Australia Head-Up Display Market Size, Share, Trends and Forecast by Product Type, Conventional and Augmented Reality, Technology, Application, and Region, 2025-2033

Australia Head-Up Display Market Overview:

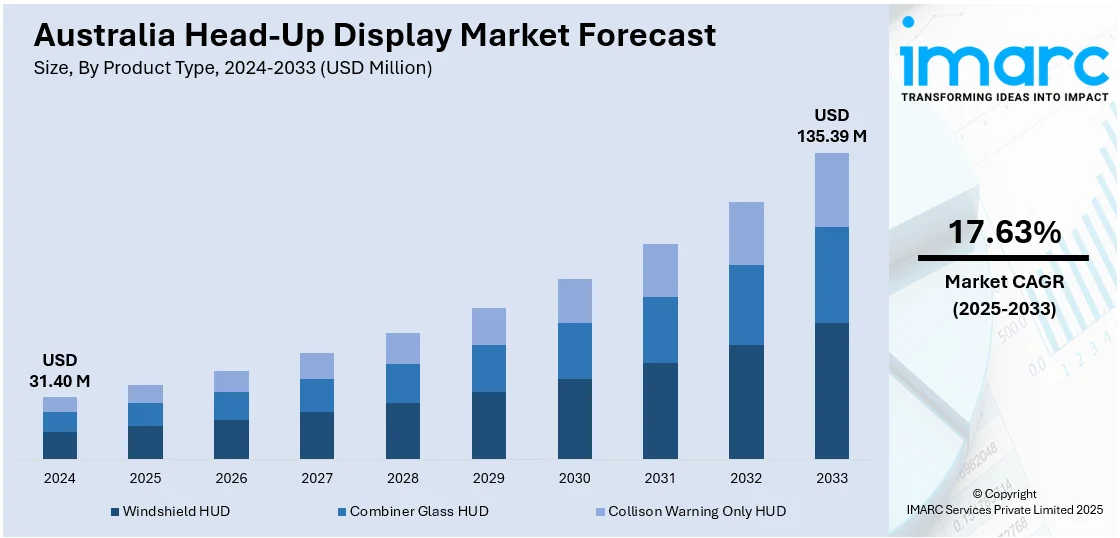

The Australia head-up display market size reached USD 31.40 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 135.39 Million by 2033, exhibiting a growth rate (CAGR) of 17.63% during 2025-2033. The market is driven by advanced projection technology improving driver and pilot situational awareness through presenting vital information within the direct line of sight, covering use across automotive and aviation industries with an emphasis on safety, navigation, and the provision of real-time data via both traditional and augmented reality (AR) technology.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 31.40 Million |

| Market Forecast in 2033 | USD 135.39 Million |

| Market Growth Rate 2025-2033 | 17.63% |

Australia Head-Up Display Market Trends:

Integration of Augmented Reality in Head-Up Displays

Australia is experiencing a sharp trend towards integrating augmented reality (AR) in head-up displays (HUDs), revolutionizing the presentation of information to drivers. For instance, in January 2024, AUO unveiled its Smart Cockpit 2024 at CES, including next-generation Micro LED in-car screens, further strengthening Australia's automotive HUD market with immersive, curved visual displays and safety-driven innovations. Moreover, the integration is fueled by the need for immersive, real-time visualization of data that makes driving safer and easier to navigate. AR HUDs overlay contextual imagery like lane guidance, hazard warnings, and turn-by-turn directions directly onto the windshield making drivers stay visually focused on the road. With consumer demands increasing for connected, intelligent in-car experiences, AR has become a point of differentiation for the auto industry. This change complements greater movement toward AI and sensor fusion-based advances that can enable more accurate, adaptive displays. Australia head-up display market outlook mirrors an amplifying demand for such cutting-edge interfaces, with OEMs focusing on user-friendly designs and integration with sophisticated driver assist systems across premium and mid-range vehicle classes.

To get more information on this market, Request Sample

Shift Towards Windshield-Projected Displays

The key trend in the Australia HUD space is the move away from combiner-based HUDs and towards windshield-projected displays. These systems provide a wider and more integrated view field, projecting important driving information onto the windshield in the driver's natural line of sight. This trend is driven by technological maturity as well as heightened consumer awareness of ergonomic vehicle design. Windshield HUDs promote safety by reducing eye movement and enabling continuous road surveillance, thus meeting current vehicle safety regulations and design priorities. For example, in January 2023, BMW unveiled its next-generation head-up display, due in 2025 in the 'Neue Klasse' cars. The HUD with augmented technology provides increased functionality, having an impact on the Australian market. Furthermore, electric and hybrid vehicle adoption is also driving OEMs to include advanced HUD systems that fit well with the digital cockpit ambiance. Australia head-up display market share is spreading at a slow pace, indicating improving consumer demand for premium attributes and vehicle manufacturers' interest in delivering differentiated, high-value technology upgrades.

Adoption of HUDs in Mid-Segment Vehicles

The uptake of head-up displays in Australia is quickly progressing from luxury segments and into mid-range car segments. The democratization is underpinned by the reduction in component prices, modular design, and increased software flexibility, enabling original equipment manufacturers (OEMs) to offer HUD features with little pricing impact. With evolving consumer expectations, buyers of cars intensely look for safety, convenience, and instant access to information, all of which HUDs easily offer. In addition, local and international regulations placing focus on driver attention and minimal distraction are backing the trend. The availability of technology-aware consumers and rising semi-autonomous feature penetration are other drivers. This shift represents a larger movement in consumer behavior, where formerly exclusive technologies are viewed as necessities. Australia head-up display market growth is supported by this diverse market approach, a good indicator for sustained innovation and uptake on a broader spectrum of automotive models and price ranges.

Australia Head-Up Display Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product type, conventional and augmented reality, technology, and application.

Product Type Insights:

- Windshield HUD

- Combiner Glass HUD

- Collison Warning Only HUD

The report has provided a detailed breakup and analysis of the market based on the product type. This includes windshield HUD, combiner glass HUD, and collison warning only HUD.

Conventional and Augmented Reality Insights:

- Conventional HUD

- Augmented Reality Based HUD

A detailed breakup and analysis of the market based on the conventional and augmented reality have also been provided in the report. This includes conventional HUD and augmented reality based HUD.

Technology Insights:

- CRT Based HUD

- Digital HUD

- Optical Waveguide HUD

- Digital Micromirror Device (DMD) HUD

- Light Emitting Diode (LED) HUD

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes CRT based HUD and digital HUD (optical waveguide HUD, digital micromirror device (DMD) HUD, light emitting diode (LED) HUD, and others).

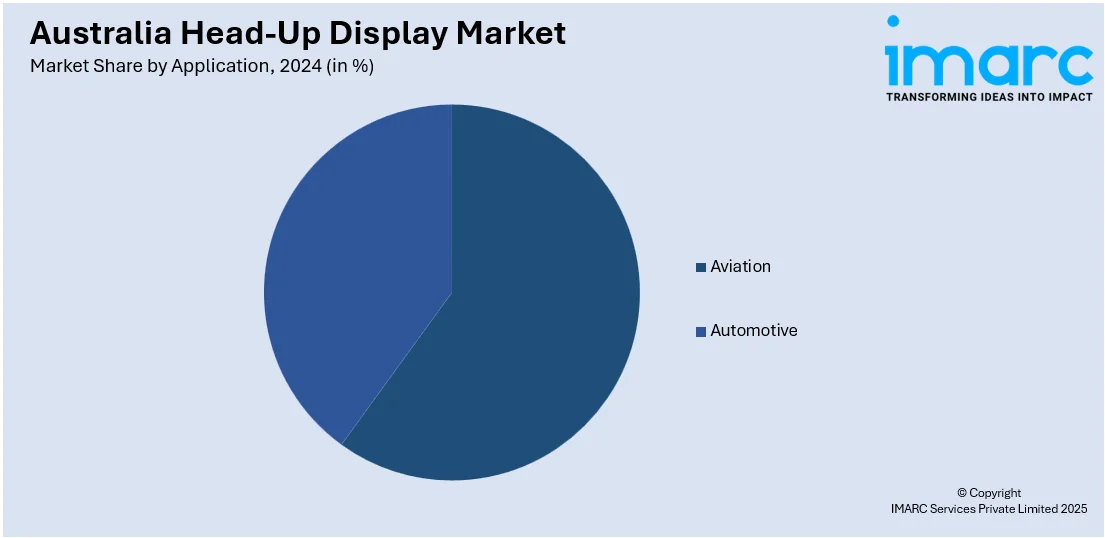

Application Insights:

- Aviation

- Automotive

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes aviation and automotive.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Head-Up Display Market News:

- In March 2024, Valeo, a world-leading automotive technology company, and Australian-headquartered Seeing Machines officially declared a strategic partnership to advance driver and occupant monitoring systems (OMS)—key elements facilitating advanced Head-Up Display (HUD) integration. Under the deal, Valeo sold its perception software business and Berlin-headquartered startup Asaphus to Seeing Machines.

Australia Head-Up Display Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Windshield HUD, Combiner Glass HUD, Collison Warning Only HUD |

| Conventional and Augmented Realities Covered | Conventional HUD, Augmented Reality Based HUD |

| Technologies Covered |

|

| Applications Covered | Aviation, Automotive |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia head-up display market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia head-up display market on the basis of product type?

- What is the breakup of the Australia head-up display market on the basis of conventional and augmented reality?

- What is the breakup of the Australia head-up display market on the basis of technology?

- What is the breakup of the Australia head-up display market on the basis of application?

- What is the breakup of the Australia head-up display market on the basis of region?

- What are the various stages in the value chain of the Australia head-up display market?

- What are the key driving factors and challenges in the Australia head-up display?

- What is the structure of the Australia head-up display market and who are the key players?

- What is the degree of competition in the Australia head-up display market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia head-up display market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia head-up display market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia head-up display industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)