Australia Green Technology and Sustainability Market Size, Share, Trends and Forecast by Component, Technology, Application, and Region, 2025-2033

Australia Green Technology and Sustainability Market Overview:

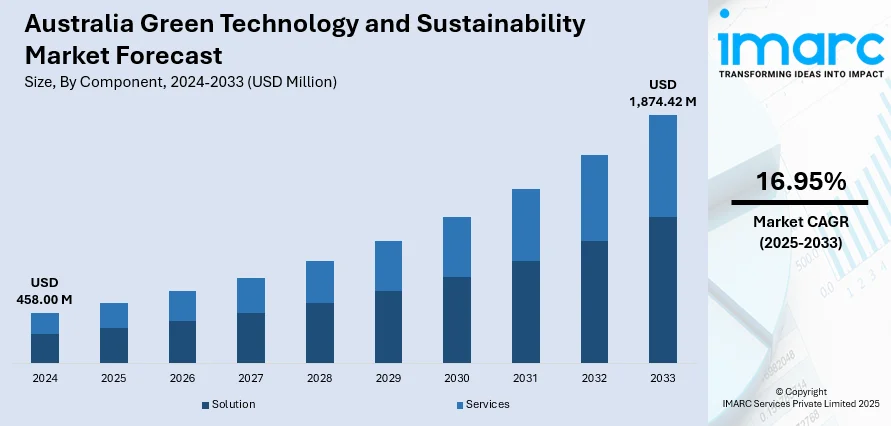

The Australia green technology and sustainability market size reached USD 458.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,874.42 Million by 2033, exhibiting a growth rate (CAGR) of 16.95% during 2025-2033. Supportive government initiatives like the ‘Future Made in Australia’ policy, substantial investments from agencies, such as ARENA and the CEFC, a strong push towards renewable energy integration, and a regulatory environment promoting transparency and accountability in environmental claims are among the key factors propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 458.00 Million |

| Market Forecast in 2033 | USD 1,874.42 Million |

| Market Growth Rate 2025-2033 | 16.95% |

Australia Green Technology and Sustainability Market Trends:

Surge in Renewable Energy Capacity and Integration of Energy Storage

Australia's electricity sector is rapidly transforming, with a significant surge in both utility-scale and behind-the-meter renewable energy driven by declining technology costs, strong policy incentives, and corporate off-take agreements. In 2023, renewables accounted for 39.4% of total generation, a strong 9.7 percentage point increase from the previous year, signaling a swift shift away from coal and gas. This expansion is supported by a growing pipeline of storage projects, with 27 large-scale battery projects under construction by the end of 2023, up from 19 the previous year. Rooftop solar continues to thrive, with Australians adding 2.9 GW of small-scale solar capacity in 2023, bringing the total to over 3 million installations, contributing 11.2% of national electricity output. Meanwhile, utility-scale solar and wind have expanded by an estimated 5.9 GW, representing a nearly 900 MW increase from 2022. With solar and wind costs falling, renewable energy is now one of the cheapest sources of new generation capacity, while corporate demand and government initiatives further stimulate investment in both generation and storage assets.

To get more information on this market, Request Sample

Emergence of a Green Hydrogen Economy and Supporting Infrastructure

Australia is rapidly positioning itself as a global leader in green hydrogen, leveraging its abundant solar and wind resources to produce zero-emission hydrogen at scale. By early 2024, the country boasted one of the world’s largest green hydrogen project pipelines, valued at over AUD 225 billion, signaling strong investor confidence in hydrogen’s role in future energy systems. This momentum is backed by robust policy support, including the Federal Government’s AUD 814 million commitment in November 2023 under the Hydrogen Headstart program to fund a 1,500 MW green hydrogen-to-ammonia export facility in Western Australia, the largest of its kind to date. Additionally, an AUD 2 billion production credit aims to make renewables-based hydrogen more cost-competitive with fossil-based alternatives. The updated National Hydrogen Strategy 2024 targets one million tons of domestic hydrogen production by 2030. Meanwhile, Renewable Energy Zones (REZs) across Western Australia, Queensland, and Victoria are strengthening grid infrastructure to support large-scale renewable power generation, further enhancing the market growth.

Australia Green Technology and Sustainability Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on component, technology, and application.

Component Insights:

- Solution

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solution and services.

Technology Insights:

- Internet-of-Things

- Cloud Computing

- Artificial Intelligence and Analytics

- Digital Twin

- Cybersecurity

- Blockchain

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes internet-of-things, cloud computing, artificial intelligence and analytics, digital twin, cybersecurity, and blockchain.

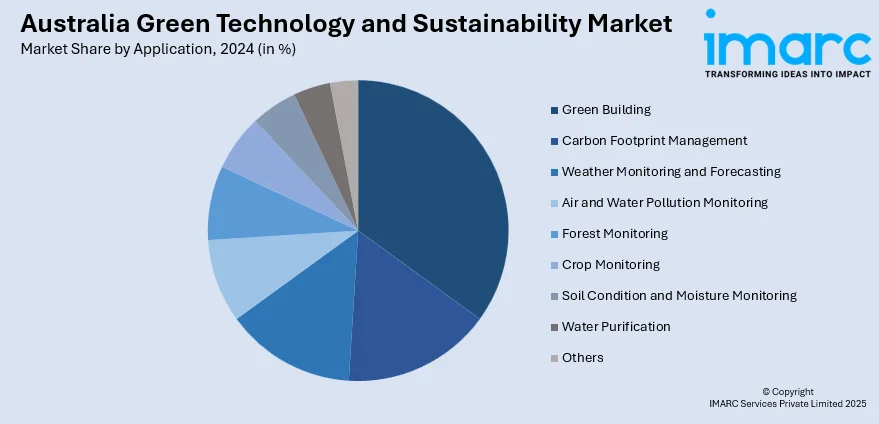

Application Insights:

- Green Building

- Carbon Footprint Management

- Weather Monitoring and Forecasting

- Air and Water Pollution Monitoring

- Forest Monitoring

- Crop Monitoring

- Soil Condition and Moisture Monitoring

- Water Purification

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes green building, carbon footprint management, weather monitoring and forecasting, air and water pollution monitoring, forest monitoring, crop monitoring, soil condition and moisture monitoring, water purification, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Green Technology and Sustainability Market News:

- October 2024: At All-Energy Australia 2024, GoodWe unveiled advanced inverters and energy storage systems, emphasizing green technology and sustainability. Key products include the ESA Series All-in-One Energy Storage System and the ET G2 Series Hybrid Inverter, designed for efficient renewable energy use.

- May 2024: Sungrow introduced new residential and commercial hybrid inverters and battery solutions in Australia. The SH15/20/25T inverters and SBH200-400 batteries offer features like off-grid support and multiple MPPTs for optimal rooftop utilization, enhancing renewable energy adoption and efficiency.

Australia Green Technology and Sustainability Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Services |

| Technologies Covered | Internet-of-Things, Cloud Computing, Artificial Intelligence and Analytics, Digital Twin, Cybersecurity, Blockchain |

| Applications Covered | Green Building, Carbon Footprint Management, Weather Monitoring and Forecasting, Air and Water Pollution Monitoring, Forest Monitoring, Crop Monitoring, Soil Condition and Moisture Monitoring, Water Purification, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia green technology and sustainability market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia green technology and sustainability market on the basis of component?

- What is the breakup of the Australia green technology and sustainability market on the basis of technology?

- What is the breakup of the Australia green technology and sustainability market on the basis of application?

- What is the breakup of the Australia green technology and sustainability market on the basis of region?

- What are the various stages in the value chain of the Australia green technology and sustainability market?

- What are the key driving factors and challenges in the Australia green technology and sustainability market?

- What is the structure of the Australia green technology and sustainability market and who are the key players?

- What is the degree of competition in the Australia green technology and sustainability market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia green technology and sustainability market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia green technology and sustainability market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia green technology and sustainability industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)