Australia Grain Production Market Report by Grain Type (Wheat, Barley, Canola, Pulses, Others), End Use (Food, Feed, Industrial Use), and Region 2025-2033

Australia Grain Production Market Overview:

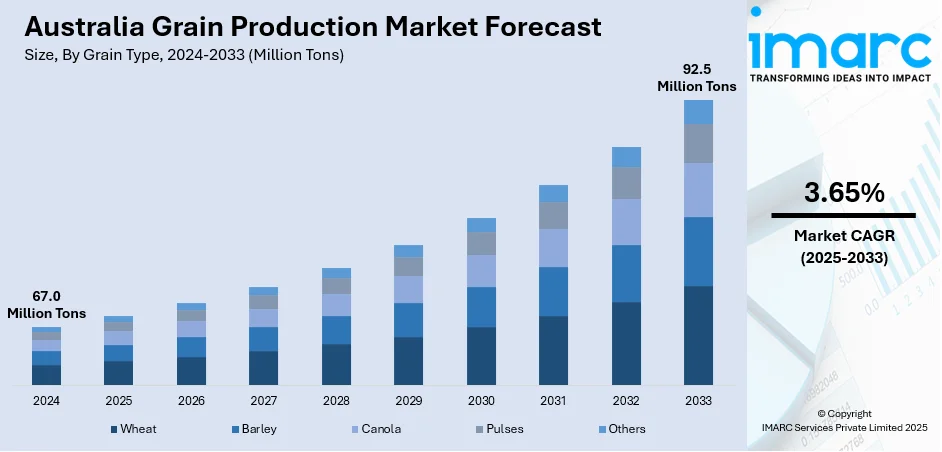

The Australia grain production market size reached 67.0 Million Tons in 2024. Looking forward, the market is expected to reach 92.5 Million Tons by 2033, exhibiting a growth rate (CAGR) of 3.65% during 2025-2033. Favorable climate conditions, advancements in agricultural technology, high global demand for grains, government policies supporting the sector, and rising innovations in farming practices and efficient supply chain management are some of the major factors propelling the growth of the market across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 67.0 Million Tons |

| Market Forecast in 2033 | 92.5 Million Tons |

| Market Growth Rate 2025-2033 | 3.65% |

Key Trends of Australia Grain Production Market:

Favorable Climatic Conditions

Australia's grain production is highly sensitive to climate and weather patterns. Factors such as rainfall levels, temperature variations, and drought conditions have a significant impact on crop yields. The El Niño and La Niña weather phenomena, for example, can greatly influence the amount of rainfall and affect growing conditions. Farmers and industry stakeholders closely monitor these conditions to make informed decisions about planting and harvesting. For instance, in September 2024, The Australian government announced that it expects to harvest 31.8 million tons of wheat in the coming harvest, raising its forecast by 2.7 million tons after rains in key growing regions. Australia is the world’s third-largest wheat exporter, and a larger harvest would boost global supply at a time when prices are near four-year lows. The government also said Australia would produce about 700,000 tons more barley and 100,000 tons more canola than estimated three months ago.

To get more information on this market, Request Sample

Significant Technological Advancements

Advancements in agricultural technology play a crucial role. Innovations such as precision farming, advanced irrigation systems, and improved crop varieties enhance efficiency and crop resilience. These technologies enable farmers to optimize resource use, manage pests and diseases more effectively, and increase overall crop output. For instance, in May 2023, Griffith University collaborated with Korean Technology Promotion Agency (KOAT) and Earthfix to rethink the way people farm in Australia, incorporating advanced technology to create consistently great-tasting and high-quality produce year-round while also boosting productivity up to 75 times more than traditional methods. Griffith intends to play a vital role in building the smart farms of the future by maximizing the sustainable use of food, land, and water, with the first farm based at Luscombe in the inner Gold Coast hinterland. Griffith University sees great potential in this partnership to deliver world-first opportunities for research collaboration around the technologies associated with smart farming and protected cropping as per the Griffith Associates.

Growth Drivers of Australia Grain Production Market:

Strategic Export Demand and Geographic Advantage

The grain production market of Australia is fueled by high global export demand, particularly from fast-growing Asian economies like Indonesia, Vietnam, and Japan. Australian grain in the form of wheat, barley, and canola is viewed as high quality, high-protein, and always reliable and is therefore sought after for food processing as well as animal feed. The country's proximity to Asia provides a determinate logistical benefit, allowing quicker delivery and lower shipping costs. Australia's system of free trade agreements with its trade partners also sustains export expansion. The export-orientation generates investment among farmers and producers to increase production and enhance grain quality, underpinning Australia as a key supplier in international grain markets.

Innovation and Sustainability in Agricultural Practices

The use of high-tech agricultural technologies and environmentally friendly practices is a strong growth enabler in Australia's grain production industry. Producers from major regions like Western Australia's Wheatbelt to New South Wales's cropping regions are using precision agriculture technology such as drones, satellite information, GPS-enabled equipment, and soil sensors. These technologies enhance yield consistency, resource utilization, and risk reduction. Accompanied by sustainable practices like conservation tillage, integrated pest management, and rotational cropping, Australian producers are maximizing long-term soil fertility while upholding environmental requirements. Industry associations and national research agencies actively encourage the development of activities related to grain variety improvement and regenerative agriculture and assist manufacturers in coping with climate uncertainty proactively and remaining competitive on the world stage, which contributes to the Australia grain production market growth and development.

Infrastructure Investment and Supply Chain Resilience

A key driver of growth for Australia's grain production industry is ongoing investment in infrastructure that supports highly efficient supply chains from farm to export. This encompasses investments in regional rail, road networks, and port facilities like specific agribulk terminals, that enhance storage, handling, and shipping efficiency. Improved infrastructure lowers the risk of bottlenecks, minimizes logistical costs, and enhances market responsiveness. Domestic policies likewise focus on safeguarding prime farmland under pressures of urban expansion, ensuring ongoing supply of productive farmland. Spending on labor training, mechanization, and automation further reinforces farm-level productivity and resilience. All these support Australia's capabilities in producing grains and facilitate strong market growth both domestically and overseas.

Opportunities of Australia Grain Production Market:

Growth into High-Value Niche Grains

Australia has a potential to diversify from conventional staples such as wheat and barley by developing into high-value niche grains. Sales of specialty grains such as quinoa, spelt, sorghum, and ancient wheats are improving in domestic as well as international health-driven markets. Australian farmers, particularly those in areas with flexible soil and climatic conditions such as areas of South Australia and Victoria, are ideally placed to respond to this demand. The country's established reputation for clean and green agriculture enhances the attractiveness of its specialty grain exports. In addition, these specialty crops tend to use less water and be more resistant to climate uncertainty, providing a chance to increase both sustainability and profitability. Researchers and agribusinesses are working together to create regionally appropriate seed varieties, improve cultivation practices, and penetrate new markets in Asia and the Middle East. Such a strategic realignment has the potential to enable Australia to establish a premium grain segment while lessening reliance on historic commodity price cycles, further solidifying the Australia grain production market demand and potential.

Leveraging Agri-Tech and Data-Driven Farming

Technological change is providing new opportunities for growth for grain farmers in Australia. By incorporating agri-tech tools such as AI-based crop tracking, automated equipment, and improved weather modeling, farmers are better able to make educated choices, improve yield performance, and decrease input expenses. Western Australia and New South Wales are among the leading areas adopting precision agriculture, which is especially useful for managing large-scale grain farms extended across semi-arid regions. These technologies also optimize harvest timing, water consumption, and pest control measures, enhancing quality and sustainability. Data analytics platforms are utilized to monitor grain quality, soil health, and market trends in real time, allowing farmers to respond instantly to shifting conditions and customer requirements. The rising digitization of agriculture provides the prospect of boosting productivity while enhancing traceability and transparency along the grain supply chain, which are key points of sale in domestic and foreign markets alike and hence increase the Australia grain production market share.

Enhancing Regional Food Security and Domestic Value-Addition

The grain farming sector in Australia can help to contribute more to enhancing regional food security and broadening domestic value-added processing. With climate shocks and geopolitical conflicts affecting international supply chains, surrounding nations in Southeast Asia are looking for secure, high-quality grain supplies. Australia can satisfy this demand and expand its national processing infrastructure to supply flour, cereal products, malt, and plant protein ingredients for export instead of only raw grains. This change generates more value per tonne and creates jobs throughout rural communities. Development of inland rail and regional processing centers is a support for this opportunity by making supply chains more efficient. Finally, encouraging regional branding and certification of Australian grain can assist in premium prices and recognition in competitive markets. With directional investment and innovation, Australia's grain industry has the potential to move from being mainly a raw commodity exporter to an Asian-Pacific value-added grain-based products leader.

Role of Research and Development in Australia Grain Production Market:

Developing Climate-Resilient Grain Varieties

According to the Australia grain production market analysis, research and development within Australia's grain sector have played a crucial role in developing climate-resilient grain varieties specific to the nation's varied and sometimes unforgiving growing conditions. Australian scientists, funded by both public agencies and industry organizations, have bred cultivars of grain more resistant to drought, heat, and salinity, which are issues often encountered in large areas of cultivation like Western Australia's Wheatbelt and the interior of Queensland. While these new varieties guarantee more consistent yields, they also decrease the dependency on water and chemicals. Continuing genetic research is investigating how to maximize pest and disease resistance, lengthen life cycle and productivity of crops. Australia's specialized landscape and conditions call for specific solutions, and R&D activity is still closing the gap between environmental stresses and crop yields. This has enabled grain growers to sustain competitive levels of production despite higher climatic pressures, ensuring long-term sustainability and food security within Australia and in overseas markets.

Improving Soil Health and Sustainable Agriculture

Soil health is a top priority of R&D in Australia's grain market because the country has poor soils in terms of nutrients and weathering. Research centers are investing in research that investigates soil microbiology, carbon levels, and nutrient cycling to formulate sustainable methods of soil management. Technologies like biological fertilisers, cover cropping systems, and conservation tillage practices are being experimented with and adapted to fit within particular Australian agro-ecological regions. These technologies are especially significant in areas like South Australia and New South Wales, where excessive cropping may cause soil degradation when it goes unchecked. R&D activities have also made it possible to create decision-support tools that inform growers about assessing the health of soil and real-time adjusting of their practice. Such tools enable growers to enhance long-term soil fertility and reduce environmental degradation. Through enhanced soil resilience and effective land use, Australian R&D is establishing a foundation for more sustainable, more profitable grain production that is compatible with the world's climate and biodiversity objectives.

Post-Harvest Technology and Grain Quality Innovation

In addition to crop production, Australian R&D is taking great leaps in post-harvest technology and grain quality measurement. Scientists are creating sophisticated storage systems that minimize spoilage and pest control, especially crucial in the nation's warm, arid environment. Some innovations include temperature-controlled silos, in-grain monitoring systems in real time, and eco-friendly fumigation alternatives. Besides, quality inspection technologies are also being improved to allow grain producers and processors to better analyze protein content, moisture, and grain hardness, which are important characteristics for domestic and export use grading. This research facilitates more effective sorting, pricing, and marketing of grains, which drives profitability and international competitiveness. Places such as Victoria and Western Australia are particularly advantaged by such developments, where a significant section of the harvest is intended for export. R&D also enables traceability solutions that enable Australian grains to access strict import requirements in overseas markets. R&D ensures the quality, marketability, and value addition of Australian grain produce through post-harvest innovation.

Challenges of Australia Grain Production Market:

Climate Variability and Environmental Stress

One of the longest-running challenges for Australia's grain production market is climate variability, whose effects weigh heavily on crop yields as well as agricultural activities. The geography of the country subjects to extensive agricultural areas, especially in Western Australia and New South Wales, to erratic weather conditions like extended droughts, heatwaves, and unexpected frosts. Such volatile climatic patterns cause stress on soil and water resources, and farmers find it challenging to achieve stable production. Though technological and breeding improvements have assisted in enhancing resilience, the underlying environmental instability still risks damaging planting schedules and harvest returns. Additionally, heightened bushfire hazards and increasing salinity levels in some regions add to the complexity of crop management. In contrast to other parts of the world where more stable conditions are present for cultivation, Australian grain farmers must continuously adjust their activities to changing environmental conditions, which boosts production expenses and diminishes long-term assurance. This consistent challenge requires continued investment in mitigation measures, such as drought planning and diversified cropping systems.

Increased Input Prices and Supply Chain Interruptions

Australian grain farmers are experiencing rising input prices, particularly for fuel, fertilisers, pesticides, and spare machinery parts. Most of these inputs are imported or subject to world market volatility, which increases the cost and unpredictability of production. In those areas where large-scale farms are common, including South Australia and Western Australia, the cost pressure can have a big impact on profitability. Moreover, supply chain disturbances in global markets caused by geopolitical tensions, port congestion, and shortages of transport workers have complicated access to key inputs. Grain producers are also hit by high domestic transport costs, especially the cost of getting harvests from inland areas to coast-based export terminals. Lack of effective rail and road infrastructure means that producers can be delayed and subjected to risk of spoilage, which further eats into margins. The logistical and economic setbacks underscore the importance of localized support for production, input cost stabilization measures, and upgrading infrastructure to safeguard the long-term sustainability of Australia's grain industry.

Labor Shortages and Knowledge Gaps

One of the significant challenges faced by Australia's grain farming sector is the lack of skilled workers, particularly during the peak planting and harvesting seasons. Most grain-producing areas in Queensland and Victoria are rural and have difficulty bringing in and retaining farm laborers, machinery operators, and agronomists. Depending on seasonal labor has become increasingly challenging with immigration controls and low interest in agricultural professions among young Australians. Aside from shortages in labor, there is an increasing shortage of technical experts, particularly since farms are increasingly dependent on digital technology, automation, and precision agriculture technology. Not all farmers possess the training or means to implement and utilize these innovations successfully. This shortage of skills diminishes the full potential of agri-tech solutions and delays the shift to more productive, data-based farm models. Solving these human resource issues will demand more robust agricultural education programs, industry training initiatives, and incentives to bring workers to rural grain-producing communities.

Australia Grain Production Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on grain type, and end use.

Grain Type Insights:

- Wheat

- Barley

- Canola

- Pulses

- Others

The report has provided a detailed breakup and analysis of the market based on the grain type. This includes wheat, barley, canola, pulses and others.

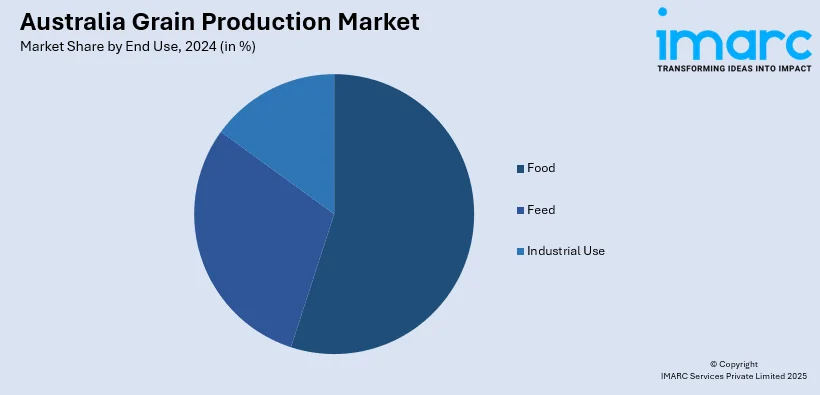

End Use Insights:

- Food

- Feed

- Industrial Use

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes food, feed, and industrial use.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Grain Production Market News:

- In March 2024, Grains Australia represented in New Delhi on February 14-17 at Pulses 2024, the annual conference of the Global Pulse Confederation (GPC). It is a festival of pulses, with hundreds of members of the international pulse trade from every importing and exporting country meeting to discuss industry developments and market outlooks, as well as doing business.

- In July 2024, Australian agribusiness Commodity Ag intends to export its first cargo from its Albany port terminal facility, boosting export competition in Western Australia against established grain handlers CBH and Bunge.

- In January 2024, AgCulture announced to be the exclusive provider of Farmwave's Harvest Vision yield loss monitor in Australia. Initial trial systems have commenced use during the 2023-2024 Australian harvest season with positive initial results and feedback.

Australia Grain Production Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Grain Types Covered | Wheat, Barley, Canola, Pulses, Others |

| End Uses Covered | Food, Feed, Industrial Use |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia grain production market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia grain production market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia grain production industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia grain production market reached 67.0 Million Tons in 2024.

The Australia grain production market is projected to exhibit a CAGR of 3.65% during 2025-2033.

The Australia grain production market is expected to reach a volume of 92.5 Million Tons by 2033.

The Australia grain production market is evolving with a stronger focus on sustainability, precision farming, and climate-adaptive crop varieties. Producers are increasingly adopting digital agriculture technologies, such as drones, soil sensors, and data analytics to optimize yields and reduce environmental impact. Meanwhile, demand for specialty and value-added grains continues to drive diversification.

The Australia grain production market is driven by strong global demand, especially from Asia, along with favorable trade agreements and high-quality crop standards. Technological innovation, government support, and resilient farming practices also contribute to growth. Expanding export infrastructure and rising interest in sustainable agriculture further strengthen the market’s long-term potential.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)