in 2026, further enhancing Bradken’s presence and capabilities in the Americas.

Australia Forging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Techniques Covered | Closed Die Forging, Open Die Forging, Seamless Forging |

| Materials Covered | Nickel-Based Alloys, Titanium Alloys, Aluminum Alloys, Steel Alloys |

| Industries Covered | Automotive, Aerospace, Railway, Heavy Equipment, Wind Power |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia forging market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia forging market on the basis of technique?

- What is the breakup of the Australia forging market on the basis of material?

- What is the breakup of the Australia forging market on the basis of industry?

- What is the breakup of the Australia forging market on the basis of region?

- What are the various stages in the value chain of the Australia forging market?

- What are the key driving factors and challenges in the Australia forging market?

- What is the structure of the Australia forging market and who are the key players?

- What is the degree of competition in the Australia forging market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia forging market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia forging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia forging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)