Australia Grid Energy Storage Solutions Market Size, Share, Trends and Forecast by Technology, Application, End User, and Region, 2025-2033

Australia Grid Energy Storage Solutions Market Overview:

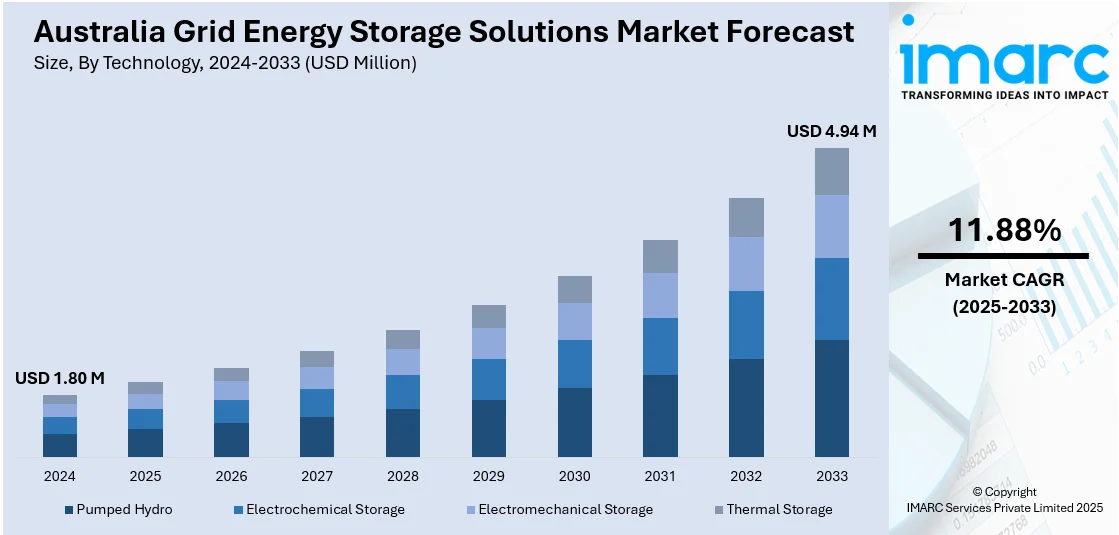

The Australia grid energy storage solutions market size reached USD 1.80 Million in 2024. Looking forward, the market is expected to reach USD 4.94 Million by 2033, exhibiting a growth rate (CAGR) of 11.88% during 2025-2033. Innovations in the energy storage system is primarily contributing to the market. In addition to this, favorable government policies and regulatory support are propelling the product adoption. Additionally, the rising demand for incorporating renewable energy is guaranteeing the adoption of grid energy storage systems. Continued technology advancement, encouraging regulatory policies, and renewable energy demand are also expanding the Australia grid energy storage solutions market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.80 Million |

| Market Forecast in 2033 | USD 4.94 Million |

| Market Growth Rate 2025-2033 | 11.88% |

Key Trends of Australia Grid Energy Storage Solutions Market:

Technological Advancements and Innovation in Energy Storage

The integration of cutting-edge technologies into grid energy storage systems is a central driver in the market. Different developments in battery technology, especially lithium-ion and solid-state batteries, have greatly enhanced energy density, charging rates, and efficiency overall. These technologies allow for the storage of huge amounts of energy in small space, which is important in addressing rising electricity needs. Additionally, breakthroughs in software and artificial intelligence (AI) allow for better management of energy systems by enhancing storage capabilities and optimizing grid operations. Energy Vault announced a partnership with the State Electricity Commission (SEC) of Victoria on February 13, 2025, to deliver a 100 MW/200 MWh battery energy storage system (BESS) at the SEC Renewable Energy Park in Horsham, Victoria. The AUD 570 million (USD 370 million) project aims to provide renewable energy for 51,000 homes, enhancing grid stability and creating 246 jobs during construction. Moreover, advancements in energy storage systems allow for more efficient renewable energy integration. Technologies like advanced inverters, smart grids, and hybrid storage solutions provide new ways to store and release renewable energy when it is needed most. These technologies reduce the intermittency challenges of renewable energy sources such as wind and solar. As energy storage systems become more reliable and cost-effective, the role they play in stabilizing grids and enhancing energy security becomes more vital. The increasing penetration of these innovations is one of the key factors propelling the Australia grid energy storage solutions market growth, as they enhance the functionality and scalability of energy storage, making it a feasible solution for both residential and commercial applications.

To get more information on this market, Request Sample

Growing Demand for Renewable Energy Integration

The increasing demand for renewable energy is a key factor driving the market. As the country seeks to meet its climate goals, a larger portion of the energy mix is shifting toward solar, wind, and other renewable sources. However, renewable energy generation often experiences fluctuations, making grid energy storage essential for balancing supply and demand. Energy storage systems enable the capture of excess power generated during peak renewable energy production and allow for its release when generation is low or demand is high. Additionally, the need for energy storage is further amplified by the rise of decentralized energy generation, where consumers and businesses generate their own power, often using solar panels. These decentralized systems create challenges for grid operators in maintaining a reliable and stable supply of electricity. On April 9, 2025, Wärtsilä announced its role in delivering a 64 MW/128 MWh energy storage system for Octopus Australia's Fulham Solar Battery Hybrid project in Victoria. This system, one of Australia’s first large-scale DC-coupled hybrid battery installations, will pair with an 80 MW AC solar farm to enhance grid stability and support the country’s renewable energy goals. The project, expected to complete in 2027, reflects a significant move towards integrating solar and storage solutions in Australia’s National Electricity Market (NEM). Energy storage solutions can help mitigate these challenges by providing on-demand power to the grid or local systems when necessary. The increased integration of renewable energy, paired with the growing push for energy independence and sustainability, underscores the importance of energy storage solutions. This growing demand for renewable energy integration directly influences the trajectory of the Australia grid energy storage solutions market growth, promoting investments and adoption in both commercial and residential sectors.

Growth Drivers of Australia Grid Energy Storage Solutions Market:

Accelerating Renewable Energy Transition

Australia's commitment to achieving net-zero emissions by 2050 is driving unprecedented investments in renewable energy infrastructure, creating substantial market demand. The intermittent nature of solar and wind power generation needs a continuous electricity supply and advanced storage solutions for grid stability. For large-scale renewable projects across Queensland, New South Wales, and Victoria, advanced battery systems are required as they can store excess energy during peak production periods as well as release it during phases of high demand or low generation. Clean energy transition gains government support via large funding amounts, plus renewable energy zones are built. Government initiatives also set mandatory renewable energy targets, which will directly stimulate the deployment of those storage systems. This energy transformation creates a robust foundation for sustained market growth and technological advancement.

Advanced Battery Technology Integration

Breakthrough innovations in lithium-ion battery technology, solid-state batteries, and hybrid storage systems are revolutionizing grid-scale energy storage capabilities and cost-effectiveness across Australia. Improved energy density, with faster charging rates, improved cycle life, and modern battery systems are more attractive for utility-scale applications because reduced degradation rates occur. Artificial intelligence integrates to enable predictive maintenance as well as to optimize charging-discharging cycles. Furthermore, artificial intelligence monitors real-time performance, which is something that maximizes system efficiency and operational lifespan. Smart grid compatibility allows smooth integration with existing infrastructure, providing advanced functionalities like frequency regulation, voltage support, and peak demand management. These technological advancements reduce the total cost of ownership and improve return on investment for grid operators and energy companies.

Grid Modernization and Decentralization Trends

Australia's aging electricity infrastructure requires comprehensive modernization to accommodate distributed energy resources, electric vehicle charging, and smart city initiatives, driving storage system adoption. The proliferation of rooftop solar installations, community energy projects, and microgrids creates complex grid management challenges that energy storage systems effectively address. Utility companies are investing heavily in grid flexibility solutions to manage bidirectional power flows, voltage fluctuations, and system stability issues arising from distributed generation. Energy storage systems provide essential services, including load balancing, frequency regulation, backup power, and grid resilience during extreme weather events. This infrastructure transformation represents a fundamental shift toward more resilient, flexible, and intelligent electricity networks requiring sophisticated storage capabilities.

Government Support of Australia Grid Energy Storage Solutions Market:

Federal Funding and Investment Programs

The Australian Government has allocated over AUD 200 million in the 2025 budget specifically for energy storage infrastructure development, demonstrating strong commitment to accelerating grid modernization and renewable energy integration. The Australian Renewable Energy Agency (ARENA) provides substantial grants, loans, and research funding for innovative storage technologies including large-scale battery projects, pumped hydro systems, and emerging technologies like compressed air energy storage. The Clean Energy Finance Corporation offers competitive financing options for commercial and utility-scale storage deployments, reducing capital costs and financial risks for project developers. Federal tax incentives, accelerated depreciation allowances, and renewable energy certificates create favorable economic conditions for storage investments. These comprehensive support mechanisms establish Australia as a leading destination for energy storage investment and development.

Regulatory Framework and Policy Support

The Australian Energy Market Operator (AEMO) has implemented progressive market rules and mechanisms that recognize energy storage as essential infrastructure for grid reliability and renewable energy integration. National Electricity Rules updates enable storage systems to participate in multiple revenue streams, including energy arbitrage, frequency control ancillary services, and network support services. State governments have established renewable energy zones with dedicated transmission infrastructure and streamlined approval processes specifically designed to support large-scale storage projects. The Integrated System Plan provides a clear long-term planning framework identifying optimal locations and sizing requirements for storage infrastructure development. According to the Australia grid energy storage solutions market analysis, these regulatory improvements create stable, predictable market conditions that encourage private sector investment and technological innovation.

State-Level Initiatives and Incentives

Victoria's Renewable Energy Target includes specific storage deployment requirements alongside mandatory renewable energy procurement, creating guaranteed demand for grid-scale battery systems. New South Wales has established the Electricity Infrastructure Roadmap with dedicated funding for storage projects that support system reliability and renewable energy integration. Queensland's Energy and Jobs Plan includes substantial investments in publicly owned renewable energy and storage assets to ensure energy security and affordability. South Australia's leadership in battery storage deployment continues through supportive policies, streamlined approvals, and strategic partnerships with international technology providers. These state-level initiatives complement federal programs and create competitive advantages for early movers in the market analysis.

Opportunities of Australia Grid Energy Storage Solutions Market:

Export Market Development and Technology Leadership

Australia's geographic advantages, abundant renewable resources, and advanced storage technologies position the country as a potential global leader in clean energy exports and storage system manufacturing. The development of green hydrogen production facilities requires massive energy storage infrastructure to manage renewable energy intermittency and optimize production efficiency. International partnerships with Asia-Pacific countries seeking energy security and decarbonization solutions create export opportunities for Australian storage expertise and technologies. Local manufacturing of battery components, energy management systems, and specialized storage equipment can reduce costs, create employment, and establish supply chain resilience. Australia's mining sector provides access to critical minerals including lithium, cobalt, and rare earth elements, essential for battery manufacturing and storage system development.

Grid Services and Revenue Diversification

Energy storage systems can simultaneously participate in multiple revenue streams, including energy arbitrage, frequency regulation, voltage support, and emergency backup services, creating attractive investment returns. The growing electric vehicle market requires extensive charging infrastructure supported by localized energy storage to manage grid impacts and optimize charging schedules. Industrial and commercial customers increasingly demand energy resilience solutions, backup power systems, and demand management capabilities that storage providers can deliver. Remote and off-grid communities represent significant opportunities for hybrid renewable-storage systems that replace expensive diesel generation and improve energy security. These diverse revenue opportunities reduce investment risks and improve project economics for storage developers and operators, driving the Australia grid energy storage solutions market demand.

Emerging Technology Integration and Innovation

Next-generation storage technologies including flow batteries, compressed air energy storage, and gravity-based systems, offer longer duration capabilities and different cost profiles suitable for specific applications. Integration with emerging technologies like green hydrogen production, carbon capture systems, and industrial process optimization creates new market segments for specialized storage solutions. Digitalization trends including IoT sensors, blockchain technology, and advanced analytics, enable new business models like peer-to-peer energy trading and automated grid services. Research partnerships between universities, technology companies, and government agencies accelerate innovation and create intellectual property advantages for Australian storage companies. These technological developments position Australia at the forefront of global energy storage innovation and commercialization.

Challenges of Australia Grid Energy Storage Solutions Market:

High Capital Investment and Financing Barriers

Large-scale energy storage projects require substantial upfront capital investments ranging from millions to hundreds of millions of dollars, creating significant financial barriers for many potential developers. Complex project financing structures involving multiple stakeholders, long-term revenue contracts, and technology risk assessments can delay project development and increase transaction costs. Limited availability of long-term financing options specifically designed for storage projects forces developers to rely on shorter-term funding that may not align with project lifecycles. Technology risks associated with emerging storage solutions and uncertain long-term performance create challenges for traditional financing institutions and insurance providers. Currency fluctuations, supply chain disruptions, and component cost volatility add financial complexity and risk to storage project development and operations.

Grid Integration and Technical Complexity

Integrating large-scale storage systems with existing electricity infrastructure requires sophisticated engineering solutions, extensive testing, and coordination with multiple system operators and stakeholders. Technical challenges include managing power quality issues, ensuring system stability during transient conditions, and maintaining grid security during storage system operations. Aging transmission and distribution infrastructure may require upgrades to accommodate bidirectional power flows and high-power charging-discharging cycles from storage systems. Cybersecurity concerns related to digitally controlled storage systems require robust protection measures and ongoing monitoring to prevent malicious attacks on critical infrastructure. Skilled workforce shortages in specialized areas, including power electronics, grid integration, and energy management systems, limit project execution capabilities and increase labor costs.

Market Competition and Technology Evolution

Rapid technological advancement in battery chemistry, power electronics, and energy management systems creates risks of technology obsolescence and stranded assets for early adopters. International competition from established manufacturers in China, South Korea, and the United States challenges local industry development and technology commercialization efforts. Market volatility in electricity prices, renewable energy certificate values, and ancillary service revenues creates uncertainty for storage project economics and investment returns. Regulatory changes, policy reversals, and evolving market rules can significantly impact project viability and long-term revenue projections for storage investments. The emergence of alternative solutions, including demand response, virtual power plants, and improved grid flexibility, may reduce demand for traditional storage applications and services.

Australia Grid Energy Storage Solutions Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on technology, application, and end user.

Technology Insights:

- Pumped Hydro

- Electrochemical Storage

- Electromechanical Storage

- Thermal Storage

The report has provided a detailed breakup and analysis of the market based on the technology. This includes pumped hydro, electrochemical storage, electromechanical storage, and thermal storage.

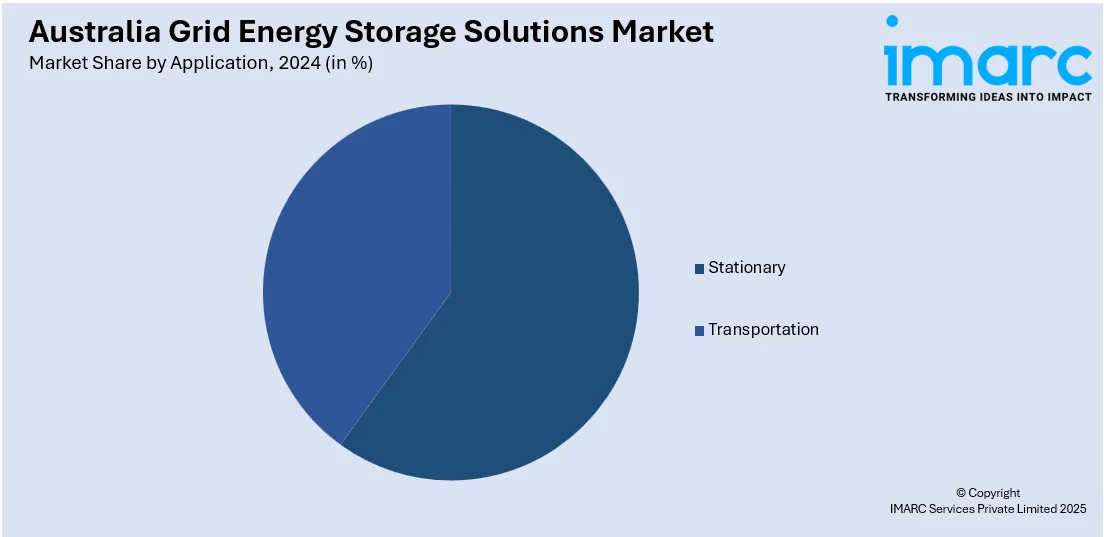

Application Insights:

- Stationary

- Transportation

The report has provided a detailed breakup and analysis of the market based on the application. This includes stationary and transportation.

End User Insights:

- Residential

- Non-Residential

- Utilities

The report has provided a detailed breakup and analysis of the market based on the end user. This includes residential, non-residential, and utilities.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has provided a comprehensive analysis of all major regional markets, including Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Grid Energy Storage Solutions Market News:

- On February 10, 2025, Canadian Solar’s e-STORAGE division announced a contract with Copenhagen Infrastructure Partners (CIP) to supply a 240 MW/960 MWh battery energy storage system for the Summerfield project. Construction is expected to begin later in 2025. By 2027, the project aims to support South Australia’s goal of reaching 100% net renewable energy by storing surplus wind and solar power.

Australia Grid Energy Storage Solutions Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Pumped Hydro, Electrochemical Storage, Electromechanical Storage, Thermal Storage |

| Applications Covered | Stationary, Transportation |

| End Users Covered | Residential, Non-Residential, Utilities |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia grid energy storage solutions market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia grid energy storage solutions market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia grid energy storage solutions industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia grid energy storage solutions market was valued at USD 1.80 Million in 2024.

The Australia grid energy storage solutions market is projected to exhibit a CAGR of 11.88% during 2025-2033.

The Australia grid energy storage solutions market is projected to reach a value of USD 4.94 Million by 2033.

The market is experiencing rapid growth driven by technological advancements in battery systems and renewable energy integration requirements. Large-scale battery energy storage system deployments dominate the landscape, reflecting Australia's focus on grid modernization and decarbonization goals. Integration with smart grid technologies is becoming essential, enabling advanced grid services and optimized energy management capabilities.

The Australia grid energy storage solutions market is driven by the accelerating renewable energy transition, advanced battery technology integration, and government policy support. Grid modernization requirements, decentralization trends, and increasing demand for energy security solutions further accelerate adoption across residential, commercial, and utility sectors nationwide, supporting sustained market expansion and technological innovation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)