Australia Gearbox Market Size, Share, Trends and Forecast by Type, Gear Type, End User, and Region, 2025-2033

Australia Gearbox Market Overview:

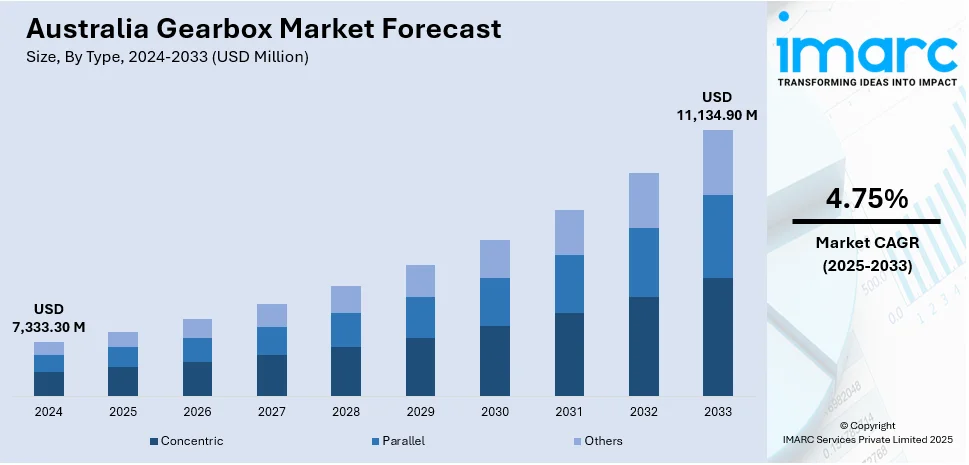

The Australia gearbox market size reached USD 7,333.30 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 11,134.90 Million by 2033, exhibiting a growth rate (CAGR) of 4.75% during 2025-2033. The market is driven by the growing demand for efficient transmission systems across industries such as mining, construction, and agriculture, supported by Australia's ongoing infrastructure development. Increasing automation in manufacturing facilities, along with a shift towards energy-efficient machinery, is fueling the adoption of advanced gearboxes. Additionally, government initiatives promoting renewable energy projects are increasing the need for gear-driven systems in wind turbines and related applications, further augmenting the Australia gearbox market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 7,333.30 Million |

| Market Forecast in 2033 | USD 11,134.90 Million |

| Market Growth Rate 2025-2033 | 4.75% |

Australia Gearbox Market Trends:

Integration of Gearbox Technologies in Renewable Energy Installations

The market is experiencing a marked impact due to increased demand from wind turbine manufacturers as the country enhances its commitment to renewable energy, particularly wind power. Gearboxes play a vital role in converting low-speed rotation from turbine blades into higher-speed output suitable for electricity generation. The country's expanding onshore wind farms, such as those in Victoria, South Australia, and Western Australia, require high-torque gearboxes that can operate under variable loads and harsh environmental conditions. According to an industry report, there are more than 300 wind farm projects in Australia that are operational and under development as of 2023. Manufacturers are responding with precision-engineered planetary and helical gear designs optimized for low noise, high durability, and minimal energy loss. As wind installations increase, the requirement for gearbox condition monitoring and predictive maintenance systems that use vibration, oil particle, and temperature data are on the rise. This trend is also supported by Australia's clean energy policies, investment incentives, and corporate procurement of renewable electricity. Furthermore, strategic collaboration between gearbox manufacturers and wind turbine OEMs is leading to design standardization and enhanced compatibility, which is positively impacting the Australia gearbox market growth.

To get more information on this market, Request Sample

Growing Emphasis on Gearbox Efficiency and Lightweight Design in Automotive Manufacturing

Australia's automotive component industry is transforming to high-value precision engineering, with an emphasis on supplying performance components for electric vehicles (EVs), hybrid vehicles, and specialty vehicles. Gearbox efficiency and lightweight design are emerging as central trends in this segment. Manufacturers are utilizing materials such as magnesium and advanced aluminum alloys to produce gear housings that reduce overall vehicle weight without compromising strength. Precision-engineered gear teeth and high-efficiency lubricants are also employed to minimize frictional losses and improve transmission efficiency. These innovations align with the growing local and export demand for low-emission and high-performance drivetrains. As per industry reports, electric vehicle (EV) sales in Australia made up 9.4% of vehicle sales by the end of April 2024. In response, Australian firms are increasingly engaging with global EV supply chains and are adapting gearbox designs to suit electric powertrains, where torque delivery and thermal behavior differ significantly from those of internal combustion engines. Also, the focus on modular gearbox assemblies that support scalability across vehicle classes is gaining traction, fostering research and development (R&D) activities and manufacturing capabilities within the market.

Australia Gearbox Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, gear type, and end user.

Type Insights:

- Concentric

- Parallel

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes concentric, parallel, and others.

Gear Type Insights:

- Spur Gear

- Worm Gear

- Bevel Gear

- Helical Gear

- Others

A detailed breakup and analysis of the market based on the gear type have also been provided in the report. This includes spur gear, worm gear, bevel gear, helical gear, and others.

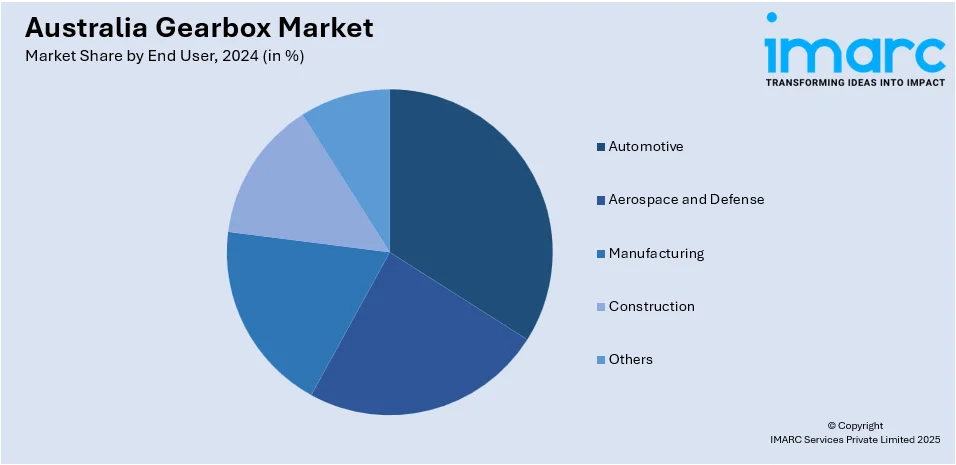

End User Insights:

- Automotive

- Aerospace and Defense

- Manufacturing

- Construction

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes automotive, aerospace and defense, manufacturing, construction, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Gearbox Market News:

- On 19 March 2024, David Brown Santasalo Australia announced a partnership with CNC Design to develop a new gearbox load test machine for its Bulli, New South Wales facility. This initiative will enhance the company's testing capabilities, increasing load test capacity from 1MW to 2.8MW, thereby enabling comprehensive in-house gearbox services. The collaboration aims to meet stringent industrial and wind sector requirements.

Australia Gearbox Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Concentric, Parallel, Others |

| Gear Types Covered | Spur Gear, Worm Gear, Bevel Gear, Helical Gear, Others |

| End Users Covered | Automotive, Aerospace and Defense, Manufacturing, Construction, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia gearbox market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia gearbox market on the basis of type?

- What is the breakup of the Australia gearbox market on the basis of gear type?

- What is the breakup of the Australia gearbox market on the basis of end user?

- What is the breakup of the Australia gearbox market on the basis of region?

- What are the various stages in the value chain of the Australia gearbox market?

- What are the key driving factors and challenges in the Australia gearbox market?

- What is the structure of the Australia gearbox market and who are the key players?

- What is the degree of competition in the Australia gearbox market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia gearbox market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia gearbox market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia gearbox industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)