Australia Gear Market Size, Share, Trends and Forecast by Gear Type, End Use Industry, and Region, 2025-2033

Australia Gear Market Overview:

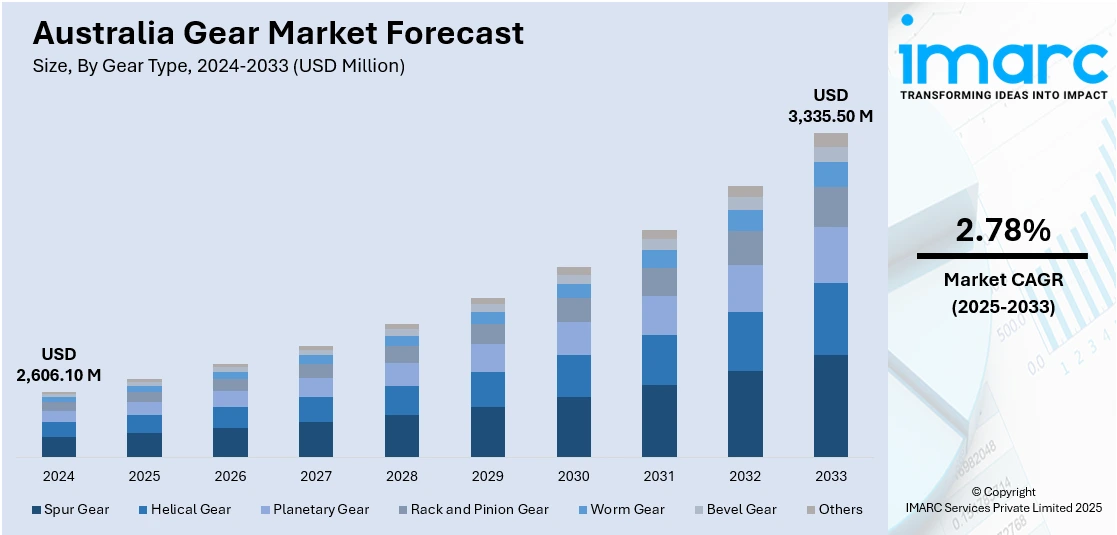

The Australia gear market size reached USD 2,606.10 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 3,335.50 Million by 2033, exhibiting a growth rate (CAGR) of 2.78% during 2025-2033. The increasing demand for performance-oriented machinery in construction, agriculture, and mining, rising automation in industries, and the development in material science are propelling the market growth. Moreover, the shift in the direction of energy-efficient products, electric vehicle usage, infrastructure growth, and increasing investments in renewable energy are propelling the market growth. Apart from this, strong demand for long-lasting and efficient gear systems, demand for light-weight materials, growing demand for accuracy in automatic systems, the focus on reducing carbon footprints, and continuous innovation in gear technology are favoring the Australia gear market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2,606.10 Million |

| Market Forecast in 2033 | USD 3,335.50 Million |

| Market Growth Rate 2025-2033 | 2.78% |

Australia Gear Market Trends:

Demand for high-performance equipment

The Australia gears market is characterized by the growing need for high-performance capacity equipment, primarily in the construction, agricultural, and mining sectors. These are sectors with heavy machinery that must be rugged yet operate under severe conditions, requiring gears that are robust but consistent. In the mining sector, for example, equipment must withstand extreme conditions like high vibration, dust, and abrasives. Thus, gears utilized in mining operations must be robust and can withstand high mechanical stress. The construction of buildings also relies on heavy equipment that requires gears to enable high workload and smooth operations, which is driving the Australia gear market growth. Additionally, advancements in gear materials and heat treatment processes have significantly improved durability and efficiency, making them more suitable for harsh environments. The increasing automation in agriculture, such as the use of tractors, harvesters, and other mechanized equipment, is also fueling demand for precision-engineered gears. Moreover, government investments in infrastructure development and mineral exploration projects are creating sustained demand for heavy-duty gear systems across Australia.

To get more information on this market, Request Sample

Expansion in Automation and Industrial Mechanization

Mechanization and automation are presently powerful forces leading the Australian gear market. With manufacturing, agricultural, and mining sectors aiming at enhancing operating efficiency, there is a growing tendency towards automated systems. Automation reduces the possibility of human error, boosts productivity, and reduces long-term operating expenses. With more companies moving to automation, there is high need for advanced gear systems that can deliver precision control and withstand the demands of automated operations. Automated production lines of manufacturing companies, for example, require highly accurate and durable gears to offer reliable performance. The mining sector is also moving towards automation, with autonomous vehicles and equipment becoming commonplace. Such machines utilize gears with higher load-carrying capacity and those that are able to operate effectively under distant or unfavorable conditions.

Improvements in Materials Science to Improve Gear Performance

Advances in materials technology have played an essential role in advancing the performance of gears used in various Australian industries. Through the use of light yet strong materials, gears that are more efficient and stronger than before are being produced. Among the materials that are being utilized for the improvement of the performance and lifespan of gears are high-strength alloys, composite materials, and better coatings. These technologies enabled gears to be operated at increased levels of stress and load without compromising efficiency. For example, technologies in materials like ceramics and carbon have greatly improved the wear resistance of gears, which is extremely important in heavy-duty applications like manufacturing and mining. Moreover, thermally stable and corrosion-resistant materials are to be employed in hostile environments, such as those found in the marine and mining sectors.

Australia Gear Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on gear type and end use industry.

Gear Type Insights:

- Spur Gear

- Helical Gear

- Planetary Gear

- Rack and Pinion Gear

- Worm Gear

- Bevel Gear

- Others

The report has provided a detailed breakup and analysis of the market based on the gear type. This includes spur gear, helical gear, planetary gear, rack and pinion gear, worm gear, bevel gear, and others.

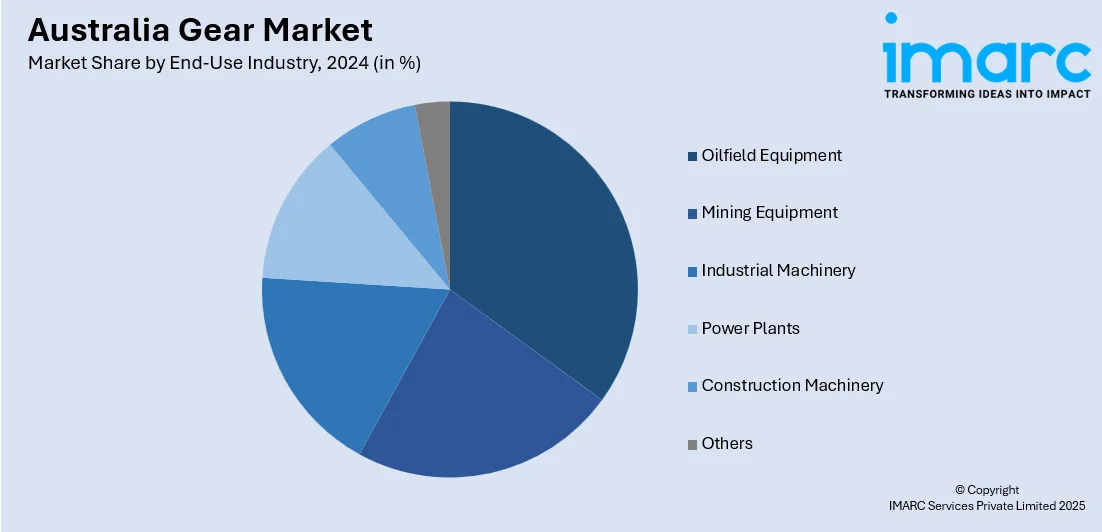

End-Use Industry Insights:

- Oilfield Equipment

- Mining Equipment

- Industrial Machinery

- Power Plants

- Construction Machinery

- Others

A detailed breakup and analysis of the market based on the end-use industry have also been provided in the report. This includes oilfield equipment, mining equipment, industrial machinery, power plants, construction machinery, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Gear Market News:

- In 2024, Fortescue has secured a USD 2.8 billion partnership with Liebherr to supply 360 autonomous electric trucks, 55 electric excavators, and 60 battery-powered dozers, aiming to convert two-thirds of its mining fleet to zero-emission technology by 2026.

- In 2024, the Tallawarra B Power Station commenced operations in New South Wales, utilizing GE Vernova’s 9F.05 gas turbine capable of running on a blend of natural gas and hydrogen, marking Australia's first dual-fuel capable power plant.

Australia Gear Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Gear Types Covered | Spur Gear, Helical Gear, Planetary Gear, Rack and Pinion Gear, Worm Gear, Bevel Gear, Others |

| End User Industries Covered | Oilfield Equipment, Mining Equipment, Industrial Machinery, Power Plants, Construction Machinery, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia gear market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia gear market on the basis of gear type?

- What is the breakup of the Australia gear market on the basis of end-use industry?

- What is the breakup of the Australia gear market on the basis of region?

- What are the various stages in the value chain of the Australia gear market?

- What are the key driving factors and challenges in the Australia gear market?

- What is the structure of the Australia gear market and who are the key players?

- What is the degree of competition in the Australia gear market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia gear market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia gear market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia gear industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)