Australia Galvanization Market Size, Share, Trends and Forecast by Type, Combustion Chamber Type, Application, End Use Industry, and Region, 2025-2033

Australia Galvanization Market Overview:

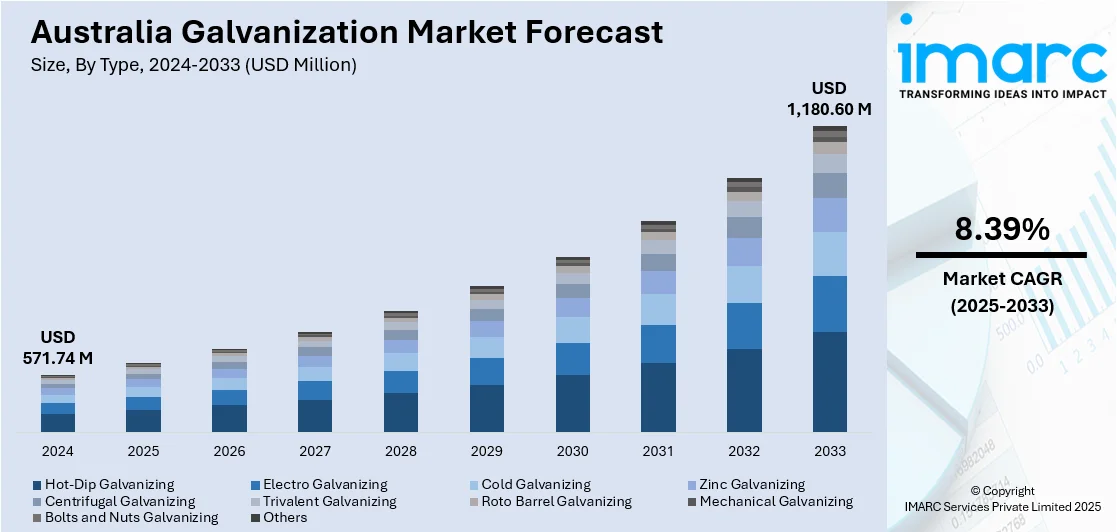

The Australia galvanization market size reached USD 571.74 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,180.60 Million by 2033, exhibiting a growth rate (CAGR) of 8.39% during 2025-2033. The market is driven by government investment in green metals and a growing demand for sustainable energy solutions. Key drivers include the commitment to low-emission technologies and innovations in solar energy systems. These factors contribute to expanding Australia galvanization market share, enhancing demand for corrosion-resistant materials in various sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 571.74 Million |

| Market Forecast in 2033 | USD 1,180.60 Million |

| Market Growth Rate 2025-2033 | 8.39% |

Australia Galvanization Market Trends:

Government Investment in Green Metals

The Australian galvanization market is witnessing massive growth on the back of growing government support for low-emission technologies. The project targets developing sustainable production methods, with the Australian government pledging USD 750 million in March 2025. The money specifically targets funding for green metal development, the upgrading of production processes, minimizing emissions, and enhancement of competitiveness in international markets. These initiatives are likely to directly influence industries that depend upon galvanized products, e.g., infrastructure and construction, by providing access to more environmentally friendly, lower-carbon materials. As an example, in March 2025, the Australian government pledged AUD 750 Million to progress low-emissions technology, strengthening the green metals industry, including galvanization. The investments were meant to update production processes, reduce emissions, and make Australian metals more competitive globally, which would boost the growth and trade of galvanization. Due to the investments, the consumption of galvanized products will increase, especially in construction, where demand for strong, corrosion-proof materials is key. Also, the drive for sustainability in the green metals industry will spur innovation in production methods to the benefit of the galvanization industry. This market force will be an essential factor in placing Australia as the world leader in environmentally friendly manufacturing, further cementing the significance of galvanization in Australia's industrial landscape.

To get more information on this market, Request Sample

Emerging Trends in Solar Integration Technology

The market is witnessing growing demand with the integration of new technology, especially in the renewable energy segment. As the nation emphasizes sustainable energy solutions, applications of galvanized materials in solar power systems have become more prominent. The trend is driven by innovations like the application of hot-dip galvanization and zinc-aluminum-magnesium coating to solar equipment to improve durability and functionality. Innovations have had a positive impact on the galvanization market for solar energy technologies. In November 2024, for example, Arctech unveiled its high-end solar tracking solutions at All Energy Australia, including hot-dip galvanization and zinc-aluminum-magnesium coatings to prevent atmospheric corrosion. This innovation raised the durability and performance of solar installations, fueling the growth of Australia's galvanization industry. With these advancements, solar energy suppliers are all about making their installations last longer, thereby boosting demand for high-performance, anti-corrosion materials such as galvanized steel. This solar energy trend has worked in favor of galvanization as a protective solution against nature. The demand for sustainable, long-lasting infrastructure within the renewable energy industry will keep galvanization innovation spurred, further solidifying its position in the Australia galvanization market growth.

Australia Galvanization Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on type, combustion chamber type, application, and end use industry.

Type Insights:

- Hot-Dip Galvanizing

- Electro Galvanizing

- Cold Galvanizing

- Zinc Galvanizing

- Centrifugal Galvanizing

- Trivalent Galvanizing

- Roto Barrel Galvanizing

- Mechanical Galvanizing

- Bolts and Nuts Galvanizing

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes hot-tip galvanizing, electro galvanizing, cold galvanizing, zinc galvanizing, centrifugal galvanizing, trivalent galvanizing, roto barrel galvanizing, mechanical galvanizing, bolts and nuts galvanizing, and others.

Combustion Chamber Type Insights:

- Oil

- Gas

- Electric

- Others

A detailed breakup and analysis of the market based on the combustion chamber type have also been provided in the report. This includes oil, gas, electric, and others.

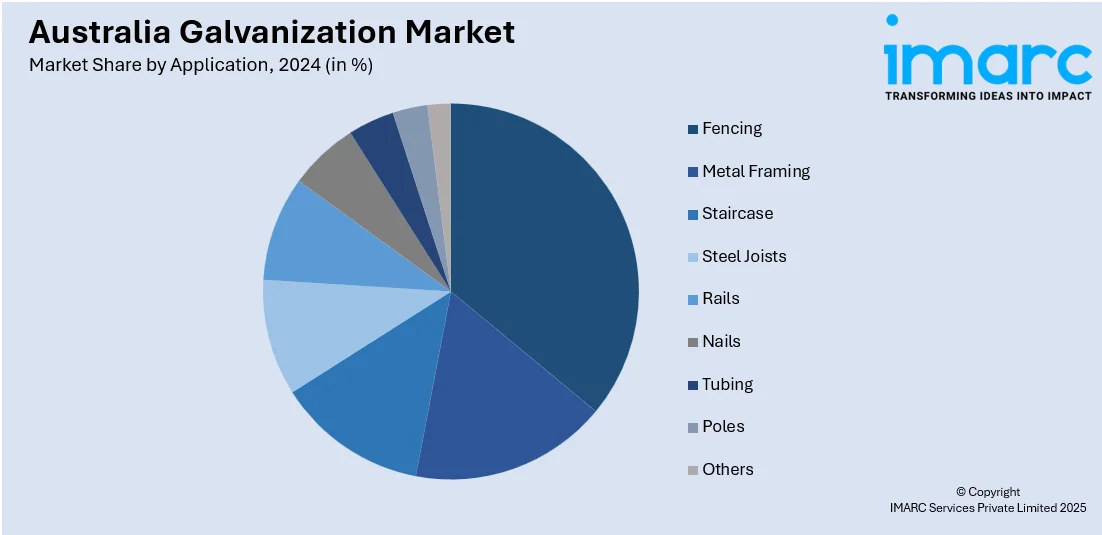

Application Insights:

- Fencing

- Metal Framing

- Staircase

- Steel Joists

- Rails

- Nails

- Tubing

- Poles

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes fencing, metal framing, staircase, steel joints, rails, nails, tubing, poles, and others.

End Use Industry Insights:

- Electrical and Electronics

- Wind and Solar Industries

- Energy Industry

- Telecommunications Industry

- Transportation

- Aerospace

- Marine

- Automotive

- Others

- Building and Construction

- Residential Construction

- Commercial Construction

- Industrial

- Infrastructure

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes electrical and electronics, wind and solar industries, energy industry, telecommunications industry, transportation (aerospace, marine, automotive, and others), building and construction (residential construction, commercial construction, industrial, and infrastructure), and others.

Regional Insights:

- Australia Capital Territory and New South Wales

- Victoria and Tasmania

- Queensland

- Northern Territory and Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory and New South Wales, Victoria and Tasmania, Queensland, Northern Territory and Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Galvanization Market News:

- April 2025: InfraBuild secured USD 700 Million in liquidity, strengthening its balance sheet and enabling investment in sustainable steel production, including galvanization. The move enhanced its market position, allowing for innovation in low-carbon steel, advanced robotics, and digital services, driving future growth.

- November 2024: Arctech showcased its advanced solar tracking solutions at All Energy Australia, incorporating hot-dip galvanization and zinc-aluminum-magnesium coatings to combat atmospheric corrosion. This innovation enhanced the durability and performance of solar installations, driving growth in Australia's galvanization sector.

Australia Galvanization Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Hot-Dip Galvanizing, Electro Galvanizing, Cold Galvanizing, Zinc Galvanizing, Centrifugal Galvanizing, Trivalent Galvanizing, Roto Barrel Galvanizing, Mechanical Galvanizing, Bolts and Nuts Galvanizing, Others |

| Combustion Chamber Types Covered | Oil, Gas, Electric, Others |

| Applications Covered | Fencing, Metal Framing, Staircase, Steel Joists, Rails, Nails, Tubing, Poles, Others |

| End Use Industries Covered |

|

| Regions Covered | Australia Capital Territory and New South Wales, Victoria and Tasmania, Queensland, Northern Territory and Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia galvanization market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia galvanization market on the basis of type?

- What is the breakup of the Australia galvanization market on the basis of combustion chamber type?

- What is the breakup of the Australia galvanization market on the basis of application?

- What is the breakup of the Australia galvanization market on the basis of end use industry?

- What is the breakup of the Australia galvanization market on the basis of region?

- What are the various stages in the value chain of the Australia galvanization market?

- What are the key driving factors and challenges in the Australia galvanization market?

- What is the structure of the Australia galvanization market and who are the key players?

- What is the degree of competition in the Australia galvanization market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia galvanization market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia galvanization market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia galvanization industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)