Australia Green Cement Market Size, Share, Trends and Forecast by Product Type, End Use Industry, and Region, 2025-2033

Australia Green Cement Market Overview:

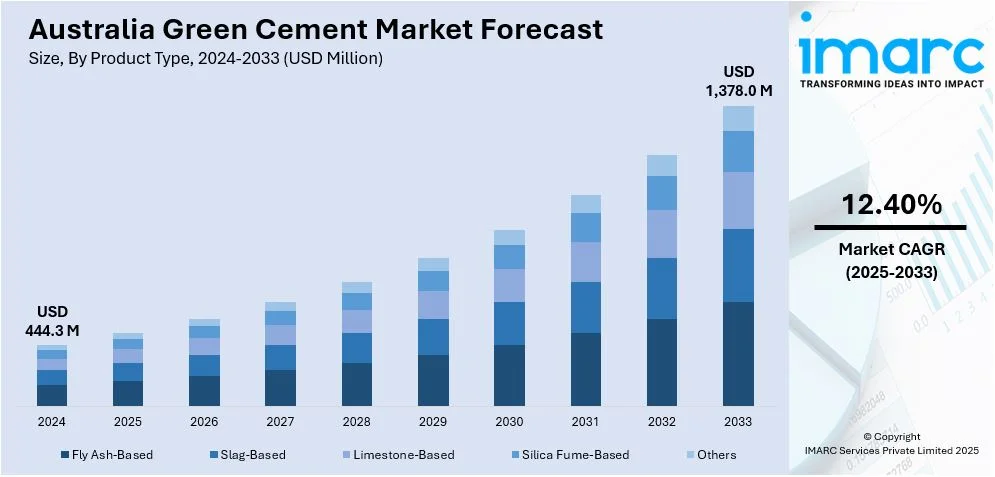

The Australia green cement market size reached USD 444.3 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,378.0 Million by 2033, exhibiting a growth rate (CAGR) of 12.40% during 2025-2033. The rising environmental concerns, stringent carbon emission regulations, growing adoption of sustainable construction practices, increasing infrastructure development, government support for eco-friendly materials, technological advancements in cement production, and corporate focus on reducing ecological footprints are some of the major factors Australia green cement market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 444.3 Million |

| Market Forecast in 2033 | USD 1,378.0 Million |

| Market Growth Rate 2025-2033 | 12.40% |

Australia Green Cement Market Trends:

Shift Toward Low-Carbon Construction Materials

The transition to low-carbon construction materials is one of the most prominent trends positively impacting the Australia green cement market outlook. According to an industry report, Australia intends to reduce its emissions by 42.7% from 2005 levels by 2030. With the country’s national emissions reduction targets and growing scrutiny of the construction sector’s carbon footprint, developers and contractors are actively seeking alternatives to traditional Portland cement. Green cement, which includes blended cement, geopolymer cement, and other formulations with reduced clinker content, is gaining traction as a sustainable substitute. This trend is reinforced by public and private sector initiatives encouraging the use of low-carbon building materials in infrastructure and residential projects. Apart from this, certification programs such as Green Star and NABERS are influencing procurement decisions by prioritizing carbon efficiency. Moreover, cement manufacturers are responding by investing in carbon capture, utilization, and storage (CCUS) technologies, and integrating industrial waste such as fly ash, slag, and silica fume into production processes. These innovations are helping reduce emissions associated with clinker production, which traditionally accounts for the majority of cement’s carbon intensity.

To get more information on this market, Request Sample

Increasing Construction Activities Driving Demand for Sustainable Materials

Australia’s expanding construction landscape is significantly contributing to the growth of the green cement market. According to an industry report, approximately AUD 17.1 Billion (around USD 10.738 Billion) has been allocated over ten years to support new and existing road and rail projects under the Infrastructure Investment Program. This sustained public investment is creating substantial demand for construction materials, including environmentally responsible alternatives like green cement. Besides this, rapid urban redevelopment, a rising volume of commercial projects, and steady residential construction activity are further elevating the need for sustainable building solutions. This trend is further amplified by government-backed stimulus packages and funding for infrastructure recovery, especially post-pandemic, which emphasize environmental accountability and long-term resilience. As builders and contractors face mounting expectations to reduce the carbon impact of their projects, green cement emerges as a practical solution. The uptake is particularly visible in high-density developments in cities like Sydney, Melbourne, and Brisbane, where green building certifications influence investor confidence and project approvals. In this context, green cement is not only a sustainability measure but a strategic enabler of continued industry growth under stricter environmental conditions. This structural demand from the construction sector continues to facilitate Australia green cement market growth.

Australia Green Cement Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type and end use industry.

Product Type Insights:

- Fly Ash-Based

- Slag-Based

- Limestone-Based

- Silica Fume-Based

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes fly ash-based, slag-based, limestone-based, silica fume-based, and others.

End Use Industry Insights:

.webp)

- Residential

- Non-Residential

- Infrastructure

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes residential, non-residential, and infrastructure.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Green Cement Market News:

- On January 7, 2025, Cement Australia utilized its GreenCem technology for the first time in a South Australian infrastructure project, in collaboration with Holcim. This partnership aimed to enhance sustainability and performance in construction by incorporating innovative cement solutions. GreenCem enables up to 80% replacement of general-purpose cement with locally sourced fly ash and slag, achieving comparable concrete strength while reducing embodied carbon. This collaboration resulted in a 38% reduction in embodied carbon for the project. The initiative reflects both companies' commitment to advancing environmentally friendly practices within the industry.

Australia Green Cement Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Fly Ash-Based, Slag-Based, Limestone-Based, Silica Fume-Based, Others |

| End Use Industries Covered | Residential, Non-Residential, Infrastructure |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia green cement market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia green cement market on the basis of product type?

- What is the breakup of the Australia green cement market on the basis of end use industry?

- What is the breakup of the Australia green cement market on the basis of region?

- What are the various stages in the value chain of the Australia green cement market?

- What are the key driving factors and challenges in the Australia green cement market?

- What is the structure of the Australia green cement market and who are the key players?

- What is the degree of competition in the Australia green cement market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia green cement market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia green cement market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia green cement industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)