Australia Hearing Aids Market Size, Share, Trends and Forecast by Product Type, Hearing Loss, Patient Type, Technology Type, End-User, and Region, 2025-2033

Australia Hearing Aids Market Overview:

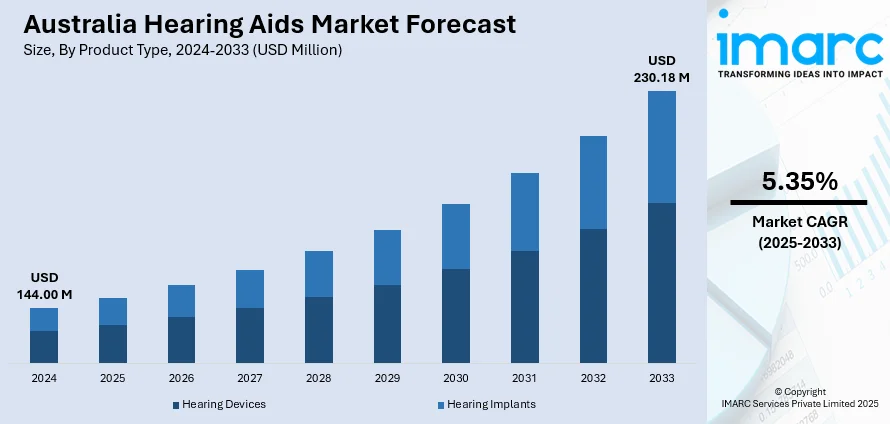

The Australia hearing aids market size reached USD 144.00 Million in 2024. Looking forward, the market is projected to reach USD 230.18 Million by 2033, exhibiting a growth rate (CAGR) of 5.35% during 2025-2033. The growing population of elderly people in Australia is particularly driving the demand for hearing improvement devices. Moreover, ongoing developments in hearing support technology, including the inclusion of Bluetooth connectivity, rechargeable batteries, and artificial intelligence (AI), are propelling the market growth. Additionally, heightened awareness about hearing health is expanding the Australia hearing aids market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 144.00 Million |

| Market Forecast in 2033 | USD 230.18 Million |

| Market Growth Rate 2025-2033 | 5.35% |

Key Trends of Australia Hearing Aids Market:

Aging Population Increasing Demand for Hearing Aids

The growing population of elderly people in Australia is particularly driving the demand for hearing aids. The number of Australians aged 75 and older is expected to rise in the coming decade, by a staggering 49 per cent or an additional one million individuals, while life expectancy is also projected to increase, according to the new Centre for Population’s 2024 Population Statement. With a rise in the population of seniors, age-related hearing loss is becoming more common. This population change is promoting the use of hearing aids among older Australians who need hearing solutions to manage hearing deficits. Most older people are becoming aware about the necessity of wearing hearing devices to sustain their quality of life and remain active in social and work environments. The aging population is actively pursuing high-end, easy-to-use, and unobtrusive hearing aid solutions to tackle hearing loss more successfully. This increasing demand is also sustained through improvements in healthcare services for the elderly that ensure hearing aids become more accessible and affordable with both public and private health insurance coverage. Thus, the aging population is continually propelling the Australia hearing aids market growth.

To get more information on this market, Request Sample

Technological Developments in Hearing Aid Devices

Technological advancements in hearing support systems are driving the market. Ongoing developments in hearing aid technology, including the inclusion of Bluetooth connectivity, rechargeable batteries, and artificial intelligence (AI), are improving the functionality and usability of hearing aids. These technological developments are improving the effectiveness of hearing aids in alleviating hearing loss and offering superior sound quality, comfort, and customization. They are shifting toward digital hearing aids that can be tailored through smartphone apps, giving more control and customization. The launch of telehealth services for hearing testing and fittings is also making it more convenient for people to get access to hearing aids, particularly in rural regions. Since technology keeps getting better, people are increasingly willing to embrace up-to-date hearing aid technology that not only enhances hearing ability but also fits conveniently into their connected way of life. In 2024, Starkey launched Genesis AI hearing aid devices in Australia and New Zealand. The hearing aid features a unique and efficient processor, a long-lasting rechargeable battery, along with various other aspects to improve its performance.

Increasing Awareness and Early Detection of Hearing Loss

Increased awareness about hearing health is driving the market of hearing aids in Australia. Both public and private bodies are placing greater emphasis on making people aware about hearing impairment, detection at an early stage, and urgency to approach treatment at the onset of hearing loss. This change is encouraging people to opt for hearing solutions earlier instead of waiting for advanced hearing loss. Audiologists and medical professionals are also stressing the importance of routine hearing testing, particularly among those who are at increased risk, like individuals with a hereditary history of hearing impairment or workers subject to loud sounds on the job. As the consciousness of hearing health keeps spreading, Australians are voluntarily seeking hearing aids. In addition, government-sponsored programs and private insurance coverage are making access less of a barrier to market growth.

Growth Drivers of Australia Hearing Aids Market:

Health Insurance Coverage and Subsidies Support Market Accessibility

Government subsidies and private health insurance are essential in enhancing access to hearing aids throughout Australia. Programs like the Hearing Services Program (HSP) assist eligible individuals particularly seniors and pensioners in obtaining hearing devices either at no cost or at reduced prices. Moreover, many private insurance plans now provide partial reimbursement for hearing aids as part of their extras cover. These financial aids lessen the economic strain on consumers making it more feasible for them to opt for premium or advanced models. As affordability increases more individuals are inclined to pursue early hearing intervention leading to higher device adoption rates. This supportive policy landscape significantly boosts Australia hearing aids market demand across urban and rural areas.

Shift Toward Discreet and Comfortable Designs

Rising preference for discreet, visually appealing hearing aids is influencing consumer perceptions in Australia. Many people, particularly younger users and those trying them for the first time, tend to shy away from conventional hearing aids due to their noticeable appearance and associated stigma. In response, manufacturers are creating smaller, nearly invisible devices that can be fitted discreetly inside the ear canal or behind the ear, minimizing visibility. These contemporary designs boost user confidence and enhance comfort for prolonged use. With ergonomic shapes, skin-toned finishes, and lightweight materials, modern hearing aids blend effortlessly into daily life. This trend encourages more individuals to seek treatment sooner, directly leading to greater acceptance and a surge in market growth within the hearing aids industry.

Teleaudiology and Remote Fitting Services

The rise of teleaudiology is transforming how hearing care services are delivered in Australia. Via digital platforms, audiologists can conduct remote consultations, perform hearing assessments, and even adjust hearing aids without the need for in-person appointments. This approach is particularly advantageous for those in remote or underserved regions where access to hearing specialists is scarce. Patients can obtain timely support and ongoing care, which enhances user satisfaction and decreases dropout rates. Teleaudiology also enables quicker diagnoses and encourages device adoption among individuals who may be hesitant or unable to travel for appointments. According to Australia hearing aids market analysis, the acceleration of digital healthcare adoption is likely to promote greater accessibility and inclusivity in the market.

Opportunities of Australia Hearing Aids Market:

Development of Rechargeable and Smart Hearing Aids

The Australian hearing aids market is experiencing significant interest in rechargeable and smart devices, reflecting consumer demand for both convenience and advanced technology. Innovations in lithium-ion battery technology have removed the necessity for regular battery changes, providing longer usage periods and an environmentally friendly option. Additionally, smart features such as Bluetooth connectivity, app-based controls, and AI-driven sound adjustments enhance the user experience by enabling seamless integration with smartphones, TVs, and other gadgets. These developments cater to an increasing segment of tech-savvy consumers looking for multifunctional and user-friendly hearing solutions. As the desire for smarter, more interconnected devices grows, manufacturers have an excellent opportunity to market premium hearing aids as part of a contemporary, digitally enabled lifestyle.

Integration with Wearable Health Devices

Hearing aids are increasingly being developed as multi-functional health wearables, with possibilities for enhanced functionality beyond sound adjustment. With the inclusion of sensors and connectivity capabilities, contemporary hearing aids can monitor activity, monitor heart rate, sense falls, and even contribute to cognitive health through sound training. This combination of hearing technology and health monitoring aligns with the increasing consumer interest in integrated wellness and personal health information. Tech-literate consumers, especially those who already wear smartwatches or fitness trackers, are drawn to hearables that provide greater value and easy connectivity to their digital health ecosystems. This trend creates the stage for product differentiation and sector expansion in Australia's vibrant hearing care market.

Targeting Younger Demographics

An increasing number of younger Australians are facing hearing issues due to heightened exposure to loud environments, music through earbuds, and noisy workplaces. Despite this reality, hearing aid usage among younger populations remains relatively low, largely due to stigma and a lack of awareness. This scenario presents a clear opportunity for manufacturers to create youth-oriented products that are discreet, stylish, and compatible with mobile technology. Marketing initiatives focused on early hearing care, preventive measures, and the long-term cognitive advantages of prompt intervention can also help change perceptions. By addressing aesthetic preferences and highlighting smart, lifestyle-compatible features, brands can engage this underrepresented market segment and encourage early adoption among tech-savvy young adults.

Australia Hearing Aids Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, hearing loss, patient type, technology type, and end-user.

Product Type Insights:

- Hearing Devices

- Behind-the-Ear (BTE)

- Receiver-in-the Ear (RITE)

- In-the-Ear (ITE)

- Canal Hearing Aids (CHA)

- Others

- Hearing Implants

- Cochlear Implants

- BAHA Implants

The report has provided a detailed breakup and analysis of the market based on the product type. This includes hearing devices (behind-the-ear (BTE), receiver-in-the ear (RITE), in-the-ear (ITE), canal hearing aids (CHA), and others) and hearing implants (cochlear implants and BAHA implants).

Hearing Loss Insights:

- Sensorineural Hearing Loss

- Conductive Hearing Loss

The report has provided a detailed breakup and analysis of the market based on the hearing loss. This includes sensorineural hearing loss and conductive hearing loss.

Patient Type Insights:

- Adults

- Pediatrics

The report has provided a detailed breakup and analysis of the market based on the patient type. This includes adults and pediatrics.

Technology Type Insights:

- Analog

- Digital

The report has provided a detailed breakup and analysis of the market based on the technology type. This includes analog and digital.

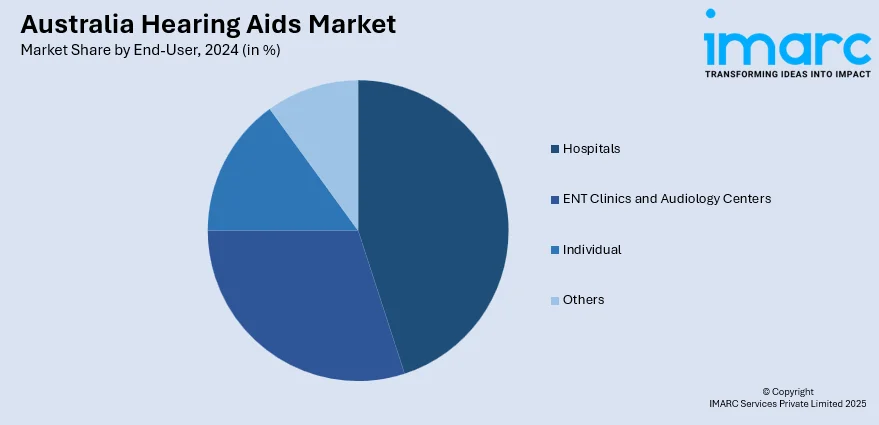

End-User Insights:

- Hospitals

- ENT Clinics and Audiology Centers

- Individual

- Others

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes hospitals, ENT clinics and audiology centers, individual, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Hearing Aids Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Hearing Losses Covered | Sensorineural Hearing Loss, Conductive Hearing Loss |

| Patient Types Covered | Adults, Pediatrics |

| Technology Types Covered | Analog, Digital |

| End-Users Covered | Hospitals, ENT Clinics and Audiology Centers, Individual, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia hearing aids market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia hearing aids market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia hearing aids industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The hearing aids market in Australia was valued at USD 144.00 Million in 2024.

The Australia hearing aids market is projected to exhibit a compound annual growth rate (CAGR) of 5.35% during 2025-2033.

The Australia hearing aids market is expected to reach a value of USD 230.18 Million by 2033.

The market is witnessing a rise in teleaudiology adoption, discreet and stylish device designs, and demand for rechargeable, Bluetooth-enabled hearing aids. There is also growing integration with health-monitoring features and increased focus on youth-friendly and tech-compatible hearing solutions, which is propelling market growth.

Key drivers include an ageing population, early-onset hearing issues, rising awareness about hearing health, and improved access through government subsidies and insurance support. Expansion of digital healthcare services and increased acceptance of hearing aids as lifestyle devices further boost market adoption.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)