Australia Freight Transportation Market Size, Share, Trends and Forecast by Offering, Transport, End Use, and Region, 2025-2033

Australia Freight Transportation Market Size and Share:

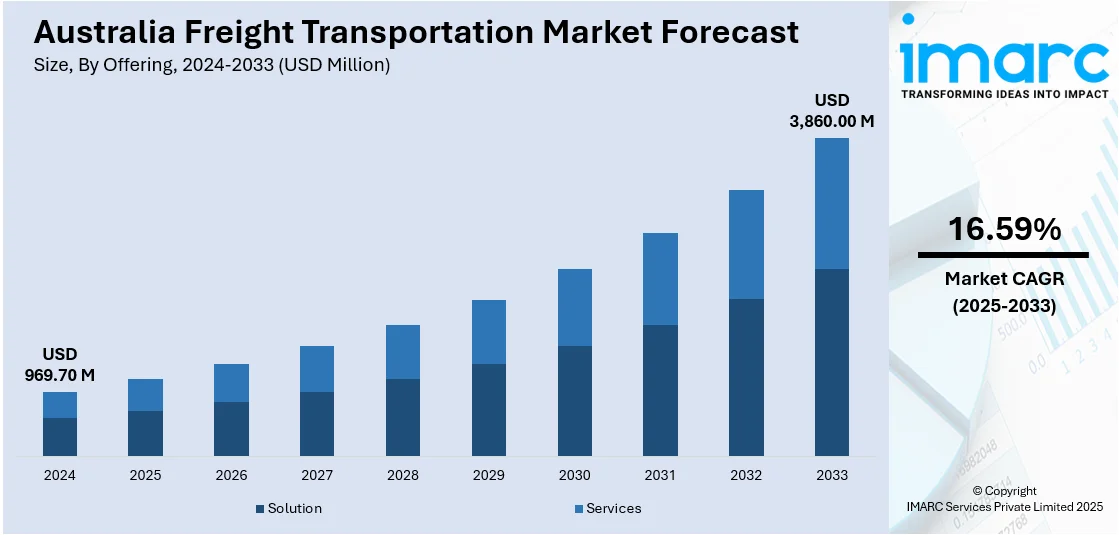

The Australia freight transportation market size reached USD 969.70 Million in 2024. Looking forward, the market is projected to reach USD 3,860.00 Million by 2033, exhibiting a growth rate (CAGR) of 16.59% during 2025-2033. The market is driven by advanced technologies like AI, automation, and real-time monitoring that enhance operational effectiveness and cut down on costs. Economic growth also significantly contributes to driving the demand for freight services, particularly in isolated areas. Robust trade relationships and increased demand for exports, including mining and agriculture drive the demand for effective transportation, further augmenting the Australia freight transportation market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 969.70 Million |

| Market Forecast in 2033 | USD 3,860.00 Million |

| Market Growth Rate 2025-2033 | 16.59% |

Key Trends of Australia Freight Transportation Market:

Technological Advancements in Logistics

Australia's freight transportation is being driven more and more by the implementation of advanced technologies to enhance operations efficiency and save costs. Automation of warehouses, artificial intelligence integration for route optimization, and the application of data analytics for supply chain management are redefining the logistics industry. Digital platforms have enabled enterprises to track shipments in real-time, making it possible to provide transparency and making services more reliable. In addition, electric cars, driverless cars and drones are in the process of being tested as possible means of last-mile delivery with solutions to remote and hard-to-reach locations. On May 15, 2025, Volvo Trucks secured a significant order from Australian logistics provider Linfox for 30 battery-electric trucks, marking the largest such order in Australia to date. This order includes 29 Volvo FH Electric and one FM Electric model, coinciding with the commencement of electric truck production at Volvo’s Brisbane facility, set to begin in 2026. The move supports the growing demand for zero-emissions vehicles in Australia’s freight transportation sector, as Volvo continues to lead the global electric truck market with over 5,000 units delivered worldwide. The increase in consumer demand, especially for e-commerce, has further amplified the need for fast, reliable delivery services. As Australia’s economy continues to grow, the freight transportation market is expected to benefit from the rising volume of goods to be transported across the nation. As the demand for faster and more efficient services grows, technology will continue to drive the Australia freight transportation market growth.

To get more information on this market, Request Sample

Trade Partnerships and Export Demand

Australia’s role as a major global exporter, especially in industries such as mining, agriculture, and natural resources, significantly contributes to the growth and demand of freight transportation. The country’s trade relationships with Asia, the United States, and other global markets create a steady flow of goods that require transportation services. The demand for export logistics is particularly significant in industries such as coal, iron ore, and agricultural products, which require specialized transport solutions. Notably, on April 17, 2024, Daimler Truck appointed DB Schenker to manage its new 19,000-square-meter warehouse in Melbourne. This facility is designed to improve the distribution of spare parts throughout Australia and New Zealand. It will house more than 40,000 stock-keeping units (SKUs) for truck and bus components, including large items like truck cabs, and features sustainable design elements such as EV charging stations and LED lighting. The collaboration underscores DB Schenker’s commitment to improving operational efficiency in the Australian freight sector, ensuring faster delivery of spare parts to minimize vehicle downtime. Additionally, free trade agreements with various countries have made it easier for Australian goods to enter international markets, further stimulating the need for robust and efficient freight transportation networks. As the country continues to experience growth in industries such as mining, agriculture, and manufacturing, there is a constant need for transportation of goods across vast distances within the country. The ongoing expansion of these trade partnerships will continue to support the growth of the market.

E-commerce Growth

The growth of e-commerce in Australia has had a profound impact on the freight transport industry. With growing online shopping, customers are increasingly demanding faster delivery and better logistics. This has escalated the relevance of last-mile solutions, with emphasis on delivering products from local distribution hubs to the end point. Firms are now investing in speed enhancement technologies like route optimization software and real-time tracking. Additionally, more consumers are demanding flexible delivery services, including next-day and same-day services, to meet their needs. This demand for fast and dependable deliveries is revolutionizing the logistics market, compelling freight firms to be innovative and responsive to the changing e-commerce environment.

Growth Drivers of Australia Freight Transportation Market:

Supply Chain Optimization

Supply chain optimization is one of the significant drivers in the Australian freight transport sector. Business organizations are looking more and more towards improving efficiency and reducing costs of operations through end-to-end integrated as well as digital freight management systems. Such systems promote greater coordination between distributors, suppliers, and transportation providers, leading to faster response times and decision-making capabilities. Real-time monitoring and sophisticated data analytics allow companies to predict demand, make routing optimization, and efficiently track inventory levels. Also, such technologies provide better visibility and reduce the likelihood of disruptions by giving a comprehensive overview of the supply chain. With companies still prioritizing more efficient processes, the demand for sophisticated freight management solutions will increase and trigger additional investments in technology in the industry.

Infrastructure Development

Infrastructure development is crucial for the growth of the Australian freight transport industry. Constant investment in roads, rails, ports, and airports is required to ensure the smooth movement of goods across the country. As more people need quicker and more reliable transportation, updating infrastructure is critical to reducing bottlenecks, congestion, and delays. Port facility upgrades, the extension of rail networks, and upgrading road systems play critical roles in enhancing freight operations, especially in urban centers and regional hubs. These upgrades also benefit in the facilitation of increased freight volumes, especially due to the increase in global trade and e-commerce. Infrastructure investment facilitates improved logistics systems, which in turn secure greater linkages between suppliers, distributors, and customers as well as improving the overall competitiveness of Australia's freight industry.

Rapid Urbanization

The urbanization in Australia is greatly raising the demand for more effective freight and transport solutions. With the expansion of urban populations, logistics in high-population areas become increasingly complicated. Greater demands in cities for quick deliveries, coupled with the rise in e-commerce, pose issues with congestion and last-mile delivery. In order to address these challenges, companies are resorting to smart transport solutions, including electric delivery vans, drones, and routing optimization to reduce delays and fuel consumption. Urban freight networks are changing to better manage the high volume of deliveries with less impact on traffic flow, getting products to destinations quickly without disrupting traffic. This sustained urbanization trend will also fuel more developments in city logistics and transport infrastructure in the coming years.

Opportunities of Australia Freight Transportation Market:

Cold Chain Logistics

The growing requirement for temperature-sensitive items, such as food, pharmaceuticals, and medical supplies, is driving the demand for improved cold chain logistics solutions. As both consumers and businesses pursue fresh, safe, and high-quality items, there is a substantial opportunity to innovate and develop the cold chain infrastructure in Australia. Companies can make investments in refrigerated transportation, temperature-controlled storage, and advanced monitoring systems to ensure that products stay within the necessary temperature ranges throughout the supply chain. By focusing on preserving product integrity and quality, businesses can provide dependable services to sectors like perishable food, pharmaceuticals, and biotechnology. This increasing demand allows companies to devise specialized solutions for both domestic and international markets, providing a competitive advantage within the logistics industry.

Regional Freight Solutions

With urban areas in Australia becoming more congested, the importance of regional and rural freight solutions is rising. As the demand for goods increases alongside the growth of e-commerce, transportation networks beyond major cities have become crucial for more efficient logistics. Companies can capitalize on this opportunity by enhancing regional freight services through infrastructure improvements and the use of advanced technologies, such as route optimization software. These advancements can shorten delivery times, reduce costs, and enhance service reliability. Furthermore, regional freight solutions can provide better access to rural communities and create more direct supply chains, alleviating pressure on urban logistics systems. By targeting regional areas, companies can tap into new market segments and streamline goods transportation to underserved locations, ultimately improving the efficiency of Australia’s logistics landscape.

Collaborative Logistics

Collaborative logistics offers a valuable opportunity for freight companies to optimize resources and cut transportation costs by forming partnerships with third-party logistics providers, retailers, and e-commerce platforms. By sharing assets like transportation vehicles, warehouse space, and last-mile delivery solutions, businesses can increase efficiency, minimize redundancies, and lower operational expenses. For instance, joint distribution networks can enable smaller companies to access logistics services comparable to their larger counterparts. This collaborative strategy also allows for greater flexibility and responsiveness to changing demand. As businesses across various sectors strive to reduce costs and boost their sustainability efforts, collaborative logistics provides an effective solution. By utilizing shared infrastructure, companies can streamline supply chains, enhance service quality, and drive growth in the Australian freight transportation sector.

Australia Freight Transportation Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on offering, transport, and end use.

Offering Insights:

- Solution

- Freight Transportation Cost Management

- Freight Mobility Solution

- Freight Security and Monitoring System

- Freight Information Management System

- Fleet Tracking and Maintenance Solution

- Freight Operational Management Solutions

- Freight 3PL Solution

- Warehouse Management System

- Services

The report has provided a detailed breakup and analysis of the market based on the offering. This includes solution (freight transportation cost management, freight mobility solution, freight security and monitoring system, freight information management system, fleet tracking and maintenance solution, freight operational management solutions, freight 3PL solution, and warehouse management system) and services.

Transport Insights:

- Roadways

- Railways

- Waterways

- Airways

The report has provided a detailed breakup and analysis of the market based on the transport. This includes roadways, railways, waterways, and airways.

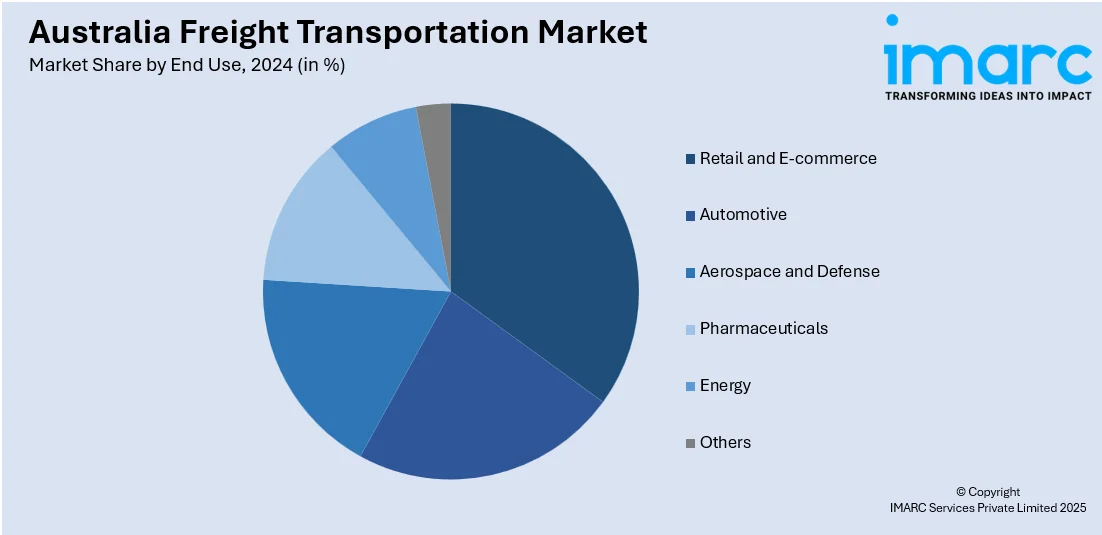

End Use Insights:

- Retail and E-commerce

- Automotive

- Aerospace and Defense

- Pharmaceuticals

- Energy

- Others

The report has provided a detailed breakup and analysis of the market based on the end use. This includes retail and e-commerce, automotive, aerospace and defense, pharmaceuticals, energy, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all major regional markets. This includes Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Freight Transportation Market News:

- On November 5, 2024, Qantas Freight joined the Freightos platform, enhancing digital booking capabilities for freight forwarders on key trans-Pacific routes between the US, Australia, and New Zealand. The partnership allows forwarders to search, compare, and book capacity across Qantas and Jetstar services from major US hubs like Los Angeles and New York to Australian cities such as Sydney and Melbourne, providing more flexibility and efficiency in the booking process. This collaboration further strengthens Qantas Freight's position in the market, offering unmatched capacity options with its combined passenger and freighter services.

Australia Freight Transportation Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Offerings Covered |

|

| Transports Covered | Roadways, Railways, Waterways, Airway |

| End Uses Covered | Retail and E-commerce, Automotive, Aerospace and Defense, Pharmaceuticals, Energy, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia freight transportation market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia freight transportation market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia freight transportation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The freight transportation market in the Australia was valued at USD 969.70 Million in 2024.

The Australia freight transportation market is projected to exhibit a compound annual growth rate (CAGR) of 16.59% during 2025-2033.

The Australia freight transportation market is expected to reach a value of USD 3,860.00 Million by 2033.

Strong demand from e-commerce, infrastructure development, and mining sectors; and government investment in road and rail upgrades enhancing connectivity and capacity are driving freight volumes. Rising exports of agricultural and manufactured goods further fuel domestic and cross-border freight demand, encouraging logistics expansion and network optimization across the country.

The Australia freight transportation market is witnessing a shift toward intermodal logistics and digital fleet management. Growing adoption of electric and low-emission vehicles, supported by sustainability goals, along with automation in warehousing and route optimization technologies, are also gaining momentum to improve delivery speed and cost efficiency.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)