Australia Fortified Dairy Products Market Size, Share, Trends and Forecast by Product, Ingredient, Flavor, Distribution Channel, and Region, 2025-2033

Australia Fortified Dairy Products Market Overview:

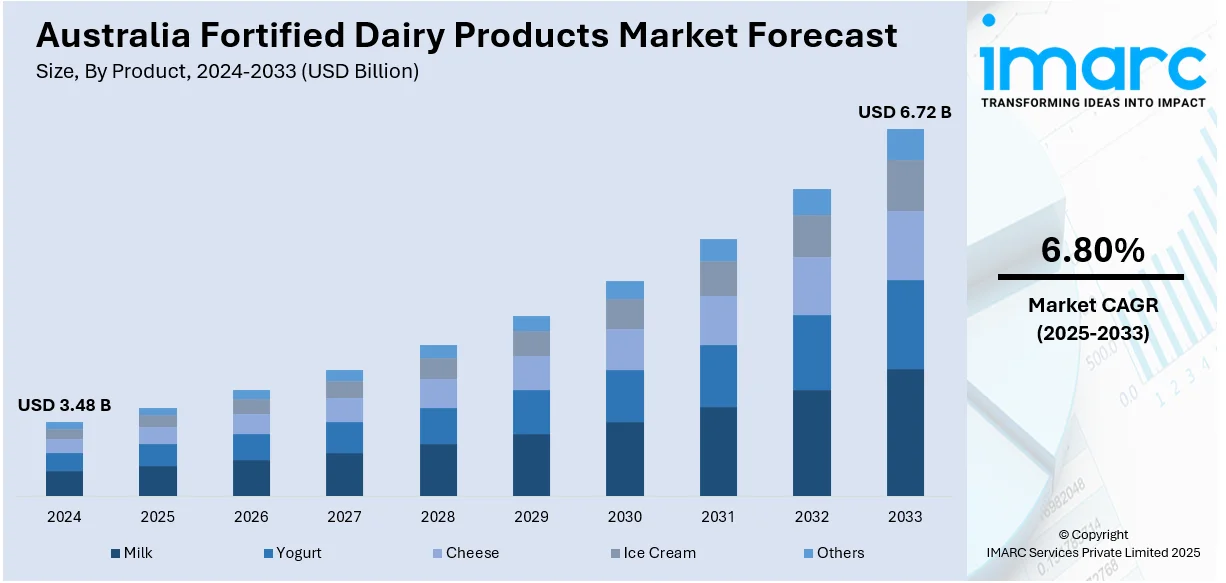

The Australia fortified dairy products market size reached USD 3.48 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 6.72 Billion by 2033, exhibiting a growth rate (CAGR) of 6.80% during 2025-2033. At present, Australian consumers are becoming increasingly health conscious and demanding food items that have added nutritional value. This trend, along with the heightened demand for functional food products, is impelling the growth of the market. Moreover, ongoing developments in fortification technologies are expanding the Australia fortified dairy products market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.48 Billion |

| Market Forecast in 2033 | USD 6.72 Billion |

| Market Growth Rate 2025-2033 | 6.80% |

Australia Fortified Dairy Products Market Trends:

Health Awareness Among Consumers:

Australian consumers are becoming increasingly health-conscious and demanding food items that have added nutritional value. Dairy food products fortified with vitamins A, D, B12, and minerals, calcium, and iron are becoming popular because they meet the demand for functional foods. Australians are becoming aware about food products that prevent lifestyle diseases such as osteoporosis, diabetes, and cardiovascular diseases. This holds particularly true for middle-aged and older populations who are actively taking charge of their health through diet. Additionally, parents are increasingly opting for fortified milk and yogurt products for their kids to aid in growth and immunity. With this awareness growing, consumers are opting for products that provide both taste and health. This continuing trend is greatly promoting the market, encouraging manufacturers to innovate and develop new products to address the changing requirements of health-oriented Australians.

To get more information on this market, Request Sample

Increasing Demand for Functional Foods:

Demand for functional foods in Australia is rising, with customers actively looking for dairy food products that offer more than simple nutrition. Fortified dairy foods are becoming more widely used due to their capacity to solve certain health issues, including increasing energy levels, bettering digestion, and generally improving well-being. With functional foods becoming a major component of diet, fortified dairy is being introduced into everyday life to address diverse nutritional requirements. Fortified dairy products like milk, yogurt, and cheese are popularized as consumers seek food products that contribute to health aspects beyond minimum nutrition, with the expansion in wellness trends. This increased interest is also encouraging dairy brands to innovate by launching new products with vitamins, minerals, and probiotics, aligning with the enhanced consumer demand for food that doubles as nutrition and health improvement. In 2025, Yo-Chi, a well-known Australian dessert brand, announced the expansion of its self-serve frozen yogurt chain along with the opening of five new stores.

Advancements in Fortification Technology

Ongoing developments in fortification technologies are allowing dairy manufacturers to enrich the nutritional content of dairy products, and this is reflected in driving the market further. New methods are being researched to enhance nutrient absorption and bioavailability so that fortified dairy products can become more efficient in filling nutritional gaps. For example, improved microencapsulation and delivery systems for nutrients are keeping vitamins and minerals stable and bioavailable during the product's shelf life. They are making it possible for dairy manufacturers to provide fortified dairy products that address increasing consumer demand for high-quality, nutrient-rich products. With advances in fortification technology, the possibility of designing more effective and targeted fortified dairy products grows, making consumers more confident in the advantages of such products. This advancement is propelling the Australia fortified dairy products market growth. In 2024, Yakult Australia declared its participation as an exhibitor at the Dietitians Australia 2024 Conference, where it showcased exquisite, fermented milk probiotic drink.

Australia Fortified Dairy Products Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, ingredient, flavor, and distribution channel.

Product Insights:

- Milk

- Yogurt

- Cheese

- Ice Cream

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes milk, yogurt, cheese, ice cream, and others.

Ingredient Insights:

- Vitamins

- Minerals

- Probiotics

- Omega-3 Fatty Acids

- Proteins

- Others

The report has provided a detailed breakup and analysis of the market based on the ingredient. This includes vitamins, minerals, probiotics, omega-3 fatty acids, proteins, and others.

Flavor Insights:

- Unflavored/Natural

- Flavored

The report has provided a detailed breakup and analysis of the market based on the flavor. This includes unflavored/natural and flavored.

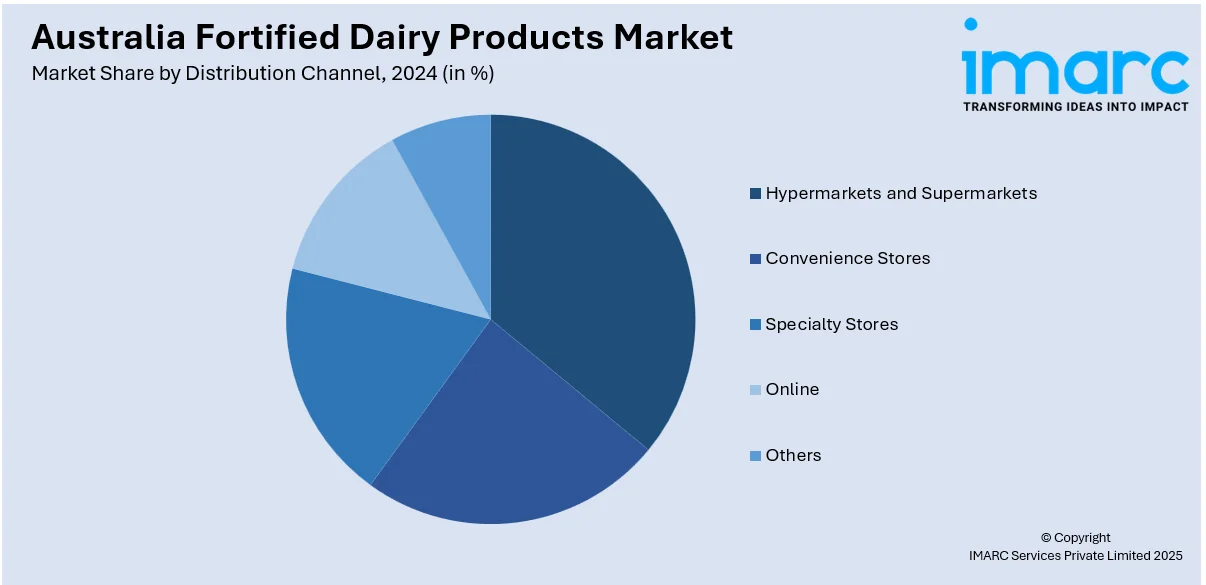

Distribution Channel Insights:

- Hypermarkets and Supermarkets

- Convenience Stores

- Specialty Stores

- Online

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes hypermarkets and supermarkets, convenience stores, specialty stores, online, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Fortified Dairy Products Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Milk, Yogurt, Cheese, Ice Cream, Others |

| Ingredients Covered | Vitamins, Minerals, Probiotics, Omega-3 Fatty Acids, Proteins, Others |

| Flavors Covered | Unflavored/Natural, Flavored |

| Distribution Channels Covered | Hypermarkets and Supermarkets, Convenience Stores, Specialty Stores, Online, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia fortified dairy products market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia fortified dairy products market on the basis of product?

- What is the breakup of the Australia fortified dairy products market on the basis of ingredient?

- What is the breakup of the Australia fortified dairy products market on the basis of flavor?

- What is the breakup of the Australia fortified dairy products market on the basis of distribution channel?

- What is the breakup of the Australia fortified dairy products market on the basis of region?

- What are the various stages in the value chain of the Australia fortified dairy products market?

- What are the key driving factors and challenges in the Australia fortified dairy products market?

- What is the structure of the Australia fortified dairy products market and who are the key players?

- What is the degree of competition in the Australia fortified dairy products market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia fortified dairy products market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia fortified dairy products market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia fortified dairy products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)