Australia Gaming Console Market Size, Share, Trends and Forecast by Type, Application, End Use, and Region, 2025-2033

Australia Gaming Console Market Size and Share:

The Australia gaming console market size reached USD 840.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,907.4 Million by 2033, exhibiting a growth rate (CAGR) of 9.54% during 2025-2033. The boosting consumer demand for digital entertainment, combined with the growth in internet connectivity, has played a key role in increasing the popularity of online multiplayer gaming and streaming options. Furthermore, the growing popularity of exclusive game titles has also fueled demand in the market for gaming consoles. All these factors combined, along with ongoing technological advancements in the gaming industry, are collectively promoting growth in the industry, hence positively impacting the Australia gaming console market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 840.0 Million |

| Market Forecast in 2033 | USD 1,907.4 Million |

| Market Growth Rate 2025-2033 | 9.54% |

Key Trends of Australia Gaming Console Market:

Growing Popularity Across Age Groups and Genders

The Australia gaming console market is becoming increasingly inclusive, with more households viewing consoles as family-friendly devices for both casual and competitive play. Gaming is no longer seen as an activity solely for young males as it has evolved into a mainstream form of entertainment enjoyed by a diverse demographic across all age groups and genders. Approximately 94% of Australian households engage in gaming activities, with 81% owning gaming consoles. This shift reflects a cultural embrace of gaming as a social and interactive experience that brings people together. Whether for solo enjoyment or online multiplayer fun, consoles offer versatile entertainment options appealing to a wide range of users. This broadening audience is driving the Australia gaming console market growth, ensuring its ongoing relevance across various consumer groups.

.webp)

To get more information on this market, Request Sample

Rise of Cloud Gaming and 5G Integration in Australia

According to the Australia gaming console market analysis, the market is witnessing a dramatic shift toward cloud gaming, enabled by the deployment of fifth generation (5G) networks. Cloud gaming services enable users to stream games of high quality without the necessity of costly hardware, opening gaming to a wider population. The advent of 5G technology further adds to this experience by offering faster download speeds, reduced latency, and better connectivity, especially for mobile and online gaming. This blend allows for smooth gameplay, even for graphically demanding games, on devices such as smartphones and tablets. Consequently, players can have console-like experiences on the move, fueling the popularity of hybrid gaming consoles and subscription-based services. This is transforming the way Australians engage with their gaming consoles, prioritizing convenience and flexibility.

Shift Toward Portability and Digital Subscriptions

The contemporary Australian gamer increasingly demands convenience, and this has stimulated demand for hybrid gaming consoles that merge handheld and conventional play styles. Such devices provide the versatility to play games both at home and on the move, making them popular with a broad base of users. With about 68% of Australian gamers utilizing consoles, conventional gaming platforms continue to be extremely popular. Meanwhile, digital subscription services are revolutionizing the gaming scene with access to a changing pool of games for a monthly subscription fee. The trend is gaining popularity among casual and budget players with variety and flexibility without requiring the purchase of full games. Combined, the emergence of handheld gaming and subscription models is redefining the way Australians interact with their consoles, making gaming more convenient and tailored to personal tastes.

Growth Drivers of Australia Gaming Console Market:

Government Support and Tax Incentives

The active position taken by the Australian government on the gaming business directly fuels the market growth for gaming consoles. Programs such as the Digital Games Tax Offset (DGTO) provide huge tax credits to game developers, drawing both local and foreign game studios to open business in Australia. This policy has seen prominent developers such as EA Firemonkeys and Sledgehammer Games open studios in the Brisbane city. These investments augment the domestic gaming environment while further propelling the Australia gaming console market demand for sophisticated gaming consoles with the ability to support high-end game development and experience. The government also aids in infrastructure growth, so that the digital and physical infrastructure is supportive of the growth of the gaming industry. Such an all-around support system makes Australia an attractive center for gaming console installation and innovation.

Technological Advancements and 5G Integration

Australia's focus on technological development is at the core of the growth of the gaming console business. The rollout of 5G networks across the country improves internet speed and connectivity, enabling smooth online gaming experience. Such technological advancement enables the increasing popularity of cloud gaming, where demanding games are directly streamed to consoles without the requirement for heavy hardware. 5G-enabled consoles allow gamers to play a huge collection of games and engage in multiplayer sessions with low latency. In addition, innovations in console hardware, including enhanced graphics processing units and high-speed processors, improve the gaming experience, drawing casual as well as professional gamers to them. Such advancements in technologies assure Australian gamers access to the latest gaming experiences, thus fueling the demand for next-generation gaming consoles.

Cultural Participation and Gaming Groups

The strong gaming culture in Australia plays an important role in developing the market for gaming consoles. AVCon in Adelaide, the biggest combined anime and games festival in the Southern Hemisphere, is a testament to Australia's passion for gaming and related cultures. These events create a sense of community among gamers, encouraging socialization and the exchange of gaming experiences. In addition, the growth of esports in Australia has provided a boost to the development of competitive gaming leagues and tournaments, further integrating gaming into the cultural mainstream. Such cultural activities not only increase the popularity of gaming consoles but also promote ongoing investment in gaming hardware to cater to the needs of an ever-changing gaming population. The close cultural affinity with gaming guarantees a sustained level of interest and expansion in the gaming console market throughout Australia.

Australia Gaming Console Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, application, and end use.

Type Insights:

- Home Consoles

- Handheld Consoles

- Hybrid Consoles

- Dedicated Consoles

- Others

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes home consoles, handheld consoles, hybrid consoles, dedicated consoles, and others.

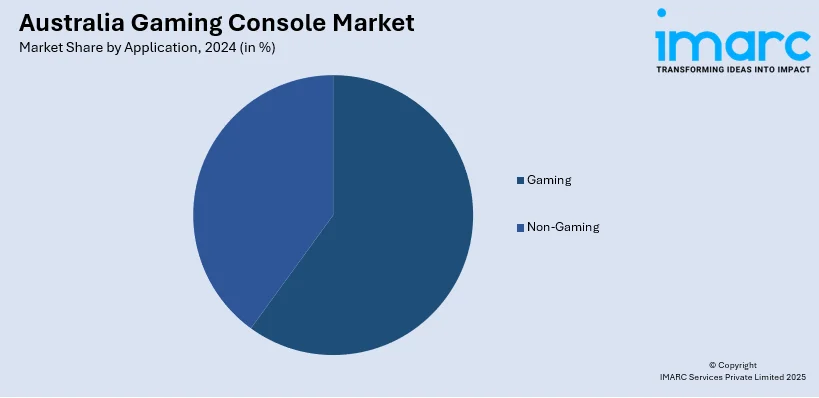

Application Insights:

- Gaming

- Non-Gaming

The report has provided a detailed breakup and analysis of the market based on the application. This includes gaming and non-gaming.

End Use Insights:

- Residential

- Commercial

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes residential and commercial.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided, including:

- Anyun Intelligent Technology (Hong Kong) Co., Ltd

- ASUSTeK Computer Inc.

- Lenovo

- Microsoft Corporation

- Micro-Star International Co., Ltd

- Nintendo Co., Ltd

- Sony Group Corporation

- Valve Corporation

Australia Gaming Console Market News:

- In April 2025, EB Games Australia launched a retro games and console collection online, featuring classics like the Nintendo Wii, PlayStation 2 and 3, and Xbox 360. While the range is limited for now, it offers a nostalgic slice of gaming history at reasonable prices, comparable to eBay. A few larger stores will stock physical copies, but the full selection is available online for those eager to revisit the early 2000s gaming era.

- In April 2025, Nintendo officially announced the Switch 2, set to launch in Australia on June 5 at a price of $700. As the successor to the hugely popular original Switch, the new console offers both TV and handheld play modes. It features larger hardware, magnetically attaching redesigned controllers, improved performance, and built-in voice and video chat. The price aligns with other next-gen consoles from Sony and Microsoft.

Australia Gaming Console Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Home Consoles, Handheld Consoles, Hybrid Consoles, Dedicated Consoles, Others |

| Applications Covered | Gaming, Non-Gaming |

| End Uses Covered | Residential, Commercial |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Companies Covered | Anyun Intelligent Technology (Hong Kong) Co., Ltd, ASUSTeK Computer Inc., Lenovo, Microsoft Corporation, Micro-Star International Co., Ltd, Nintendo Co., Ltd, Sony Group Corporation, Valve Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia gaming console market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia gaming console market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia gaming console industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia gaming console market was valued at USD 840.0 Million in 2024.

The Australia gaming console market is projected to exhibit a CAGR of 9.54% during 2025-2033.

The Australia gaming console market is expected to reach a value of USD 1,907.4 Million by 2033.

The gaming console industry in Australia is changing with the launch of hybrid consoles such as the Nintendo Switch 2 that combine handheld and home gameplay. The digital subscription and cloud gaming, made possible with the advent of 5G connectivity, are also changing the way Australians interact with gaming consoles.

Australia's console gaming market is fueled by tax incentives offered by the government to developers, national 5G rollout that supports online play, and a robust gaming culture. Local esports happenings, high community interest, and increasing demand for immersive entertainment spur console use among various age groups and tech-savvy Australian homes.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)