Australia Gas Turbine Market Size, Share, Trends and Forecast by Technology, Design Type, Rated Capacity, End-User, and Region, 2025-2033

Australia Gas Turbine Market Overview:

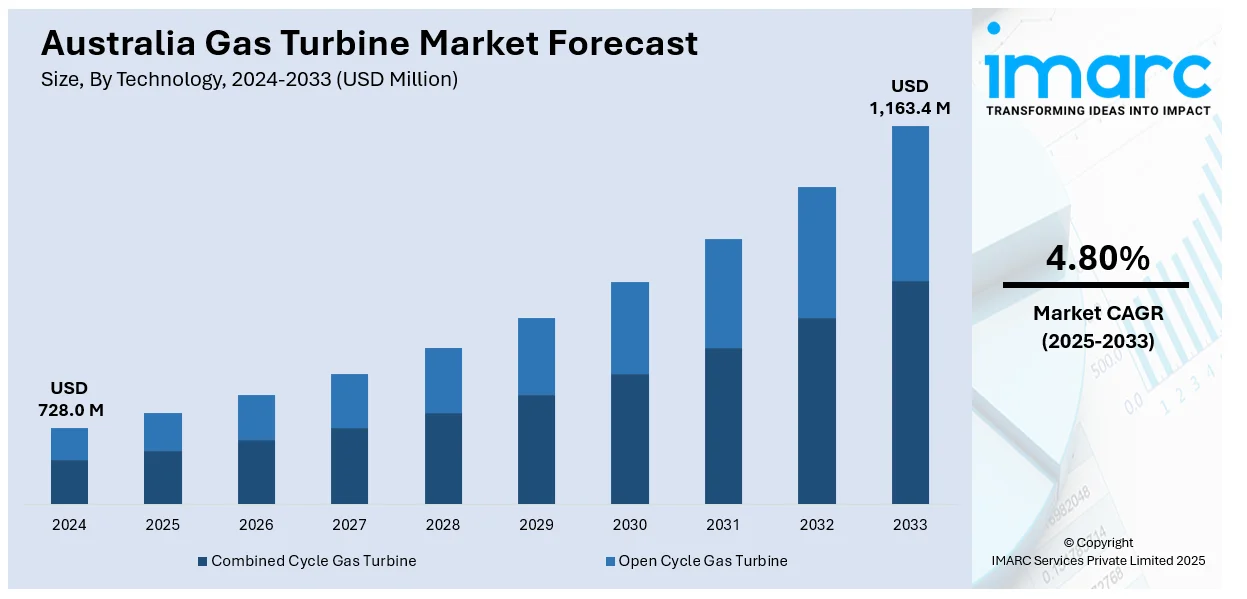

The Australia gas turbine market size reached USD 728.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,163.4 Million by 2033, exhibiting a growth rate (CAGR) of 4.80% during 2025-2033. The market is driven by the growing need for flexible power generation to support renewable energy integration, replace retiring coal plants, and ensure grid stability. Additionally, decarbonization efforts and rising investments in hydrogen-compatible turbines are accelerating demand. Government policies promoting cleaner energy and energy security across the country are further expanding the Australia gas turbine market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 728.0 Million |

| Market Forecast in 2033 | USD 1,163.4 Million |

| Market Growth Rate 2025-2033 | 4.80% |

Australia Gas Turbine Market Trends:

Increasing Demand for Flexible Power Generation Solutions

The market is experiencing a rise in demand for flexible power generation solutions due to the country’s transition toward renewable energy. As solar and wind power become more prevalent, their intermittent nature creates grid stability challenges. Gas turbines are increasingly being deployed to provide rapid-response backup power, ensuring reliability during peak demand or renewable supply fluctuations. Combined-cycle gas turbines (CCGTs) and aeroderivative turbines are gaining traction due to their high efficiency and quick start-up capabilities. Additionally, aging coal-fired plants are being phased out, further driving the need for gas-based power as a transitional energy source. As of 2022, Australia's energy mix was still heavily dependent on fossil fuels at 90% of the total, where natural gas supplied 27% of the supply and 34% of power generation. At the same time, renewable sources expanded to 9.5%, led mainly by solar and biomass. Bioenergy accounted for 5% of the final consumption, supported by major projects, including the Malabar Biomethane Injection and Kwinana Waste-to-Energy. These projects demonstrate significant shifts towards more energy-efficient and grid-integrated infrastructure. Government policies supporting cleaner energy alternatives while ensuring grid resilience are also driving the Australia gas turbine market growth. With Australia’s focus on reducing emissions without compromising energy security, the gas turbine market is poised for steady growth, particularly in hybrid power projects integrating renewables and gas-fired generation.

To get more information on this market, Request Sample

Shift Toward Hydrogen-Capable Gas Turbines

A key trend shaping the market is the growing interest in hydrogen-capable turbines as part of the country’s decarbonization strategy. Australia is investing heavily in green hydrogen production, aiming to become a global leader in this emerging sector. Gas turbine manufacturers are responding by developing and retrofitting units to run on hydrogen blends or 100% hydrogen, reducing carbon emissions. Major energy companies are piloting hydrogen-compatible turbines to align with Australia’s long-term sustainability goals. This shift is further supported by government incentives and partnerships between industry players and research institutions. Australia's ACCU Scheme awards one carbon credit for every tonne of CO₂ avoided or sequestered by projects in different sectors such as energy, transport, and land use, thus enabling the decarbonization of high-emitting industries. Gas turbine operators can benefit by applying low-emission upgrades and purchasing tradable credits under strict Offset Integrity Standards. The Clean Energy Regulator has the task of ensuring compliance and overseeing government-backed carbon contracts, which assist in reaching emissions goals and encouraging investment in cleaner technologies. While technical challenges such as combustion stability and material compatibility remain, advancements in turbine technology are accelerating adoption. As hydrogen infrastructure develops, gas turbines will play a crucial role in providing low-emission, dispatchable power, ensuring their relevance in Australia’s changing energy landscape.

Australia Gas Turbine Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on technology, design type, rated capacity, and end-user.

Technology Insights:

- Combined Cycle Gas Turbine

- Open Cycle Gas Turbine

The report has provided a detailed breakup and analysis of the market based on the technology. This includes combined cycle gas turbine and open cycle gas turbine.

Design Type Insights:

- Heavy Duty (Frame) Type

- Aeroderivative Type

A detailed breakup and analysis of the market based on the design type have also been provided in the report. This includes heavy duty (frame) type and aeroderivative type.

Rated Capacity Insights:

- Above 300 MW

- 120-300 MW

- 40-120 MW

- Less Than 40 MW

The report has provided a detailed breakup and analysis of the market based on the rated capacity. This includes above 300 MW, 120-300 MW, 40-120 MW, and less than 40 MW.

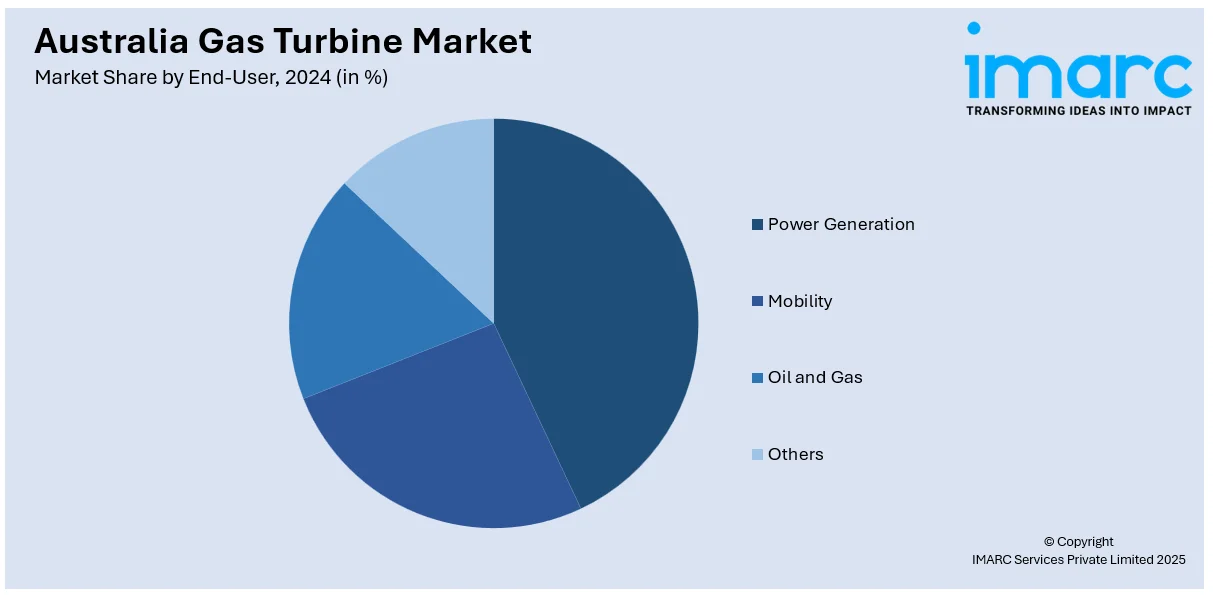

End-User Insights:

- Power Generation

- Mobility

- Oil and Gas

- Others

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes power generation, mobility, oil and gas, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Gas Turbine Market News:

- November 21, 2024: GE Vernova announced commissioning its first LM6000 aero-derivative gas turbine, with the full ability to run on 100% hydrogen, in the 200MW Whyalla hydrogen power plant in South Australia, scheduled to go live by early 2026. With ATCO Australia's backing, the project is in line with the state's Hydrogen Jobs Plan and grid stability goals. With over 120 hydrogen-ready turbines globally, GE Vernova is leading the charge in innovation in decarbonizing the gas turbine sector in Australia.

Australia Gas Turbine Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Combined Cycle Gas Turbine, Open Cycle Gas Turbine |

| Design Types Covered | Heavy Duty (Frame) Type, Aeroderivative Type |

| Rated Capacities Covered | Above 300 MW, 120-300 MW, 40-120 MW, Less Than 40 MW |

| End-Users Covered | Power Generation, Mobility, Oil and Gas, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia gas turbine market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia gas turbine market on the basis of technology?

- What is the breakup of the Australia gas turbine market on the basis of design type?

- What is the breakup of the Australia gas turbine market on the basis of rated capacity?

- What is the breakup of the Australia gas turbine market on the basis of end-user?

- What is the breakup of the Australia gas turbine market on the basis of region?

- What are the various stages in the value chain of the Australia gas turbine market?

- What are the key driving factors and challenges in the Australia gas turbine market?

- What is the structure of the Australia gas turbine market and who are the key players?

- What is the degree of competition in the Australia gas turbine market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia gas turbine market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia gas turbine market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia gas turbine industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)