Australia Forklift Market Size, Share, Trends and Forecast by Class, Power Source, Load Capacity, Electric Battery, End User, and Region, 2025-2033

Australia Forklift Market Overview:

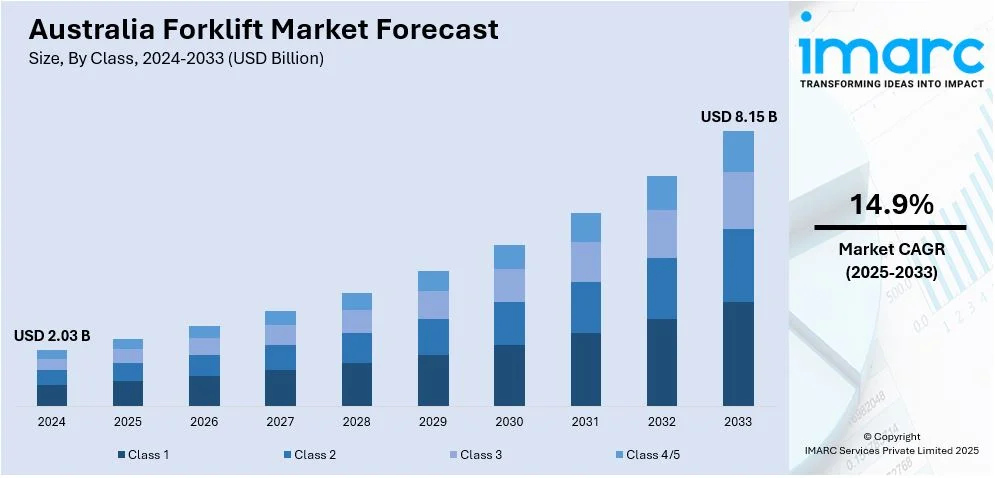

The Australia forklift market size reached USD 2.03 Billion in 2024. Looking forward, the market is projected to reach USD 8.15 Billion by 2033, exhibiting a growth rate (CAGR) of 14.9% during 2025-2033. Rising warehouse automation, expanding e-commerce logistics, infrastructure development projects, and increased demand from the construction and manufacturing sectors are some of the factors contributing to Australia forklift market share. Technological advancements and electric forklift adoption also support growth due to sustainability goals and lower operational costs.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.03 Billion |

| Market Forecast in 2033 | USD 8.15 Billion |

| Market Growth Rate 2025-2033 | 14.9% |

Key Trends of Australia Forklift Market:

Rising Preference for Electric Forklifts and Service-Based Deployments

The material handling sector in Australia is showing a clear move toward electric forklifts supported by long-term service commitments. Businesses are increasingly opting for rental models that include comprehensive maintenance contracts, reducing operational uncertainty and upfront capital expenditure. The deployment of a mix of medium- and heavy-duty forklifts, including lithium-ion electric variants, signals growing confidence in battery technology for demanding industrial tasks. This approach also supports broader goals to cut emissions and improve workplace sustainability. The focus is on equipment performance and also on reliability, lifecycle cost optimization, and environmental compliance. As electric models become more robust and service networks expand, such integrated arrangements are becoming a preferred choice across major facilities. These factors are intensifying the Australia forklift market growth. For example, in October 2024, Kalmar and BlueScope entered into a fully maintained rental agreement for the supply of 13 large forklift trucks to BlueScope’s Western Port facility in Victoria, Australia. This agreement includes six electric forklifts (with lithium-ion batteries), two medium-duty, and five heavy-duty units, along with an eight-year service contract. The collaboration supports BlueScope’s emissions reduction goals.

To get more information on this market, Request Sample

Expanding Imports of Attachments and Cross-Border Supply Opportunities

Rising trade volumes between India and Australia are boosting cross-border supply of industrial equipment components, particularly in the forklift sector. A significant share of forklift attachments used in Australia already originates from India, and this figure is expected to grow with enhanced bilateral cooperation. As material handling operations scale, there is a stronger push to diversify sourcing while maintaining cost efficiency and quality. This development enables Australian operators to access a wider range of specialized attachments suited for varied terrains and applications. For Indian manufacturers, it opens doors for deeper integration into Australia’s logistics and industrial supply chains. The focus is shifting toward long-term partnerships, consistent quality standards, and streamlined import processes for aftermarket and OEM-grade components. For instance, in January 2024, Australia's Consul General in Mumbai stated that India-Australia trade is expected to double to USD 100 Billion in five years under the Economic Cooperation and Trade Agreement (ECTA). This surge is expected to benefit the forklift market, with India already exporting 38% of its forklift attachments to Australia. The expanding trade partnership opens up promising opportunities for Indian manufacturers and enhances Australia’s material handling capabilities.

Compact and Versatile Models

One of the most significant trends in the Australian forklift market is the increasing popularity of compact and versatile models. This shift is driven by the scarcity of warehouse space and the growth of urban logistics hubs. Compact forklifts are specifically designed to operate efficiently in narrow aisles, making them ideal for modern storage warehouses and distribution centers that require optimal space utilization. These models offer greater mobility, enabling operators to transport goods more safely and efficiently in tight spaces. Moreover, industries such as retail, e-commerce, and food delivery favor these forklifts due to their adaptability and ease of operation. The rising demand for this type of equipment illustrates the wider movement toward efficiency and space optimization, greatly enhancing Australia forklift market demand across both urban and regional supply chains.

Growth Drivers of Australia Forklift Market:

Construction and Infrastructure Development

Australia's ongoing investment in infrastructure, including roads, railways, and major construction projects, is fueling the demand for forklifts specifically designed for heavy-duty use. Compared with the standard warehouse unit, outdoor construction sites require heavy-duty machines with high load capacity, flat surfaces, and the ability to withstand harsh weather conditions. Forklifts with higher load capacities and diesel motors are gaining popularity in this industry. The expansion in mining and energy projects further increases this demand, as these industries also require a strong focus on material handling equipment. As both government and private sector spending drives consistent growth in construction, the demand for consistent, high-performance forklifts is increasing, making this an essential driver of growth within the Australian forklift market.

Preference for Rental and Leasing Models

The significant initial costs associated with forklift ownership are leading Australian businesses to consider rental and leasing solutions as viable alternatives. These options provide flexibility, enabling companies to adjust equipment usage according to seasonal demands or project requirements without substantial capital expenditure. Rental services also grant access to cutting-edge forklift technologies, such as electric and automated units, without long-term obligations. This model is particularly appealing to small and medium-sized enterprises, as well as industries that experience variable demand, like retail and logistics. According to Australia forklift market analysis, the trend toward rental and leasing is anticipated to increase, ensuring consistent equipment availability while minimizing operational risks and maintenance responsibilities for businesses across various sectors.

Focus on Workplace Safety

Workplace safety has emerged as a primary concern in Australia, with stringent regulations and compliance standards shaping equipment selections. Forklifts are frequently involved in workplace incidents, prompting employers to invest in models equipped with advanced safety features. These features encompass anti-collision sensors, load stability systems, operator assistance technologies, and improved visibility designs. Awareness initiatives and industry training programs further promote the critical nature of safe equipment use. Companies understand that modern forklifts mitigate accident risks and enhance overall productivity by fostering operator confidence. This increasing focus on safety compliance is generating substantial demand for technologically advanced forklifts, making safety both a regulatory necessity and a competitive edge within the Australian forklift market.

Australia Forklift Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on class, power source, load capacity, electric battery, and end user.

Class Insights:

- Class 1

- Class 2

- Class 3

- Class 4/5

The report has provided a detailed breakup and analysis of the market based on the class. This includes Class 1, Class 2, Class 3, and Class 4/5.

Power Source Insights:

- ICE

- Electric

A detailed breakup and analysis of the market based on the power source have also been provided in the report. This includes ICE and electric.

Load Capacity Insights:

- Below 5 Ton

- 5-15 Ton

- Above 16 Ton

The report has provided a detailed breakup and analysis of the market based on the load capacity. This includes below 5 ton, 5-15 ton, and above 16 ton.

Electric Battery Insights:

- Li-ion

- Lead Acid

A detailed breakup and analysis of the market based on the electric battery have also been provided in the report. This includes Li-ion and lead acid.

End User Insights:

.webp)

- Industrial

- Logistics

- Chemical

- Food and Beverage

- Retail and E-Commerce

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes industrial, logistics, chemical, food and beverage, retail and e-commerce, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria and Tasmania

- Queensland

- Northern Territory and Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria and Tasmania, Queensland, Northern Territory and Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Forklift Market News:

- In April 2025, United Forklift and Access Solutions introduced the world's first fully electric tire handler in Australia, built on the Konecranes E-VER platform. This innovation aligns with Australia's growing shift toward electric forklifts, driven by environmental concerns and stricter emission regulations.

- In April 2025, Mars Forklifts, based in Sydney, expanded its hire services to meet rising demand across Australia's forklift market. The company added electric, LPG, diesel, and all-terrain forklifts to its fleet, catering to industries like warehousing, cold storage, and manufacturing. With over 50 years of experience, Mars Forklifts emphasizes fast service, on-site consultations, and a large independent repair team, reinforcing its role in Australia's material handling sector.

Australia Forklift Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Classes Covered | Class 1, Class 2, Class 3, Class 4/5 |

| Power Sources Covered | ICE, Electric |

| Load Capacities Covered | Below 5 Ton, 5-15 Ton, Above 16 Ton |

| Electric Batteries Covered | Li-ion, Lead Acid |

| End Users Covered | Industrial, Logistics, Chemical, Food and Beverage, Retail and E-Commerce, Others |

| Regions Covered | Australia Capital Territory and New South Wales, Victoria and Tasmania, Queensland, Northern Territory and Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia forklift market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia forklift market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia forklift industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The forklift market in Australia was valued at USD 2.03 Billion in 2024.

The Australia forklift market is projected to exhibit a compound annual growth rate (CAGR) of 14.9% during 2025-2033.

The Australia forklift market is expected to reach a value of USD 8.15 Billion by 2033.

The Australia forklift market is witnessing trends such as increasing adoption of electric and battery-powered forklifts, integration of automation and smart sensors, rising use of telematics for fleet management, focus on ergonomics and operator safety, and growing demand for compact and versatile forklifts in urban and warehouse settings.

Growth in the Australia forklift market is driven by expanding warehousing and logistics operations, growth in e-commerce and industrial sectors, rising need for material handling efficiency, adoption of energy-efficient and low-emission equipment, and increasing investment in modernizing supply chains to improve productivity and reduce operational costs.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)