Australia Health Insurance Market Size, Share, Trends and Forecast by Provider, Type, Plan Type, Demographics, Provider Type, and Region, 2025-2033

Australia Health Insurance Market Size and Share:

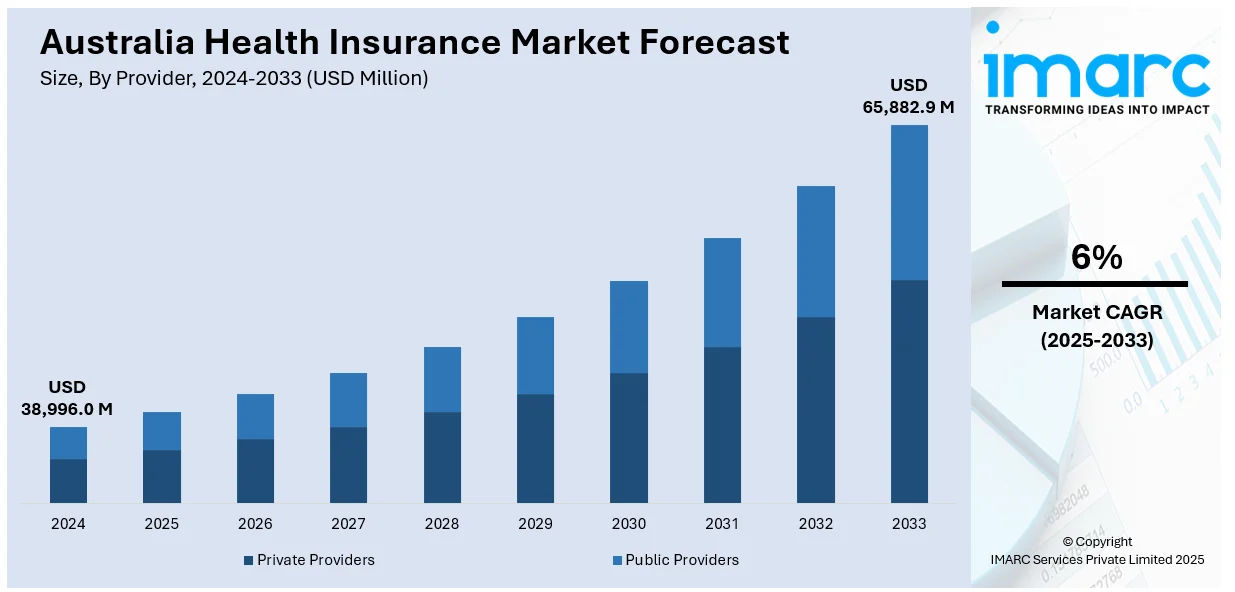

The Australia health Insurance market size reached USD 38,996.0 Million in 2024. Looking forward, the market is expected to reach USD 65,882.9 Million by 2033, exhibiting a growth rate (CAGR) of 6% during 2025-2033. The market is fueled by rising demand for full-coverage, digital healthcare solutions, and the aging population. These drivers are creating a dynamic market, which is challenging insurers to evolve with more customized products and innovative services.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 38,996.0 Million |

| Market Forecast in 2033 | USD 65,882.9 Million |

| Market Growth Rate 2025-2033 | 6% |

Key Trends of Australia Health Insurance Market:

Increasing Demand for Comprehensive Health Plans

The Australian health insurance industry has seen a significant trend towards extensive coverage policies. Increasingly, people are choosing policies that provide both hospital and extras cover, which cater to a broader spectrum of healthcare needs. This is due to the accelerating out-of-pocket costs for medical care and the shortcomings of Medicare, which does not cover all treatments or services. An increasing number of consumers in Australia are realizing the worth of extra coverage for dental, eye, and mental health care, amplifying the demand for bundled policies. With more Australians looking for wider healthcare cover, there has been a rise in combined cover policies. This shift reflects a broader trend of individuals seeking more comprehensive healthcare coverage, resulting in a notable rise in combined cover policies. The demand for holistic health solutions is expected to persist, further supporting the expansion of bundled offerings. The Australia health insurance market outlook remains positive, with this trend contributing to sustained industry growth. It presents insurers with opportunities to develop more tailored and inclusive plans that address a broad spectrum of consumer healthcare needs. According to reports from March 2024, Health Minister Mark Butler approved an average premium increase of 3.03% for private health insurance. Notably, NIB raised its rates by 4.1%, while Medibank implemented a 3.31% increase, reflecting ongoing adjustments within the sector to meet evolving consumer expectations and healthcare costs.

To get more information on this market, Request Sample

Rise of Digital Health Solutions

Digital health solutions are the emerging trend in the Australian health insurance sector, fueled by customer needs for easier, more accessible healthcare services. The uptake of telemedicine, health monitoring apps, and online claim handling technology is changing the way Australians engage with their health insurers. For instance, in October 2024, more than 2.2 million Bupa health insured Australians became entitled to three telehealth doctor consults free each year through the Blua platform, alleviating cost-of-living burdens and facilitating emergency department demand management. Moreover, with a growing dependence on smartphones and digital channels, insurers are incorporating technology into their products to simplify processes like virtual consultations, real-time monitoring of health, and quicker filing of claims. This mirrors general trends in consumer demand for enhanced convenience and efficiency in healthcare services. The development of digital solutions has also been an increasingly important factor in retaining and attracting policyholders, particularly with newer generations adopting technology across all areas of life. The future pattern for Australia health insurance market growth will continue to gain momentum through ongoing innovation in digital health services. Insurers will be urged to further develop digitally in order to remain competitive in this rapidly changing market.

Aging Population and Tailored Insurance Products

Australia's aging population is also strongly impacting the nation's health insurance industry, where the trend in demand for specially tailored policies targeting the specific requirements of aged Australians is gaining prominence. With a growing population nearing retirement, greater emphasis is placed on extending healthcare coverage through offerings such as management of chronic illness, rehabilitation, and aged care. This demographic change has caused insurers to adjust their product, producing policies which are specifically tailored to meet the individual healthcare requirements of seniors. These usually feature amplified levels of hospital stay cover, boosted outpatient services, and increased levels of home and community care. The mounted demand for these specialized insurance products is driving the Australian health insurance market share. The share of policies serving aged Australians will further grow, as it mirrors the general Australia health insurance growth trend. The aging population trend highlights the need for insurers to meet changing needs through adaptation.

Growth Drivers of Australia Health Insurance Market:

Incentives and Policy Mechanisms Encouraging Private Coverage

One unique growth driver in Australia's health insurance market is the government incentives within national health policy. Tools such as the Medicare Levy Surcharge and Lifetime Health Cover loading positively incentivize people to acquire private hospital insurance coverage. The Private Health Insurance Rebate offsets premiums, especially among middle-income and older age groups, making private cover more affordable. Exclusive to Australia's dual public‑private system, these arrangements decrease the dependency on public hospitals by moving non-emergency care from public into insured private facilities. This promotes consumer take-up of packaged combined cover policies that package hospital cover with extras such as dental, optical, and physiotherapy. Further, as Australians learn about these incentives, they increasingly turn to customized policy arrangements that provide both fiscal relief and more control over health care interactions. This policy-driven environment strongly underpins the Australia health insurance market demand and spurs consistent market growth.

Public System Pressures and Need for Faster Access

Another main driver of private health insurance growth in Australia is the pressure on the public health system. Although Medicare covers almost everything, long waits for elective procedures, specialist consultations, and some diagnostic tests tend to encourage people to seek faster access via private care. More and more Australians are buying private insurance in order to avoid long public hospital queues and to have the ability to select doctors and hospitals more freely. This is particularly common in urban centers such as Sydney and Melbourne, where public wait times are often long and there is high demand for health services. Couples and older people with continuing health requirements also favor the security and lower pressure involved in using private hospital facilities. The increasing feeling that private insurance provides convenience, speed of treatment, and more customized care is driving market demand, which is a singular and potent growth force in Australia.

Flexibility, Lifestyle Fit, and Personalized Cover

According to the Australia health insurance market analysis, a key growth driver in the industry is the enhanced demand for flexible, customizable cover that fits into individual lifestyles and health concerns. Australian consumers are now looking for policies that can be tailored to stages of life, whether it's maternity cover for young families, mental health services for young adults, or wellness extras for sporty people. Health insurers are answering with tiered policies, modular extras, and specialty benefits that enable consumers to tailor their protection. For example, insurers are providing mental wellness programs, gym memberships, or rebates for natural therapy to accommodate holistic health preferences. This personalization is fueled by a wider Australian consumer shift towards choice, transparency, and value. With competitive and digitally connected insurance, the capacity to personalize policies improves customer satisfaction and increases retention as well as new customer acquisition. With changing expectations, customization emerges as a key driver of health insurance expansion.

Opportunities of Australia Health Insurance Market:

Expansion of Regional and Rural Health Coverage

One of the key opportunities in Australia’s health insurance market lies in addressing coverage gaps in regional and rural areas. Whereas major cities such as Sydney and Melbourne enjoy high levels of insurance take-up and access to private hospitals, numerous Australians residing in rural or remote communities experience difficulties in receiving both public and private healthcare services. Such geographical inequality offers insurers the opportunity to create specialized products best suited to rural demand. These might consist of policies that involve increased telehealth allowances, travel and accommodation incentives for specialist interventions in urban cities, and collaborations with regional healthcare providers. Providing such focused coverage would not only close a current service gap but also reinforce brand loyalty among underserved populations. As digital infrastructure continues to advance in regional Australia, insurers that embrace outreach, education, and flexible policy design for rural consumers can gain competitive advantage while helping to deliver more even health outcomes across the country.

Integration of Mental Health and Preventive Wellness

There is an emerging national debate in Australia on mental health that is creating new opportunities for health insurers to build out their product offerings. As awareness grows and stigma wanes, Australians are approaching mental health treatment earlier, such as counseling, therapy, and stress management services. Health insurers can act by including more comprehensive mental health cover in base policies, especially under extras cover or via wellness add-ons. Besides, insurers can also collaborate with digital health platforms to provide app-based therapy sessions, mindfulness training, and distant psychological consultations, well suiting Australia's high level of digital use. Preventive wellness is also an emerging area, as consumers seek assistance not only for sickness but for sustaining daily health. Rewarding programs for healthy habits, such as fitness visits to the gym, nutrition counseling, or health check-ups—can improve customer retention and participation. By accessing these changing health needs, insurers are able to provide more value and enhance customer satisfaction across a range of age groups.

Increase in Expatriate, Student, and Migrant Health Cover

Australia's reputation as a top destination for international students, skilled migrants, and temporary workers represents a significant opportunity for health insurers to create niche products for this emerging population. These audiences may need health insurance that meets visa requirements but also want policies that enable convenient access to treatment while they are abroad. Insurers providing transparent, low-cost, and adaptable policies, particularly those with multilingual customer support and streamlined sign-up processes, can gain a large slice of this business. As Australia is a multicultural nation, this also creates a strong demand for culturally responsive services and customer experiences that respect and respond to diverse communities. International students in Brisbane, Adelaide, and Perth frequently experience difficulties in accessing the healthcare system, leaving room for insurers to introduce value-added offerings like health literacy information or concierge-level assistance. By modifying their products and communication approaches, health insurers can develop trust with these high-value, but temporary, populations, releasing significant growth potential in a competitive market.

Challenges of Australia Health Insurance Market:

Increasing Premium Prices and Affordability Issues

One of the most significant challenges for the Australian health insurance market is the consistent rise in premium prices, causing affordability issues for numerous consumers. Even with government rebates aimed at counteracting costs, medical inflation, improvements in medical technology, and growing cost of claims exert upward pressure on premiums. Low- to middle-income families, particularly young Australians and regional residents, can have coverage reduced or even fall off insurance altogether because of these increasing costs. This is augmented by the belief that private health insurance has limited value compared with out-of-pocket costs and Medicare services. Australians living in rural and remote areas may especially feel disadvantaged, as less choice of private hospitals and greater distances to travel to access care diminishes the attractiveness of buying private cover. Maintaining a balance between sustainable premium pricing and comprehensive coverage remains a critical hurdle for insurers seeking to expand their customer base nationwide.

Navigating Complex Regulatory Environment and Policy Changes

Australia’s health insurance market operates within a complex regulatory framework that can create challenges for both insurers and consumers. Government regulations like as the Medicare Levy Surcharge, Lifetime Health Cover loading, and rebate designs heavily influence the sector and force insurers to continuously alter their pricing and plan designs. Ongoing policy reviews and changing healthcare funding models create uncertainty for insurers and increase administrative expenses. These regulatory nuances have also the potential to perplex consumers, and it may be challenging for many to discern the advantages and constraints of their coverage. In addition, any possible modification to government incentives or rebate adjustments has the potential to create market disruptions, impacting insurer profitability and consumer behavior. As the healthcare landscape in Australia unfolds with emerging public-private partnerships and digital health developments, insurers need to stay nimble to keep up with changing regulations without compromising on product competitiveness and consumer confidence.

Consumer Distrust and Perceived Value Issues

Consumer skepticism over the value and transparency of private health insurance products is another significant challenge in the Australian health insurance industry. Most Australians debate whether or not the value of private health insurance outweighs the expense, especially with the extensive public healthcare provision made available through Medicare. Much of this distrust is caused by ambiguous policy wording, exclusions, and convoluted claim procedures that result in dissatisfied and frustrated customers. Others view private health insurance as having less access to particular treatments or specialists, which has negative implications on retention rates and new customer acquisition. Insurers are constantly challenged with improving communication, streamlining policy choices, and providing higher transparency to enhance trust. Customizing products to suit varied requirements and sensitizing consumers to optimum benefits are key steps. This challenge acquires a high relevance in a market where educated consumer choice and competitive pricing govern buying decisions.

Australia Health Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on provider, type, plan type, demographics, and provider type.

Provider Insights:

- Private Providers

- Public Providers

The report has provided a detailed breakup and analysis of the market based on the provider. This includes private providers and public providers.

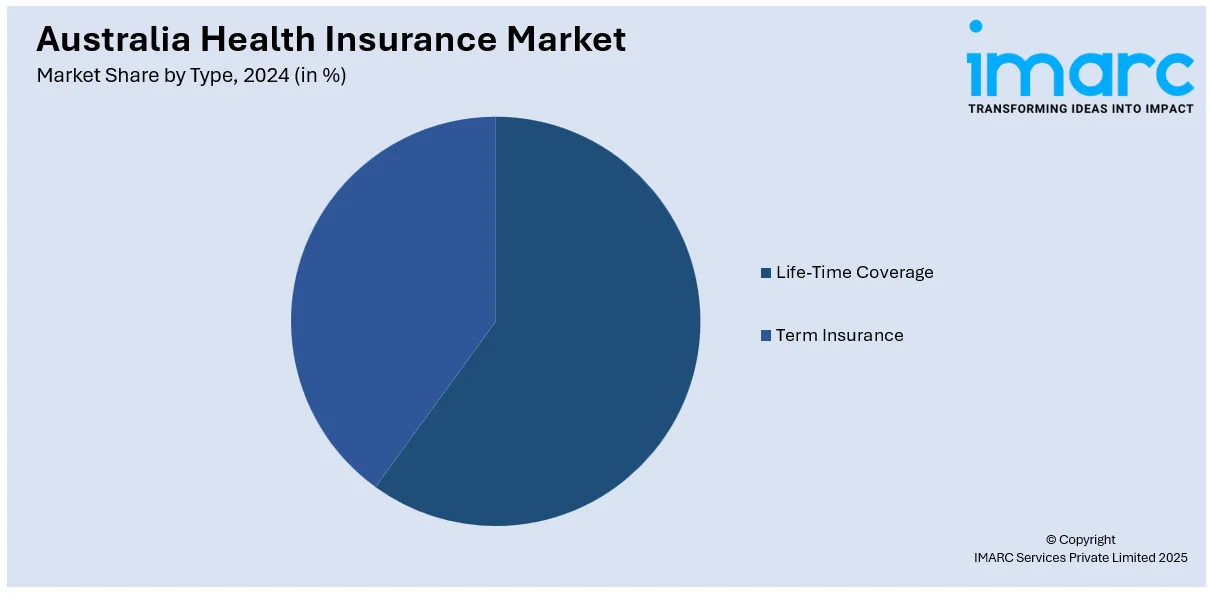

Type Insights:

- Life-Time Coverage

- Term Insurance

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes life-time coverage and term insurance.

Plan Type Insights:

- Medical Insurance

- Critical Illness Insurance

- Family Floater Health Insurance

- Others

The report has provided a detailed breakup and analysis of the market based on the plan type. This includes medical insurance, critical illness insurance, family floater health insurance, and others.

Demographics Insights:

- Minor

- Adults

- Senior Citizen

A detailed breakup and analysis of the market based on the demographics have also been provided in the report. This includes minor, adults, and senior citizen.

Provider Type Insights:

- Preferred Provider Organizations (PPOs)

- Point of Service (POS)

- Health Maintenance Organizations (HMOs)

- Exclusive Provider Organizations (EPOs)

The report has provided a detailed breakup and analysis of the market based on the provider type. This includes preferred provider organizations (PPOs), point of service (POS), health maintenance organizations (HMOs), and exclusive provider organizations (EPOs).

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided, including:

- Bupa HI Pty Ltd

- HBF Health Limited

- HCF Australia

- Medibank Private Limited

- nib Group

Australia Health Insurance Market News:

- In September 2024, HCF launched Hospital Basic Plus, a private hospital cover product specifically for young Australians, offering basic hospital cover—including accident protection and procedures such as joint reconstructions—for an affordable cost to fill the gap in insurance affordability.

- In July 2024, AIA Australia debuted its Member Insurance Portal simplifying group insurance claims with real-time monitoring, electronic ID verification, and secure third-party access. The enhancement aims to enhance claim transparency, mitigate admin hassles, and enhance member experience, with takeup by HESTA, CSC, and Vanguard.

- In April 2024, nib Group introduced an artificial intelligence-based symptom checker to support members, particularly international workers and students, through Australia's health system. Within the nib app, the service improves access to care, de-loads the emergency department, and facilitates informed triage, demonstrating nib's focus on technology-driven, cost-effective healthcare solutions.

Australia Health Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Providers Covered | Private Providers, Public Providers |

| Types Covered | Life-Time Coverage, Term Insurance |

| Plan Types Covered | Medical Insurance, Critical Illness Insurance, Family Floater Health Insurance, Others |

| Demographics Covered | Minor, Adults, Senior Citizen |

| Provider Types Covered | Preferred Provider Organizations (PPOs), Point of Service (POS), Health Maintenance Organizations (HMOs), Exclusive Provider Organizations (EPOs) |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Companies Covered | Bupa HI Pty Ltd, HBF Health Limited, HCF Australia, Medibank Private Limited, nib Group, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia health Insurance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia health Insurance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia health Insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia health insurance market was valued at USD 38,996.0 Million in 2024.

The Australia health insurance market is projected to exhibit a CAGR of 6% during 2025-2033.

The Australia health insurance market is expected to reach a value of USD 65,882.9 Million by 2033.

The Australia health insurance market is evolving with growing demand for personalized and flexible plans, increased digital health integration, and expanded mental health coverage. Consumers prioritize value-added wellness services and preventive care. There is also a shift toward hybrid policies combining hospital and extras cover to better meet diverse healthcare needs across demographics.

The Australia health insurance market is driven by government incentives, rising demand for faster access to private care, and an aging population requiring specialized coverage. Increasing health awareness and digital health innovations also boost demand. Consumers seek personalized plans that offer flexibility, value-added services, and better control over their healthcare choices.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)