Australia Generator Market Size, Share, Trends and Forecast by Fuel Type, Power Rating, Sales Channel, Design, Application, End User, and Region, 2026-2034

Australia Generator Market Overview:

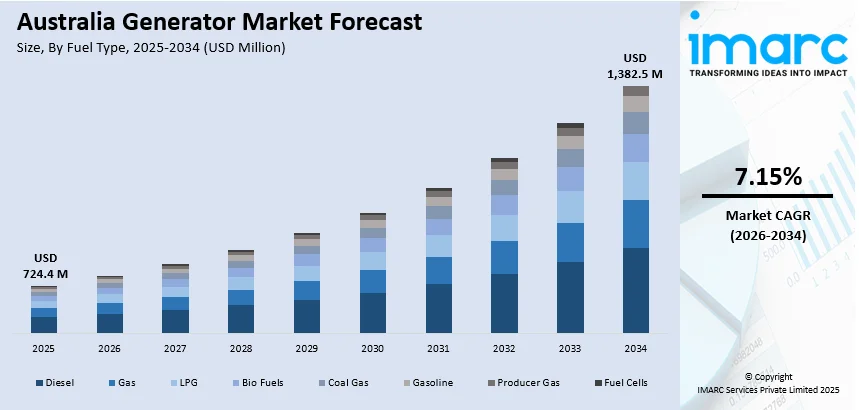

The Australia generator market size reached USD 724.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,382.5 Million by 2034, exhibiting a growth rate (CAGR) of 7.15% during 2026-2034. The market is fueled by accelerating demand for smart technology-integrated and portable generators that are compatible with renewable energy, as well as heightened attention to sustainable energy solutions and power backup flexibility in residential, commercial, and industrial applications. Increased importance on sustainable energy solutions and power backup flexibility in residential, commercial, and industrial domains drives this demand. Improvements in fuel efficiency, noise reduction, and remote-control further drive adoption. These factors collectively contribute to the increasing Australia generator market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 724.4 Million |

| Market Forecast in 2034 | USD 1,382.5 Million |

| Market Growth Rate 2026-2034 | 7.15% |

Australia Generator Market Trends:

Increasing Use of Renewable Energy-Suitable Generators

The Australia generator market is also growing significantly with the amplifying use of generators that are compatible with renewable energy sources like solar and wind. With Australia moving at a faster pace towards cleaner energy, hybrid generators that easily integrate with renewable power systems are becoming the need of the hour. These generators ensure backup power during times when renewable generation is low, maintaining a constant supply of power. Technologically advanced control systems improve fuel efficiency and cut emissions, in line with national sustainability objectives. The trend serves Australia's initiatives to lower carbon footprints without compromising energy security. Additionally, the adaptability of renewable-compatible generators makes them viable for both household and commercial use, responding to changing power requirements. Australia generator expansion demonstrates a broader transition towards sustainable and resilient energy infrastructure, with greater focus on environmental stewardship in addition to operational reliability.

To get more information on this market Request Sample

Increasing Demand for Portable and Lightweight Generators

The Australia generator market is growing with changing consumer demand toward portable and light-weight generators owing to the necessity for easy, mobile power solutions. For instance, Smaller generators are being used for diverse applications such as outdoor leisure activities, emergency power backup, and off-grid construction camps where grid availability is scarce or zero. Recent technological progress has enhanced noise suppression, fuel efficiency, and emissions management in these handheld generators, which are now more environmental-friendly and consumer-oriented. Being lightweight and compact, they are simple to move around and store, gaining their use by homeowners, small-scale enterprises, and recreation seekers. With Australia generator development going on, there will be an increased demand for adaptable and flexible power generation systems that cater to the needs of current lifestyles and changing energy use trends throughout the country.

Smart Technology and Remote Monitoring Integration

Smart technology integration is revolutionizing the Australia generator industry, which is adding immensely to its growth. New generation generators increasingly feature remote monitoring systems that provide real-time monitoring of operational variables like fuel levels, performance indicators, and maintenance timetables through mobile applications or web platforms. This interconnectivity enables users to optimize the use of generators, decrease downtime, and plan preventative maintenance, leading to increased overall efficiency and cost savings. Predictive analytics and automatic notifications ensure timely interventions, extending equipment life and improving reliability. These smart systems are especially beneficial in high-stakes industries such as healthcare, telecommunication, and manufacturing, where continuity of power is paramount. The trend towards smart generators reflects the growing need for technologically superior, networked solutions across Australia to enhance energy security as well as enable better asset management and operational transparency in the new energy environment.

Australia Generator Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on fuel type, power rating, sales channel, design, application, and end user.

Fuel Type Insights:

- Diesel

- Gas

- LPG

- Bio Fuels

- Coal Gas

- Gasoline

- Producer Gas

- Fuel Cells

The report has provided a detailed breakup and analysis of the market based on the fuel type. This includes diesel, gas, LPG, bio fuels, coal gas, gasoline, producer gas, and fuel cells.

Power Rating Insights:

- Up To 50 Kw

- 51–280 Kw

- 281–500 Kw

- 501–2,000 Kw

- 2,001–3,500 Kw

- Above 3,500 Kw

A detailed breakup and analysis of the market based on the power rating have also been provided in the report. This includes up to 50 Kw, 51–280 Kw, 281–500 Kw, 501–2,000 Kw, 2,001–3,500 Kw, and above 3,500 Kw.

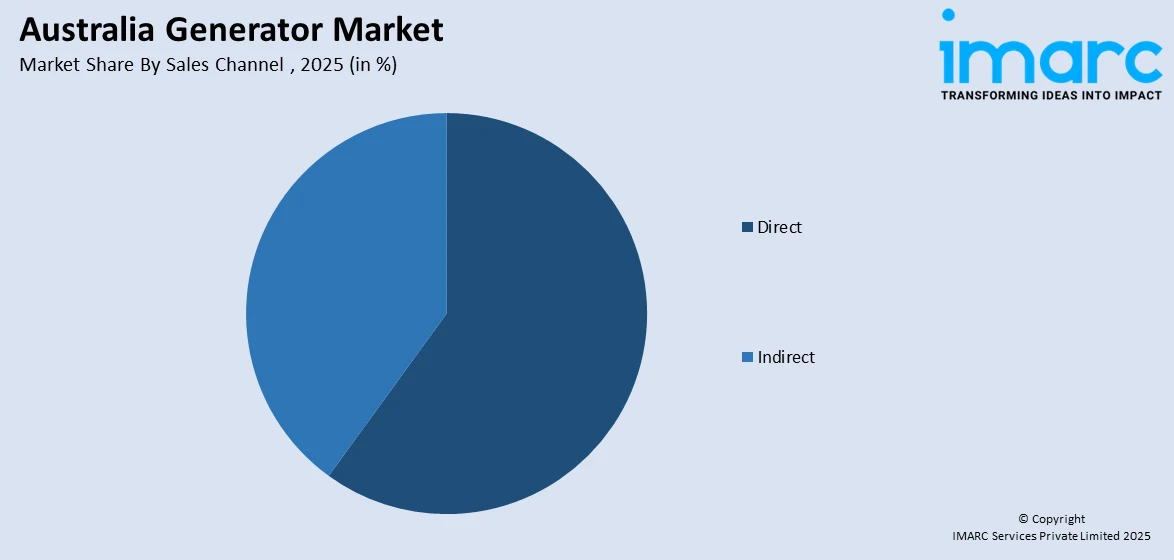

Sales Channel Insights:

Access the comprehensive market breakdown Request Sample

- Direct

- Indirect

The report has provided a detailed breakup and analysis of the market based on the sales channel. This includes direct and indirect.

Design Insights:

- Stationary

- Portable

A detailed breakup and analysis of the market based on the design have also been provided in the report. This includes stationary and portable.

Application Insights:

- Standby

- Prime and Continuous

- Peak Shaving

The report has provided a detailed breakup and analysis of the market based on the application. This includes standby, prime and continuous, and peak shaving.

End User Insights:

- Utilities/Power Generation

- Oil and Gas

- Chemicals And Petrochemicals

- Mining and Metals

- Manufacturing

- Marine

- Construction

- Others

- Residential

- Commercial

- Healthcare

- IT and Telecommunications

- Data Centers

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes utilities/power generation (oil and gas, chemicals and petrochemicals, mining and metals, manufacturing, marine, construction, others), residential, and commercial (healthcare, IT and telecommunications, data centers, others).

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Generator Market News:

- In October 2024, Baudouin unveiled its new range of diesel generator sets designed specifically for data centres. These high-performance gensets, delivering 2000 to 5250 kVA, comply with Tier III and IV standards and support sustainable fuel options like Hydrogenated Vegetable Oil (HVO), ensuring reliable, efficient, and scalable power solutions.

Australia Generator Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fuel Types Covered | Diesel, Gas, LPG, Bio Fuels, Coal Gas, Gasoline, Producer Gas, Fuel Cells |

| Power Ratings Covered | Up To 50 Kw, 51–280 Kw, 281–500 Kw, 501–2,000 Kw, 2,001–3,500 Kw, Above 3,500 Kw |

| Sales Channels Covered | Direct, Indirect |

| Designs Covered | Stationary, Portable |

| Applications Covered | Standby, Prime and Continuous, Peak Shaving |

| End Users Covered |

|

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia generator market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia generator market on the basis of fuel type?

- What is the breakup of the Australia generator market on the basis of power rating?

- What is the breakup of the Australia generator market on the basis of sales channel?

- What is the breakup of the Australia generator market on the basis of design?

- What is the breakup of the Australia generator market on the basis of application?

- What is the breakup of the Australia generator market on the basis of end user?

- What is the breakup of the Australia generator market on the basis of region?

- What are the various stages in the value chain of the Australia generator market?

- What are the key driving factors and challenges in the Australia generator?

- What is the structure of the Australia generator market and who are the key players?

- What is the degree of competition in the Australia generator market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia generator market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia generator market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia generator industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)