Australia Graphite Market Size, Share, Trends and Forecast by Type, Application, End Use Industry, and Region, 2026-2034

Australia Graphite Market Summary:

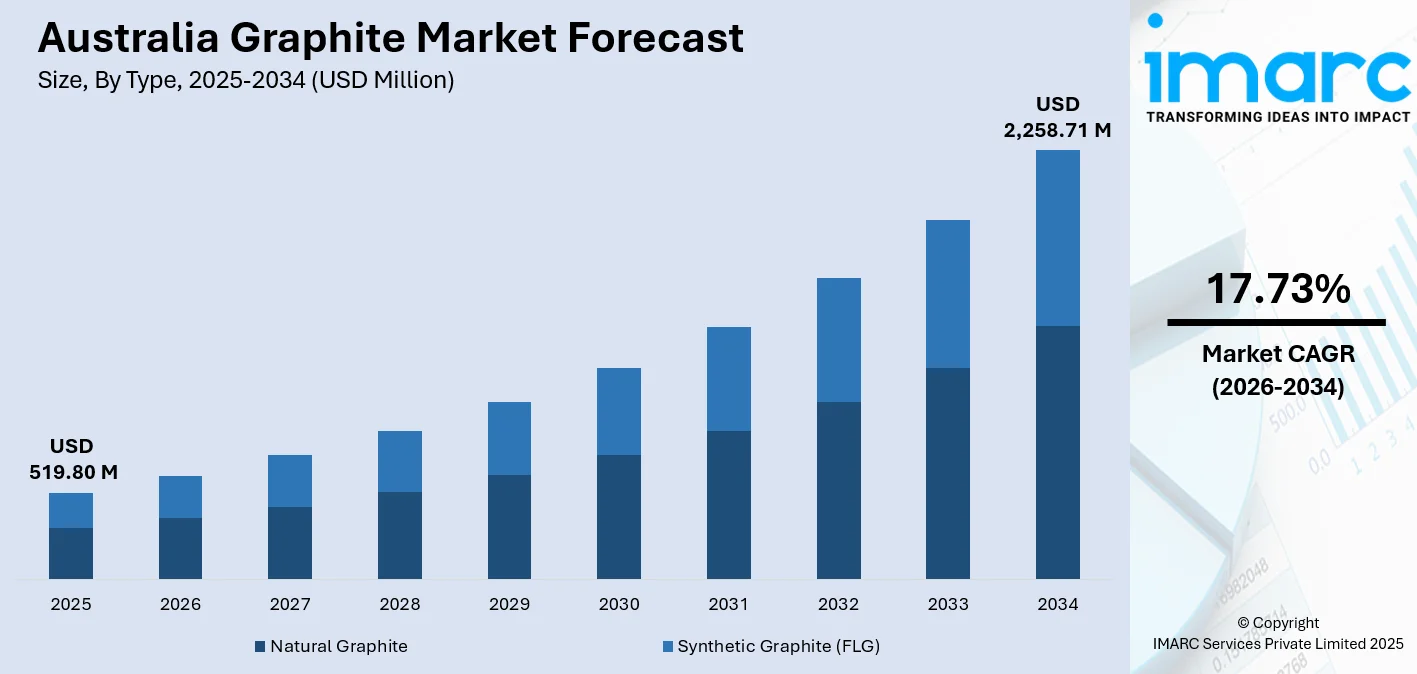

The Australia graphite market size was valued at USD 519.80 Million in 2025 and is projected to reach USD 2,258.71 Million by 2034, growing at a compound annual growth rate of 17.73% from 2026-2034.

The Australia graphite market is experiencing robust expansion, driven by accelerating demand for lithium-ion battery materials essential for electric vehicles (EVs) and energy storage systems. The nation's abundant high-quality graphite deposits, combined with strategic government support for critical minerals development, are positioning Australia as a reliable alternative supplier in global supply chains seeking diversification away from concentrated production regions.

Key Takeaways and Insights:

- By Type: Natural graphite dominates the market with a share of 62% in 2025, owing to its cost-effectiveness compared to synthetic alternatives and superior suitability for battery anode applications. Growing demand from lithium-ion battery manufacturers seeking sustainable raw materials is fueling the segment expansion.

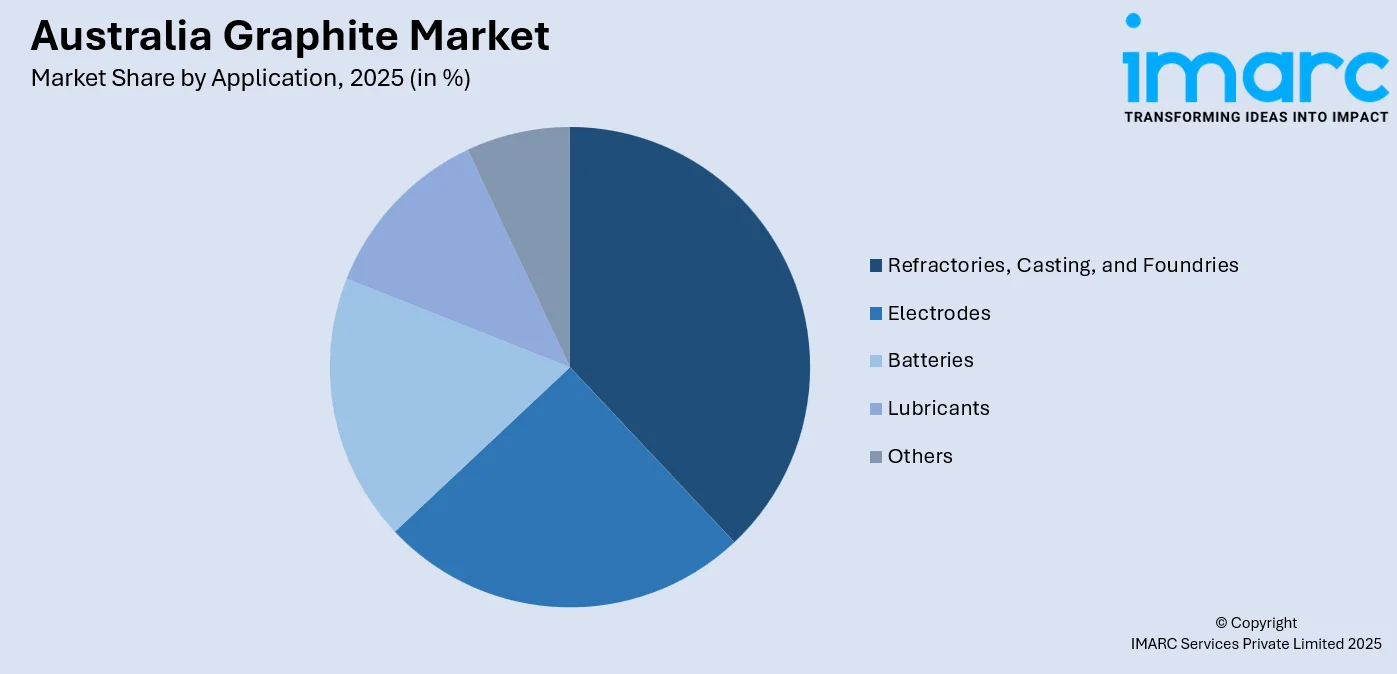

- By Application: Refractories, casting, and foundries lead the market with a share of 30% in 2025. This dominance is driven by continued industrial demand from steel manufacturing and metallurgical processes requiring high-temperature resistant materials, alongside expanding infrastructure development activities across the country.

- By End Use Industry: Metallurgy exhibits a clear dominance in the market with 41% share in 2025, reflecting strong industrial requirements for graphite electrodes in electric arc furnaces, crucibles for metal casting, and refractory materials essential for high-temperature manufacturing processes.

- By Region: Western Australia represents the largest region with 30% share in 2025, driven by the presence of advanced graphite exploration and development projects, established mining infrastructure, and streamlined permitting processes that support critical minerals extraction.

- Key Players: Key players drive the Australia graphite market by advancing vertically integrated production capabilities, developing innovative purification technologies, and securing strategic partnerships with battery manufacturers. Their investments in downstream processing facilities, government-backed funding initiatives, and sustainable mining practices boost industry development, accelerate project timelines, and ensure reliable supply availability across diverse end use applications.

To get more information on this market Request Sample

The Australia graphite market is witnessing substantial growth momentum, fueled by the accelerating global transition towards clean energy technologies and electrified transportation. The rising adoption of EVs is generating unprecedented demand for battery-grade graphite, which constitutes the primary anode material in lithium-ion batteries. In Australia, sales of battery electric vehicles (BEVs) increased by 13.1%, rising from 91,290 in 2024 to 103,270 in 2025. Australia's strategic positioning as a trusted supplier of critical minerals, combined with government initiatives supporting domestic processing and manufacturing capabilities, is attracting significant investments in the graphite sector. The nation's commitment to developing complete value chains from mining to battery-ready materials addresses growing concerns about supply chain concentration and geopolitical risks. Technological advancements in graphite purification processes, including environmentally sustainable methods that eliminate toxic chemicals, are enabling Australian producers to meet stringent quality specifications required by international battery manufacturers.

Australia Graphite Market Trends:

Vertically Integrated Battery Anode Material Production

Australian graphite developers are increasingly pursuing vertically integrated production strategies that encompass mining, concentration, purification, and spheronization processes within domestic facilities. This approach enables producers to capture higher value margins throughout the supply chain while offering battery manufacturers complete traceability and supply security. The integration of downstream processing capabilities positions Australian operations to deliver battery-ready anode materials rather than exporting raw concentrates, fundamentally transforming the nation's role from commodity supplier to advanced materials producer serving global clean energy markets.

Environmentally Sustainable Purification Technologies

Australian graphite processors are pioneering innovative purification technologies that eliminate the use of hydrofluoric acid, traditionally employed in graphite refining operations globally. These thermal and alternative chemical purification methods achieve battery-grade purity levels while significantly reducing environmental impacts and occupational health risks. The development of environmentally sustainable processing approaches provides Australian producers with competitive advantages in markets increasingly demanding responsible sourcing and production practices, particularly among EV manufacturers with stringent environmental, social, and governance (ESG) requirements.

Strategic Supply Chain Diversification Partnerships

Australian graphite producers are establishing strategic partnerships with international battery manufacturers, automotive companies, and trading houses seeking alternative supply sources outside concentrated production regions. These collaborative arrangements include binding offtake agreements, joint venture investments, and technical cooperation programs that provide project funding security while guaranteeing market access for Australian-produced materials. The growing emphasis on supply chain resilience among Western nations is positioning Australia as a preferred partner for critical minerals sourcing across North American, European, and Asian markets.

Market Outlook 2026-2034:

The Australia graphite market outlook remains exceptionally positive, as the nation advances its strategic positioning within global critical minerals supply chains. Substantial investments in exploration, mining infrastructure, and downstream processing capabilities are establishing the foundation for expanded production capacity. The market generated a revenue of USD 519.80 Million in 2025 and is projected to reach a revenue of USD 2,258.71 Million by 2034, growing at a compound annual growth rate of 17.73% from 2026-2034. Government policy frameworks supporting critical minerals development, combined with international partnerships prioritizing secure supply sources, are accelerating project advancement timelines. The convergence of battery demand growth, supply chain diversification imperatives, and Australian resource advantages creates favorable conditions for sustained market expansion throughout the forecast period.

Australia Graphite Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Natural Graphite |

62% |

|

Application |

Refractories, Casting, and Foundries |

30% |

|

End Use Industry |

Metallurgy |

41% |

|

Region |

Western Australia |

30% |

Type Insights:

- Natural Graphite

- Synthetic Graphite (FLG)

Natural graphite dominates with a market share of 62% of the total Australia graphite market in 2025.

Natural graphite maintains commanding market leadership in Australia owing to its superior cost-effectiveness for battery anode applications and abundant domestic resource availability. The material's natural crystalline structure provides excellent electrochemical properties essential for lithium-ion battery performance, making it the preferred choice for anode manufacturers seeking sustainable and ethically sourced raw materials. In 2023, South Australia contained 66% of Australia's confirmed graphite resources, with significant deposits concentrated on the eastern Eyre Peninsula.

The natural graphite segment benefits from Australia's strategic focus on developing complete battery material supply chains within domestic boundaries. Flake graphite deposits across Australian territories demonstrate favorable geological characteristics enabling conventional processing methods that reduce operational complexity and costs. The growing international emphasis on supply chain diversification away from concentrated production regions creates substantial opportunities for Australian natural graphite producers positioned to serve expanding EV and energy storage markets requiring reliable, high-quality anode materials with transparent provenance documentation.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Electrodes

- Refractories, Casting, and Foundries

- Batteries

- Lubricants

- Others

Refractories, casting, and foundries lead with a share of 30% of the total Australia graphite market in 2025.

Refractories, casting, and foundries maintain market leadership, driven by sustained industrial demand from steel manufacturing and metallurgical processing operations throughout Australia. Graphite's exceptionally high melting point makes it indispensable for manufacturing materials used in high-temperature environments, including kilns, blast furnace linings, and continuous casting equipment. The material's unique thermal conductivity properties help dissipate heat effectively while reducing thermal gradients, enhancing refractory performance and extending operational lifespan across demanding industrial applications.

Australia's expanding infrastructure development activities and construction sector growth are generating consistent demand for graphite-based refractory materials essential for metal manufacturing processes. The segment benefits from graphite's non-wetting characteristics that prevent molten slag penetration and corrosion, ultimately reducing maintenance requirements and improving operational efficiency in foundry applications. Industrial modernization initiatives across Australian manufacturing facilities continue to support stable demand trajectories for high-performance refractory materials incorporating graphite components essential for achieving production quality standards and operational reliability in continuous processing environments.

End Use Industry Insights:

- Electronics

- Metallurgy

- Automotive

- Others

Metallurgy exhibits a clear dominance with a 41% share of the total Australia graphite market in 2025.

Metallurgy commands the largest market share reflecting Australia's robust industrial manufacturing sector and extensive steel production activities requiring graphite-based materials. Graphite electrodes serve as essential components in electric arc furnaces used extensively for steel production, while crucibles and refractory linings incorporating graphite provide the heat resistance necessary for metal casting operations. The global shift towards electric arc furnace steelmaking, which offers environmental advantages over traditional blast furnace methods, continues to support demand growth for high-quality graphite electrodes across metallurgical applications.

Australian metallurgical operations benefit from domestic graphite availability that enables supply chain reliability and reduces procurement risks associated with international sourcing complexities. The segment's stability derives from consistent industrial requirements regardless of broader economic fluctuations, as steel and metal production remain fundamental to construction, infrastructure, and manufacturing activities. Technological advancements in electrode manufacturing and refractory formulations continue improving performance specifications while expanding application possibilities across diverse metallurgical processes serving Australian and export markets.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Western Australia represents the leading region with a 30% share of the total Australia graphite market in 2025.

Western Australia maintains regional market leadership, driven by the concentration of advanced graphite exploration and development projects across the state's established mining regions. The state's well-developed mining infrastructure, streamlined permitting processes, and experienced workforce provide significant operational advantages for graphite producers establishing new production facilities. In 2024-25, Western Australia's mining sector employed 134,009 full-time equivalent (FTE) positions on-site. This was a solid outcome and close to the record of 135,978 FTEs established in 2024, showcasing the continued strength of mining production and construction efforts in the region.

The region benefits from proximity to established port facilities enabling efficient export logistics to Asian battery manufacturing centers representing primary demand markets. Western Australia's comprehensive mining regulatory framework provides investor confidence while supporting responsible resource development aligned with environmental and community expectations. Ongoing exploration activities across the state continue to identify additional graphite deposits with potential for commercial development, expanding the regional resource base available for future production expansion, as market demand trajectories continue to ascend throughout the forecast period.

Market Dynamics:

Growth Drivers:

Why is the Australia Graphite Market Growing?

Accelerating EV and Battery Storage Demand

Accelerating demand for EVs and battery energy storage systems is significantly driving growth of the Australia graphite market, as graphite is a critical material for lithium-ion battery anodes. As per IMARC Group, the Australia EV market size was valued at USD 21.1 Billion in 2025. Australia’s push towards electrification, renewable energy integration, and decarbonization is increasing domestic and export-oriented demand for battery-grade graphite. Rising EV adoption is stimulating interest in secure, high-quality raw material supply chains, positioning Australia as a strategic source for critical minerals. Battery storage projects supporting grid stability and renewable integration further expand graphite consumption beyond automotive applications. Manufacturers are increasingly focused on developing spherical and purified graphite suitable for advanced batteries. Australia’s strong mining capabilities, stable regulatory environment, and alignment with global clean energy supply chains are encouraging investments in graphite processing and value addition.

Government Critical Minerals Policy Support and Investment

Australian federal and state governments have implemented comprehensive policy frameworks supporting critical minerals development, including graphite, through dedicated funding facilities, tax incentives, and streamlined regulatory processes. The National Critical Minerals Mission establishes a coordinated national approach to growing domestic production capabilities while international partnerships with allied nations prioritize secure supply chain development over the 2023-2030 period. Government-backed financing through the Critical Minerals Facility provides project developers with access to capital essential for advancing mining and processing operations through development stages. The Future Made in Australia initiative reinforces policy commitment to building domestic manufacturing capabilities across battery material value chains, including graphite processing and anode production. These supportive policy environments reduce investment risks while accelerating project timelines, creating favorable conditions for commercial production establishment and expansion throughout Australian jurisdictions.

Global Supply Chain Diversification Imperatives

Growing concerns regarding concentrated graphite production and processing capacity are driving international efforts to develop alternative supply sources outside dominant producing regions. Battery manufacturers, automotive companies, and governments across North America, Europe, and Asia are actively seeking partnerships with reliable suppliers capable of providing secure long-term material access. Australia's established reputation as a stable investment destination with transparent regulatory frameworks, strong rule of law, and excellent environmental governance positions domestic producers favorably for capturing emerging diversification demand. The strategic alignment between Australian critical minerals policies and international supply chain security objectives creates natural partnership opportunities with allied nations prioritizing resilient material sourcing. This geopolitical dynamic provides Australian graphite producers with competitive advantages in securing offtake agreements and investment partnerships essential for project development and production expansion.

Market Restraints:

What Challenges the Australia Graphite Market is Facing?

Price Volatility and Global Market Competition

Australian graphite producers face challenging competitive dynamics from established global producers operating with lower cost structures derived from economies of scale and reduced labor expenses. Price volatility in international graphite markets creates uncertainty regarding project economics and investment returns, potentially affecting financing availability and development timelines. The heavy concentration of production capacity in specific regions enables market manipulation through excess supply tactics designed to suppress prices below economic thresholds for higher-cost producers, creating ongoing viability concerns for emerging operations.

Limited Domestic Processing Infrastructure

Australia lacks commercial-scale graphite processing facilities capable of converting raw concentrates into battery-grade purified spherical graphite required by anode manufacturers. This infrastructure gap necessitates export of lower-value concentrates for overseas processing, reducing value capture within domestic supply chains and limiting market positioning flexibility. Developing downstream processing capabilities requires substantial capital investment, specialized technical expertise, and extended construction timelines that create barriers to rapid industry expansion despite favorable resource availability.

Workforce and Technical Skills Constraints

The specialized nature of graphite mining and processing operations requires technical expertise that remains relatively limited within Australian labor markets. Competition for skilled workers across expanding mining and resources sectors creates recruitment challenges and cost pressures affecting operational efficiency. Remote project locations characteristic of many Australian graphite deposits compound workforce attraction difficulties, requiring enhanced compensation packages and worker amenities that increase operational cost profiles relative to international competitors with more accessible labor pools.

Competitive Landscape:

The Australia graphite market competitive landscape is characterized by a mix of exploration-stage developers, advanced project proponents, and emerging producers, positioning themselves to capture growing battery materials demand. Market participants are differentiating through vertical integration strategies, innovative processing technologies, and strategic partnership development with international battery manufacturers and trading houses. Competitive advantages derive from resource quality, processing cost efficiency, project development stage advancement, and secured offtake arrangements providing revenue certainty. Companies with demonstrated technical capabilities, government funding support, and established customer relationships maintain favorable market positions. The competitive environment encourages continuous innovation in purification methods, environmental performance, and supply chain integration to meet evolving customer specifications and sustainability requirements increasingly influencing procurement decisions across the battery manufacturing sector.

Recent Developments:

- In July 2025, Renascor Resources Limited successfully completed bulk sample production of high-grade graphite concentrate at its Siviour deposit in South Australia, achieving an average grade of 96.8% carbon with 96.5% graphite recovery rate. The concentrate exceeded initial processing parameters and would serve as feedstock for the company's government-funded purified spherical graphite (PSG) demonstration plant.

- In March 2025, Federal Industry and Science Minister Ed Husic approved a three-year major project status for the hub on SA’s Eyre Peninsula. It would be centered on Quantum's Uley 2 flake graphite project, together with Sunland's associated manufacturing, logistics and inventory management facilities in South Australia. The designation recognizes the project's national significance for critical minerals development and energy storage applications.

Australia Graphite Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Natural Graphite, Synthetic Graphite (FLG) |

| Applications Covered | Electrodes, Refractories, Casting, and Foundries, Batteries, Lubricants, Others |

| End-Use Industries Covered | Electronics, Metallurgy, Automotive, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia graphite market size was valued at USD 519.80 Million in 2025.

The Australia graphite market is expected to grow at a compound annual growth rate of 17.73% from 2026-2034 to reach USD 2,258.71 Million by 2034.

Natural graphite dominated the market with a share of 62%, owing to its cost-effectiveness for battery anode applications and superior suitability for lithium-ion battery manufacturing requiring sustainable, ethically sourced raw materials.

Key factors driving the Australia graphite market include accelerating EV and battery storage demand, government critical minerals policy support, and global supply chain diversification imperatives seeking reliable alternative sources.

Major challenges include price volatility and global market competition from lower-cost producers, limited domestic processing infrastructure for battery-grade materials, workforce and technical skills constraints, and extended project development timelines requiring substantial capital investment.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)