Australia Glass Market Size, Share, Trends and Forecast by Product Type, End Use Industry, and Region, 2026-2034

Australia Glass Market Overview:

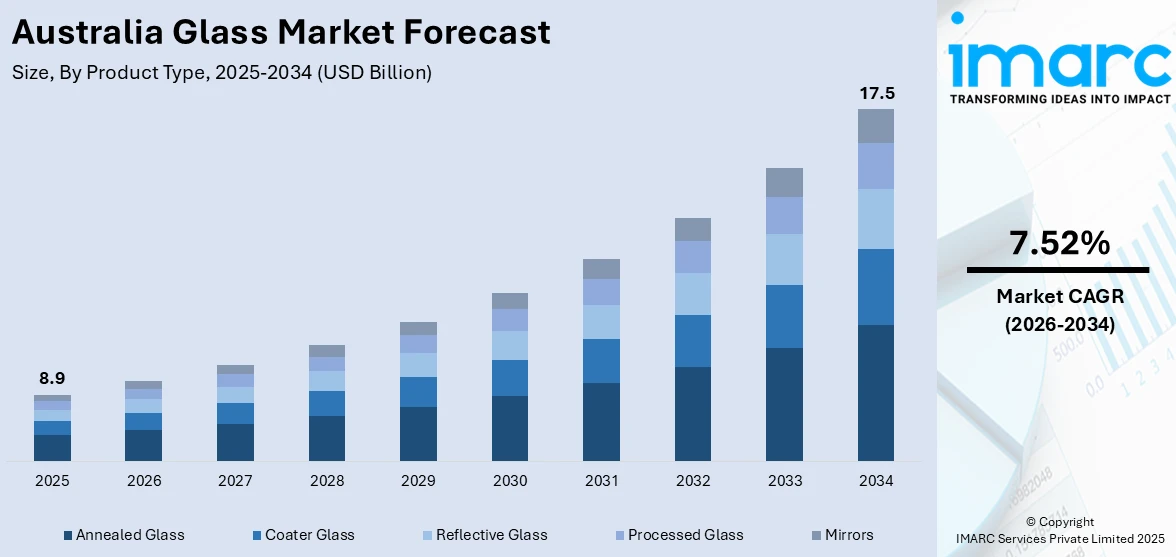

The Australia glass market size reached USD 8.9 Billion in 2025. Looking forward, the market is projected to reach USD 17.5 Billion by 2034, exhibiting a growth rate (CAGR) of 7.52% during 2026-2034. The market is developing with a keen emphasis on energy-efficient glazing, architectural decorative applications, and green recycling methods. Smart glass developments and advanced coatings are improving building performance, while innovative glass designs are enhancing visual appeal within urban developments. Moreover, enhanced recycling technologies contribute to green production. These trends work together to propel sector growth in response to increasing demand for flexible, sustainable glass solutions. This dynamic growth heavily influences the Australia glass market share in the large-scale construction and manufacturing sector.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 8.9 Billion |

| Market Forecast in 2034 | USD 17.5 Billion |

| Market Growth Rate 2026-2034 | 7.52% |

Key Trends of Australia Glass Market:

Rising Need for Energy Efficient Glass Solutions

The Australian building sector is facing an escalating need for energy-efficient glass solutions because of increased awareness about sustainability and compliance requirements to limit energy consumption in buildings. Low emissivity coated glass, double and triple glazing, and smart glass technology that changes its transparency according to exposure to sunlight are witnessing increased demand. These technologies contribute to indoor temperature control, minimizing the use of heating and cooling systems, as well as lowering the greenhouse gas emissions. In turn, energy-efficient glazing is revolutionizing architectural practice and facilitating green building certifications. This shift toward sustainable building materials is a driving force in the current Australia glass expansion, placing glass as a key factor in sustainable building designs. While urbanization speeds up, energy-saving glass technologies will dominate new developments, supporting the sector's move toward innovation aligned with international climate goals.

To get more information on this market Request Sample

Increasing Use of Architectural and Decorative Glass

The flexibility of glass continues to propel its increased application in architectural and decorative uses throughout Australia. Specialty glass forms like tint, frosted, patterned, and textured glasses are being more and more incorporated into commercial and residential construction to add glamour and utility. All these kinds of decorative glass items offer privacy, diffused lighting, and unique visual signatures, all adding up to the design story of contemporary buildings. Moreover, glass is frequently employed in façades, partitions, balustrades, and interior feature walls, reflecting a trend toward openness and natural light maximization in building design. This diversification fosters creativity among architects and interior designers, aligning with contemporary preferences for light-filled and visually engaging spaces. Furthermore trend, Australia glass market growth is further supported by increasing need for new glass products that marry beauty and performance, transforming urban skies with increased architectural refinement.

Increases in Glass Recycling and Sustainability Measures

Sustainability measures are increasingly shaping the Australian glass market, with remarkable improvements in recycling and environmentally friendly manufacturing techniques. New recycling technologies allow effective collection and reworking of glass cullet, thus minimizing raw material processing and energy consumption in production. This leads to a decrease in carbon footprints and aid in circular economy principles by promoting waste reduction and conserving resources. The market for recycled glass in packaging, construction, and automotive industries is increasing gradually as consumers and regulatory agencies focus on environmental stewardship. Further, production methods are becoming greener as manufacturers implement cleaner products and processes to meet national sustainability objectives. For instance, in July 2024, Visy ordered a USD150 Million oxygen-only glass furnace at Penrith, reducing energy consumption by half and allowing for production of 800 million recycled glass containers per year in New South Wales. Moreover, these efforts support the sustained Australia glass market growth in a demonstration of how environmental responsibility can coexist with competitiveness and innovation in product development.

Growth Drivers of Australia Glass Market:

Automotive Industry Expansion

Australia's automotive industry is seeing huge growth, and with that, there is a higher demand for different kinds of automotive glass including windshields, side windows, and sunroofs. It is driven by increased vehicle manufacturing and consumers' demand for newer, safer vehicles, which drives the use of excellent quality tempered and laminated glass. Manufacturers are also putting money into new glass technologies in order to improve durability, UV protection, and sound reduction. In addition, the growing electric vehicle industry, which is infamous for using bigger and more complex glass parts, is driving this demand even further. As the automotive industry continues to grow in passenger cars, commercial vehicles, and luxury segments, glass consumption is anticipated to rise steadily, directly impacting Australia glass market demand in both original equipment manufacturing (OEMs) and replacement sectors.

Growth in Renewable Energy Sector

The renewable energy industry is increasingly emerging as a dominant driver of Australia's glass market especially through the growing installation of solar panels and energy-efficient building products. Glass is a key component for photovoltaic panels providing strength, clarity, and protection for solar cells and enhanced energy efficiency. Additionally, energy-efficient building practices are heightening the demand for low-emissivity and insulated glass in windows and façades to reduce heating and cooling costs. As renewable energy use increases manufacturers are focusing their efforts on making specialized glass intended for solar and energy applications. These advancements are enhancing production and distribution channels, thereby growing the presence of Australia glass market share in both residential and commercial energy projects.

Technological Advancements

Innovations in the glass industry, including tempered, laminated, and coated glass, are significantly improving functionality and safety in various applications across Australia. Tempered glass offers enhanced strength and break resistance, whereas laminated glass provides superior security and sound insulation. Coated and smart glass solutions are increasingly being utilized in architectural, automotive, and electronic sectors to regulate heat, light, and energy efficiency. Progress in manufacturing processes and materials has also permitted the creation of more customized, high-performance products that meet modern design and safety standards. According to Australia glass market analysis, these developments are reshaping the competitive landscape and promoting adoption across industries, contributing to market expansion.

Australia Glass Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product type and end use industry.

Product Type Insights:

- Annealed Glass

- Coater Glass

- Reflective Glass

- Processed Glass

- Mirrors

The report has provided a detailed breakup and analysis of the market based on the product type. This includes annealed glass, coater glass, reflective glass, processed glass, and mirrors.

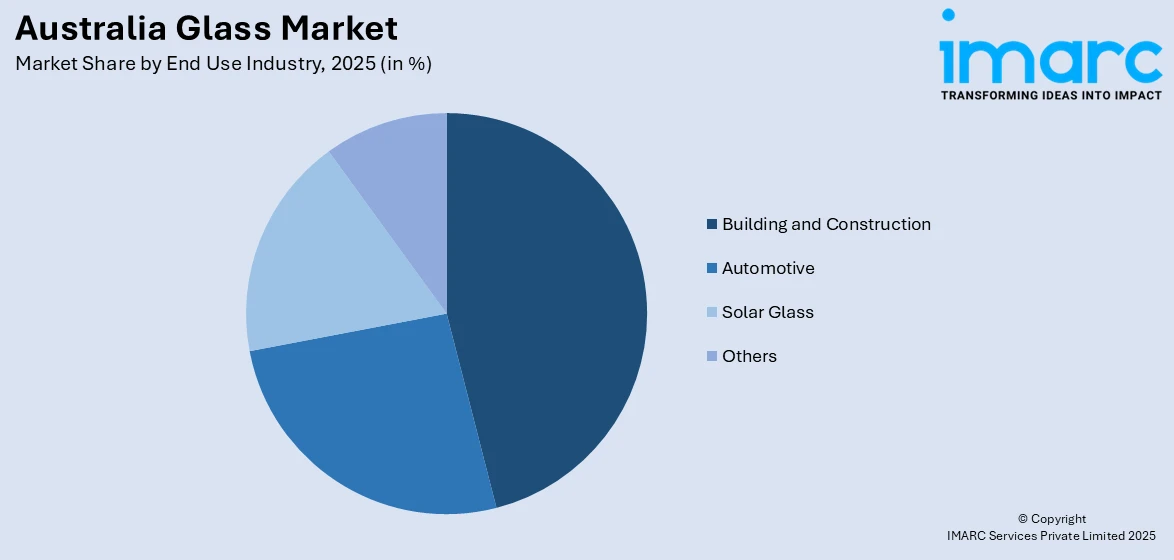

End Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Building and Construction

- Automotive

- Solar Glass

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes building and construction, automotive, solar glass, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Glass Market News:

- In January 2024, MS Glass acquired exclusive rights to produce and distribute ClearVue's revolutionary solar integrated glass units throughout Australia. This historic agreement enhances the Australian glass industry by bringing cutting-edge solar glazing technology, enabling sustainable building solutions and stimulating development in Australia's glass market.

Australia Glass Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Annealed Glass, Coater Glass, Reflective Glass, Processed Glass, Mirrors |

| End Use Industries Covered | Building and Construction, Automotive, Solar Glass, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia glass market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia glass market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia glass industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The glass market in Australia was valued at USD 8.9 Billion in 2025.

The Australia glass market is projected to exhibit a compound annual growth rate (CAGR) of 7.52% during 2026-2034.

The Australia glass market is expected to reach a value of USD 17.5 Billion by 2034.

The Australia glass market is witnessing trends such as increasing use of energy-efficient and insulated glass, growing adoption of smart and multifunctional glass in buildings and vehicles, and rising demand for eco-friendly and recycled glass. Expansion of online sales and customized glass solutions are also shaping the market.

The market is driven by rapid construction and infrastructure development, expansion of the automotive sector, and growth in renewable energy applications. Technological advancements, rising urbanization, increased consumer electronics production, and focus on sustainability and energy efficiency are further accelerating demand for high-performance glass across various sectors.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)