Australia Geriatric Healthcare Market Size, Share, Trends and Forecast by Product Type, Service Type, Disease Indication, End User, and Region, 2025-2033

Australia Geriatric Healthcare Market Overview:

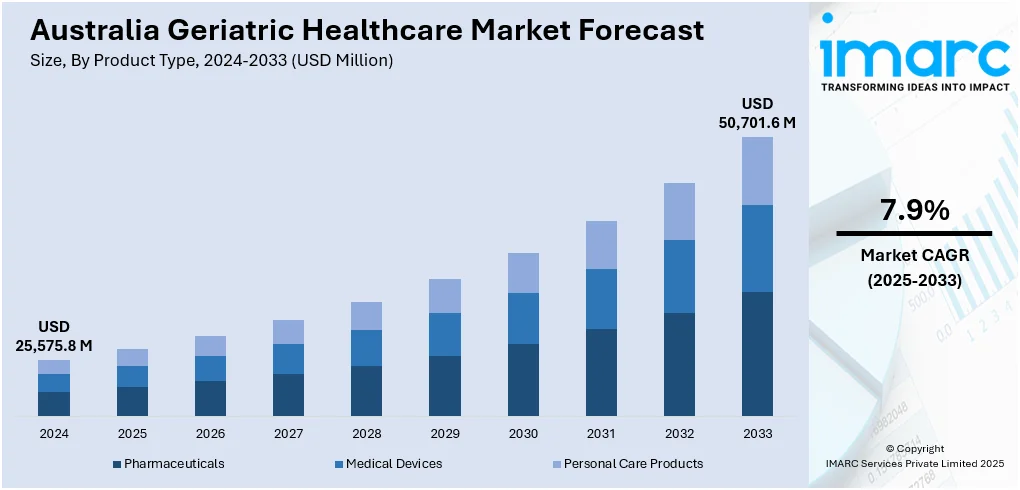

The Australia geriatric healthcare market size reached USD 25,575.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 50,701.6 Million by 2033, exhibiting a growth rate (CAGR) of 7.9% during 2025-2033. The market is witnessing radical change, fueled by rising geriatric population, advancements in digital health, and a movement toward preventive and community care. Rising investments in home support services and individualized healthcare models are improving the quality of care and accessibility. Policies at the government level are also falling in line with these trends for enabling aging in place and cutting hospital dependency. These factors are leading to consistent growth in the Australia geriatric healthcare market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 25,575.8 Million |

| Market Forecast in 2033 | USD 50,701.6 Million |

| Market Growth Rate (2025-2033) | 7.9% |

Australia Geriatric Healthcare Market Trends:

Growth in Home-Based and Community-Oriented Care

Australia is experiencing a significant growth in home-based and community-oriented care models, which cater to older patients in the comfort of their own homes. This is part of a greater transformation from institutional healthcare to person-centered delivery of healthcare, with the goals of advancing independence, minimizing hospitalizations, and maximizing resource utilization. Nursing, rehabilitation, personal care, and remote monitoring devices are increasingly being incorporated in support services within the home environment. These services are designed to respond to the sophisticated and changing needs of older persons, particularly those with chronic illnesses or mobility impairments. Greater integration between primary care practitioners and allied health specialists ensures continuity of care and reduces fragmentation. This trend not only improves quality of life for older Australians but also concords with national policy directions with a focus on preventive care and community resilience. According to the reports, in October 2024, the Australian Government invested $13 million to enhance aged care innovation by growing person-centred models of care and workforce skills through Aged Care Research and Industry Innovation Australia. Furthermore, Australia geriatric healthcare market growth is highly influenced by these decentralized, patient-focused models of service delivery.

To get more information on this market, Request Sample

Integration of Digital Health Technologies for Geriatric Management

Integration of digital health technologies is transforming geriatric care in Australia, specifically by applying telehealth, wearable sensors, and electronic health records. For instance, in July 2024, Australia's first electronic aged care screening and risk forecasting tool, created by RMIT and Telstra Health, received a national innovation award for improving elderly safety and care., Moreover, they allow real-time tracking of vital signs, medication compliance, and chronic disease progression, thereby facilitating timely intervention. For older patients who can be limited in accessing conventional care sites, such innovations introduce accessible and reliable health delivery. Post-pandemic telehealth consultations are increasingly becoming acceptable and an integral part of regular geriatric treatment by providing convenience and alleviating travel loads. In addition, wearable device data and mobile health app information assist clinicians in making informed decisions and customizing treatment plans. This integration of digitalization also promotes communication among multidisciplinary teams and enhances care coordination. With growing modernization of healthcare, the use of technology to facilitate safe, efficient, and personalized care of the older population is likely to grow, further accelerating the revolution of geriatric services in Australia.

Focus on Preventive and Proactive Aging Interventions

Australia is putting more focus on preventive health measures designed to support active aging and limit the development of age-related illnesses. Geriatric care is putting more priority on early detection, lifestyle modification, and risk reduction to postpone functional loss and dependency. Nutrition, mental health, fall prevention, cognitive stimulation, and physical activity programs are being incorporated into primary care and community-based environments. These initiatives are bolstered by public health promotion and geriatric screenings to detect risks before they become critical conditions. Proactive prevention decreases the workload of acute care systems and encourages healthier aging paths. The emphasis in policy on aging in place and preserving functional capability is particularly aligned with these preventive endeavors. Through the integration of prevention as a part of standard geriatric care, Australia hopes to enhance long-term health results as well as minimize healthcare expenditures on frailty and comorbidities, ultimately transforming the face of aged care delivery in the country.

Australia Geriatric Healthcare Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, service type, disease indication, and end user.

Product Type Insights:

- Pharmaceuticals

- Medical Devices

- Personal Care Products

The report has provided a detailed breakup and analysis of the market based on the product type. This includes pharmaceuticals, medical devices, and personal care products.

Service Type Insights:

- Home Healthcare Services

- Hospital and Clinical Services

- Assisted Living and Nursing Care

- Palliative and Hospice Care

A detailed breakup and analysis of the market based on the service type have also been provided in the report. This includes home healthcare services, hospital and clinical services, assisted living and nursing care, and palliative and hospice care.

Disease Indication Insights:

- Cardiovascular Diseases

- Neurological Disorders

- Diabetes and Endocrine Disorders

- Respiratory Disorders

- Osteoarthritis and Musculoskeletal Disorders

- Cancer

- Others

The report has provided a detailed breakup and analysis of the market based on the disease indication. This includes cardiovascular diseases, neurological disorders, diabetes and endocrine disorders, respiratory disorders, osteoarthritis and musculoskeletal disorders, cancer, and others.

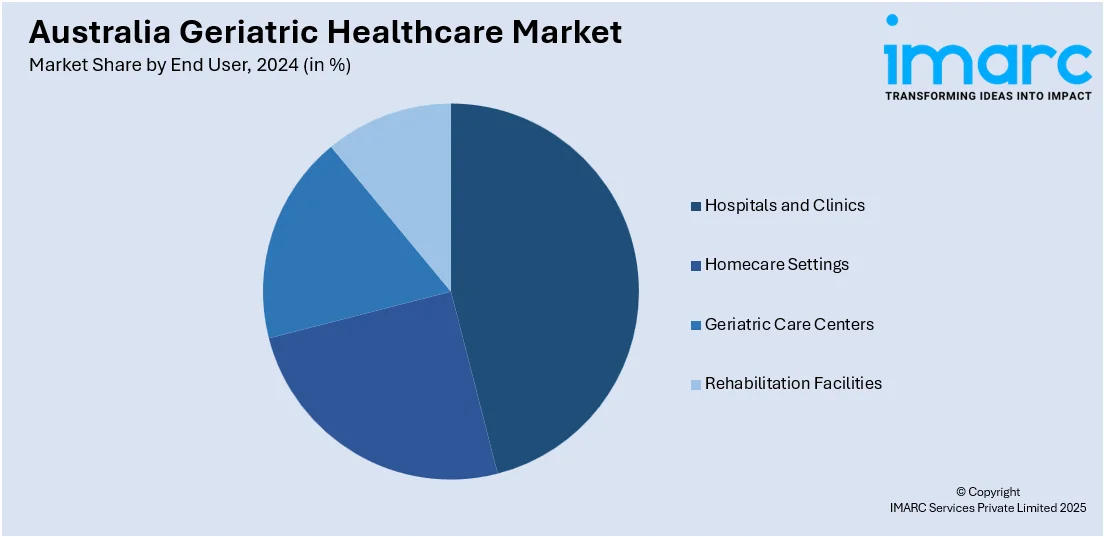

End User Insights:

- Hospitals and Clinics

- Homecare Settings

- Geriatric Care Centers

- Rehabilitation Facilities

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals and clinics, homecare settings, geriatric care centers, and rehabilitation facilities.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Geriatric Healthcare Market News:

- In September 2024, the Australian Department of Health and Aged Care began planning to launch virtual nursing through telehealth in 30 residential aged care facilities with the goal of improving person-centred care using technology integration, training the staff, and digital governance as part of its overall Aged Care Data and Digital Strategy.

- In June 2024, Telstra Health soft launch HeraCARE, the initial remote maternity solution offered through its Smart Connected Care platform. Unveiled at the May 2024 RACGP Practice Owners Conference, the early adopter rollout is expected to eventually fully integrate and onboard expecting mothers by end of year 2024.

Australia Geriatric Healthcare Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Pharmaceuticals, Medical Devices, Personal Care Products |

| Service Types Covered | Home Healthcare Services, Hospital and Clinical Services, Assisted Living and Nursing Care, Palliative and Hospice Care |

| Disease Indications Covered | Cardiovascular Diseases, Neurological Disorders, Diabetes and Endocrine Disorders, Respiratory Disorders, Osteoarthritis and Musculoskeletal Disorders, Cancer, Others |

| End User Covered | Hospitals and Clinics, Homecare Settings, Geriatric Care Centers, Rehabilitation Facilities |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia geriatric healthcare market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia geriatric healthcare market on the basis of product type?

- What is the breakup of the Australia geriatric healthcare market on the basis of service type?

- What is the breakup of the Australia geriatric healthcare market on the basis of disease indication?

- What is the breakup of the Australia geriatric healthcare market on the basis of end user?

- What is the breakup of the Australia geriatric healthcare market on the basis of region?

- What are the various stages in the value chain of the Australia geriatric healthcare market?

- What are the key driving factors and challenges in the Australia geriatric healthcare?

- What is the structure of the Australia geriatric healthcare market and who are the key players?

- What is the degree of competition in the Australia geriatric healthcare market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia geriatric healthcare market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia geriatric healthcare market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia geriatric healthcare industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)