Australia Gut Health Supplements Market Size, Share, Trends and Forecast by Product Type, Form, Sales Channel, and Region, 2025-2033

Australia Gut Health Supplements Market Overview:

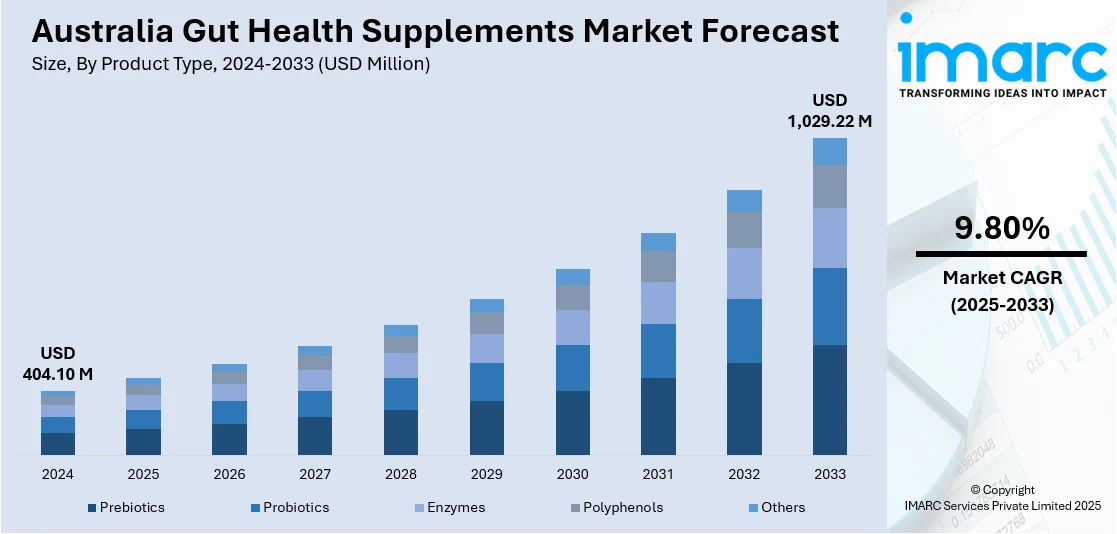

The Australia gut health supplements market size reached USD 404.10 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,029.22 Million by 2033, exhibiting a growth rate (CAGR) of 9.80% during 2025-2033. At present, as gastrointestinal issues are becoming more common, gut health supplements are gaining wider acceptance as an effective and preventative solution. Besides this, the broadening of e-commerce portals is making products more accessible, convenient, and visible to a wider audience, thereby contributing to the expansion of the Australia gut health supplements market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 404.10 Million |

| Market Forecast in 2033 | USD 1,029.22 Million |

| Market Growth Rate 2025-2033 | 9.80% |

Australia Gut Health Supplements Market Trends:

Growing incidence of gastrointestinal disorders

Rising prevalence of gastrointestinal disorders is positively influencing the market in Australia. Conditions, such as inflammatory bowel disease (IBD), bloating, acid reflux, and constipation, affect a growing segment of the population, leading individuals to seek natural and accessible remedies. On 11th February 2025, the Hon. Mark Butler unveiled the ‘Final Report on the State of the Nation’ in Inflammatory Bowel Disease at Parliament House in Australia. It emphasized that there were 179,420 Australians affected by IBD. As people are experiencing discomfort and seeking non-prescription solutions, they are turning to gut health supplements like prebiotics, digestive enzymes, fiber blends and probiotics. These supplements help restore gut flora balance, improve nutrient absorption, and support overall digestive function. Healthcare professionals are also recommending supplements as part of long-term gut health strategies, which strengthens user trust in these products. The aging population, which is more prone to digestive issues, is further driving the demand. People are becoming more educated about the gut-brain axis and its role in immunity and mental health, adding to supplement adoption. Marketing campaigns highlight science-backed benefits, increasing appeal among health-conscious Australians. Rising clean-label preferences and demand for allergen-free, vegan, and organic formulas are also shaping the market.

To get more information on this market, Request Sample

Expansion of e-commerce sites

The expansion of e-commerce portals is impelling the Australia gut health supplements market growth. According to industry reports, in 2024, 17.08 Million Australian people utilized online shopping platforms each month, marking a 45% rise from 2020 (11.78%). Individuals increasingly prefer shopping online for health and wellness products due to the flexibility of browsing, comparing, and ordering from home. Online platforms offer a wide assortment of gut health supplements, inculcating digestive enzymes and fiber-rich options, catering to diverse dietary needs and preferences. The rise of health-focused e-commerce websites and wellness apps provides users with personalized recommendations, detailed product information, and verified customer reviews, which boost user confidence and drive purchases. Subscription models and discount offers available online encourage repeat buying and brand loyalty. E-commerce also enables smaller and niche brands to enter the market and compete by targeting specific user segments. Influencers and digital marketing campaigns on social media platforms are creating awareness and promoting gut health products directly to health-conscious audiences. As internet penetration and smartphone usage are increasing across Australia, e-commerce is becoming a dominant distribution channel.

Australia Gut Health Supplements Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, form, and sales channel.

Product Type Insights:

- Prebiotics

- Probiotics

- Enzymes

- Polyphenols

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes prebiotics, probiotics, enzymes, polyphenols, and others.

Form Insights:

- Tablet

- Capsules

- Liquid

- Powder Premixes

- Gummies/Chewable

- Lozenges

- Liquid and Gels

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes tablet, capsules, liquid, powder premixes, gummies/chewable, lozenges, and liquid and gels.

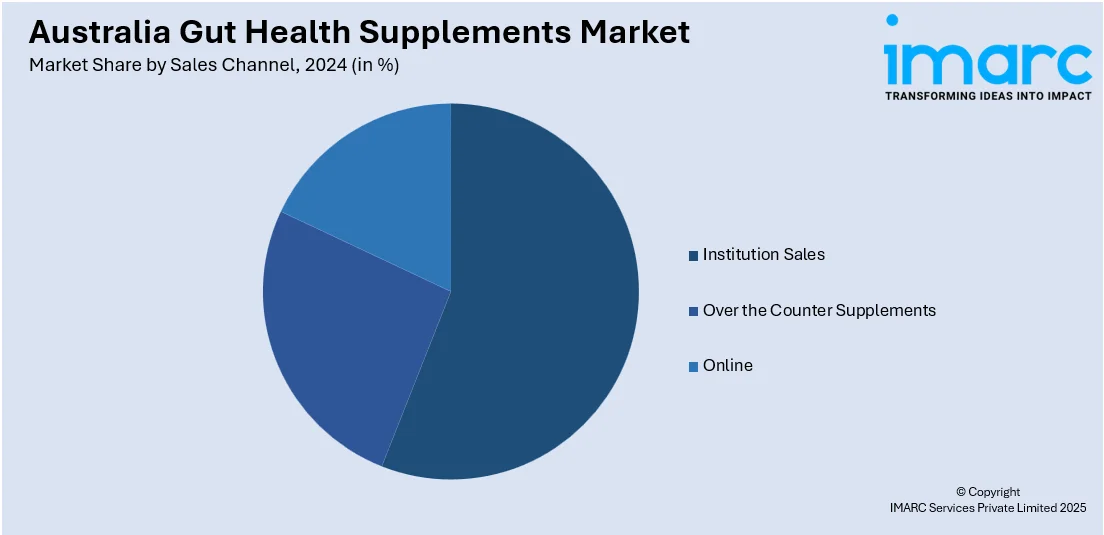

Sales Channel Insights:

- Institution Sales

- Over the Counter Supplements

- Drug Stores and Pharmacies

- Hypermarkets/Supermarkets

- Convenience Stores

- Health and Wellness Stores

- Specialty Stores

- Departmental Stores

- Online

- Company Websites

- 3rd Party/Mass Merchandiser

The report has provided a detailed breakup and analysis of the market based on the sales channel. This includes institution sales, over the counter supplements (drug stores and pharmacies, hypermarkets/supermarkets, convenience stores, health and wellness stores, specialty stores, and departmental stores), and online (company websites and 3rd party/mass merchandiser).

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Gut Health Supplements Market News:

- In June 2024, ADM, a worldwide frontrunner in natural innovative solutions, revealed that the spore-forming probiotic DE111™* (Bacillus subtilis) received formal approval from the Therapeutic Goods Administration (TGA), which was a division of the Australian Department of Health. By broadening access to DE111™, the firm aimed to foster new avenues for innovation for its Australian clients, allowing the creation of groundbreaking gut health supplements. Moreover, the endorsement of DE111™ by significant governmental bodies illustrated its high caliber, safety, and compliance with stringent regulatory requirements.

- In February 2024, in a publication in the journal Nutrients, researchers from Australia performed a review to comprehend the species-level diversity of the gut microbiome and its involvement in the pathology of Alzheimer’s disease. They additionally explored how confounding factors like prebiotics, probiotics, and diet affected the different stages of Alzheimer’s disease. It was found that the makeup of the gut microbiome could be altered by particular dietary habits and the intake of different supplements, which might subsequently affect the gut-brain axis.

Australia Gut Health Supplements Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Prebiotics, Probiotics, Enzymes, Polyphenols, Others |

| Forms Covered | Tablet, Capsules, Liquid, Powder Premixes, Gummies/Chewable, Lozenges, Liquid and Gels |

| Sales Channels Covered |

|

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia gut health supplements market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia gut health supplements market on the basis of product type?

- What is the breakup of the Australia gut health supplements market on the basis of form?

- What is the breakup of the Australia gut health supplements market on the basis of sales channel?

- What is the breakup of the Australia gut health supplements market on the basis of region?

- What are the various stages in the value chain of the Australia gut health supplements market?

- What are the key driving factors and challenges in the Australia gut health supplements market?

- What is the structure of the Australia gut health supplements market and who are the key players?

- What is the degree of competition in the Australia gut health supplements market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia gut health supplements market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia gut health supplements market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia gut health supplements industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)