Australia General Insurance Market Size, Share, Trends and Forecast by Type and Region, 2026-2034

Australia General Insurance Market Summary:

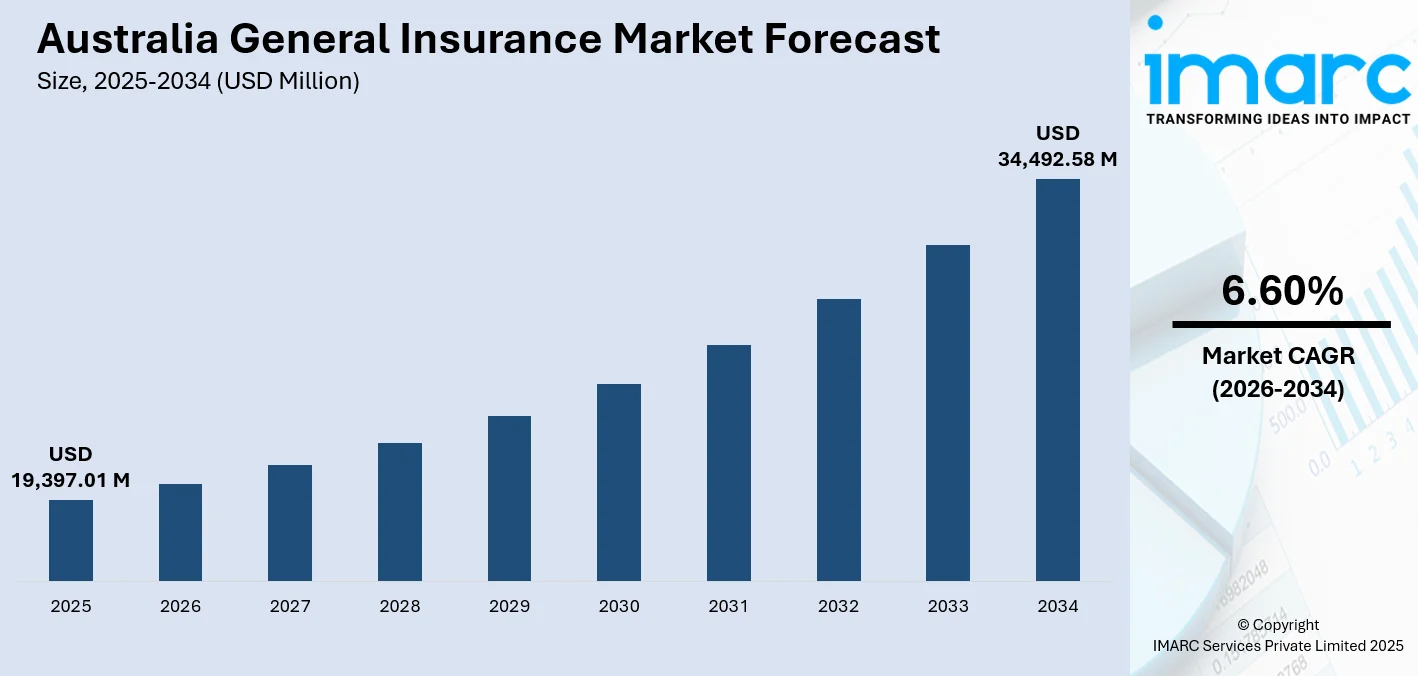

The Australia general insurance market size was valued at USD 19,397.01 Million in 2025 and is projected to reach USD 34,492.58 Million by 2034, growing at a compound annual growth rate of 6.60% from 2026-2034.

The Australia general insurance market is experiencing sustained momentum driven by heightened climate risk awareness, digital transformation initiatives, and evolving regulatory frameworks. Rising consumer demand for comprehensive protection against natural catastrophes, coupled with expanding vehicle ownership and property values, reinforces market fundamentals. Advancements in artificial intelligence, telematics-driven underwriting, and parametric insurance solutions are reshaping product offerings and distribution channels. These dynamics collectively strengthen the Australia general insurance market share.

Key Takeaways and Insights:

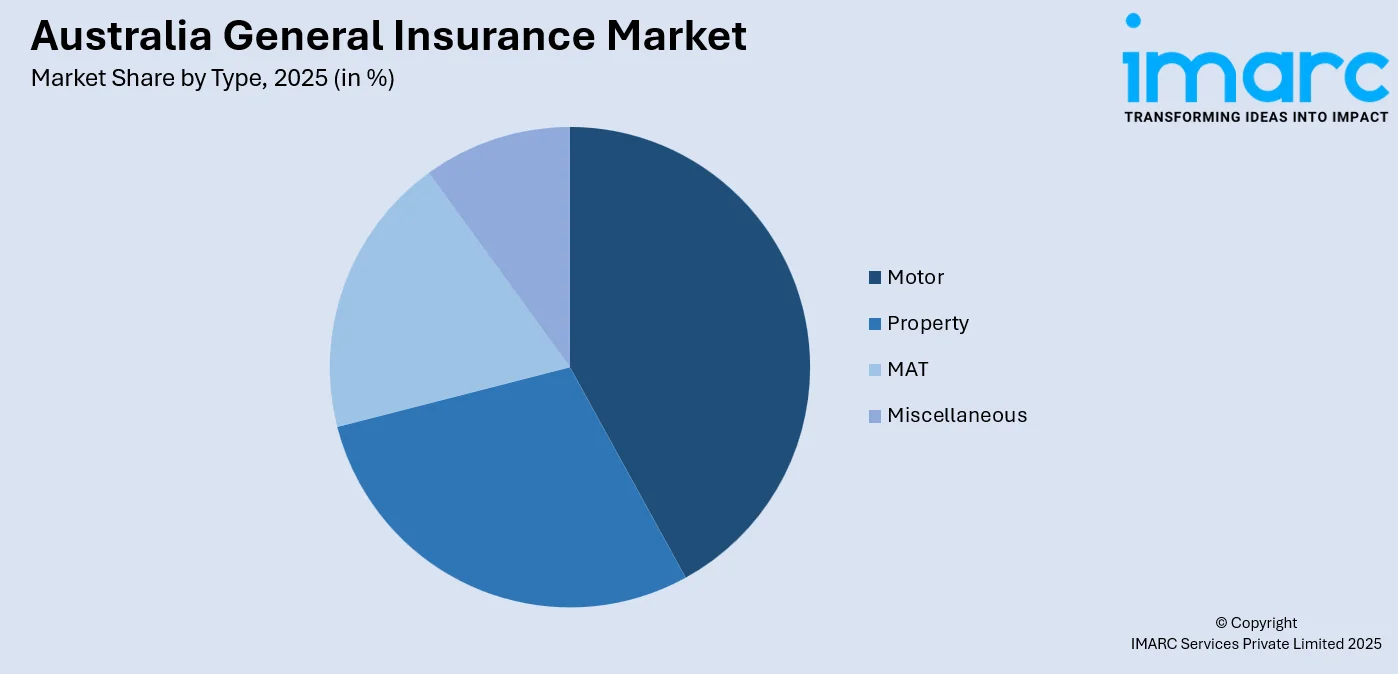

- By Type: Motor insurance dominates the market with a share of 38% in 2025, driven by high vehicle registrations across major population centers, rising comprehensive coverage adoption, and premium increases linked to repair cost inflation and advanced vehicle technology requirements.

- By Region: Australia Capital Territory & New South Wales leads the market with a share of 25% in 2025, attributed to Sydney's position as the nation's financial hub, substantial property values, high population density, and concentrated commercial insurance activity requiring comprehensive risk coverage solutions.

- Key Players: The Australian general insurance market shows moderate competition, with companies strengthening their presence through digital innovation, broader product offerings, strategic acquisitions, and improved claims management, creating a competitive environment focused on efficiency, customer experience, and service differentiation.

To get more information on this market Request Sample

The Australia general insurance market continues evolving as insurers adapt to increasingly complex risk landscapes shaped by climate volatility and technological disruption. Major players are investing substantially in artificial intelligence and data analytics to enhance underwriting precision, accelerate claims processing, and deliver personalized customer experiences. For instance, in August 2025, Suncorp opened a Disaster Management Center in Brisbane utilizing AI and aerial/satellite imagery to assess natural disaster damage, comparing pre- and post-event imagery to estimate repair costs and expedite claims processing. The integration of telematics in motor insurance enables usage-based pricing models that reward safe driving behaviors while improving risk assessment accuracy. Parametric insurance products offering rapid payouts triggered by predefined weather thresholds are gaining traction, particularly for properties exposed to flood and cyclone risks. The market outlook remains positive as economic fundamentals support continued premium growth while innovation drives operational efficiencies.

Australia General Insurance Market Trends:

Climate-Responsive Parametric Insurance Solutions

The increasing frequency and severity of natural disasters are accelerating demand for parametric insurance products that deliver instantaneous payouts based on indexed weather events. These products address policyholder needs for rapid claim settlement during crisis situations, utilizing satellite imagery, IoT sensors, and predictive modeling for enhanced risk assessment. Following Ex-Tropical Cyclone Alfred in March 2025, over 63,600 insurance claims were filed, highlighting the critical need for efficient catastrophe response mechanisms. Parametric solutions triggered by rainfall thresholds or fire-danger ratings are gaining traction, contributing to Australia general insurance market growth.

Digital Transformation and AI-Powered Claims Processing

Digital transformation is reshaping insurance operations through artificial intelligence integration, automated claims management, and enhanced customer service platforms. Insurers are deploying AI-powered chatbots, predictive analytics, and machine learning algorithms to streamline underwriting decisions and accelerate claims resolution. Insurance Australia Group (IAG) reported strong profit growth in June 2025, crediting AI-driven technology for accelerating claims processing and customer acquisition. The deployment of online self-service platforms enables customers to obtain quotes, purchase policies, and manage claims digitally, reducing operational costs while improving accessibility and service responsiveness.

Usage-Based Insurance and Telematics Integration

Telematics technology is transforming motor insurance through usage-based pricing models that correlate premiums with actual driving behaviors rather than traditional demographic risk factors. Connected devices monitor driving patterns including speed, braking habits, and mileage, to enable personalized premium calculations and reward safe drivers. For instance, in March 2024, KOBA Insurance launched an electric vehicle insurance product tailored to EV drivers, featuring repair service choices, EV car hire, charging equipment coverage, and battery health assessments. This behavioral approach enhances customer engagement while improving risk selection accuracy for insurers.

Market Outlook 2026-2034:

The outlook for the Australian general insurance market remains optimistic as insurers strive to balance profitability with broader coverage accessibility amid an evolving risk landscape. Recent regulatory updates, including the introduction of enhanced accountability frameworks and updated prudential standards, are strengthening governance and promoting market stability. At the same time, ongoing digital innovation and collaboration with technology-driven platforms are expected to drive operational efficiencies, support product development, and enhance customer experiences, positioning the market for sustained growth and resilience in a rapidly changing insurance environment. The market generated a revenue of USD 19,397.01 Million in 2025 and is projected to reach a revenue of USD 34,492.58 Million by 2034, growing at a compound annual growth rate of 6.60% from 2026-2034.

Australia General Insurance Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Motor |

38% |

|

Region |

Australia Capital Territory & New South Wales |

25% |

Type Insights:

Access the comprehensive market breakdown Request Sample

- Property

- Motor

- MAT

- Miscellaneous

Motor dominates with a market share of 38% of the total Australia general insurance market in 2025.

Motor insurance remains the largest segment within Australia’s general insurance market, fueled by high vehicle ownership, mandatory coverage requirements, and ongoing adjustments in premium rates. Demand is particularly strong in regions with dense populations and extensive road networks, positioning certain states as key markets for motor insurance products. The segment continues to attract focus from insurers due to its broad customer base, consistent renewal patterns, and opportunities for offering diversified coverage options to meet evolving consumer needs. Comprehensive motor insurance premiums have increased by 42% since 2019, reflecting escalating input costs including parts, labor, and advanced vehicle repair technologies.

The motor insurance segment continues evolving through technological innovation and product diversification. Telematics integration enables usage-based insurance models that calculate premiums based on actual driving behavior rather than demographic factors alone. The growing adoption of electric and hybrid vehicles is prompting insurers to develop specialized coverage products addressing unique EV-related risks including battery performance, charging equipment protection, and specialized repair requirements. Digital transformation across distribution channels facilitates seamless policy comparison, purchase, and claims management through mobile applications and online platforms.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Australia Capital Territory & New South Wales leads the market with a 25% share of the total Australia general insurance market in 2025.

New South Wales holds a leading position in Australia’s general insurance market, driven by its strong financial services infrastructure, high levels of commercial activity, and valuable property holdings concentrated around Sydney. The region’s concentration of insured assets, combined with exposure to natural hazards such as coastal storms and flooding, contributes to substantial insurance activity. Additionally, the presence of major insurer operations and headquarters reinforces the state’s role as a central hub for insurance innovation, distribution, and market development, making it a key driver of the country’s general insurance landscape.

The Australian Capital Territory complements New South Wales through government-related insurance requirements and a high proportion of professional service industries requiring commercial liability coverage. Sydney's finance cluster drives demand for directors-and-officers insurance, cyber liability products, and professional indemnity coverage. Sophisticated catastrophe modeling utilizing lidar elevation data enables insurers to segment risk at the street level, maintaining loss ratio discipline despite increasing claim frequency from flood and storm events. New strata laws effective July 2025 focus on fairness, stability, and transparency, requiring updated insurance coverage approaches for multi-unit residential developments.

Market Dynamics:

Growth Drivers:

Why is the Australia General Insurance Market Growing?

Rising Frequency and Intensity of Natural Catastrophes

The increasing prevalence of extreme weather events including floods, bushfires, and cyclones is driving heightened awareness and demand for comprehensive insurance protection across residential and commercial sectors. Climate volatility has fundamentally shifted consumer attitudes toward risk coverage, transforming insurance from optional to essential protection. According to the Insurance Council of Australia, the country recorded nsured losses nationwide decreased sharply, dropping from over $3.6 billion in 2023 to around $500 million in the following year. Natural hazard costs have reached record levels, with insured costs of extreme weather events totaling AUD 22.5 billion over the past five years. Insurers are responding with enhanced catastrophe modeling, risk-based pricing adjustments, and innovative products designed to address evolving climate risks. This sustained exposure to natural disasters continues driving premium growth and coverage expansion across the market.

Digital Transformation and Technology Integration

Technology integration is revolutionizing insurance operations through artificial intelligence, machine learning, and advanced data analytics capabilities. Insurers are deploying AI-powered systems to enhance underwriting accuracy, accelerate claims processing, and improve customer service delivery. The Australia Insurtech market size reached USD 376.7 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 4,186.9 Million by 2034, exhibiting a growth rate (CAGR) of 30.68% during 2026-2034. For instance, in February 2025, the governments of Australia and the United Kingdom launched a joint initiative called the UK-Australia Insurtech Pathway to support cross-border expansion for insurtech firms. Digital platforms enable real-time quotes, streamlined onboarding, and automated servicing that increase market accessibility while reducing operational costs. Cloud computing infrastructure supports scalable operations and innovative product development, positioning technology-forward insurers for competitive advantage.

Regulatory Reforms and Governance Enhancement

Australia's regulatory framework continues strengthening through enhanced prudential standards, consumer protection measures, and climate-related disclosure requirements. The Financial Accountability Regime implemented in March 2025 imposes greater accountability on senior individuals within financial institutions, reinforcing governance practices across the insurance sector. The Australian Prudential Regulation Authority introduced Prudential Standard CPS 230 in July 2025, requiring insurers to enhance operational risk management frameworks particularly in supply chain and claims handling areas. Climate-related financial disclosures under the Australian Sustainability Reporting Standards commenced phasing in from January 2025, promoting transparency regarding climate risk exposure. These regulatory developments strengthen market integrity, enhance consumer confidence, and encourage sustainable business practices across the industry.

Market Restraints:

What Challenges the Australia General Insurance Market is Facing?

Rising Premium Costs and Affordability Concerns

Premium affordability remains a significant challenge as natural disaster risks, reinsurance costs, and claims inflation drive sustained rate increases. State government taxes adding 20-40% to premium costs further compound affordability pressures for policyholders, particularly in high-risk areas. These escalating costs risk creating coverage gaps for vulnerable communities and households with limited financial capacity, potentially leading to underinsurance or policy non-renewal in areas most exposed to catastrophe risk.

Climate Change and Increasing Claims Volatility

Climate change presents fundamental challenges to traditional insurance risk assessment and pricing models. The increasing frequency and unpredictability of extreme weather events create claims volatility that strains insurer reserves and challenges profitability assumptions. Properties in flood-prone, coastal, and bushfire-risk areas face potential insurability constraints as risk profiles exceed sustainable coverage thresholds. Cascading and compounding climate events where one disaster amplifies another remain difficult to model accurately, creating uncertainty for both insurers and policyholders.

Regulatory Compliance Burden and Implementation Costs

The accelerating pace of regulatory change creates significant compliance challenges for insurers managing multiple concurrent reform initiatives. Implementation of new prudential standards, climate disclosure requirements, and consumer protection measures demands substantial investment in systems, processes, and human resources. Smaller insurers may face disproportionate compliance burdens relative to larger competitors with greater resources, potentially affecting competitive dynamics and market diversity. Ongoing regulatory evolution requires continuous adaptation and vigilance to maintain compliance while pursuing business objectives.

Competitive Landscape:

The Australian general insurance market exhibits moderate to high competitive intensity, with companies competing across diverse product lines and distribution channels. Market dynamics are shaped by investments in digital transformation, strategic acquisitions, and enhanced customer service initiatives. Emerging technology-driven entrants are challenging traditional models by offering streamlined digital experiences and innovative coverage solutions. Successful insurers differentiate themselves through efficient claims handling, strong risk management practices, and community engagement programs that build customer trust and loyalty, while consolidation and strategic partnerships continue to influence market structure and competitive positioning.

Recent Developments:

- November 2025: The Insurance Council of Australia (ICA) unveiled a new partnership with leading international AI firms, Shift Technology and EXL, to develop a nationwide data analytics platform aimed at enhancing fraud detection and investigation capabilities across the Australian insurance sector.

- August 2025: Sompo Holdings announced the acquisition of Aspen Insurance for USD 3.5 billion, expanding its global property and casualty footprint. The deal includes a 35.6% premium per share and is expected to close in early 2026, enhancing Aspen's long-term stability while supporting Sompo's 2026 growth targets.

Australia General Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Property, Motor, MAT, Miscellaneous |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia general insurance market size was valued at USD 19,397.01 Million in 2025.

The Australia general insurance market is expected to grow at a compound annual growth rate of 6.60% from 2026-2034 to reach USD 34,492.58 Million by 2034.

Motor insurance represents the largest market share at 38% in 2025, driven by extensive vehicle ownership across major population centers, rising comprehensive coverage adoption, and premium adjustments reflecting increasing repair costs and advanced vehicle technology requirements.

Key factors driving the Australia general insurance market include rising frequency of natural disasters increasing demand for catastrophe coverage, digital transformation enabling enhanced underwriting and customer service, regulatory reforms strengthening governance frameworks, and growing consumer awareness of comprehensive risk protection needs.

Major challenges include rising premium costs impacting affordability for households and businesses, climate change creating claims volatility and insurability constraints in high-risk areas, regulatory compliance demands requiring substantial investment, increasing reinsurance costs, and inflation pressures affecting claims expenses and operational costs.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)