Australia Fuel Station Market Size, Share, Trends and Forecast by Fuel Type, End Use, and Region, 2025-2033

Australia Fuel Station Market Overview:

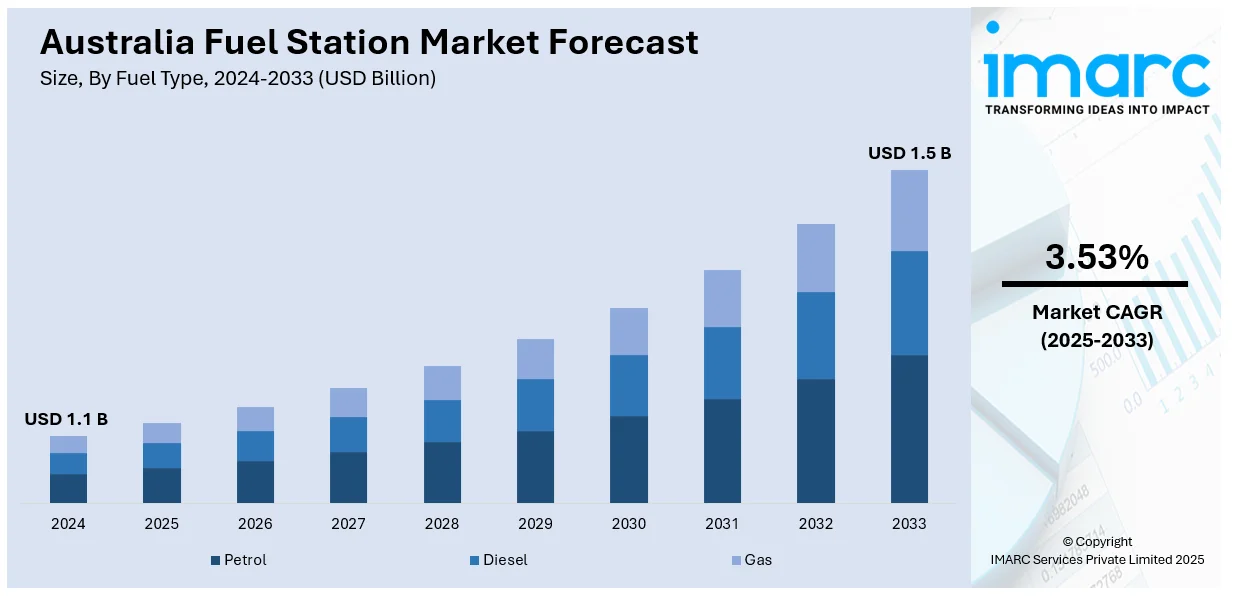

The Australia fuel station market size reached USD 1.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.5 Billion by 2033, exhibiting a growth rate (CAGR) of 3.53% during 2025-2033. The market is driven by infrastructure growth, boosting vehicle use, and transition towards sustainable mobility, with increasing consumer need for convenience, digital solutions, and energy diversification, setting the industry up for ongoing expansion and change throughout metropolitan and regional Australia in the next few years.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.1 Billion |

| Market Forecast in 2033 | USD 1.5 Billion |

| Market Growth Rate 2025-2033 | 3.53% |

Australia Fuel Station Market Trends:

Retail and On-Site Service Expansion

Australian fuel stations are changing into full-service retail centers, providing an extended range of facilities beyond fueling. Most of them now incorporate convenience stores, fresh food counters, and parcel collection points as a response to consumers' need for convenience and efficiency. For instance, in August 2023, Ampol joined forces with OneH2 to grow hydrogen fuel stations in Australia, focusing on heavy vehicle fleets to cut emissions. This comes after BP's refuelling station launch, backing Australia's hydrogen aspirations. Moreover, this diversification is especially useful in busy urban and regional corridors where consumers tend to favor consolidated services. Convenience and operational simplification are achieved through the incorporation of technology, including mobile payment systems and loyalty applications. Expansion of the value proposition has raised dwell time and transaction values per visit. This trend indicates a change in the function of service stations, which is now in sync with evolving lifestyles and consumer behavior. Australia fuel station market outlook continues to be positive as operators drive customer interaction through non-fuel products, making them diversified service centers in the wider retail and transport environment.

To get more information on this market, Request Sample

Development of Renewable Fuel Infrastructure

The shift towards cleaner fuels is slowly transforming the Australia fuel station market. Operators are starting to add renewable fuels like biodiesel and ethanol blends, as well as nascent-stage hydrogen supply infrastructure, to their portfolios. This trend both responds to regulatory requirements and is driven by an increasing consumer concern with sustainable transportation solutions. The trend toward renewables illustrates a more universal commitment to environment stewardship and forward thinking. In urban and certain regional areas, pump lanes for alternative fuel use are being seen more regularly, accommodating hybrid and environmentally friendly vehicle use. Green infrastructure investment is a strategic positioning tool, and not just a compliance action. Australia fuel station market growth is being addressed through incremental levels of adoption of renewable energy options, assuring the long-term sustainability and contemporary modernization of fuel station operations in the nation.

EV Charging Networks Consolidation

Electric vehicle (EV) integration is increasingly becoming a strategic priority for fuel stations in Australia, as the country advances towards electric mobility at a national level. Charging infrastructure is being rolled out at existing fuel station locations, particularly along major highways and in city centres, to cater to the rising number of EVs on Australian roads. For example, in November 2024, Shell Card widens its acceptance to 184 OTR service stations and over 1,500 sites nationwide, including Shell, Coles Express, and Liberty, transforming Australian fleet management within the fuel station sector. Furthermore, high-speed charging technology and real-time digital interfaces facilitate users to find, use, and pay for charging quickly. This twin model providing both conventional fuels and electric charging keeps stations current in an evolving transport landscape. Collaboration with energy companies and government-sponsored funding is further driving this shift. The change also aligns with consumer demands for environmentally friendly travel choices and greater convenience. Australia fuel station market share is changing as more sites accommodate the shifting energy mix, representing a major milestone in the refuelling and mobility infrastructure overhaul of the country.

Australia Fuel Station Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on fuel type and end use.

Fuel Type Insights:

- Petrol

- Diesel

- Gas

The report has provided a detailed breakup and analysis of the market based on the fuel type. This includes petrol, diesel, and gas.

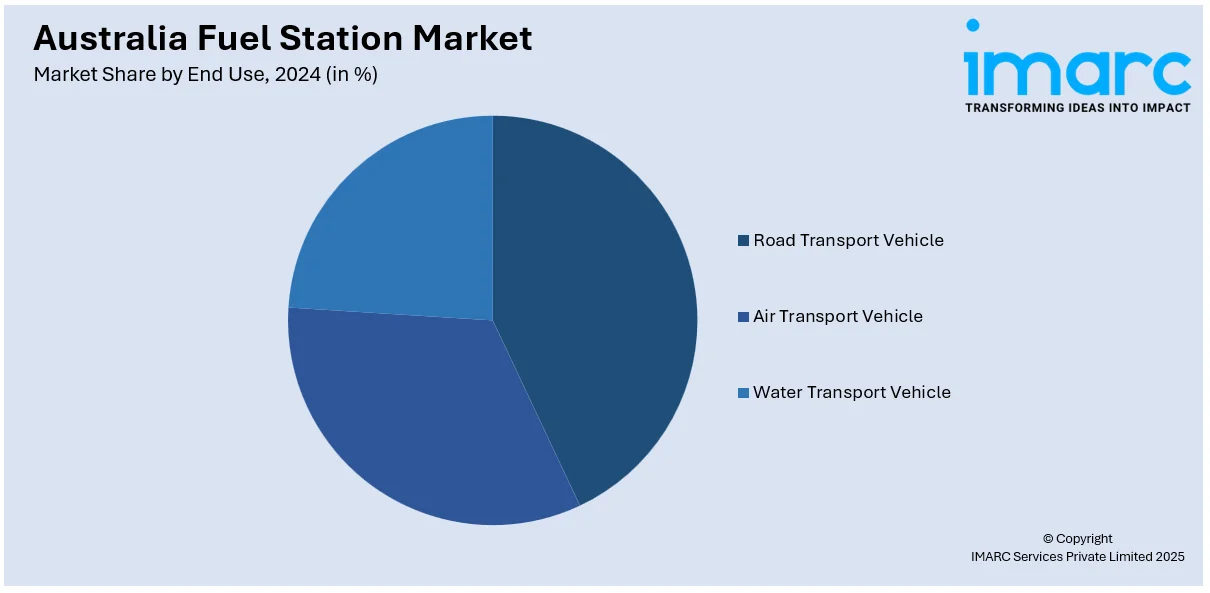

End Use Insights:

- Road Transport Vehicle

- Air Transport Vehicle

- Water Transport Vehicle

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes road transport vehicle, air transport vehicle, and water transport vehicle.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Fuel Station Market News:

- In March 2025, US-based electric vehicle charging technology firm Konect to turn Australian petrol stations into "multi-fuel convenience hubs" as the nation transitions to electrification. A part of Gilbarco Veeder-Root, Konect will provide EV infrastructure at service stations, enabling them to remain competitive in the face of falling fuel sales.

- In August 2024, Australia's United Petroleum unveiled the opening of operations in Sri Lanka on under its subsidiary, United Petroleum Lanka. The firm will acquire 150 sites, develop 50 new ones, and venture into food production with a USD 20-30 million investment, venturing into real estate businesses.

Australia Fuel Station Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fuel Types Covered | Petrol, Diesel, Gas |

| End Uses Covered | Road Transport Vehicle, Air Transport Vehicle, Water Transport Vehicle |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia fuel station market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia fuel station market on the basis of fuel type?

- What is the breakup of the Australia fuel station market on the basis of end use?

- What is the breakup of the Australia fuel station market on the basis of region?

- What are the various stages in the value chain of the Australia fuel station market?

- What are the key driving factors and challenges in the Australia fuel station?

- What is the structure of the Australia fuel station market and who are the key players?

- What is the degree of competition in the Australia fuel station market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia fuel station market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia fuel station market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia fuel station industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)