Australia Foundry Equipment Market Size, Share, Trends and Forecast by Equipment Type, Foundry Process, Application, and Region, 2026-2034

Australia Foundry Equipment Market Summary:

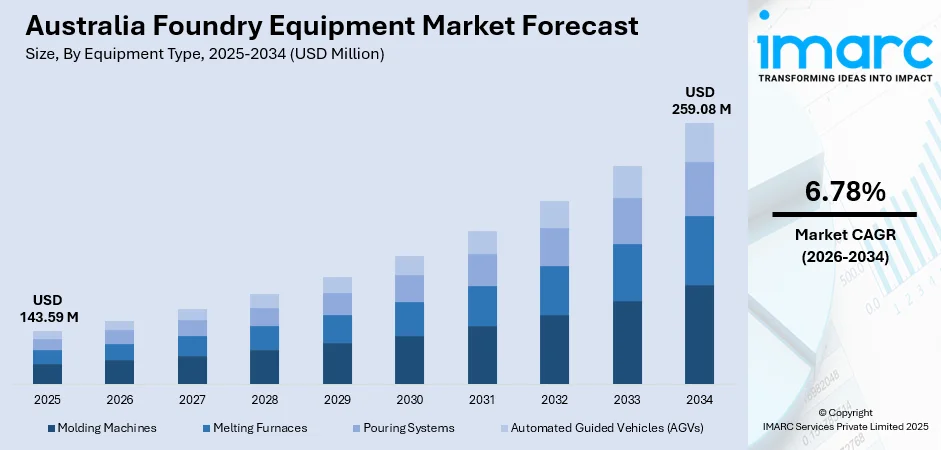

The Australia foundry equipment market size was valued at USD 143.59 Million in 2025 and is projected to reach USD 259.08 Million by 2034, growing at a compound annual growth rate of 6.78% from 2026-2034.

The Australian industry is a dynamic market for foundry machines. This is due to a strong mining industry and a developing automotive industry. In addition to this, the country is witnessing infrastructure growth projects. These are the factors responsible for the growth of the Australia foundry equipment industry. However, strict regulations on the environment and energy conservation are transforming the industry into a sustainable industry. Therefore, all these factors are augmenting the industry share of the Australia foundry equipment industry.

Key Takeaways and Insights:

- By Equipment Type: Molding machines dominate the market with a share of 41.09% in 2025, driven by widespread adoption across foundry operations for producing consistent, high-volume castings with improved dimensional accuracy.

- By Foundry Process: Green sand casting leads the market with a share of 48.07% in 2025, attributed to its cost-effectiveness, versatility in handling various metal alloys, and ability to accommodate both small and large-scale production requirements.

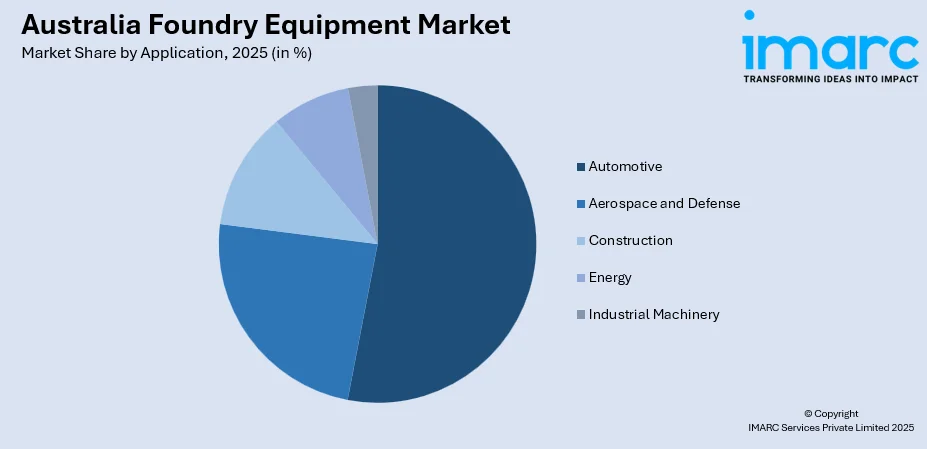

- By Application: Automotive dominates the market with a share of 53.06% in 2025, reflecting strong demand for lightweight cast components in vehicle manufacturing and the growing electric vehicle sector.

- By Region: Australia Capital Territory & New South Wales leads the market with a share of 28.4% in 2025, owing to the concentration of manufacturing facilities, established industrial infrastructure, and proximity to major automotive and mining operations.

- Key Players: The Australia foundry equipment market features a competitive landscape comprising domestic manufacturers, international equipment suppliers, and specialized technology providers catering to diverse casting requirements across mining, automotive, aerospace, and general engineering sectors.

To get more information on this market Request Sample

The Australian foundry industry is experiencing a significant shift as it integrates Industry 4.0 technologies into core operations. Foundries are increasingly deploying robotics, AI-enabled quality inspection, and IoT-based predictive maintenance to improve productivity, reduce downtime, and enhance casting precision. In March 2025, the Australian Research Council launched the ARC Industrial Transformation Research Hub for Future Digital Manufacturing, aimed at accelerating Australia’s move toward intelligent, connected manufacturing systems. The hub supports collaboration between researchers and industry partners to commercialize AI and IoT solutions, directly benefiting advanced metalcasting and fabrication activities. Alongside digital adoption, investment in equipment modernization and advanced manufacturing practices is reshaping production environments. Sustainability and green technologies are also gaining importance, influencing process design and material use. Stronger domestic manufacturing boosts competitiveness and expands export opportunities across mining and industrial sectors.

Australia Foundry Equipment Market Trends:

Accelerating Adoption of Automation and Smart Manufacturing Technologies

The Australian foundry sector is undergoing a strong transition toward automation and intelligent manufacturing. Foundries are investing in robotic pouring systems, automated molding lines, and AI-based quality control to improve efficiency and reduce reliance on manual labor. In August 2025, the National Reconstruction Fund Corporation partnered with the Bradfield Development Authority and the Advanced Manufacturing Readiness Facility to support advanced manufacturing, including robotics, digital technologies, and Industry 4.0 adoption. The integration of IoT sensors and predictive maintenance is further enhancing real-time visibility, productivity, and competitiveness across domestic and global markets.

Growing Focus on Sustainable and Energy-Efficient Equipment

Environmental regulations and rising energy costs are accelerating demand for sustainable foundry equipment aligned with Australia’s net-zero targets. Technologies such as electric induction furnaces, regenerative burners, and waste heat recovery systems are increasingly adopted to lower emissions. In June 2025, the Australian government granted funding to the NeoSmelt consortium, including BlueScope Steel, BHP, and Rio Tinto, to develop a low-carbon electric smelter. Growing use of recycled materials and circular economy practices is further driving demand for advanced, quality-focused processing equipment.

Increasing Demand for Lightweight Automotive Components

The automotive industry’s shift toward electric vehicles and fuel-efficient designs is boosting demand for lightweight cast components. Die-cast aluminum and magnesium alloys are increasingly used for engine blocks, transmission parts, and structural elements to achieve improved strength-to-weight performance. In May 2025, Nissan’s Casting Australia Plant at Dandenong South, producing more than 1.2 million high-pressure die-cast aluminum components annually for EV and conventional powertrains, received Australian Made accreditation, highlighting strong domestic capabilities. This trend is driving investment in advanced casting equipment to meet strict automotive precision and quality requirements.

Market Outlook 2026-2034:

The Australia foundry equipment market demonstrates positive growth prospects supported by ongoing industrial expansion, government investment in manufacturing capabilities, and increasing adoption of advanced production technologies. The emphasis on domestic production and sovereign manufacturing capabilities is creating sustained demand for modern foundry equipment. Growing applications in mining, automotive, aerospace, and renewable energy sectors are expected to drive continued market expansion throughout the forecast period. The market generated a revenue of USD 143.59 Million in 2025 and is projected to reach a revenue of USD 259.08 Million by 2034, growing at a compound annual growth rate of 6.78% from 2026-2034.

Australia Foundry Equipment Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Equipment Type |

Molding Machines |

41.09% |

|

Foundry Process |

Green Sand Casting |

48.07% |

|

Application |

Automotive |

53.06% |

|

Region |

Australia Capital Territory & New South Wales |

28.4% |

Equipment Type Insights:

- Molding Machines

- Melting Furnaces

- Pouring Systems

- Automated Guided Vehicles (AGVs)

The molding machines dominates with a market share of 41.09% of the total Australia foundry equipment market in 2025.

Molding machines are the backbone of the molding process and allow for the creation of high-quality castings. Foundries in the Australian region are slowly moving towards automated molding lines that interact seamlessly with digital manufacturing systems designed to optimize manufacturing cycle times and increase the speed of manufacturing production rates. There is a steady increase in the demand for the installation of green sand molding systems and chemically bonded systems in manufacturing units.

Technologies involving advanced molding with servo systems and programmable logic controllers are also being adopted by foundry operators in efforts to enhance dimensional accuracy and surface finish qualities. The adoption of sensor and monitoring technology has also ensured that molding processes are optimized in real time. There is increased spending on large molding machines to meet burgeoning molding demand in various applications that include automotive use, mining, and industrial machines.

Foundry Process Insights:

- Green Sand Casting

- Investment Casting

- Die Casting

- Permanent Mold Casting

- Centrifugal Casting

The green sand casting leads with a share of 48.07% of the total Australia foundry equipment market in 2025.

Green sand casting continues to dominate Australia’s foundry industry due to its cost efficiency, versatility, and ability to support both ferrous and non-ferrous castings. The process suits small-batch and high-volume production, making it ideal for a wide range of industrial applications. Australian foundries are increasingly upgrading to modern green sand systems with automated sand preparation, conditioning, and reclamation. For example, Camcast in New South Wales has implemented automated green sand molding and on-site sand reclamation to improve efficiency, enhance casting quality, and reduce waste. These upgrades support streamlined operations and enable foundries to meet evolving domestic and export market requirements.

The emphasis on sustainable practices is driving the adoption of advanced sand reclamation equipment, which reduces consumption of virgin materials while maintaining casting quality. Foundries are implementing state-of-the-art sand testing and quality monitoring systems to ensure consistent mold properties throughout production cycles. Proven reliability combined with ongoing technological enhancements places green sand casting as the preferred process for many Australian foundry operations.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Automotive

- Aerospace and Defense

- Construction

- Energy

- Industrial Machinery

The automotive dominates with a market share of 53.06% of the total Australia foundry equipment market in 2025.

The automotive sector is a major driver of demand for foundry equipment, as manufacturers require high-precision casting for engine, transmission, and structural components. Australia’s automotive market reached 1.22 million units in 2024 and is projected to grow to 2.50 million units by 2033, reflecting sustained vehicle production and demand. The accelerating shift toward electric vehicles is further increasing demand for lightweight aluminum and magnesium castings that enhance battery efficiency and overall vehicle performance. In response, Australian automotive foundries are investing in advanced die casting and gravity casting equipment to meet evolving design requirements and strict quality standards.

Growing local production of aftermarket components and specialized parts for high-performance vehicles creates additional demand for versatile foundry equipment. The emphasis on precision engineering and tight tolerances requires modern equipment featuring advanced process controls and real-time monitoring capabilities. Collaboration between foundries and automotive manufacturers supports continuous improvement in casting quality and production efficiency.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The Australia Capital Territory & New South Wales exhibits a clear dominance with a 28.4% share of the total Australia foundry equipment market in 2025.

Australia Capital Territory/New South Wales is the largest market for foundry machinery due to established manufacturing bases and accessibility to large industries in Australia. This region has some of the largest foundry capacity in Australia that is applied to several industries like mining equipment production, transport industries, and general engineering. This region has a strong labor force and research base that gives a competitive advantage to this market.

Government support for manufacturing innovation and development of manufacturing infrastructure in the region provides an ideal environment for investments in foundry equipment. The fact that large foundry firms and equipment manufacturers are present in the region helps in adopting technology and learning in the industrial sector. The trend towards reliance on manufacturing capabilities in the region has spurred efforts in updating manufacturing equipment in the region.

Market Dynamics:

Growth Drivers:

Why is the Australia Foundry Equipment Market Growing?

Expanding Mining Sector and Heavy Industrial Applications

Australia’s robust mining sector is a key driver of foundry equipment demand, requiring specialized cast components for extraction machinery, processing systems, and transport infrastructure. Mining operations need high‑durability castings that can endure extreme wear, sustaining demand for advanced foundry capabilities. In June 2025, Metso secured a three‑year contract to supply engineered metallic liners and wear solutions to BHP’s Western Australia Iron Ore operations, highlighting the need for high-performance components in harsh mining environments. Expanding domestic and international mining activities further drive investment in modern foundry equipment capable of producing large, heavy-duty castings while ensuring quality standards.

Government Support for Advanced Manufacturing and Industry 4.0 Adoption

Government initiatives promoting advanced manufacturing, automation, and green technologies are fostering investment in foundry equipment. Grants and incentives for energy-efficient systems and advanced manufacturing encourage operators to modernize capabilities. For instance, the Australian government’s $1.5 billion Future Made in Australia Innovation Fund provides targeted support for clean energy technology manufacturing and green metals production, backing low-emission equipment, decarbonisation projects, and advanced manufacturing solutions. Emphasis on strengthening sovereign manufacturing and reducing dependence on international supply chains further drives domestic infrastructure investment, while tax incentives and funding help lower the financial burden for foundries adopting energy-efficient and renewable technologies.

Growing Automotive Industry and Electric Vehicle Transition

The automotive sector’s shift toward electric vehicles is driving strong demand for foundry equipment that produces lightweight, high-precision cast components. EV manufacturing relies on specialized aluminum and magnesium castings to optimize battery efficiency and vehicle performance. In 2025, Australia saw EV sales rise by around 38% from 2024, with over 157,000 units sold, representing roughly 13% of new car sales, highlighting growing domestic adoption. To meet stringent quality requirements, Australian foundries are investing in advanced die casting and precision casting equipment, reinforcing long-term demand for high-performance automotive components.

Market Restraints:

What Challenges the Australia Foundry Equipment Market is Facing?

High Capital Investment Requirements and Operating Costs

The substantial capital investment required for modern foundry equipment presents a significant barrier for many operators, particularly smaller foundries seeking to upgrade their capabilities. High energy costs in Australia add to operational expenses, impacting the economic viability of foundry operations and equipment investment decisions. The cost of skilled labor and ongoing maintenance requirements for advanced equipment further contribute to operational cost pressures facing the industry.

Skilled Workforce Shortages and Training Requirements

The foundry industry faces challenges in attracting and retaining skilled workers capable of operating advanced manufacturing equipment. The transition to automated and digitally-enabled production systems requires workforce training and upskilling initiatives that represent additional investment for foundry operators. Competition for technical talent with other advanced manufacturing sectors intensifies the challenge of building capable teams for modern foundry operations.

Stringent Environmental Regulations and Compliance Requirements

Increasingly stringent environmental regulations governing emissions, waste management, and energy consumption require foundries to invest in compliance-related equipment and systems. Meeting environmental standards while maintaining production efficiency demands careful equipment selection and ongoing monitoring investments. The regulatory complexity associated with foundry operations can extend project timelines and increase the overall cost of equipment installation and commissioning.

Competitive Landscape:

The Australia foundry equipment market features a competitive landscape comprising domestic equipment manufacturers, international suppliers, and specialized technology providers serving diverse foundry applications. Established players leverage technical expertise and service capabilities to maintain customer relationships, while international suppliers offer advanced technologies and global best practices. The market increasingly emphasizes automation, energy efficiency, and digital integration as key competitive differentiators. Strategic partnerships between equipment suppliers and foundry operators are facilitating technology transfer and customized solution development. Growing demand for sustainable manufacturing solutions is creating opportunities for equipment providers offering environmentally friendly technologies and circular economy capabilities.

Recent Developments:

- In July 2025, General Kinematics, a US-based vibratory equipment manufacturer used in foundry material handling and processing, acquired SKALA Australasia, an Australian system integrator and equipment provider for recycling and mining sectors. The move strengthens GK’s presence in the Australia-NZ industrial market.

Australia Foundry Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Equipment Types Covered | Molding Machines, Melting Furnaces, Pouring Systems, Automated Guided Vehicles (AGVs) |

| Foundry Processes Covered | Green Sand Casting, Investment Casting, Die Casting, Permanent Mold Casting, Centrifugal Casting |

| Applications Covered | Automotive, Aerospace and Defense, Construction, Energy, Industrial Machinery |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia foundry equipment market size was valued at USD 143.59 Million in 2025.

The Australia foundry equipment market is expected to grow at a compound annual growth rate of 6.78% from 2026-2034 to reach USD 259.08 Million by 2034.

Molding machines held the largest market share of 41.09%, driven by widespread adoption across foundry operations for producing consistent, high-volume castings with improved dimensional accuracy and automation integration.

Key factors driving the Australia foundry equipment market include expanding mining sector requirements, government support for advanced manufacturing, growing automotive industry demand particularly for electric vehicles, and increasing adoption of automation and Industry 4.0 technologies.

Major challenges include high capital investment requirements, rising operational costs including energy expenses, skilled workforce shortages, stringent environmental compliance requirements, and competition from lower-cost international manufacturing locations.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)