Australia Gear Oil Market Size, Share, Trends and Forecast by Product Type, End Use Industry, and Region, 2025-2033

Australia Gear Oil Market Overview:

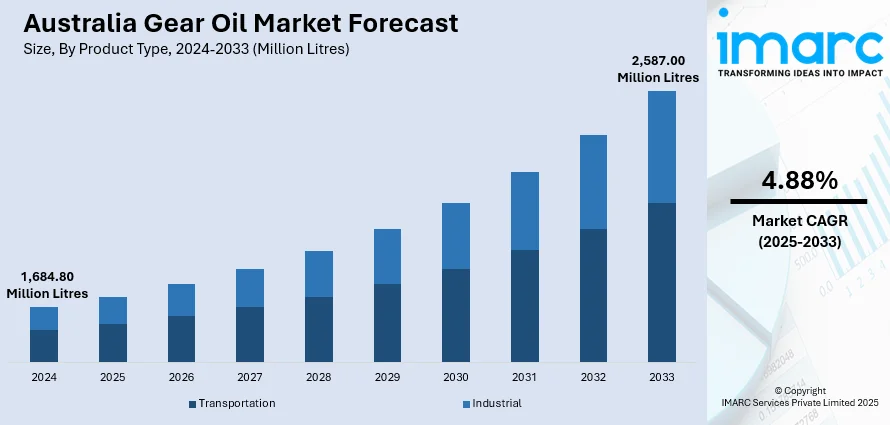

The Australia gear oil market size reached 1,684.80 Million Litres in 2024. Looking forward, IMARC Group expects the market to reach 2,587.00 Million Litres by 2033, exhibiting a growth rate (CAGR) of 4.88% during 2025-2033. The market is driven by the rapid digitalization of procurement processes, with e-commerce platforms and AI-driven tools enabling efficient gear oil selection and automated supply chain management. Additionally, stringent environmental policies, including Australia’s Circular Economy Framework, are accelerating the adoption of bio-based lubricants derived from sustainable sources. Growing industrial demand for energy-efficient and high-performance gear oils further supports market expansion, with these trends augmenting the Australia gear oil market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 1,684.80 Million Litres |

| Market Forecast in 2033 | 2,587.00 Million Litres |

| Market Growth Rate 2025-2033 | 4.88% |

Australia Gear Oil Market Trends:

Growth in Online Sales and Digital Lubricant Procurement

The market is experiencing a rise in online sales and digital procurement channels, driven by the increasing adoption of e-commerce platforms and digital transformation in the industrial sector. The Australian e-commerce industry reached a record high of AUD 63.6 Billion (approximately USD 40.98 Billion) in 2024, with fashion and electronics leading the way in sales. Online spending now accounts for 16.8% of total spending, representing a 68% increase from pre-pandemic levels. With Australian industries, such as the gear oil business, embracing digital platforms more than ever before, these figures confirm the growing role of e-commerce in driving business change and enhancing consumer interaction. Businesses are shifting towards online purchasing due to convenience, competitive pricing, and access to a wider range of products. Distributors and lubricant manufacturers are enhancing their digital presence by offering detailed product specifications, real-time inventory tracking, and automated ordering systems. Additionally, the rise of B2B marketplaces and subscription-based lubrication services is streamlining supply chain management for end-users, particularly in mining, construction, and transportation sectors. The COVID-19 pandemic further accelerated this trend, as companies sought contactless purchasing solutions. With advancements in AI-driven recommendation tools and predictive maintenance integrations, customers can now select the most suitable gear oils based on equipment requirements. As digital platforms continue to change, online sales are expected to become a dominant distribution channel, reshaping traditional lubricant supply chains in Australia.

To get more information on this market, Request Sample

Shift Towards Bio-Based and Environmentally Friendly Gear Oils

Sustainability concerns and stricter environmental policies are driving a shift towards bio-based and eco-friendly gear oils in the Australian market. Therefore, this is significantly supporting the Australia gear oil market growth. In December 2024, Australia's Circular Economy Framework was published, and its targets are a 10% reduction in material footprint, a 30% increase in material productivity, and an 80% recovery rate for resources by 2035. Industrial production has a critical role to play in this transition. The framework will influence sustainable manufacturing practices, including recycled ingredients, green chemistry, and circular product design. These efforts align with Australia's sustainability goals for industries, fostering cleaner and more resource-efficient production techniques. Traditional petroleum-based gear oils are increasingly being replaced by biodegradable alternatives derived from renewable sources such as plant-based esters and synthetic hydrocarbons. These bio-based lubricants offer comparable performance while significantly reducing environmental impact, particularly in sensitive sectors including marine, forestry, and agriculture. Government initiatives promoting sustainable practices and corporate sustainability goals are further accelerating this trend. Additionally, end-users are becoming more conscious of their carbon footprint, leading to higher adoption of green lubricants. Manufacturers are responding by developing high-performance bio-based gear oils that meet industry standards without compromising on load-bearing capacity or thermal stability. As environmental regulations tighten and consumer preferences change, the demand for sustainable gear oils is expected to rise, reshaping the competitive landscape of the market.

Australia Gear Oil Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type and end use industry.

Product Type Insights:

- Transportation

- Manual Gearbox

- Automatic Gearbox

- CVT

- DCT

- Axle Oils

- Industrial

The report has provided a detailed breakup and analysis of the market based on the product type. This includes transportation [manual gearbox, automatic gearbox (CVT and DCT), and axle oils] and industrial.

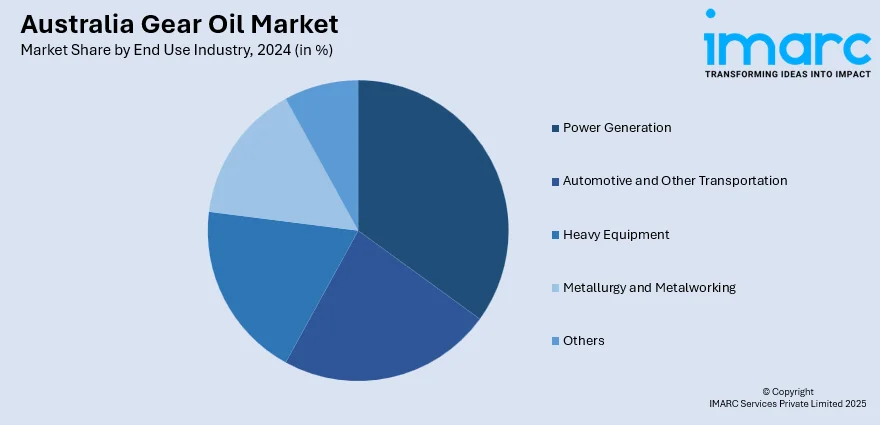

End Use Industry Insights:

- Power Generation

- Automotive and Other Transportation

- Heavy Equipment

- Metallurgy and Metalworking

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes power generation, automotive and other transportation, heavy equipment, metallurgy and metalworking, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Gear Oil Market News:

- December 13, 2024: LIQUI MOLY launched its new Special Tec T motor oil range for Australia, offering improved fuel efficiency, enhanced engine protection, and reduced consumption, with production now taking place in Thailand. The range, supplied in 205-litre drums, is designed for workshops, fleet owners, and heavy-duty transport, offering a budget-friendly solution without compromising on the high-quality standards of German engineering. This growth strengthens LIQUI MOLY's position in Australia's competitive gear oil market, ensuring reliability for both general workshops and specialized use.

Australia Gear Oil Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Litres |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| End-User Industries Covered | Power Generation, Automotive and Other Transportation, Heavy Equipment, Metallurgy and Metalworking, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia gear oil market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia gear oil market on the basis of product type?

- What is the breakup of the Australia gear oil market on the basis of end use industry?

- What is the breakup of the Australia gear oil market on the basis of region?

- What are the various stages in the value chain of the Australia gear oil market?

- What are the key driving factors and challenges in the Australia gear oil market?

- What is the structure of the Australia gear oil market and who are the key players?

- What is the degree of competition in the Australia gear oil market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia gear oil market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia gear oil market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia gear oil industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)