Australia Generic Injectables Market Size, Share, Trends and Forecast by Therapeutic Area, Container, Distribution Channel, and Region, 2025-2033

Australia Generic Injectables Market Overview:

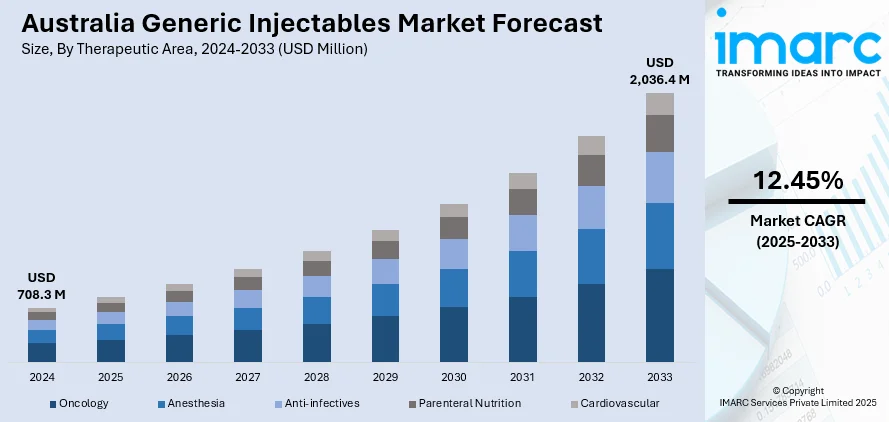

The Australia generic injectables market size reached USD 708.3 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,036.4 Million by 2033, exhibiting a growth rate (CAGR) of 12.45% during 2025-2033. Cost containment pressures, aging population, chronic disease burden, PBS pricing reforms, tender-based procurement, hospital cost efficiency goals, rising demand for parenteral therapies, expanding outpatient treatments, supply chain resilience, TGA regulatory pathways, and growing use of injectable generics in institutional protocols are some of the factors positively impacting the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 708.3 Million |

| Market Forecast in 2033 | USD 2,036.4 Million |

| Market Growth Rate 2025-2033 | 12.45% |

Australia Generic Injectables Market Trends:

Escalating Cost Containment Pressures Across the Australian Healthcare Sector

Australia's public and private healthcare systems are under increasing pressure to contain costs, primarily driven by an aging population, higher chronic disease burden, and healthcare budget constraints. In Australia, generic medicines account for approximately 75% of all prescriptions dispensed under the Pharmaceutical Benefits Scheme (PBS). As public hospitals and health insurers prioritize cost efficiency, there is a measurable pivot toward generic injectable medicines, which offer equivalent therapeutic outcomes to their branded counterparts at significantly reduced prices. This economic rationale aligns with policy preferences and purchasing frameworks of the Pharmaceutical Benefits Scheme (PBS), which favors affordable alternatives to branded formulations. Hospital procurement policies are increasingly favoring tender-based mechanisms and volume-linked agreements with generic suppliers, intensifying demand for such products. This development has directly impacted the Australia generic injectables market share, enabling generic manufacturers to penetrate institutional supply chains at an accelerated pace. Furthermore, pricing reforms in the PBS, including statutory price reductions and price disclosure mechanisms, have reinforced cost-saving imperatives. These measures encourage rapid entry of generics post-patent expiry and penalize high-priced alternatives. The increasingly price-sensitive procurement behavior among healthcare providers has prompted major suppliers to invest in supply reliability and regulatory compliance to secure long-term institutional contracts. As budgetary scrutiny tightens, the Australian injectable generics market is expected to remain a core element of national cost control strategies. The result is steady, demand-side momentum favoring generic injectables across therapeutic categories.

To get more information on this market, Request Sample

Rising Incidence of Chronic and Acute Medical Conditions Requiring Parenteral Therapies

The growing prevalence of diseases that require hospital-administered treatments—such as cancer, cardiovascular conditions, autoimmune disorders, and infectious diseases—is a key factor reinforcing the demand for injectable therapeutics. These conditions often necessitate fast-acting formulations, many of which are best delivered intravenously or intramuscularly. In Australia, subcutaneous injectables with a 2–4 week dosing interval were the most preferred injectable regimen, outperforming both more frequent and less frequent options in terms of patient and physician acceptability. The increasing clinical adoption of these therapies in both acute and long-term care settings has opened substantial opportunities for generic alternatives. Healthcare providers are prioritizing availability, treatment continuity, and supply chain resilience when selecting injectable drug suppliers. This scenario is contributing to the overall Australia generic injectables market growth across institutional channels. With multiple hospitalizations and recurrent treatment cycles becoming more common, cost-efficient generic injectables are becoming essential components of formulary strategies. Market participants are responding with expanded portfolios and faster regulatory filings, aligning with the Therapeutic Goods Administration’s (TGA) streamlined approval pathways for generics. Distributors are enhancing logistics infrastructure to support timely supply to regional hospitals and metropolitan healthcare facilities. These strategic responses are underpinned by clinical guidelines that increasingly specify injectable treatment protocols for a broadening array of chronic illnesses. The long-term Australia generic injectables market outlook remains shaped by these epidemiological and clinical trends, particularly as demographic shifts amplify demand for scalable, cost-efficient treatment solutions that align with hospital pharmacy management policies.

Australia Generic Injectables Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on therapeutic area, container, and distribution channel.

Therapeutic Area Insights:

- Oncology

- Anesthesia

- Anti-infectives

- Parenteral Nutrition

- Cardiovascular

The report has provided a detailed breakup and analysis of the market based on the therapeutic area. This includes oncology, anesthesia, anti-infectives, parenteral nutrition, and cardiovascular.

Container Insights:

- Vials

- Ampoules

- Premix

- Prefilled Syringes

The report has provided a detailed breakup and analysis of the market based on the container. This includes vials, ampoules, premix, and prefilled syringes.

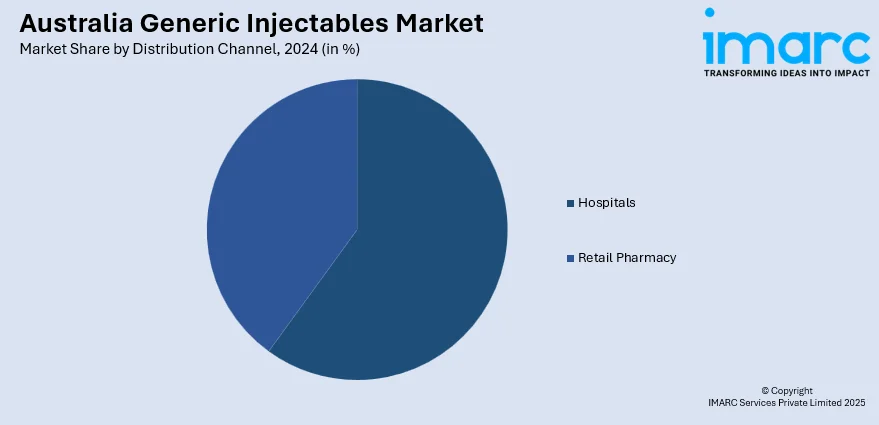

Distribution Channel Insights:

- Hospitals

- Retail Pharmacy

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes hospitals and retail pharmacy.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Generic Injectables Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Therapeutic Areas Covered | Oncology, Anesthesia, Anti-infectives, Parenteral Nutrition, Cardiovascular |

| Containers Covered | Vials, Ampoules, Premix, Prefilled Syringes |

| Distribution Channels Covered | Hospitals, Retail Pharmacy |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia generic injectables market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia generic injectables market on the basis of therapeutic area?

- What is the breakup of the Australia generic injectables market on the basis of container?

- What is the breakup of the Australia generic injectables market on the basis of distribution channel?

- What is the breakup of the Australia generic injectables market on the basis of region?

- What are the various stages in the value chain of the Australia generic injectables market?

- What are the key driving factors and challenges in the Australia generic injectables?

- What is the structure of the Australia generic injectables market and who are the key players?

- What is the degree of competition in the Australia generic injectables market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia generic injectables market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia generic injectables market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia generic injectables industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)