Australia Frozen Food Market Report by Product (Frozen Vegetable Snacks, Frozen Meat Products, Frozen Vegetables and Fruits), and Region 2026-2034

Australia Frozen Food Market Overview:

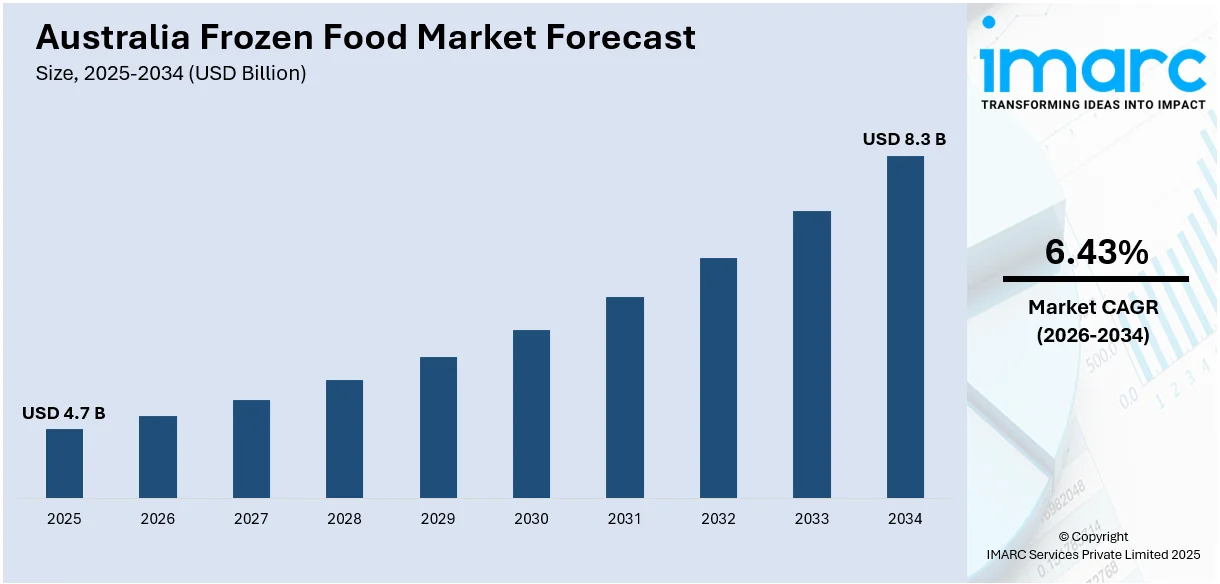

Australia frozen food market size reached USD 4.7 Billion in 2025. Looking forward, the market is expected to reach USD 8.3 Billion by 2034, exhibiting a growth rate (CAGR) of 6.43% during 2026-2034. The market is expanding due to growing consumer demand for convenient, ready-to-eat meals and premium quality products. Rising interest in healthy options, innovative flavors, and sustainable packaging is driving adoption across households and foodservice channels, while retail and e-commerce accessibility strengthens distribution, enhancing overall Australia frozen food market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 4.7 Billion |

|

Market Forecast in 2034

|

USD 8.3 Billion |

| Market Growth Rate 2026-2034 | 6.43% |

Frozen food products encompass various items kept under low temperatures for prolonged preservation. They include fruits, vegetables, edible roots, ready-to-eat meals, seafood, bakery goods, snacks, desserts, etc. The process of freezing serves as an effective means of preserving nutrients, allowing these food products to maintain their nutritional value over an extended period. One notable advantage is the accessibility of a diverse range of seasonal items throughout the year, irrespective of their natural availability. This provides consumers with the flexibility to enjoy a variety of foods at any given time. Additionally, the convenience of using only the necessary amount of frozen food helps in curbing food waste. This aspect aligns with the principle of minimizing wastage by allowing consumers to utilize portions as needed, contributing to a more sustainable and resource-efficient approach in the consumption of food products.

To get more information on this market Request Sample

Key Trends of Australia Frozen Food Market:

Technological Innovations in Freezing and Packaging

Continuous advancements in freezing techniques and packaging materials significantly enhance product quality and shelf life, reinforcing consumer trust in frozen foods. Quick-freezing technologies preserve nutrients, texture, and flavor, ensuring a fresh-like eating experience. Similarly, high-performance packaging protects against contamination, maintains temperature integrity, and reduces food spoilage during transport and storage. These improvements address consumer concerns regarding taste and nutrition, making frozen options more appealing. Innovative methods also allow for diverse product offerings, from fruits and vegetables to complete meals, catering to various dietary preferences. As technology continues to evolve, enhanced preservation and improved product safety remain key factors driving the expansion of the Australian frozen food industry.

Strategic Partnerships and Market Expansion

Collaborations between frozen food manufacturers, retailers, and logistics providers are strengthening distribution networks and increasing product accessibility throughout Australia. Joint ventures and partnerships help expand retail presence, improve supply chain efficiency, and ensure a steady supply of high-quality frozen goods. These alliances enable brands to launch innovative products more effectively and enhance marketing visibility, capturing wider consumer attention. By combining resources, companies can optimize pricing strategies and penetrate both urban and regional markets. This coordinated effort not only boosts sales but also builds consumer confidence in frozen food reliability. Consequently, strategic collaborations and strengthened retail partnerships significantly contribute to sustained growth within Australia’s frozen food market.

Growth Drivers of Australia Frozen Food Market:

Rapid Urbanization and Changing Lifestyle Patterns

The accelerating pace of urbanization across Australia has fundamentally transformed consumer lifestyle patterns, creating unprecedented demand for convenient food solutions that fit busy schedules. Urban professionals, dual-income households, and time-constrained families are increasingly turning to frozen food products as practical alternatives to traditional meal preparation methods. The growing participation of women in the workforce has particularly contributed to this trend, as working mothers seek efficient ways to provide nutritious meals for their families without extensive cooking time. Modern urban living spaces often feature smaller kitchens and limited storage, making frozen foods an attractive option due to their extended shelf life and minimal preparation requirements. This demographic shift toward convenience-oriented consumption is a primary catalyst driving sustained growth in the Australia frozen food market analysis, with manufacturers responding by developing products specifically tailored to urban consumer preferences and lifestyle demands.

Advanced Cold Chain Infrastructure Development

The continuous expansion and modernization of Australia's cold chain infrastructure represents a crucial growth enabler for the frozen food sector, ensuring product quality maintenance from production to consumer delivery. Significant investments in state-of-the-art refrigeration facilities, temperature-controlled transportation networks, and advanced storage systems have enhanced the reliability and efficiency of frozen food distribution across the continent. Major retailers and logistics companies are implementing cutting-edge cold storage technologies, including automated warehouse systems, IoT-enabled temperature monitoring, and energy-efficient refrigeration solutions that minimize operational costs while maximizing product quality. This infrastructure development has enabled frozen food manufacturers to expand their geographic reach, reduce product losses due to temperature fluctuations, and maintain consistent quality standards throughout the supply chain. The improved cold chain capabilities are directly contributing to increased Australia frozen food market demand by making frozen products more accessible to consumers in remote areas and regional markets.

Innovation in Product Variety and Quality Enhancement

Technological advancements in freezing methods, packaging innovations, and product development are revolutionizing the quality and variety of frozen food offerings available to Australian consumers. Manufacturers are employing sophisticated flash-freezing techniques, modified atmosphere packaging, and natural preservation methods that significantly improve taste, texture, and nutritional retention compared to traditional frozen products. The introduction of gourmet frozen meals, international cuisines, specialty dietary options (gluten-free, vegan, keto-friendly), and restaurant-quality frozen dishes has elevated consumer perceptions of frozen food quality and expanded market appeal. Research and development investments in flavor enhancement, ingredient sourcing, and cooking instructions have resulted in frozen products that closely replicate fresh food experiences. This continuous innovation cycle is attracting new consumer segments, including food enthusiasts and quality-conscious buyers, thereby expanding the overall market demand and driving sustained industry growth through premium product positioning and enhanced consumer satisfaction.

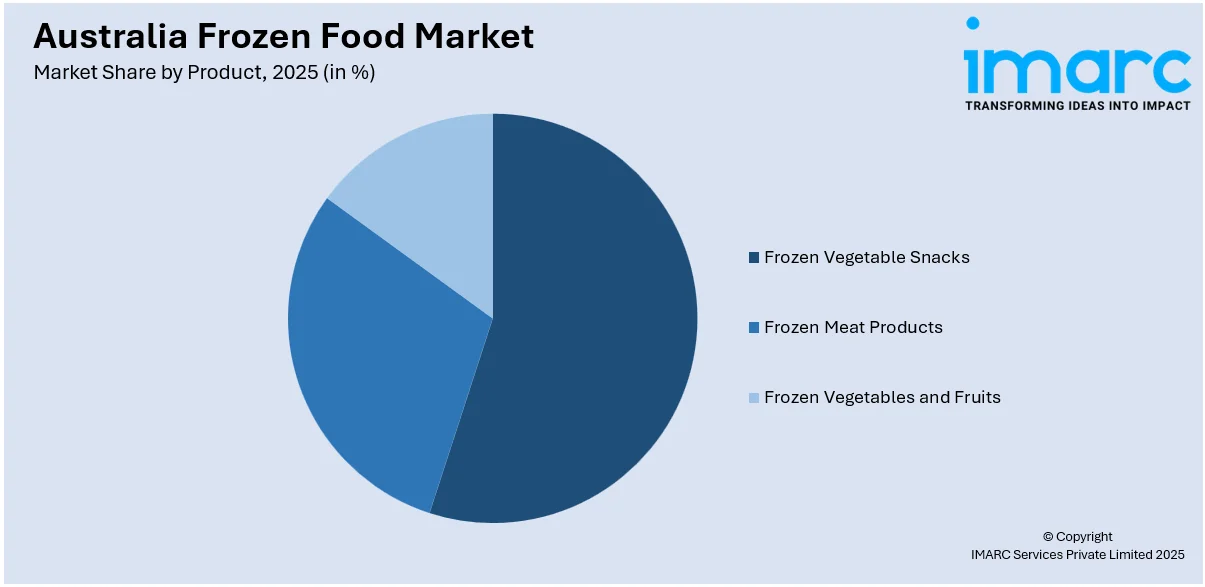

Australia Frozen Food Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on product.

Product Insights:

Access the comprehensive market breakdown Request Sample

- Frozen Vegetable Snacks

- French Fries

- Bites, Wedges and Smileys

- Aloo Tikki

- Nuggets

- Others

- Frozen Meat Products

- Chicken

- Fish

- Pork

- Mutton

- Others

- Frozen Vegetables and Fruits

- Breakup by Frozen Vegetables

- Green Peas

- Corn

- Mixed Vegetables

- Carrot

- Cauliflower

- Others

- Breakup by Frozen Fruits

- Strawberries

- Berries (Raspberries, Blueberries and Blackberries)

- Cherries

- Others

- Breakup by Frozen Vegetables

The report has provided a detailed breakup and analysis of the market based on the product. This includes frozen vegetable snacks (french fries, bites, wedges and smileys, aloo tikki, nuggets, and others), frozen meat products (chicken, fish, pork, mutton, and others), and frozen vegetables and fruits [breakup by frozen vegetables (green peas, corn, mixed vegetables, carrot, cauliflower, and others), breakup by frozen fruits (strawberries, berries (raspberries, blueberries and blackberries), cherries, and others)].

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Frozen Food Market News:

- August 2025: Silly Solly’s unveiled a pioneering plan poised to transform Australia’s discount retail scene, declaring itself the nation’s first retailer to provide premium frozen food products priced at $5 or less. This initiative arrives as countless Australians grapple with escalating living costs, where everyday groceries and essential items are becoming increasingly difficult for many households to afford.

- May 2025: OMD Create partnered with Good Food to unveil Birds Eye Deli’s latest premium frozen vegetable collection. The launch, branded ‘Deli Lane’, offered an exclusive culinary experience designed to motivate Australians to elevate their midweek meals with added convenience and taste.

- October 2024: Nissin Foods acquired ABC Pastry, a prominent Australian frozen food manufacturer renowned for its premium quality frozen dumplings, strengthening the company's position in the Asia-Pacific frozen food market. This strategic acquisition enhances Nissin's product portfolio diversification and expands its distribution network across Australia's growing frozen food sector.

Australia Frozen Food Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia frozen food market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia frozen food market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia frozen food industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia frozen food market was valued at USD 4.7 Billion in 2025.

The Australia frozen food market is projected to exhibit a CAGR of 6.43% during 2026-2034.

The Australia frozen food market is projected to reach a value of USD 8.3 Billion by 2034.

The market experiences rapid growth driven by premium health-conscious product development, digital integration with e-commerce expansion, and sustainable packaging innovations. Advanced freezing technologies and cold chain infrastructure improvements are enhancing product quality and accessibility nationwide.

The Australia frozen food market is driven by rapid urbanization, changing lifestyle patterns, advanced cold chain infrastructure development, and continuous innovation in product variety and quality enhancement. The growing convenience demand and technological advancements further accelerate market expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)