Australia Geriatric Healthcare Products Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, End-User, and Region, 2025-2033

Australia Geriatric Healthcare Products Market Overview:

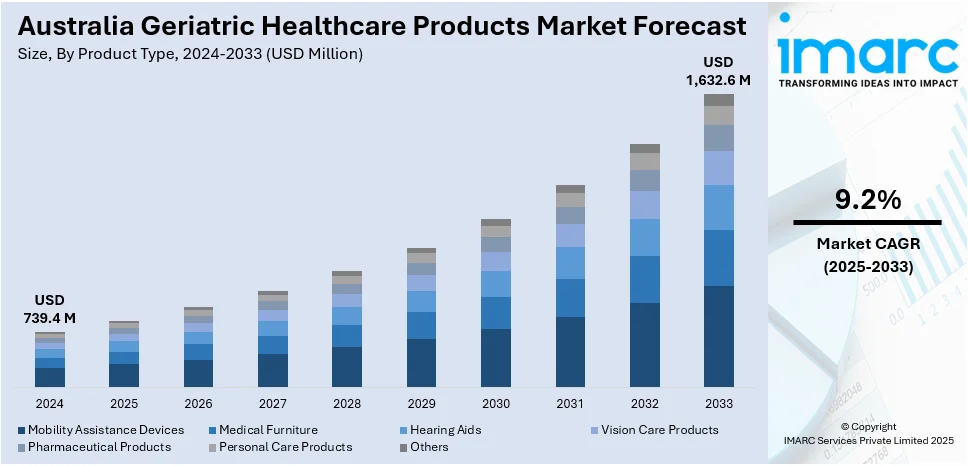

The Australia geriatric healthcare products market size reached USD 739.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,632.6 Million by 2033, exhibiting a growth rate (CAGR) of 9.2% during 2025-2033. The growing elderly population, technological advancements in healthcare, and increasing chronic conditions among seniors are fueling the market growth. Moreover, greater awareness of elderly care, a rise in home care services, increased online access to healthcare products, and government support for geriatric care are stimulating the market growth. Furthermore, cultural respect for aging individuals, innovations in medical devices, the popularity of aging in place, private health insurance coverage for elder care, improvements in product safety and ease of use, and evolving regulations that promote eldercare solutions are boosting the Australia geriatric healthcare products market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 739.4 Million |

| Market Forecast in 2033 | USD 1,632.6 Million |

| Market Growth Rate (2025-2033) | 9.2% |

Australia Geriatric Healthcare Products Market Trends:

Ageing Population in Australia

Australia is also witnessing a phenomenal rise in its aging population, which is one of the prime drivers for the geriatric healthcare products market. The proportion of people over 65 years is slowly on the rise, and projections are that by the year 2030, this demographic will represent an even higher proportion of the population. This population shift means a greater number of individuals require specialized health care devices to cope with age-related ailments and improve the quality of their lives. With the aging process, people face mobility constraints, impaired hearing, and age-related diseases like arthritis or diabetes. This, in turn, accentuates the demand for products like mobility aid devices, hearing aid devices, orthopedic appliances, and home care devices. Besides, the need for long-term care products like in-home monitoring equipment and medical devices also rises. For instance, The Australian government provided Aged Care Research and Industry Innovation Australia (ARIIA) USD 13 million to support evidence-based practice and enhance the quality of care for Australian older people, which is further driving the Australia geriatric healthcare products market growth.

To get more information on this market, Request Sample

Continuous Advancements in Healthcare Technology

The health care industry has witnessed huge technological revolution, which has led to the emergence of new products especially intended for the aged population. For example, vital signs monitoring devices like heart rate, blood pressure, and oxygen level have come a long way to become more advanced, affordable, and within reach. In addition, wearables, such as smartwatches and fitness trackers, can now monitor a range of health indicators in real-time, providing older adults and their caregivers with critical information about the state of their health. These innovations are not just making healthcare more efficient but also improving quality of life for older individuals as a whole. Equipment like automated medication dispensers, fall detectors, and advanced mobility aids are also gaining popularity. These products allow the elderly to live independently, better communicate with physicians and nurses, and get instant treatment when necessary. As the elderly become more technologically savvy, these advanced healthcare solutions will gain immense demand, making it a prime growth driver.

Risk of Long-Term Conditions

This is another important driver of the growth of the geriatric healthcare products market in Australia. Older people are more susceptible to diseases that must be treated in the long term and require specialized products. For instance, people with arthritis often need joint braces, walking aids like walkers and canes, and pain management devices to go about their daily lives. Those with diabetes, on the other hand, might need monitoring devices, insulin pumps, and protective footwear to be able to manage their condition effectively. The increasing prevalence of such illnesses has created a vast market for products that aid in chronic disease management in the elderly. Medical supplies that assist in managing pain, mobility, or a nutritious diet are in great demand, especially as the elderly seek ways to maintain their independence despite suffering from the diseases. As more elderly individuals suffer from chronic illnesses, so does demand for specialty health care products rise, and this forms a key consideration for market growth.

Australia Geriatric Healthcare Products Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, distribution channel, and end-user.

Product Type Insights:

- Mobility Assistance Devices

- Wheelchairs’

- Walkers

- Canes

- Medical Furniture

- Hospital Beds

- Lift Chairs

- Hearing Aids

- Vision Care Products

- Reading Glasses

- Contact Lenses

- Pharmaceutical Products

- Chronic Disease Medications

- Supplements

- Personal Care Products

- Adult Diapers

- Skincare

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes mobility assistance devices (wheelchairs, walkers, and canes), medical furniture (hospital beds and lift chairs), hearing aids, vision care products (reading glasses and contact lenses), pharmaceutical products (chronic disease medications and supplements), personal care products (adult diapers and skincare), and others.

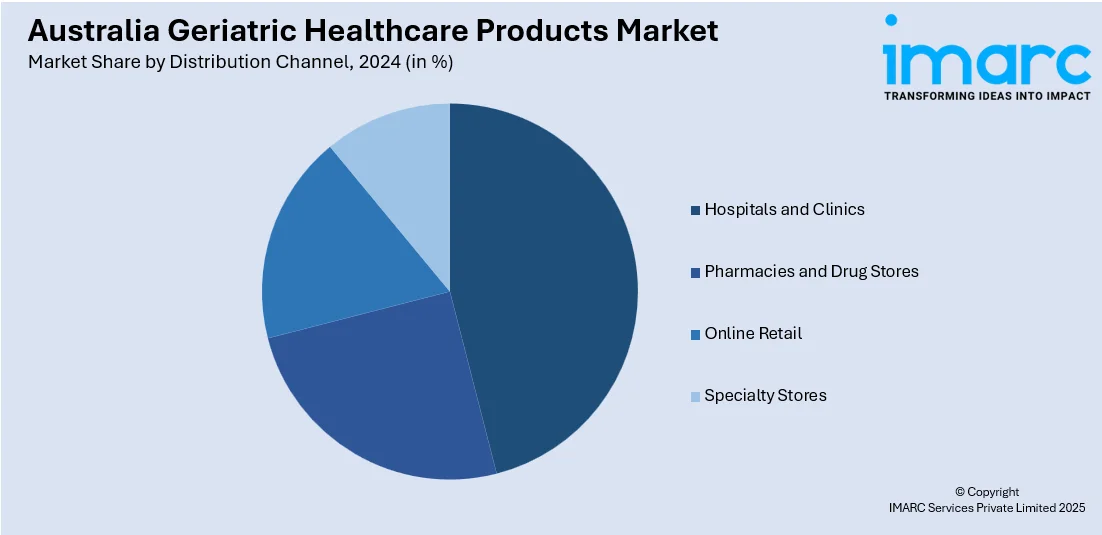

Distribution Channel Insights:

- Hospitals and Clinics

- Pharmacies and Drug Stores

- Online Retail

- Specialty Stores

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes hospitals and clinics, pharmacies and drug stores, online retail, and specialty stores.

End-User Insights:

- Home Healthcare

- Assisted Living Facilities

- Nursing Homes

- Hospitals

The report has provided a detailed breakup and analysis of the market based on the end-user. This includes home healthcare, assisted living facilities, nursing homes, and hospitals.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Geriatric Healthcare Products Market News:

- In 2025, Minikai, an AI startup, raised USD 2.5 million to automate administrative tasks in aged care, focusing on reducing caregiver burnout and enhancing operational efficiency. The technology is designed to assist with care management, improving productivity in aged care facilities and addressing long-standing industry challenges

Australia Geriatric Healthcare Products Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Distribution Channels Covered | Hospitals and Clinics, Pharmacies and Drug Stores, Online Retail, Specialty Stores |

| End-Users Covered | Home Healthcare, Assisted Living Facilities, Nursing Homes, Hospitals |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia geriatric healthcare products market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia geriatric healthcare products market on the basis of product type?

- What is the breakup of the Australia geriatric healthcare products market on the basis of distribution channel?

- What is the breakup of the Australia geriatric healthcare products market on the basis of end-user?

- What is the breakup of the Australia geriatric healthcare products market on the basis of region?

- What are the various stages in the value chain of the Australia geriatric healthcare products market?

- What are the key driving factors and challenges in the Australia geriatric healthcare products market?

- What is the structure of the Australia geriatric healthcare products market and who are the key players?

- What is the degree of competition in the Australia geriatric healthcare products market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia geriatric healthcare products market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia geriatric healthcare products market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia geriatric healthcare products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)