Australia Frozen Potato Products Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, End-Use, and Region, 2026-2034

Australia Frozen Potato Products Market Overview:

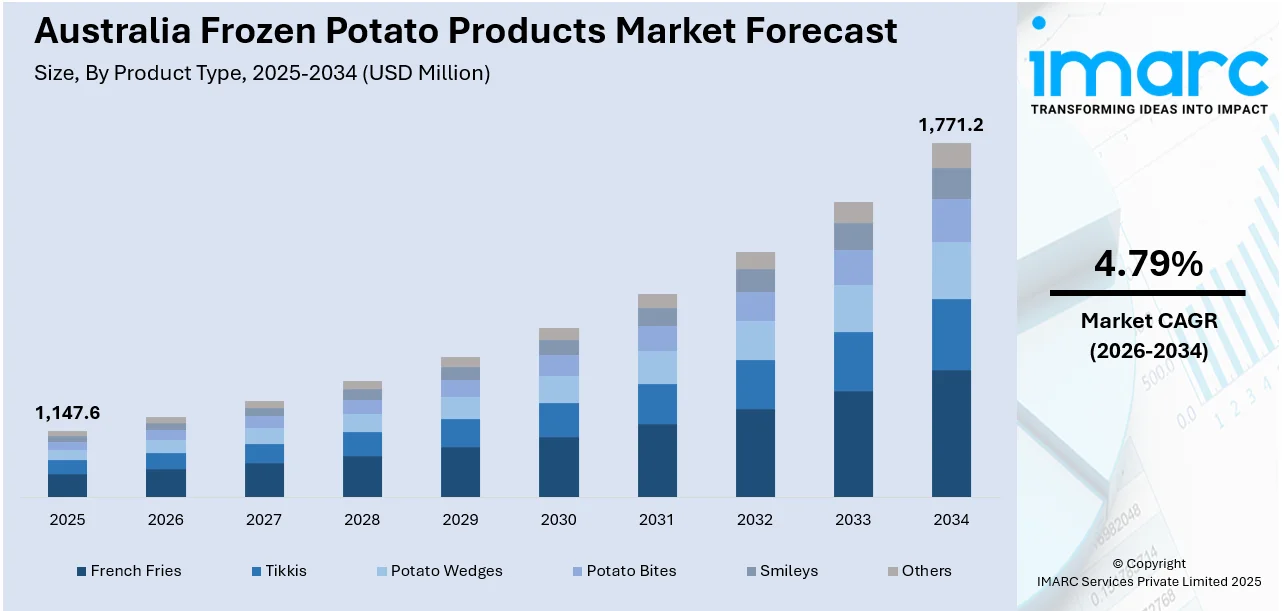

The Australia frozen potato products market size reached USD 1,147.6 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,771.2 Million by 2034, exhibiting a growth rate (CAGR) of 4.79% during 2026-2034. Rising demand from quick-service restaurants, increasing consumer preference for convenient meal options, and advancements in cold chain logistics are collectively driving the Australia's frozen potato product market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,147.6 Million |

| Market Forecast in 2034 | USD 1,771.2 Million |

| Market Growth Rate 2026-2034 | 4.79% |

Australia Frozen Potato Products Market Trends:

Rapid Growth of the Foodservice Industry and Quick-Service Restaurants (QSRs)

A key market driver is the expanding food service industry, especially the proliferation of quick-service restaurants (QSRs). For example, McDonald's, Hungry Jack's (Burger King), KFC, and more recent entrants Grill'd and Guzman y Gomez, have become an essential part of Australian metropolitan and suburban living. These restaurants are dependent greatly on frozen potato products, specifically French fries and wedges, as major side dishes and value-meal items because of their long shelf life, consistency of quality, convenience in preparation, and lighter operational load. Australia's food service market is expected to expand steadily, fueled by rising disposable incomes, hectic lifestyles, and a cultural shift toward eating out and food delivery. Based on market information, Australians allocate a significant proportion of their food budget to eating out, and fried potato foods rank among the most widely consumed sides. The industry also involves pubs, cafes, casual restaurants, and catering services, which all frequently utilize frozen potato foods to handle stock and create consistency.

To get more information on this market Request Sample

Advancements in Cold Chain Infrastructure and Supply Chain Logistics

Another important factor driving the Australian frozen potato products market is improvement of cold chain logistics and infrastructure. The frozen foods industry as a whole has a large dependency on maintenance of an unbroken temperature control throughout the supply chain, from production and processing, through warehousing, to retail distribution. In recent years, Australia has invested heavily in cold storage facilities, refrigerated vehicle fleets, and temperature-tracking technology, making it widely feasible for producers to expand frozen food manufacturing and distribution. In contrast to fresh fruits and vegetables, frozen potato products need rigorous storage conditions to maintain quality, flavor, and texture. Up until now, such logistics were a constraint for regional and remote markets. Yet, upgraded cold chain infrastructures have helped frozen potato manufacturers reach supermarkets and restaurants throughout Australia, even in remotely populated or climatically unfavorable regions, such as Western Australia and rural Queensland. Such extended logistics have played an important role in developing market size and lowering product wastage as a result of thawing or spoilage.

Australia Frozen Potato Products Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on product type, distribution channel, and end-use.

Product Type Insights:

- French Fries

- Tikkis

- Potato Wedges

- Potato Bites

- Smileys

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes French fries, tikkis, potato wedges, potato bites, smileys, and others.

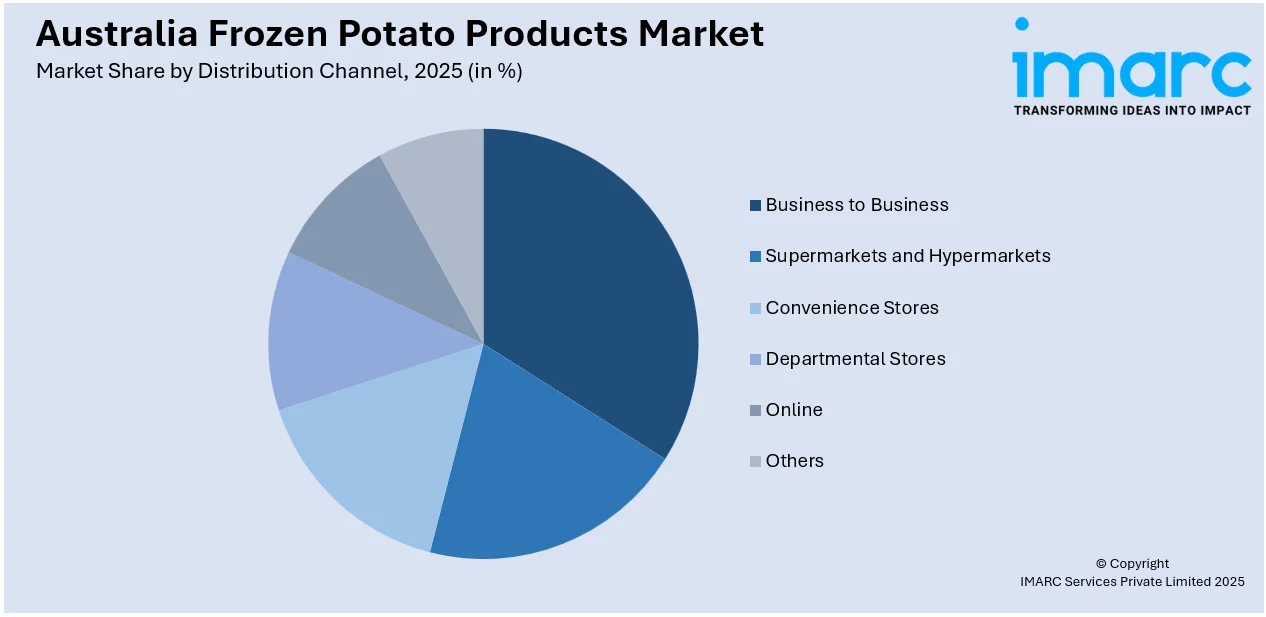

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Business to Business

- Supermarkets and Hypermarkets

- Convenience Stores

- Departmental Stores

- Online

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes business to business, supermarkets and hypermarkets, convenience stores, departmental stores, online, and others.

End-Use Insights:

- Food Services

- Retail

The report has provided a detailed breakup and analysis of the market based on the end-use. This includes food service and retail.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Frozen Potato Products Market News:

- March 2025: Farm Frites, a Dutch frozen potato products manufacturer, announced plans to build an AUD 425 million factory in Dooen, Victoria, aiming to commence production by 2027. The facility is expected to create approximately 250 local jobs and will be strategically located near major potato-growing regions, enhancing supply chain efficiency.

- December 2024: HyFun Foods, an Indian exporter of frozen potato products, partnered with Australian retail company Woolworths to introduce its premium frozen range, including hash browns and tots, to over 1,000 stores across Australia under the “Your Spud Co” label. This move aims to capture a significant share of Australia's frozen potato market.

Australia Frozen Potato Products Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | French Fries, Tikkis, Potato Wedges, Potato Bites, Smileys, Others |

| Distribution Channels Covered | Business to Business, Supermarkets and Hypermarkets, Convenience Stores, Departmental Stores, Online, Others |

| End-Uses Covered | Food Services, Retail |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia frozen potato products market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia frozen potato products market on the basis of product type?

- What is the breakup of the Australia frozen potato products market on the basis of distribution channel?

- What is the breakup of the Australia frozen potato products market on the basis of end-use?

- What is the breakup of the Australia frozen potato products market on the basis of region?

- What are the various stages in the value chain of the Australia frozen potato products market?

- What are the key driving factors and challenges in the Australia frozen potato products market?

- What is the structure of the Australia frozen potato products market and who are the key players?

- What is the degree of competition in the Australia frozen potato products market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia frozen potato products market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia frozen potato products market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia frozen potato products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)