Australia Fortified Health Drinks Market Size, Share, Trends and Forecast by Product Type, Form, Distribution Channel, and Region, 2026-2034

Australia Fortified Health Drinks Market Overview:

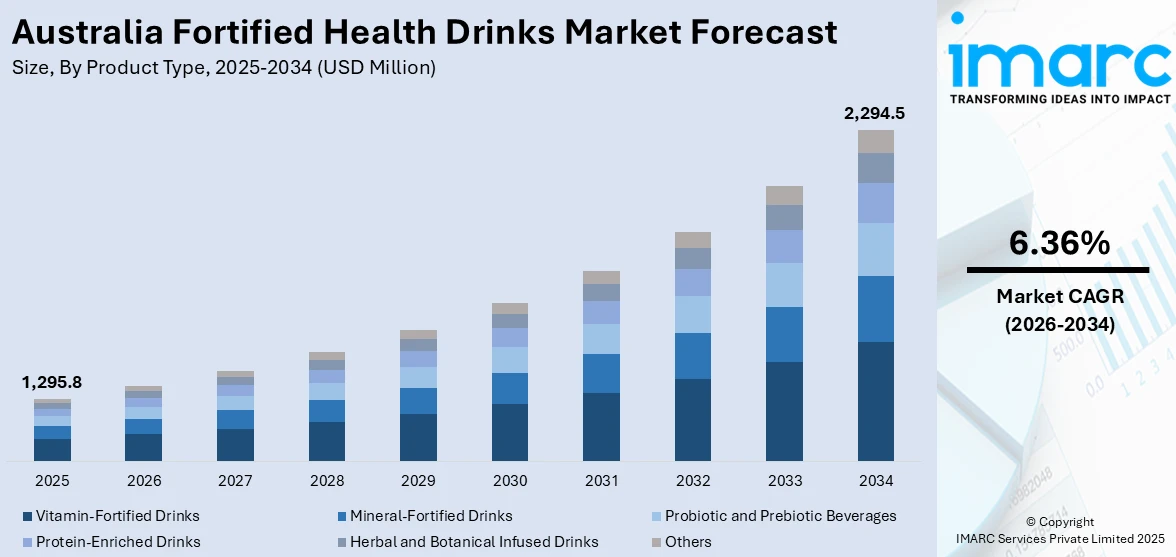

The Australia fortified health drinks market size reached USD 1,295.8 Million in 2025. Looking forward, the market is projected to reach USD 2,294.5 Million by 2034, exhibiting a growth rate (CAGR) of 6.36% during 2026-2034. The market is witnessing significant growth, driven by increasing consumer demand for beverages that offer added nutritional benefits like vitamins, minerals, and probiotics. Rising health awareness, coupled with a shift toward healthier lifestyle choices, is also fueling market expansion. Rising popularity of functional beverages, including energy-boosting, immunity-enhancing, and hydration-focused drinks, are further contributing positively to the Australia fortified health drinks market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 1,295.8 Million |

|

Market Forecast in 2034

|

USD 2,294.5 Million |

| Market Growth Rate 2026-2034 | 6.36% |

Key Trends of Australia Fortified Health Drinks Market:

Rising Demand for Functional Beverages

Functional drinks are gaining traction in Australia as consumers look for beverages that offer particular health benefits over mere hydration. Demand for fortified beverages that provide immune system support, energy, and improved hydration is on the increase, especially in a wellness-oriented and proactive market. Drinks that contain additional ingredients such as vitamins, minerals, electrolytes, and adaptogens are becoming popular because they appeal to the health-oriented crowd seeking convenient, on-the-go products. Vitamin-fortified waters, energy drinks with natural sources of caffeine, and hydration-based beverages with electrolytes are all experiencing growing consumption. These beverages are popular among those seeking to enhance overall health, reduce stress, and remain energized daily. With the trend toward functional beverages set to continue, demand for products that provide targeted health benefits is likely to drive Australian fortified health drinks market growth.

To get more information on this market Request Sample

Health-Conscious Consumer Shift

In Australia, there is also a seen trend toward health-aware consumption as more and more consumers choose to emphasize beverages that provide added nutritional value such as vitamins, minerals, and probiotics. This is triggered by increasing awareness about the value of preventive health, lifestyle diseases, and nutrient shortfall. Health drinks, like Vitamin C-fortified ones for immunity, probiotic ones for gut health, and essential minerals for general wellness, are gaining traction among consumers who want healthier versions of sugary sodas and juices. Demand for such functional drinks is particularly high among millennials and Gen Z, who are more willing to spend on products that improve their well-being. As this trend in consumer behavior increases, the market for fortified health drinks continues to grow with brands emphasizing the provision of products that balance both taste and nutritional value for an overall approach to well-being.

Rising Demand for Natural Ingredients

There is increasing demand for health drinks in Australia that are made from natural and organic ingredients due to consumers' heightened awareness about the content of their drinks. The trend is a reflection of fears over artificial additives and preservatives and the need for cleaner, healthier products. Health drinks that are fortified from natural-sourced ingredients such as herbal extracts, organic fruits, and plant-based ingredients are increasingly popular among health-aware consumers. They are looking more and more for drinks that will help them achieve their wellness objectives and values, choosing products that will provide nutrition without added synthetic chemicals. This new focus on natural ingredients drives market growth as companies innovate to deliver consumer demand for pure, functional drinks that enhance overall health. With growing awareness regarding the ill effects of artificial additives, Australia's market for organic and natural fortified health beverages will continue to grow.

Growth Drivers of Australia Fortified Health Drinks Market:

Busy Lifestyles and Convenience

The rapid pace of life among modern consumers in Australia has notably impacted beverage consumption trends. With extended working hours, longer commutes, and busy daily schedules, many people are opting for quick and convenient products that maintain nutritional value. Fortified health drinks serve this requirement by providing ready-to-drink options loaded with vitamins, minerals, and functional advantages. This convenience is especially attractive to professionals, fitness fans, and students seeking efficient nutritional solutions on the go. Additionally, the growing interest in fitness and active living further drives this demand, as fortified beverages offer a practical substitute for complex meals. The increasing popularity of health-oriented, portable drinks demonstrates the industry’s responsiveness to changing consumer habits, making convenience a key factor in the market’s expansion.

Aging Population Demand

Australia’s aging population represents a significant growth opportunity for fortified health drinks. Older adults are increasingly turning toward functional beverages that can aid bone health, boost energy, and address age-related deficiencies. The rising Australia fortified health drinks market demand within this demographic is associated with growing awareness regarding preventive healthcare and proactive nutrition management among seniors. Fortified drinks enriched with calcium, vitamin D, antioxidants, and proteins are gaining popularity for managing issues like osteoporosis, fatigue, and heart health. Furthermore, easy-to-consume drinkable forms are more appealing to elderly individuals than supplements in pill formats. As life expectancy rises, the need for targeted nutritional products that enhance quality of life will continue to grow. This demographic trend guarantees long-term growth prospects for fortified health drink producers in Australia.

Shift Toward Preventive Healthcare

Preventive healthcare is becoming a significant trend shaping consumer preferences in Australia, with fortified health beverages seen as an easy-to-access option. The increasing occurrence of health issues associated with lifestyle, such as obesity, diabetes, and heart disease, is encouraging individuals to take control of their dietary decisions. Functional beverages incorporating probiotics, fibers, plant extracts, and immunity-boosting components resonate with this preventive approach. Consumers are now focusing not just on hydration but on beverages that provide substantial health benefits. This shift mirrors the heightened awareness about the role of diet in sustaining long-term health and lowering medical expenses. Fortified health drinks align well with this narrative, making them a favored choice for people of all ages. As health-conscious behaviors become more prominent, preventive healthcare will continue to drive market growth.

Market Dynamics of Australia Fortified Health Drinks Market:

Product Innovation and Diversification

Innovation plays a crucial role in the development of the fortified health drinks market in Australia. As consumers become more health-conscious and discerning in their choices, brands are prioritizing the development of beverages that feature low-sugar, plant-based, and protein-rich ingredients. This diversification caters to various consumer segments, including vegans, fitness lovers, and those focused on weight management. The trend toward natural and clean-label components also enhances trust and boosts adoption rates. Additionally, health drinks enriched with probiotics, antioxidants, or herbal extracts are increasingly viewed as functional wellness options. By customizing products to align with changing preferences and diets, companies fortify their market positions. Continuous innovation enhances product attractiveness and keeps the category vibrant and competitive within the wider beverage market.

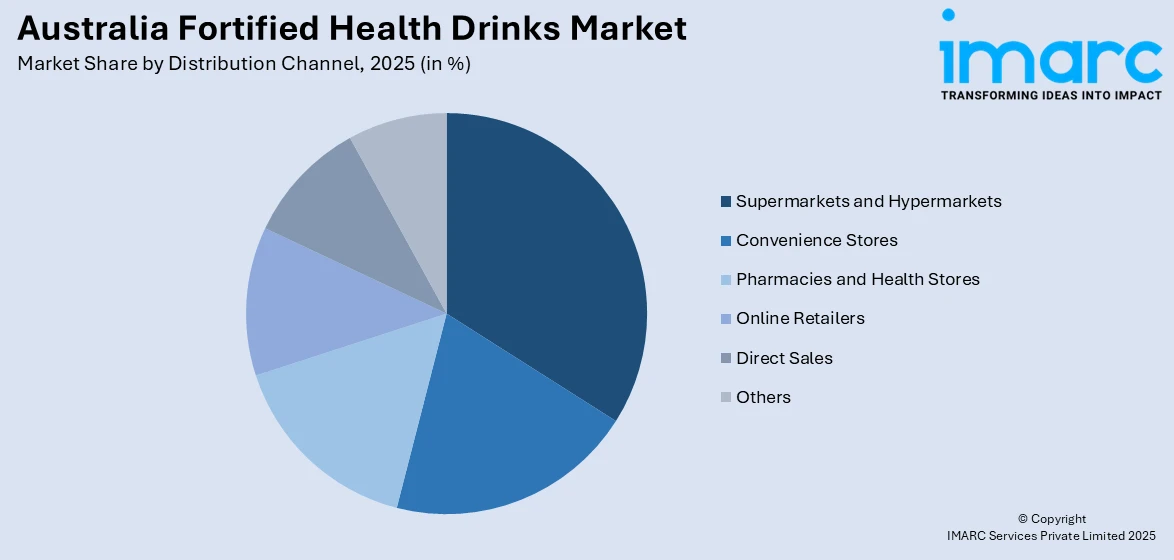

Distribution Expansion

The distribution of fortified health drinks through diverse retail channels is a critical factor propelling market development. Initially available primarily in health food stores and pharmacies, these beverages are now easily found in supermarkets, convenience stores, and fitness facilities. The swift rise of e-commerce has also improved product visibility and broadened consumer access. Online platforms offer subscription services, delivery options, and an extensive range of products, catering to busy consumers. This growth in distribution avenues ensures that fortified drinks reach both urban and regional populations. According to Australia fortified health drinks market analysis, accessibility is vital in shaping demand patterns. As traditional retail and digital platforms evolve, they create significant opportunities for brands to enhance consumer engagement and boost sales.

Pricing and Affordability

Pricing is a key factor in the market dynamics for fortified health drinks in Australia. While there is a growing consumer interest in health-oriented products, the premium pricing of many fortified beverages can limit their appeal to cost-sensitive buyers. Elevated production expenses, including high-quality raw materials, specialized recipes, and adherence to food safety regulations, often lead to increased retail costs. This situation results in a consumption divide, primarily favoring middle- to high-income consumers, while limiting affordability for a broader audience. Nevertheless, increasing competition and advancements in production techniques are fostering more affordable product offerings. Value packs, smaller sizes, and competitive pricing strategies could assist brands in reaching mass-market segments. Balancing quality with affordability will be essential for achieving sustainable growth and ensuring wider access in this evolving marketplace.

Australia Fortified Health Drinks Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product type, form, and distribution channel.

Product Type Insights:

- Vitamin-Fortified Drinks

- Mineral-Fortified Drinks

- Probiotic and Prebiotic Beverages

- Protein-Enriched Drinks

- Herbal and Botanical Infused Drinks

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes vitamin-fortified drinks, mineral-fortified drinks, probiotic and prebiotic beverages, protein-enriched drinks, herbal and botanical infused drinks, and others.

Form Insights:

- Powdered Drinks

- Ready-to-Drink (RTD)

- Liquid Concentrates

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes powdered drinks, ready-to-drink (RTD), and liquid concentrates.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Convenience Stores

- Pharmacies and Health Stores

- Online Retailers

- Direct Sales

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, pharmacies and health stores, online retailers, direct sales, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Fortified Health Drinks Market News:

- In October 2024, Ed Stening and Merrick Watts launched Posca Hydrate in Australia, a sugar-free sparkling hypertonic drink inspired by an ancient Roman recipe. Promoting hydration without stimulants, it offers essential electrolytes and health benefits through red wine vinegar.

Australia Fortified Health Drinks Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Vitamin-Fortified Drinks, Mineral-Fortified Drinks, Probiotic and Prebiotic Beverages, Protein-Enriched Drinks, Herbal and Botanical Infused Drinks, Others |

| Forms Covered | Powdered Drinks, Ready-to-Drink (RTD), Liquid Concentrates |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Pharmacies and Health Stores, Online Retailers, Direct Sales, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia fortified health drinks market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia fortified health drinks market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia fortified health drinks industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The fortified health drinks market in Australia was valued at USD 1,295.8 Million in 2025.

The Australia fortified health drinks market is projected to exhibit a compound annual growth rate (CAGR) of 6.36% during 2026-2034.

The Australia fortified health drinks market is expected to reach a value of USD 2,294.5 Million by 2034.

The market is witnessing rising demand for plant-based and dairy-free fortified drinks, alongside growing adoption of clean-label and natural formulations. Increasing use of personalized nutrition, eco-friendly packaging, and digital marketing strategies is further shaping consumer preferences and strengthening brand positioning across the fortified health drink segment.

Expanding awareness of functional nutrition, rising fitness participation, and the preference for convenient, ready-to-drink options are fueling market growth. Growing interest among younger consumers in performance-enhancing beverages and higher demand from seniors for age-specific nutrition support are driving steady expansion of fortified health drinks in Australia.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)