Australia Genetic Testing Market Size, Share, Trends and Forecast by Type, Technology, Application, and Region, 2025-2033

Australia Genetic Testing Market Overview:

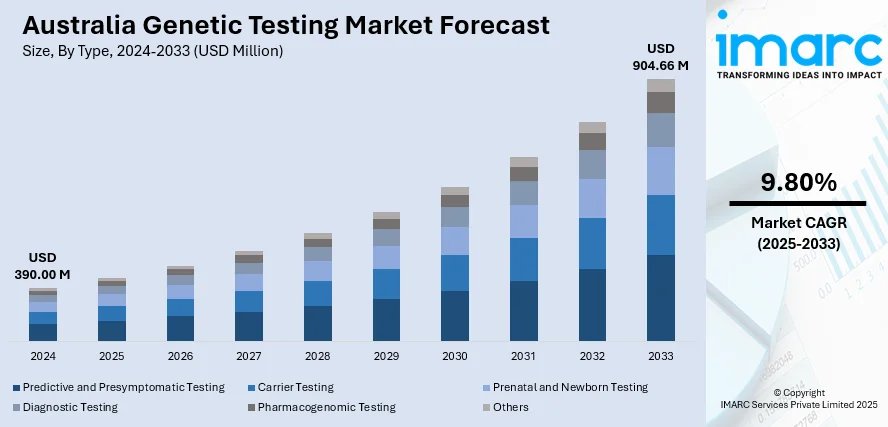

The Australia genetic testing market size reached USD 390.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 904.66 Million by 2033, exhibiting a growth rate (CAGR) of 9.80% during 2025-2033. The market is growing due to rising demand for personalized medicine, increased awareness of preventive healthcare, and advancements in genomic technologies. Government initiatives, expanded prenatal and newborn screening programs, and the popularity of direct-to-consumer (DTC) tests further propel growth. Lower sequencing costs and telehealth integration also contribute to market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 390.00 Million |

| Market Forecast in 2033 | USD 904.66 Million |

| Market Growth Rate 2025-2033 | 9.80% |

Australia Genetic Testing Market Trends:

Rising Demand for Direct-to-Consumer (DTC) Genetic Testing

The significant growth in direct-to-consumer (DTC) genetic testing, driven by increasing consumer interest in personalized health insights is favoring the Australia genetic testing market growth. Companies have popularized at-home testing kits, allowing individuals to access ancestry, health predisposition, and wellness reports without medical referrals. Advances in next-generation sequencing (NGS) and reduced testing costs have further fueled adoption. Australians are increasingly proactive about preventive healthcare, seeking genetic insights for conditions including cancer risk, cardiovascular diseases, and pharmacogenomics. Cardiovascular disease (CVD) affects 1 in every 6 Australians, or more than 4.5 million individuals, and remains one of the country's major health issues. CVD causes 24% of all deaths, a death every 12 minutes, and causes over 1,500 daily hospital admissions, with an annual cost of USD 5 Billion to public hospitals, 11% of the total cost of admissions. The elevated rates of mortality in men, Aboriginal communities, and rural dwellers all highlight the growing need for the integration of genetic risk screening into Australia's preventive cardiovascular care. Additionally, telehealth integration has made it easier for consumers to consult healthcare professionals after receiving results, enhancing market accessibility. However, concerns over data privacy and regulatory oversight remain challenges. The Therapeutic Goods Administration (TGA) is tightening guidelines to ensure test accuracy and ethical data handling, expanding the Australia genetic testing market share.

To get more information on this market, Request Sample

Expansion of Prenatal and Newborn Genetic Screening

Prenatal and newborn genetic testing is rapidly expanding in Australia, driven by advancements in non-invasive prenatal testing (NIPT) and government-backed screening programs. NIPT, which analyzes fetal DNA from maternal blood, is gaining traction due to its accuracy and safety compared to traditional invasive methods such as amniocentesis. Public and private healthcare providers are increasingly offering comprehensive carrier screening for conditions including cystic fibrosis and spinal muscular atrophy. Cystic fibrosis (CF) is a serious hereditary disorder affecting over 600 individuals in New Zealand, caused by mutations within the CFTR gene, mainly the F508del mutation, which occurs in around 90% of cases in the area. The condition is inherited when both parents carry the faulty gene, resulting in a 25% chance of their child being born with CF. Due to early diagnosis and improved treatment modalities, the outlook for individuals with CF is increasingly positive, and this emphasizes the importance of genetic screening and carrier testing in Australia's preventive health system. Additionally, state-funded newborn screening programs now include broader genetic panels for early detection of metabolic and genetic disorders. The growing emphasis on early intervention and personalized pediatric care is enhancing demand. However, ethical considerations around genetic data storage and informed consent persist. As genomic research progresses, Australia is integrating more extensive genetic screening into standard prenatal and neonatal care, further creating a positive Australia genetic testing market outlook.

Australia Genetic Testing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the county and regional levels for 2025-2033. Our report has categorized the market based on type, technology, and application.

Type Insights:

- Predictive and Presymptomatic Testing

- Carrier Testing

- Prenatal and Newborn Testing

- Diagnostic Testing

- Pharmacogenomic Testing

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes predictive and presymptomatic testing, carrier testing, prenatal and newborn testing, diagnostic testing, pharmacogenomic testing, and others.

Technology Insights:

- Cytogenetic Testing and Chromosome Analysis

- Biochemical Testing

- Molecular Testing

- DNA Sequencing

- Others

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes cytogenetic testing and chromosome analysis, biochemical testing, and molecular testing (DNA sequencing and others).

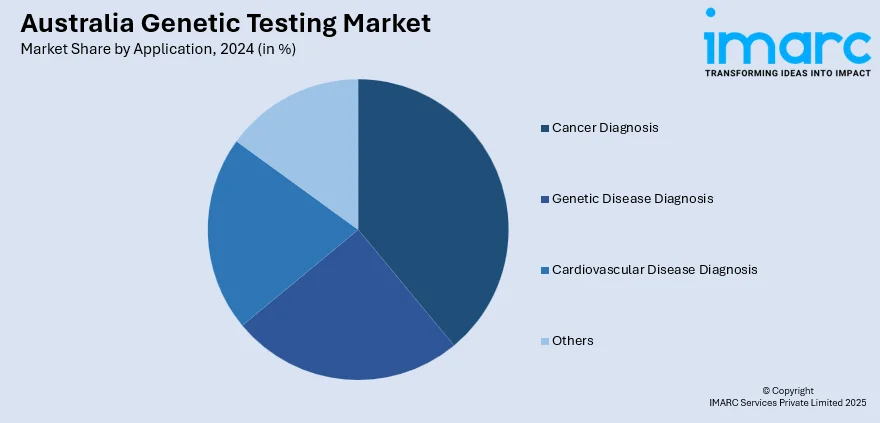

Application Insights:

- Cancer Diagnosis

- Genetic Disease Diagnosis

- Cardiovascular Disease Diagnosis

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes cancer diagnosis, genetic disease diagnosis, cardiovascular disease diagnosis, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Genetic Testing Market News:

- April 07, 2025: The Garvan Institute launched the Genomics of Rare Disease Registry to aid in diagnosing and treating rare genetic disorders affecting about 2 million Australians. Over 7,000 rare diseases, of which 80% are genetic, have been discovered, with fewer than half of the patients receiving a conclusive diagnosis and fewer than 10% having targeted therapies. Led by Associate Professors Ingles and Siggs, this effort invites Australians with diagnosed or suspected genetic disorders to join a national effort aimed at accelerating diagnosis, improving access to treatments, and connecting patients with future clinical trials.

Australia Genetic Testing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Predictive and Presymptomatic Testing, Carrier Testing, Prenatal and Newborn Testing, Diagnostic Testing, Pharmacogenomic Testing, Others |

| Technologies Covered |

|

| Applications Covered | Cancer Diagnosis, Genetic Disease Diagnosis, Cardiovascular Disease Diagnosis, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia genetic testing market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia genetic testing market on the basis of type?

- What is the breakup of the Australia genetic testing market on the basis of technology?

- What is the breakup of the Australia genetic testing market on the basis of application?

- What is the breakup of the Australia genetic testing market on the basis of region?

- What are the various stages in the value chain of the Australia genetic testing market?

- What are the key driving factors and challenges in the Australia genetic testing market?

- What is the structure of the Australia genetic testing market and who are the key players?

- What is the degree of competition in the Australia genetic testing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia genetic testing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia genetic testing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia genetic testing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)