Australia Gourmet Foods Market Size, Share, Trends and Forecast by Type, Distribution Channel, and Region, 2025-2033

Australia Gourmet Foods Market Overview:

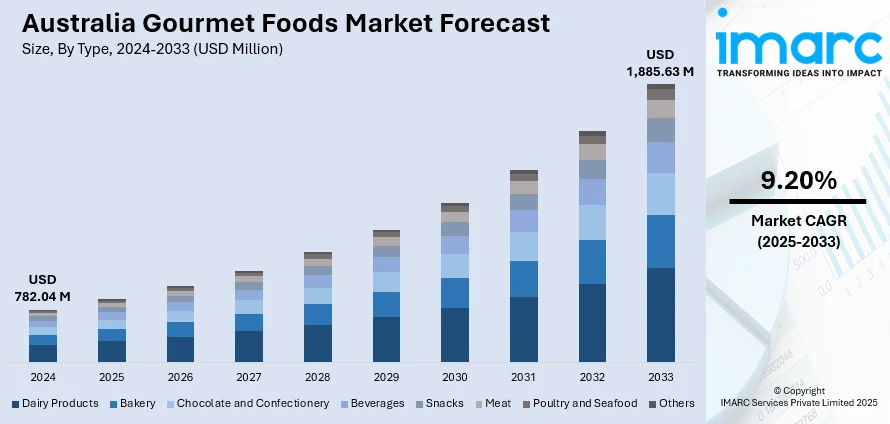

The Australia gourmet foods market size reached USD 782.04 Million in 2024. Looking forward, the market is expected to reach USD 1,885.63 Million by 2033, exhibiting a growth rate (CAGR) of 9.20% during 2025-2033. The growing health consciousness, demand for unique gastronomic experiences, and sustainability concerns are the factors propelling the market growth. In addition, growing disposable incomes, increasing trend towards convenience, and demand for premium ingredients are enhancing the market growth. Apart from this, e-commerce growth, food culture at the local level, demand for organic and natural foodstuffs, influence of social media, ethical sourcing, food delivery online, demand for ready-to-eat food (RTE) are drivers providing an impetus to the Australia gourmet foods market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 782.04 Million |

| Market Forecast in 2033 | USD 1,885.63 Million |

| Market Growth Rate 2025-2033 | 9.20% |

Key Trends of Australia Gourmet Foods Market:

Health and Wellness Trends

Health and wellness have been key contributors to the Australian gourmet food industry over the past few years. People are growing more health-aware, and their demand for products that cater to their nutritional needs and dietary limitations is ever-growing. This trend is echoed within the gourmet food sector as well, where premium ingredients and specialty diets such as gluten-free, dairy-free, vegan, and low-sugar are in greater demand. The transition to clean eating, whereby the consumer demands minimally processed products, has given rise to increasing demand for gourmet food products that include natural and organic ingredients. Furthermore, various Australian consumers are looking for foods that taste great and offer nutritional benefits. For instance, products that contain superfoods, such as quinoa, chia seeds, or spirulina, have become much more popular. These health-oriented decisions are creating more willingness to pay a premium for quality, transparency in the origin of the product, and clear nutritional benefit. Furthermore, as there has been more emphasis on mental and physical health, consumers are moving towards foods that offer energy stimulation, immune support, and enhanced gastrointestinal health.

To get more information on this market, Request Sample

Distinctive Culinary Experiences

The demand for genuine food experiences has become a top driver of the Australian gourmet food market. People are increasingly looking to try new and exotic foods that offer unique flavors and superior ingredients. This heightened interest in gourmet food is part of a larger trend of exploration in food culture, where people are more willing to try different tastes and textures around the world. Specialty foods, with their emphasis on innovation and distinctiveness, meet this demand by supplying small-batch items not commonly found in the majority of supermarkets. Consumers are transitioning their allegiance from the standard supermarket cuisine and seeking items that offer something more than the norm—be it an exotic spice mix, hand-crafted chocolate, or regionally-raised specialty meats. The cultural influence of food and the popularity of home cooking gourmet food connoisseurs are driving this demand. Moreover, social media platforms, such as Pinterest and Instagram, have been driving the promotion of specialty gourmet foods, as stunning and creative gourmet food experiences are shared and others follow the lead.

Sustainability and Ethical Sourcing

Sustainability and ethical sourcing are becoming an increasing priority for Australian consumers, and this is driving growth in the gourmet foods industry. Consumers are more conscious than ever of the social and environmental impact of their shopping, and this is causing them to be more selective about the products that they purchase. Gourmet food businesses that place emphasis on sustainability in sourcing, production, and packaging are gaining traction with this socially conscious consumer base. The consumer demand for ethically sourced ingredients—such as free-range meats, fair-trade coffee, and sustainably harvested seafood—has prompted more gourmet food companies to be transparent about, and accountable for, their methods. Environmentally friendly packaging that reduces the use of plastic and increases recyclability is also becoming a leading buying factor. This is part of the growing trend of environmental awareness in Australia, where more and more consumers are calling for brands that actively work to reduce carbon footprints and support local, sustainable farming, which is further driving the Australia gourmet foods market growth.

Growth Factors of Australia Gourmet Foods Market:

Rising Affluent Consumer Base

Australia's growing high-income population segment demonstrates increased spending power and willingness to invest in premium food experiences, driving substantial market expansion. Economic stability, property market growth, and favorable investment conditions have been created because of a larger demographic of consumers who seek luxury and gourmet food options. These wealthy consumers will prioritize quality over price, as they seek unique flavors, premium ingredients, and exclusive dining experiences that all reflect their advanced tastes. City experts grow, great business owners thrive, and rich people gain much, making lasting wants for unique food items, foreign treats, and chef-level parts to cook at home. This demographic shift supports premium pricing strategies and encourages retailers to expand their gourmet product portfolios.

Health-Conscious Premium Consumption

Increasing awareness of nutrition and wellness is transforming consumer preferences toward gourmet foods that offer both exceptional taste and health benefits simultaneously. Australia gourmet foods market analysis indicates strong growth in organic, free-range, grass-fed, and sustainably sourced premium products that align with health-conscious lifestyle choices. Consumers actively seek functional foods containing superfoods, probiotics, antioxidants, and specialized dietary formulations within the gourmet category. The intersection of health and indulgence has created opportunities for premium products that cater to specific dietary requirements, including gluten-free, keto-friendly, and plant-based gourmet options. Medical research linking diet quality to long-term health outcomes has justified higher spending on premium food products among health-aware consumers.

Cultural Diversity and Culinary Exploration

Australia's multicultural population and increasing international travel exposure have expanded consumer palates and created demand for diverse gourmet food experiences from global cuisines. Immigration patterns have introduced authentic international ingredients, cooking techniques, and flavor profiles that appeal to both ethnic communities and adventurous local consumers. Food tourism, cooking shows, and celebrity chef influence have educated consumers about premium ingredients and sophisticated preparation methods, increasing appreciation for gourmet products. The desire for authentic cultural experiences through food has driven growth in specialty import markets, ethnic gourmet stores, and fusion cuisine concepts. This cultural openness creates sustained Australia gourmet foods market demand for diverse premium products and innovative flavor combinations.

Opportunities of Australia Gourmet Foods Market:

Sustainable Premium Product Development

Environmental consciousness presents significant opportunities for gourmet food companies to develop eco-friendly premium products that appeal to sustainability-focused consumers willing to pay higher prices. Sustainable packaging innovations using biodegradable materials, reduced plastic usage, and carbon-neutral shipping options can differentiate brands in the competitive gourmet market. Organic certification, regenerative agriculture practices, and locally sourced ingredients align with consumer values while commanding premium pricing structures. Companies implementing circular economy principles, waste reduction strategies, and ethical supply chain practices can build strong brand loyalty among environmentally conscious gourmet consumers. This sustainability focus opens new market segments and partnership opportunities with eco-conscious retailers and distributors, which is driving the Australia gourmet foods market demand.

Regional Specialization and Export Potential

Australia's diverse climate zones and agricultural regions offer unique opportunities to develop distinctive gourmet products that showcase regional terroir and local ingredients for both domestic and international markets. Premium wine regions, specialty coffee growing areas, unique seafood varieties, and indigenous ingredients provide competitive advantages in global gourmet markets. Regional food tourism initiatives can create synergies between local producers and hospitality sectors, driving demand for specialty products and creating direct-to-consumer sales opportunities. International recognition of Australian culinary excellence and premium agricultural products opens export opportunities in Asian and European gourmet markets. Government trade support and agricultural export programs facilitate market entry and expansion for Australian gourmet food producers.

Technology-Enhanced Consumer Experiences

Digital innovation opportunities include personalized nutrition platforms, AI-powered flavor matching systems, and virtual tasting experiences that enhance gourmet food discovery and purchasing decisions. Blockchain technology applications for supply chain transparency, authenticity verification, and origin tracking appeal to gourmet consumers seeking product provenance and quality assurance. Augmented reality applications for wine pairing, cooking instructions, and ingredient information can create engaging customer experiences that differentiate premium products. Subscription commerce models, predictive analytics for inventory management, and customer data insights enable targeted marketing and improved product development. These technological enhancements can increase customer retention, average order values, and market penetration in the gourmet segment.

Challenges of Australia Gourmet Foods Market:

Supply Chain Complexity and Cost Pressures

Managing sophisticated supply chains for gourmet products involves significant challenges including ingredient sourcing, quality control, cold-chain logistics, and maintaining product integrity throughout distribution networks. Premium ingredients often require specialized handling, temperature-controlled storage, and shorter shelf lives, increasing operational costs and complexity for retailers and distributors. International ingredient sourcing faces currency fluctuations, import regulations, quality consistency issues, and potential supply disruptions that can impact product availability and pricing. Small-scale artisanal producers struggle with scaling production while maintaining quality standards, limiting their ability to meet growing demand or achieve cost efficiencies. These operational challenges require substantial investment in infrastructure, technology, and expertise to maintain competitive positioning.

Market Fragmentation and Competition Intensity

The gourmet foods market features numerous small producers, specialty retailers, and niche brands competing for limited shelf space and consumer attention, creating intense competitive pressures. Price competition from mass-market premium alternatives can erode margins for traditional gourmet products, particularly during economic downturns when consumers reduce discretionary spending. Large retailers possess significant bargaining power over suppliers, potentially squeezing margins and demanding promotional support that smaller gourmet brands cannot afford. Market fragmentation makes it difficult for consumers to navigate product choices and for brands to achieve sufficient scale for marketing investments and distribution expansion. Brand differentiation becomes increasingly challenging as the market becomes saturated with similar premium offerings and marketing messages.

Consumer Education and Market Development Barriers

Many consumers lack sufficient knowledge about gourmet products, cooking techniques, and flavor profiles to fully appreciate premium offerings, limiting market expansion potential among mainstream demographics. Price sensitivity remains a significant barrier for broader market adoption, as gourmet products typically carry substantial price premiums that many consumers cannot justify or afford regularly. Cultural preferences and conservative food choices in certain demographic segments create resistance to exotic ingredients, unfamiliar flavors, or non-traditional preparation methods. Limited retail presence and distribution channels in rural areas restrict market access and brand awareness among potential consumers outside major metropolitan markets. Effective consumer education requires substantial marketing investments that may not generate immediate returns, particularly for smaller gourmet food companies.

Australia Gourmet Foods Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and distribution channel.

Type Insights:

- Dairy Products

- Bakery

- Chocolate and Confectionery

- Beverages

- Snacks

- Meat

- Poultry and Seafood

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes dairy products, bakery, chocolate and confectionery, beverages, snacks, meat, poultry and seafood, and others.

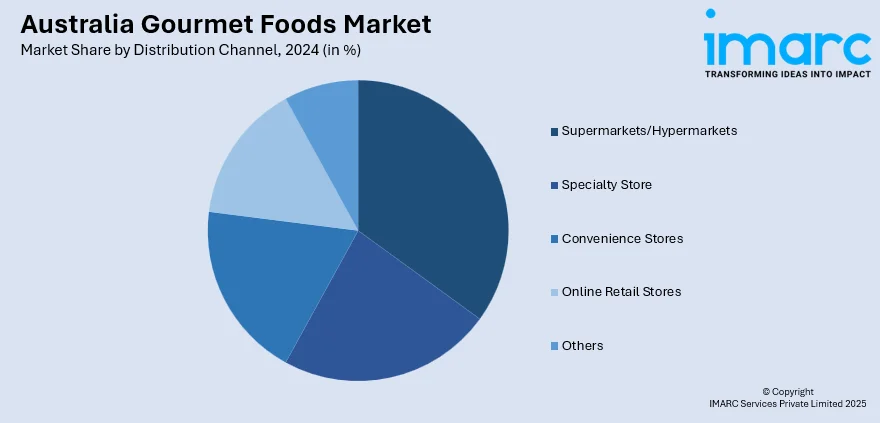

Distribution Channel Insights:

- Supermarkets/Hypermarkets

- Specialty Store

- Convenience Stores

- Online Retail Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets/hypermarkets, specialty stores, convenience stores, online retail stores, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Gourmet Foods Market News:

- Real Oats, under MyPlant Co., has developed oat-based rice, pasta, and noodles with higher protein and fiber content. A USD 5.6 million collaboration with the University of Queensland's Food and Beverage Accelerator aims for a market rollout by early 2026.

Australia Gourmet Foods Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Dairy Products, Bakery, Chocolate and Confectionery, Beverages, Snacks, Meat, Poultry and Seafood, Others |

| Distribution Channels Covered | Supermarkets/Hypermarkets, Specialty Store, Convenience Stores, Online Retail Stores, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia gourmet foods market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia gourmet foods market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia gourmet foods industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia gourmet foods market was valued at USD 782.04 Million in 2024.

The Australia gourmet foods market is projected to exhibit a CAGR of 9.20% during 2025-2033.

The Australia gourmet foods market is projected to reach a value of USD 1,885.63 Million by 2033.

The market is experiencing rapid growth driven by increasing health consciousness and digital platform adoption. Premium convenience solutions and artisanal craft food movements dominate the landscape, reflecting Australians' focus on quality ingredients and unique culinary experiences. Integration with e-commerce platforms is becoming essential, enabling seamless shopping and personalized gourmet food discovery experiences.

The Australia gourmet foods market is driven by a rising affluent consumer base, growing health consciousness, and increased demand for premium ingredients and sustainable products. Cultural diversity, culinary exploration trends, and preference for authentic, artisanal food experiences further accelerate adoption across diverse consumer segments nationwide, supporting sustained market expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)