Australia Health and Wellness Market Report by Product Type (Functional Foods and Beverages, Beauty and Personal Care Products, Preventive and Personalized Medicinal Products, and Others), Functionality (Nutrition and Weight Management, Heart and Gut Health, Immunity, Bone Health, Skin Health, and Others), and Region 2026-2034

Australia Health and Wellness Market Size and Share:

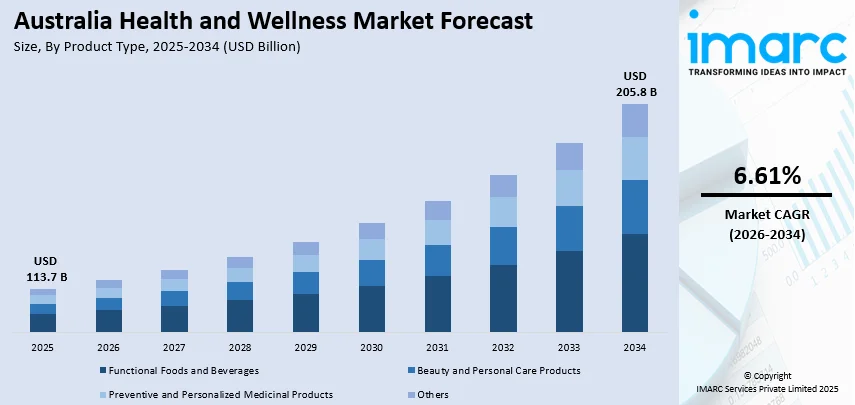

The Australia health and wellness market size reached USD 113.7 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 205.8 Billion by 2034, exhibiting a growth rate (CAGR) of 6.61% during 2026-2034. The integration of technology in health and wellness solutions, such as wearables, mobile apps, telemedicine, and health tracking devices, which make it easier for individuals to monitor and manage their health, is primarily driving the regional market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 113.7 Billion |

|

Market Forecast in 2034

|

USD 205.8 Billion |

| Market Growth Rate 2026-2034 | 6.61% |

Health and wellness encompass a holistic approach to maintaining and improving one's overall well-being. It goes beyond the absence of illness and emphasizes the integration of physical, mental, and social aspects of life. Achieving health involves adopting positive lifestyle choices, such as regular exercise, balanced nutrition, and sufficient sleep. Mental and emotional well-being are equally vital, encompassing stress management, mindfulness, and emotional resilience. Additionally, fostering strong social connections and a supportive community contributes significantly to overall wellness. Striving for a harmonious balance in these various dimensions leads to a more fulfilling and healthier life. Regular health check-ups and preventive measures also play a crucial role in maintaining optimal physical health. Ultimately, health and wellness empower individuals to lead active, meaningful lives and prevent the onset of diseases, promoting longevity and a higher quality of life.

To get more information on this market Request Sample

Key Trends of Australia Health and Wellness Market:

Integration of Digital Health Technologies

Digital health tools like mobile apps, wearables, and telehealth platforms are transforming how Australians manage wellness. Consumers increasingly rely on smartwatches, fitness trackers, and health-monitoring apps to track daily activity, diet, and vitals. Telemedicine use has exploded after the pandemic, facilitating easy remote consultations. In addition to making preventive care easier, these technologies encourage real-time health monitoring and communication, which leads to a more proactive approach to one's well-being. As digital literacy improves and technology becomes less costly, demand for holistic health-tech solutions is likely to keep rising. The marriage of data analytics and targeted insights is also more so defining consumer expectations as it brings health management more intuitive and personalized than ever to the Australian market.

Growing Demand for Holistic Wellness Solutions

According to the Australia health and wellness market analysis, Australian consumers are shifting from traditional fitness-focused health approaches to more comprehensive wellness models. The concept of holistic wellness, which includes mental, emotional, physical, and even spiritual well-being, is gaining popularity. It is reflected in the growing trend of meditation applications, yoga centers, mindfulness retreats, and holistic treatments such as acupuncture and naturopathy. People are seeking health as a long-term lifestyle perspective as opposed to quick solutions. Brands providing wellness ecosystems (encompassing sleep, stress management, nutrition, and movement) are experiencing greater customer engagement. This trend is also fueling the demand for natural and organic personal care, superfoods, and plant-based supplements, showing that Australians are adopting a more interconnected view of health and well-being.

Rise in Functional Foods and Nootropic Beverages

Functional foods, products with added health benefits beyond basic nutrition, are gaining popularity in Australia, which is further boosting the Australia health and wellness market demand. Consumers are increasingly turning to products that enhance immunity, digestion, brain function, and energy. Nootropic drinks, which are formulated to boost cognitive performance and mitigate mental exhaustion, have made quick inroads into the market, particularly among young professionals and students. Ingredients such as adaptogens, mushrooms, collagen, and probiotics are being added to daily snacks, beverages, and meals. This change is driven by consumers who want convenience without trading off health objectives. With increasing knowledge of the gut-brain axis and cellular well-being, Australians are being better informed in their food choices, creating stronger demand for fortified, clean-label, and bioactive foods.

Growth Factors of Australia Health and Wellness Market:

Increased Health Consciousness Post-COVID

The pandemic drastically altered consumer priorities, placing health and wellness at the forefront of daily life. Australians became more aware of the importance of preventive healthcare, immunity boosting, and mental well-being. This has led to increased investments in wellness routines, including dietary supplements, fitness regimes, regular health checkups, and home fitness equipment. A cultural shift toward self-care has also emerged, influencing purchasing decisions and lifestyle changes. The experience of COVID-19 has made consumers more proactive in managing health risks, which has created sustained demand for products and services that promote resilience and long-term well-being. This awareness is translating into higher spending across wellness segments and shaping how brands design their offerings, thus fueling the Australia health and wellness market share.

Supportive Government Policies and Corporate Wellness Initiatives

The Australian government’s emphasis on public health and preventive care is a major driver. Initiatives like the National Preventive Health Strategy and funding for mental health services create a conducive environment for wellness-related businesses. Additionally, corporations are increasingly adopting employee wellness programs to boost productivity and morale, which include gym memberships, mindfulness training, and nutrition counseling. The trend toward hybrid working has further accelerated demand for wellness solutions that support physical and mental health at home. These combined efforts by the public and private sectors are expanding access to health resources, encouraging a wellness-centric lifestyle, and fueling growth across the market. Regulatory support also ensures credibility and consumer trust in new wellness offerings.

Aging Population and Rise in Chronic Diseases

Australia's ageing demographic is significantly contributing to Australia health and wellness market growth. With a larger portion of the population over 60, there is a growing need for solutions that address age-related conditions like arthritis, heart disease, and diabetes. This demographic is increasingly adopting wellness products such as mobility aids, dietary supplements, and functional foods to maintain independence and quality of life. Additionally, chronic conditions affecting younger populations, linked to sedentary lifestyles and poor diet, are prompting consumers to seek preventive wellness solutions earlier in life. This dual pressure from both ageing consumers and lifestyle-driven illnesses is accelerating demand for a broad spectrum of health and wellness services, making it a sustained growth factor for the market.

Australia Health and Wellness Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on product type and functionality.

Product Type Insights:

- Functional Foods and Beverages

- Beauty and Personal Care Products

- Preventive and Personalized Medicinal Products

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes functional foods and beverages, beauty and personal care products, preventive and personalized medicinal products, and others.

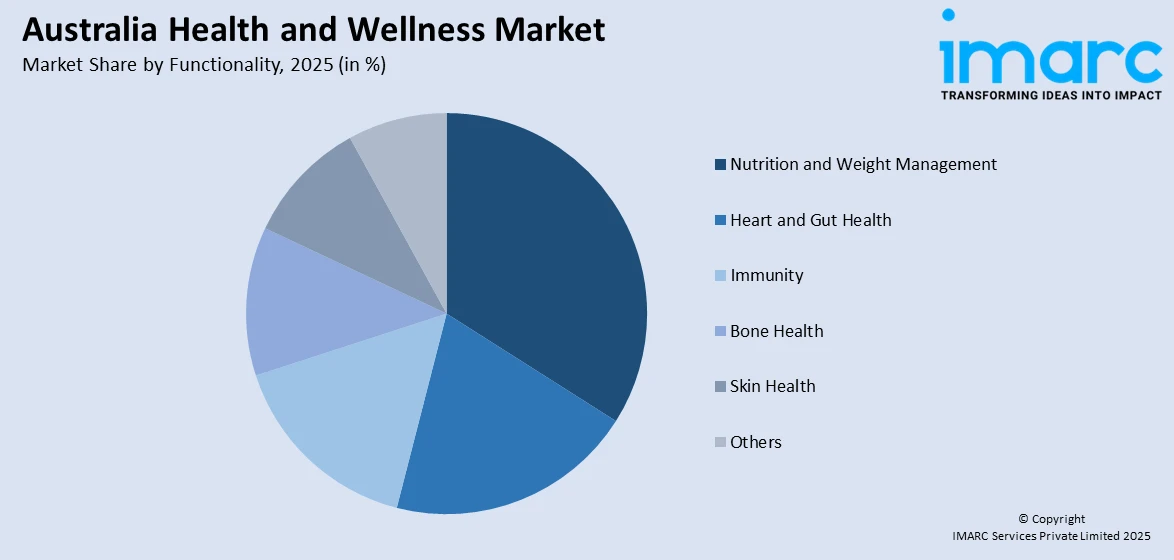

Functionality Insights:

Access the comprehensive market breakdown Request Sample

- Nutrition and Weight Management

- Heart and Gut Health

- Immunity

- Bone Health

- Skin Health

- Others

A detailed breakup and analysis of the market based on the functionality have also been provided in the report. This includes nutrition and weight management, heart and gut health, immunity, bone health, skin health, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Health and Wellness Market News:

- In January 2025, Foxtel Group teamed up with Amcal Pharmacy to debut a new health and wellness program titled ‘Gen Well’, set to premiere on the LifeStyle channel in May 2025. Fronted by renowned Australian TV host Ali Daddo, the series will also be accessible via streaming on Foxtel Go and Binge. Gen Well is designed to offer a new outlook on enhancing the health and well-being of Australia’s diverse, multigenerational families.

- In November 2024, The Australian introduced The Australian Health & Wellbeing, a new digital-first section focused exclusively on health-related content. Doctors such as specialist dermatologist Ritu Gupta, consultant obstetrician and gynecologist Michael Gannon, women's health expert and adviser Magdalena Simonis, and surgical specialist professor Steve Robson, who teaches at the Australian National University's School of Medicine, will be writing columns for Health & Wellbeing.

- In February 2024, TELUS Health, a worldwide leader in healthcare offering extensive physical, mental, and financial wellness services for families and employers globally, unveiled the TELUS Health Wellbeing solution for organizations in Australia. The platform, available as a web and mobile app, aims to assist employees in adopting wellbeing and enhancing their overall health by fostering enduring behavioral change.

- In January 2024, News Corp Australia rolled out Health of the Nation, a nationwide initiative aimed at motivating Australians to become more active and adopt healthier lifestyles in response to a growing health crisis.

Australia Health and Wellness Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Functional Foods and Beverages, Beauty and Personal Care Products, Preventive and Personalized Medicinal Products, Others |

| Functionalities Covered | Nutrition and Weight Management, Heart and Gut Health, Immunity, Bone Health, Skin Health, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia health and wellness market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia health and wellness market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia health and wellness industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia health and wellness market is projected to exhibit a CAGR of 6.61% during 2026-2034.

The health and wellness market in Australia is driven by tech integration (wearables, mobile health, telemedicine), a rise in brain-boosting supplements and nootropic drinks, increasing daily supplement usage, and demand for holistic, self-care-focused wellness offerings.

Australia’s health and wellness market is driven by rising consumer health awareness post-COVID, rapid tech adoption (apps, wearables, telemedicine), increasing disposable income, an ageing population seeking preventive care, booming corporate wellness programs, and daily supplement consumption by two-thirds of adults.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)