Australia Hand Tools Market Size, Share, Trends and Forecast by Type, Distribution Channel, End User, and Region, 2025-2033

Australia Hand Tools Market Overview:

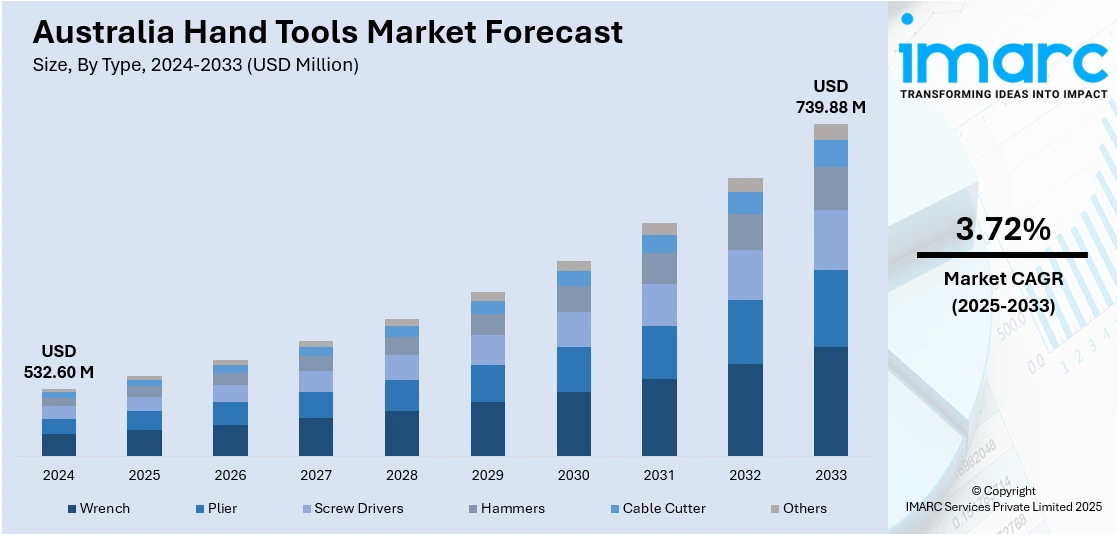

The Australia hand tools market size reached USD 532.60 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 739.88 Million by 2033, exhibiting a growth rate (CAGR) of 3.72% during 2025-2033. At present, the need for reliable and efficient hand tools is continuously growing as a result of investments made in the public and private sectors for the building of roads, bridges, railroads, and buildings. In addition, increasing demands for auto maintenance and repairs are contributing to the expansion of the Australia hand tools market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 532.60 Million |

| Market Forecast in 2033 | USD 739.88 Million |

| Market Growth Rate 2025-2033 | 3.72% |

Australia Hand Tools Market Trends:

Increasing investments in construction activities

Rising investments in construction activities are positively influencing the market in Australia. As the government and private sectors are allocating funds to build roads, bridges, railways, and buildings, the need for reliable and efficient hand tools is growing steadily. Construction workers, contractors, and maintenance teams are using a wide variety of tools, such as hammers, pliers, screwdrivers, and wrenches for daily operations. With the rise in renovation and remodeling activities, especially in urban housing and real estate development, the market is experiencing expansion. Increased focus on quality construction and safety is further driving the demand for durable and ergonomically designed hand tools. The shift towards eco-friendly and energy-efficient buildings is also encouraging specialized tool usage. Additionally, the growing number of small-scale and do-it-yourself (DIY) construction projects among homeowners and hobbyists is adding to this demand. Industrial and mining activities are also contributing by requiring robust tools for ongoing operations and repairs. Training programs and vocational education aid in promoting skilled labor, which increases tool adoption. Retail expansion, both offline and online, is supporting product accessibility and visibility. Promotional offers and toolkits are also attracting buyers. As construction projects are expanding in scope and scale, the consistent need for dependable tools ensures the market continues to grow across Australia. As per a report released by the IMARC Group, the Australia construction market is set to attain USD 588 Billion by 2033, exhibiting a CAGR of 4.30% from 2025-2033.

To get more information on this market, Request Sample

Growing automotive repair and maintenance needs

Rising automotive repair and maintenance needs are impelling the Australia hand tools market growth. Increasing vehicle production is adding more cars to the roads, which in turn is creating the need for regular maintenance and repairs. As per the Australian Automobile Association, between 1 January 2025 and 31 March 2025, 7,881 new medium sport utility vehicle (SUV) battery electric vehicles (BEVs) were sold. Mechanics, technicians, and vehicle owners rely on hand tools, such as wrenches, screwdrivers, pliers, and socket sets, for routine servicing and part replacements. As vehicles are becoming more complex, there is a growing need for specialized tools that can handle modern automotive systems. DIY car maintenance is also gaining popularity, leading individuals to invest in personal toolkits. The aging vehicle population is further adding to maintenance frequency. Automotive workshops and garages continuously upgrade their tool inventory to match evolving vehicle technologies and improve efficiency. Retailers are responding by offering toolsets tailored for automotive use, both in physical stores and online platforms.

Australia Hand Tools Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, distribution channel, and end user.

Type Insights:

- Wrench

- Plier

- Screw Drivers

- Hammers

- Cable Cutter

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes wrench, plier, screw drivers, hammers, cable cutter, and others.

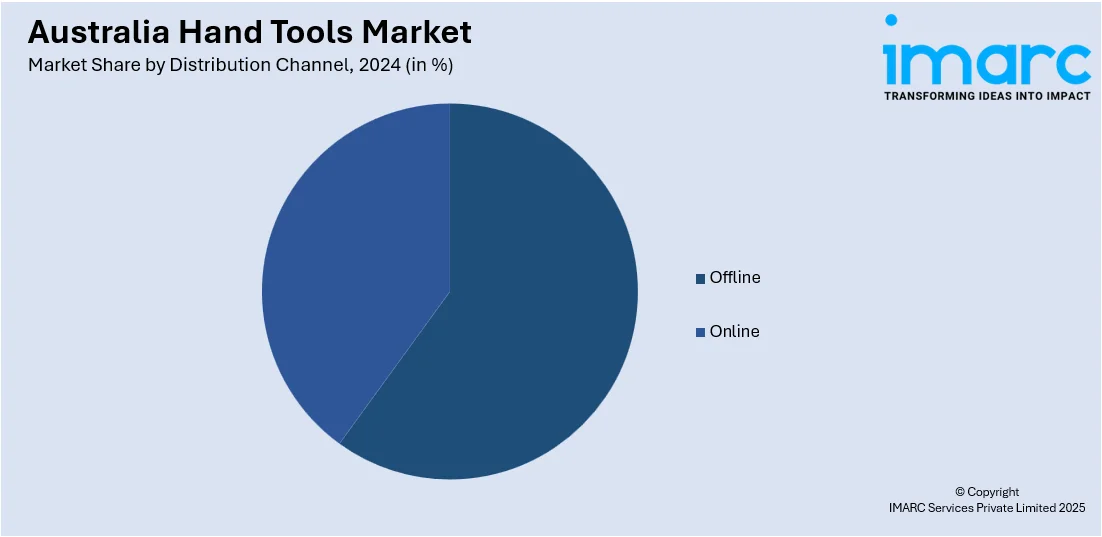

Distribution Channel Insights:

- Offline

- Online

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes offline and online.

End User Insights:

- DIY

- Commercial

- Industrial

The report has provided a detailed breakup and analysis of the market based on the end user. This includes DIY, commercial, and industrial.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Hand Tools Market News:

- In February 2025, Stealth Group Holdings Ltd obtained exclusive distribution rights in Australia and New Zealand for CAT® Power Tools and Wesco Power Tools via Positec, the prominent tool manufacturer, in addition to Harden Hand Tools. These contracts, established for an initial five-year duration for Wesco and Harden Hand Tools and a three-year duration for CAT® Power Tools, provided Stealth exclusive rights to sell these well-known brands throughout all market channels. This bolstered Stealth’s strategic emphasis on high-margin exclusive product lines and represented a crucial milestone in its FY28 growth strategy, further enhancing its standing in the power and hand tool sector.

- In July 2024, Flextool revealed that it gained exclusive distribution rights for Kraft Tool Co., a well-known brand of construction hand tools, in Australia, marking a significant expansion in product offerings and a commitment to quality. The latter became part of Flextool’s premium ‘Home of leading brands’ lineup, which featured MQ Whiteman, Multiquip, Mikasa, and Smith Performance Sprayers. This strategic partnership represented an important milestone for Flextool as it persisted in broadening its extensive range of products to cater to the varied requirements of the concrete and masonry sectors in Australia.

Australia Hand Tools Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Wrench, Plier, Screw Drivers, Hammers, Cable Cutter, Others |

| Distribution Channels Covered | Offline, Online |

| End Users Covered | DIY, Commercial, Industrial |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia hand tools market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia hand tools market on the basis of type?

- What is the breakup of the Australia hand tools market on the basis of distribution channel?

- What is the breakup of the Australia hand tools market on the basis of end user?

- What is the breakup of the Australia hand tools market on the basis of region?

- What are the various stages in the value chain of the Australia hand tools market?

- What are the key driving factors and challenges in the Australia hand tools market?

- What is the structure of the Australia hand tools market and who are the key players?

- What is the degree of competition in the Australia hand tools market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia hand tools market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia hand tools market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia hand tools industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)