Australia Ground Support Equipment Market Size, Share, Trends and Forecast by Type, Power Source, Application, and Region, 2025-2033

Australia Ground Support Equipment Market Overview:

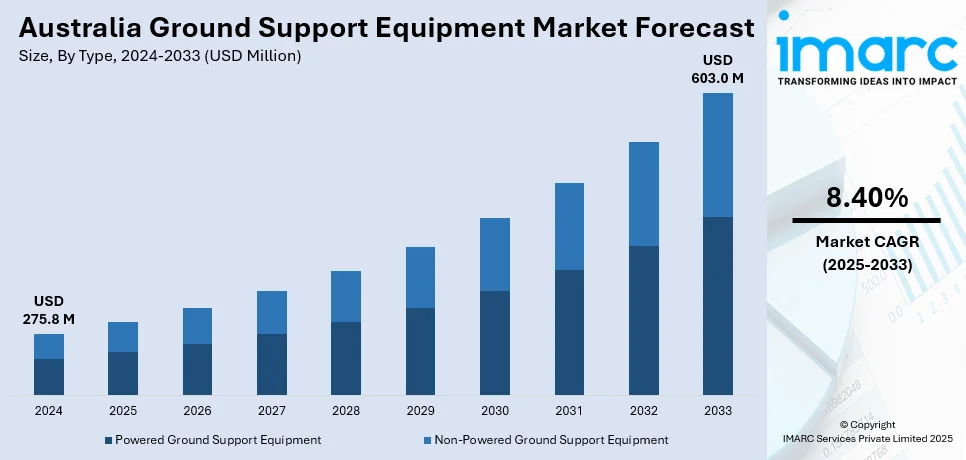

The Australia ground support equipment market size reached USD 275.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 603.0 Million by 2033, exhibiting a growth rate (CAGR) of 8.40% during 2025-2033. Airport modernization efforts, shift to electric GSE fleets, sustainability-driven procurement strategies, expansion of international long-haul services, increased servicing needs for wide-body aircraft, freight infrastructure upgrades, widespread demand for time-sensitive cargo handling, integration of telematics and predictive tools, and investments in hybrid-electric GSE technologies are some of the factors positively impacting the Australia ground support equipment market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 275.8 Million |

| Market Forecast in 2033 | USD 603.0 Million |

| Market Growth Rate 2025-2033 | 8.40% |

Australia Ground Support Equipment Market Trends:

Investment in Airport Modernization and Sustainability Goals

Australia’s aviation sector is undergoing modernization, underpinned by significant investment in airport upgrades and operational efficiency. Projects at major international gateways such as Sydney, Brisbane, and Melbourne, as well as regional airports, are focused on expanding airside capacity, improving passenger flow, and strengthening aircraft servicing infrastructure. As part of this evolution, there is a growing emphasis on the procurement of advanced ground support equipment to support seamless gate operations and reduce aircraft turnaround times. Modern GSE fleets—featuring electric baggage tractors, self-propelled passenger stairs, and multi-deck catering trucks—are being introduced to streamline airside functionality. As stakeholders transition from legacy systems to next-generation solutions, the sector is seeing a consistent Australia ground support equipment market demand favoring high-performance, sustainable GSE products tailored to large and mid-sized airport operations. Simultaneously, Australia’s national sustainability agenda is influencing GSE procurement policies, with a focus on reducing carbon emissions and noise pollution in ground operations. Major airports are implementing “green apron” initiatives to electrify support services, leading to the gradual phase-out of internal combustion GSE. This shift has prompted partnerships between GSE manufacturers and airport authorities to co-develop emission-free equipment with real-time performance monitoring. The integration of telematics and predictive maintenance technologies further adds value, minimizing downtime and maximizing equipment longevity. On March 27, 2025, Airbus partnered with Australian firm Drone Forge to deploy the Flexrotor VTOL UAS across Asia-Pacific, marking a strategic expansion in ground support equipment for defense and parapublic operations. The collaboration includes establishing a Perth-based service center for training and maintenance, enhancing regional support infrastructure for uncrewed systems. The Flexrotor’s expeditionary capabilities (requiring minimal 12×12 ft. launch areas) and 12-14 hour endurance position it as a force multiplier for Australia’s growing tactical UAV ground support requirements. These trends indicate a forward-looking trajectory of Australia Ground Support Equipment Market growth, driven by regulatory incentives, operational efficiencies, and eco-conscious procurement frameworks.

To get more information on this market, Request Sample

Growth in International Flight Capacity and Freight Operations

Australia’s geographic positioning as a hub for Asia-Pacific travel and trade continues to influence the growth of its aviation infrastructure. The post-pandemic rebound in long-haul international flights has compelled airport authorities to enhance aircraft ground servicing capabilities to meet fluctuating schedules and larger aircraft formats. Wide-body aircraft operations demand specialized GSE, including high-reach de-icing rigs, long-range ground power units, and scalable refueling vehicles, that cater to international carrier requirements. As global tourism recovers and airline alliances increase codeshare activity, the strategic need for adaptable, service-ready ground support fleets is being recognized across Australia’s major air transport nodes. These circumstances contribute to an increasingly diversified Australia ground support equipment market outlook, with heightened focus on scalability, operational readiness, and compliance with international servicing protocols. In parallel, the nation’s air cargo industry is expanding to accommodate growth in high-value goods, pharmaceuticals, and perishables exports. Key airports are investing in freight-specific infrastructure that integrates automation, cold chain handling, and advanced cargo loading systems. On February 17, 2025, Textron Aviation announced plans to open a new 35,000-square-foot service facility at Melbourne’s Essendon Fields Airport by early 2026, reinforcing its commitment to the Australia ground support equipment market with expanded maintenance and parts capabilities for regional aircraft operators. The upgraded facility, doubling the size of its current site, will feature a dedicated parts stockroom and customer lounge, aiming to reduce downtime and enhance service efficiency for over 1,400 aircraft in the APAC region. Additionally, demand for hybrid-electric equipment with extended service capabilities is increasing in response to sustainability requirements and limited service windows during peak operations. As the aviation logistics sector places greater emphasis on efficiency, reliability, and safety, GSE providers are evolving to deliver integrated, data-enhanced solutions. These innovations are propelling upward demand for next-generation GSE that enables both cargo and passenger operations to meet service-level expectations in a highly competitive regional landscape.

Australia Ground Support Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at thecountry and regional levels for 2025-2033. Our report has categorized the market based on type, power source and application.

Type Insights:

- Powered Ground Support Equipment

- Non-Powered Ground Support Equipment

The report has provided a detailed breakup and analysis of the market based on the type. This includes powered ground support equipment and non-powered ground support equipment.

Power Source Insights:

- Electric

- Non-Electric

- Hybrid

The report has provided a detailed breakup and analysis of the market based on the power source. This includes electric, non-electric, and hybrid equipment.

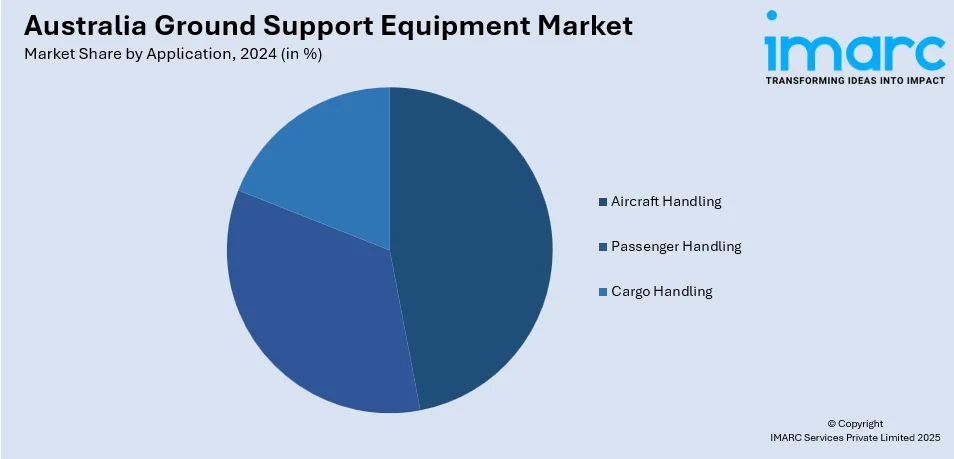

Application Insights:

- Aircraft Handling

- Passenger Handling

- Cargo Handling

The report has provided a detailed breakup and analysis of the market based on the application. This includes aircraft handling, passenger handling, and cargo handling.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Ground Support Equipment Market News:

- On November 29, 2023, South Australian firm Axiom Precision Manufacturing secured a contract with Kongsberg Defence Australia to produce ground support equipment for the Naval Strike Missile (NSM) program under SEA 1300 Phase 1, enhancing the Royal Australian Navy’s missile capabilities. The equipment, manufactured at Axiom’s Wingfield facility, will support the NSM systems replacing Harpoon missiles on ANZAC-class frigates and Hobart-class destroyers, with deliveries commencing in early 2024.

- On December 13, 2024, Babcock Australasia announced it has enhanced South Australia's emergency response capabilities by delivering a new Bell 412 helicopter to the SA Ambulance Service, expanding the aeromedical fleet to three aircraft. The company is concurrently investing USD 1.2 Million to upgrade its Adelaide Airport hangar, including workshop extensions and additional helicopter parking areas to optimize ground support equipment and response efficiency.

Australia Ground Support Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Powered Ground Support Equipment, Non-Powered Ground Support Equipment |

| Power Sources Covered | Electric, Non-Electric, Hybrid |

| Applications Covered | Aircraft Handling, Passenger Handling, Cargo Handling |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia ground support equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia ground support equipment market on the basis of type?

- What is the breakup of the Australia ground support equipment market on the basis of power source?

- What is the breakup of the Australia ground support equipment market on the basis of application?

- What is the breakup of the Australia ground support equipment market on the basis of region?

- What are the various stages in the value chain of the Australia ground support equipment market?

- What are the key driving factors and challenges in the Australia ground support equipment market?

- What is the structure of the Australia ground support equipment market and who are the key players?

- What is the degree of competition in the Australia ground support equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia ground support equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia ground support equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia ground support equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)