Australia Foundry and Casting Market Size, Share, Trends and Forecast by Casting Type, Manufacturing Process, End Use Industry, and Region, 2025-2033

Australia Foundry and Casting Market Overview:

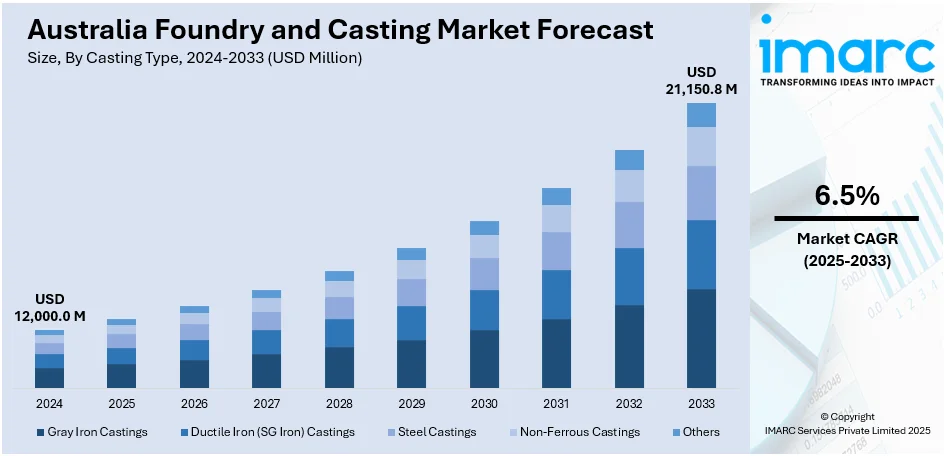

The Australia foundry and casting market size reached USD 12,000.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 21,150.8 Million by 2033, exhibiting a growth rate (CAGR) of 6.5% during 2025-2033. Rising demand from the mining and construction sectors, infrastructure development, increasing metal recycling practices, and domestic manufacturing support are some of the factors boosting the Australia foundry and casting market share. Technological upgrades and the push for lightweight, durable components in the transport and energy industries further boost growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 12,000.0 Million |

| Market Forecast in 2033 | USD 21,150.8 Million |

| Market Growth Rate (2025-2033) | 6.5% |

Australia Foundry and Casting Market Trends:

Automotive Campaigns Fueling Casting Demand

Australia's foundry and casting sector is seeing growing relevance in vehicle promotions, especially for high-performance models emphasizing rugged capabilities and premium finishes. Recent automotive advertising campaigns highlight the need for locally crafted, high-precision casting components used in both production and display models. These efforts are also expanding the creative footprint of domestic casting firms as key collaborators in high-visibility projects. With 4WD and utility vehicles continuing to anchor Australia’s off-road and adventure-driven culture, casting expertise plays a subtle but critical role in aligning product imagery with performance narratives. This reinforces the importance of skilled casting partners in delivering components that meet aesthetic and technical standards demanded by top-tier automotive marketing initiatives. These factors are intensifying the Australia foundry and casting market growth. For example, in December 2024, Citizen Cane Casting supported the launch of Toyota Australia's LandCruiser Prado campaign, spotlighting the vehicle’s off-road prowess and luxury features. The campaign, created with Saatchi & Saatchi, reflects Australian adventure culture and rolled out across major media channels. It follows the earlier HiLux campaign and underscores continued demand for precision casting in automotive marketing, reinforcing the role of local casting agencies in Australia’s evolving foundry and casting market ecosystem.

To get more information on this market, Request Sample

International Expansion Strengthening Mining Supply Role

The foundry and casting industry in Australia is expanding its global manufacturing presence to support demand from international mining operations. A recent acquisition of land and facilities in Peru reflects a targeted move to increase steel casting capacity, particularly for mill liners used in hard rock mining. With production expected to begin by 2026, this offshore investment positions Australian players to supply critical components more efficiently to South American markets. It also signals the growing role of Australian foundries in global supply chains, enhancing their relevance in high-durability applications. By aligning with mining sector growth abroad, the domestic industry is securing new revenue streams, strengthening its technical reputation, and reinforcing its position in the competitive landscape of heavy industrial castings. For instance, in January 2024, Bradken PTY Ltd., based in New South Wales, acquired foundry land and facilities in Peru from Funtec to expand its steel casting operations. The move supports Bradken’s growth in mill liner production, with initial output set for 2026. This expansion strengthens Australia’s foundry sector presence in global mining supply chains and aligns with broader efforts to meet rising demand in South America’s hard rock mining markets.

Australia Foundry and Casting Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on casting type, manufacturing process, and end use industry.

Casting Type Insights:

- Gray Iron Castings

- Ductile Iron (SG Iron) Castings

- Steel Castings

- Non-Ferrous Castings

- Others

The report has provided a detailed breakup and analysis of the market based on the casting type. This includes gray iron castings, ductile iron (SG Iron) castings, steel castings, non-ferrous castings, and others.

Manufacturing Process Insights:

- Sand Casting

- Investment Casting

- Die Casting

- Centrifugal Casting

- Others

A detailed breakup and analysis of the market based on the manufacturing process have also been provided in the report. This includes sand casting, investment casting, die casting, centrifugal casting, and others.

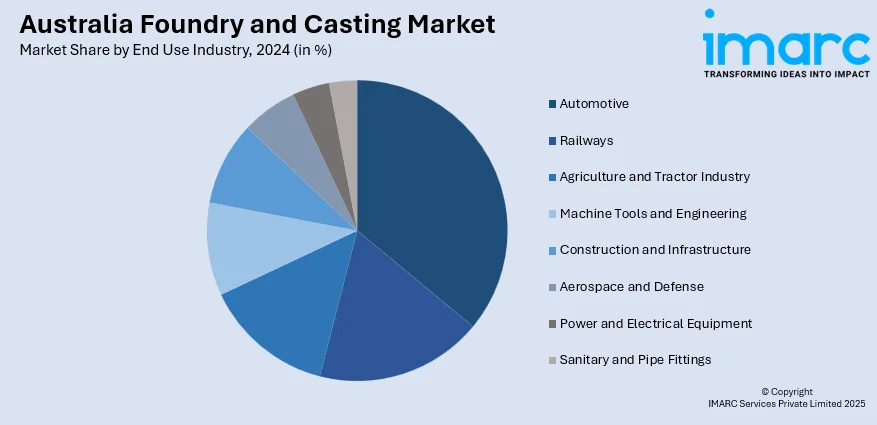

End Use Industry Insights:

- Automotive

- Railways

- Agriculture and Tractor Industry

- Machine Tools and Engineering

- Construction and Infrastructure

- Aerospace and Defense

- Power and Electrical Equipment

- Sanitary and Pipe Fittings

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes automotive, railways, agriculture and tractor industry, machine tools and engineering, construction and infrastructure, aerospace and defense, power and electrical equipment, and sanitary and pipe fittings.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Foundry and Casting Market News:

- In May 2025, Nissan’s Casting Australia Plant in Dandenong South earned Australian Made certification for its aluminum castings and towbars. The plant produces over 1.2 Million parts annually, including components for EVs and hybrids, and serves as the global sole supplier for 40 parts. This milestone highlights the plant’s advanced die-casting capabilities and strengthens Australia’s position in high-quality, locally manufactured casting for domestic and international automotive markets.

Australia Foundry and Casting Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Casting Types Covered | Gray Iron Castings, Ductile Iron (SG Iron) Castings, Steel Castings, Non-Ferrous Castings, Others |

| Manufacturing Processes Covered | Sand Casting, Investment Casting, Die Casting, Centrifugal Casting, Others |

| End Use Industries Covered | Automotive, Railways, Agriculture and Tractor Industry, Machine Tools and Engineering, Construction and Infrastructure, Aerospace and Defense, Power and Electrical Equipment, Sanitary and Pipe Fittings |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia foundry and casting market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia foundry and casting market on the basis of casting type?

- What is the breakup of the Australia foundry and casting market on the basis of manufacturing process?

- What is the breakup of the Australia foundry and casting market on the basis of end use industry?

- What is the breakup of the Australia foundry and casting market on the basis of region?

- What are the various stages in the value chain of the Australia foundry and casting market?

- What are the key driving factors and challenges in the Australia foundry and casting market?

- What is the structure of the Australia foundry and casting market and who are the key players?

- What is the degree of competition in the Australia foundry and casting market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia foundry and casting market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia foundry and casting market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia foundry and casting industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)